Stockspot performance returns

The Stockspot Portfolios delivered exceptional returns for our clients in 2019 ranging from 13.9% to 19.9% after fees. This in a year when interest rates in Australia were cut below 1% and most savers weren’t able to get much more than 2% in the bank or term deposits.

| 1 year | 3 years (p.a.) | 5 years (p.a.) | Total return | |

| Topaz (high growth) | 19.9% | 10.8% | 9.3% | 74.3% |

| Emerald (growth) | 18.4% | 9.8% | 8.3% | 64.2% |

| Turquoise (balanced) | 16.7% | 9.2% | 7.6% | 59.0% |

| Sapphire (moderately conservative) | 15.6% | 9.0% | 7.3% | 57.0% |

| Amethyst (conservative) | 13.9% | 8.1% | 6.5% | 51.9% |

Returns as of 31 December 2019 after fees

It’s our sixth straight year of positive returns across all of our investment strategies. We’ve achieved these returns while taking roughly half the risk of only owning Australian shares because we’re diversified into global shares, bonds and gold.

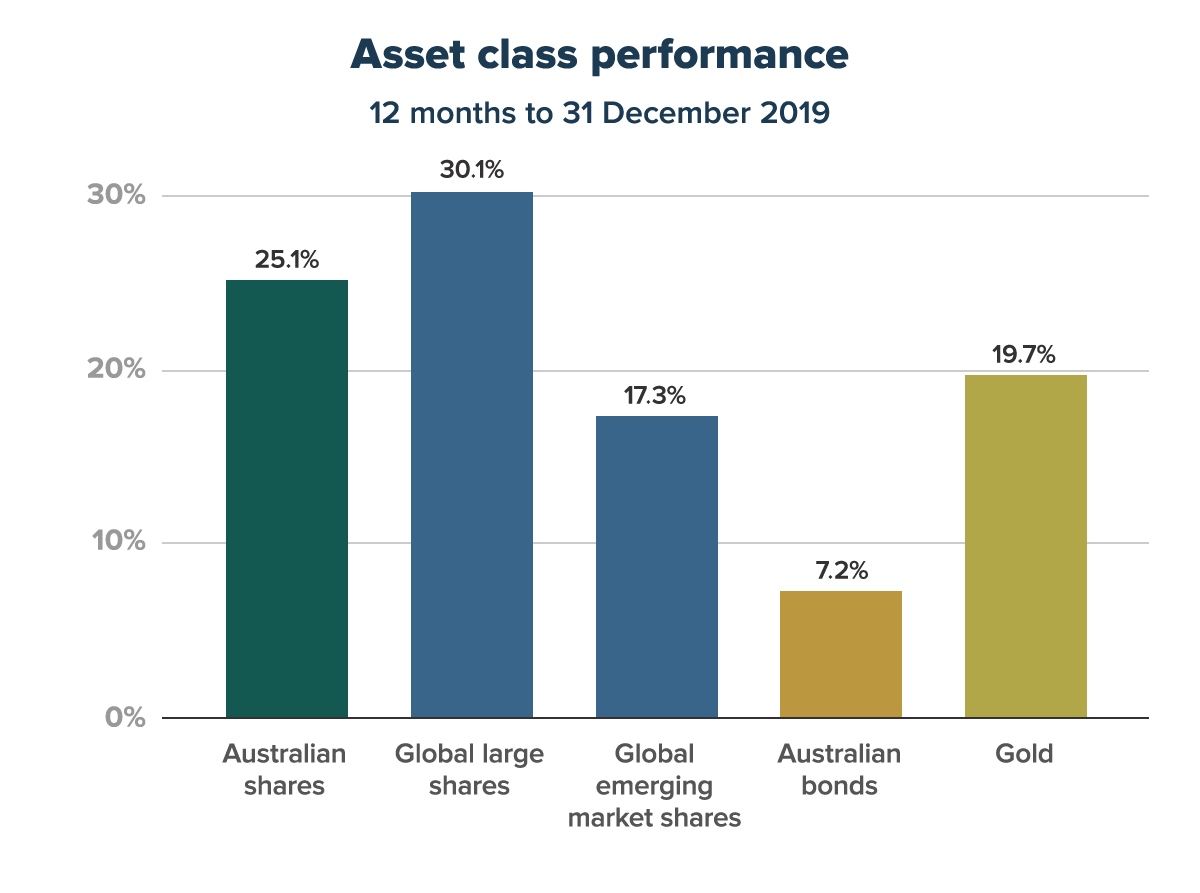

All 5 of the assets we invest in performed well in 2019. In addition, the index ETFs we’ve selected for clients performed better than the majority of other funds available, including managed funds and Listed Investment Companies (LICs).

The Australian share market enjoyed its best year in a decade. Our Australian shares ETF rose 25% in 12 months. The big return for Australian shares in 2019 came after a year when Australian shares generated negative returns in 2018.

If you take the average of the last 2 years you get close to the long term typical return of around 10% p.a. from Australian shares. It’s an excellent example of why you need to stay invested through inevitable bad years in order to enjoy the good ones.

The market moves over the last 2 years also point to the benefit of dollar cost averaging. Stockspot clients who ignored the negative news headlines at the end of 2018 and added to their portfolios did very well in 2019 as the market returned to its long term trend upwards.

Historically the share market has risen in 7 of every 10 years so it’s important to not panic in years when it’s down. Being diversified into defensive assets like bonds and gold also helps to keep you invested through the inevitable tough years like 2018 and is what kept all of our portfolios positive that year.

Australian and US share markets both reached new all time highs in 2019. We explored whether it’s sensible to be buying when the market hits all time highs. The results even surprised us!

What does 2020 have in store?

We don’t have the answer, nor does anybody. That’s why you’re best to ignore share market predictions, particularly ones from people predicting a crash. JP Morgan recently published a chart showing how much money you would have lost if you had followed the predictions of ‘market experts’ who predicted a crash in 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018 and 2019. The end result – you could have lost up to 60% by listening to these ‘market experts’.

It’s a good reminder of why we ignore market predictions. Instead our portfolios are prepared for any market environment by being well diversified, keeping costs low and keeping your portfolio rebalancing on autopilot to avoid behavioural mistakes and make the most of market dips.

Top articles of the year

Investor education is an important brand value to Stockspot. Our aim is to help more Australians understand investing and their personal finances a little bit better than they did the day before.

That’s why we’re proud to have published over 90 blog articles in 2019 which was our most on record. We wrote many to answer common client questions like “When is the best time to invest?”, “What’s the difference between a dividend and a distribution?” and “Should I pay down my mortgage or invest?”.

Below are some of the most popular articles each month of 2019 in case you missed them. We’ve also made our annual Investor Handbook available to download.

- At the start of 2019 we reviewed our 2018 performance. 2018 was a year when almost all assets fell in value so we were pleased to share that the Stockspot portfolios made money.

- In January we discussed why you should ignore market predictions. It was a timely reminder after the annus horribilis in 2018 (which very few predicted). Once again few market analysts or commentators correctly predicted the big positive returns of 2019.

- In February we got on the Marie Kondo bandwagon and considered how you can tidy up your finances by asking ‘Does it bring me joy?’

- In March we looked at the potential impact of the Labor Party’s proposed franking credit changes. As it happened, the Coalition was re-elected and no changes were made.

- In April we considered if you should Dollar Cost Average or go all in. This article was so popular that we followed it up with When is the best time to invest?

- In May we discussed how you can stay on top of your finances while living abroad.

- In June we revisited the Shares vs Property debate, adding the cost of renovations into the equation. We also launched the new Stockspot brand!

- In July we launched our annual ETF Research Report and looked into SMSF investment strategies for income and growth. We also revisited why you should own some gold.

- In August we compared ETFs to LICs. Our research was later referenced by ASIC in their recommendations for government to review the commissions paid by LICs to financial advisers. We also released our 7th annual Fat Cat Funds Report, naming the best and worst super funds.

- In September we announced some updates to the Stockspot dashboard and app. After moving to a blueprint agile process and continuous integration/continuous deployment we were able to ship hundreds of small improvements to the client dashboard and app in 2019. We can’t wait to show you plenty more in the works for 2020. Interested in joining the Stockspot engineering team? You can see current available roles here.

- In October we quashed some common myths and misconceptions about ETFs and looked at whether it’s best to pay down your mortgage or invest.

- In November we discussed why you don’t need to be worried to buy when markets are high.

- In December we interviewed our radio host client Phil Ackman and explained the difference between a dividend and a distribution.

We look forward to another great year in 2020. We’ll be releasing new dashboard and app features throughout the year, continuing to improve the Stockspot client experience and writing plenty of investing articles for our blog and newsletter.

Thanks for trusting Stockspot on your investment journey.