SMSF investors have had a tough past decade. Up until recently, returns on term deposits have been dwindling, making it harder to earn an income from the bank.

Lenders have pulled back on SMSF loans for investment properties – now one less investment class to choose from. Meanwhile, the most popular shares owned by SMSFs like Westpac and Telstra have had a forgettable decade, generating flat to negative capital returns.

There has been one shining light for SMSFs which are exchange traded funds (ETFs). These ASX listed funds which track broad market indices rather than pick stocks have ballooned in popularity with SMSFs.

ETFs in Australia have grown from around $30 billion to $135 billion in just 5 years. This growth has come from many sources, including for SMSFs adopting ETFs in their portfolios. According to the Vanguard/Investment Trends 2022 SMSF report, ETFs have accounted for 5x more of an SMSFs portfolio than it did in 2015.

These are the 3 most asked for investment strategies from our SMSF clients and how they can be achieved using ETFs:

- Best SMSF investment strategy for income

- Best SMSF investment strategy for capital growth

- Best SMSF investment strategy for capital protection

- Getting your SMSF asset allocation right

Best SMSF investment strategy for income: Australian share ETFs

Like owning shares, Australian share ETFs pay great dividends and pass on franking credits. But because ETFs are better diversified they’re much lower risk than picking a portfolio of stocks.

We recommend the Vanguard Australian Shares ETF (VAS) which currently has a historical dividend yield of 4.6% (over 10 years). That increases to around 5% once you add in franking credits, a lot higher than the prevailing interest rate!

For SMSFs who want a little more income in their portfolios we recommend the Vanguard Australian Shares High Yield ETF (VHY) which has a tilt towards dividend shares and has a dividend yield of 6.2% and grossed up yield of over 7%. This ETF is one of the more popular investment theme choices we see for Stockspot SMSFs, particularly for clients who want to increase their income return amidst falling bond yields over the last few years

SMSF tip:

It may be tempting to focus on yield, particularly as a SMSF in pension stage. We caution our SMSF clients not to be too focused on dividends. When you only focus on boosting income it can come at the expense of growing (and preserving) your capital.

We believe that SMSFs should focus on total return (income + capital growth) rather than just your income or dividend yield. Even if you’re at pension stage you shouldn’t be afraid to draw down from income and from capital growth. Over the last five years (as of 31 January 2023) our Balanced strategy (Turquoise) generated a total return of 5.7% p.a. after costs, this included an even split between income and capital growth.

| 1 year return | 3 year return (p.a.) | 5 year return (p.a.) | |

| Vanguard Australian Shares ETF (VAS) | 13.2% | 7.3% | 9.9% |

| Vanguard Australian Shares High Yield ETF (VHY) | 21.0% | 11.8% | 11.1% |

Learn more: Best Australian Share ETFs

Best SMSF investment strategy for capital growth: global and emerging market share ETFs

SMSFs now have a wonderful array of global focused ETFs to choose from. Global share ETFs can help you to keep earning a decent return even when your Australian shares are performing poorly.

ETFs give you better sector diversification

The Australian share market is heavily geared towards the financials and materials (mining) sectors. Owning some global share ETFs helps combat over exposure to these sectors as they tend to have more technology and healthcare stocks. This has helped markets like the US, Germany and Japan do much better than Australia since 2010.

We recommend the Global 100 ETF (IOO) which invests in the largest 100 companies in the world like Apple and Google. This ETF generated strong growth of 11.4% p.a. over the last five years.

We also recommend an emerging markets ETF (IEM) – even though emerging market shares can be smaller and more volatile, they give you access to faster growing economies and future growth.

Our research shows that over a full market cycle, a 45% allocation to global shares (both top 100 and emerging markets) has been the ‘sweet spot’ – the perfect balance between risk, return and diversification. Stockspot portfolios currently have 40 – 54% allocated to overseas markets – which helps SMSFs capture overseas dividend and capital growth opportunities.

SMSF tip:

While you may be tempted to pay an active fund manager to access global markets, we’ve found that low-cost global share ETFs tend to do better over the long run because of their lower fees. This is why we only recommend low cost indexed investments and avoid higher cost active funds.

| 1 year return | 3 year return (p.a.) | 5 year return (p.a.) | |

| iShares S&P Global 100 (IOO) | -9.4% | 6.5% | 11.4% |

| iShares MSCI Emerging Markets ETF (IEM) | -12.4% | -1.3% | 0.3% |

Learn more: Best Global Share ETFs

Best SMSF investment strategy for capital protection: high grade bonds

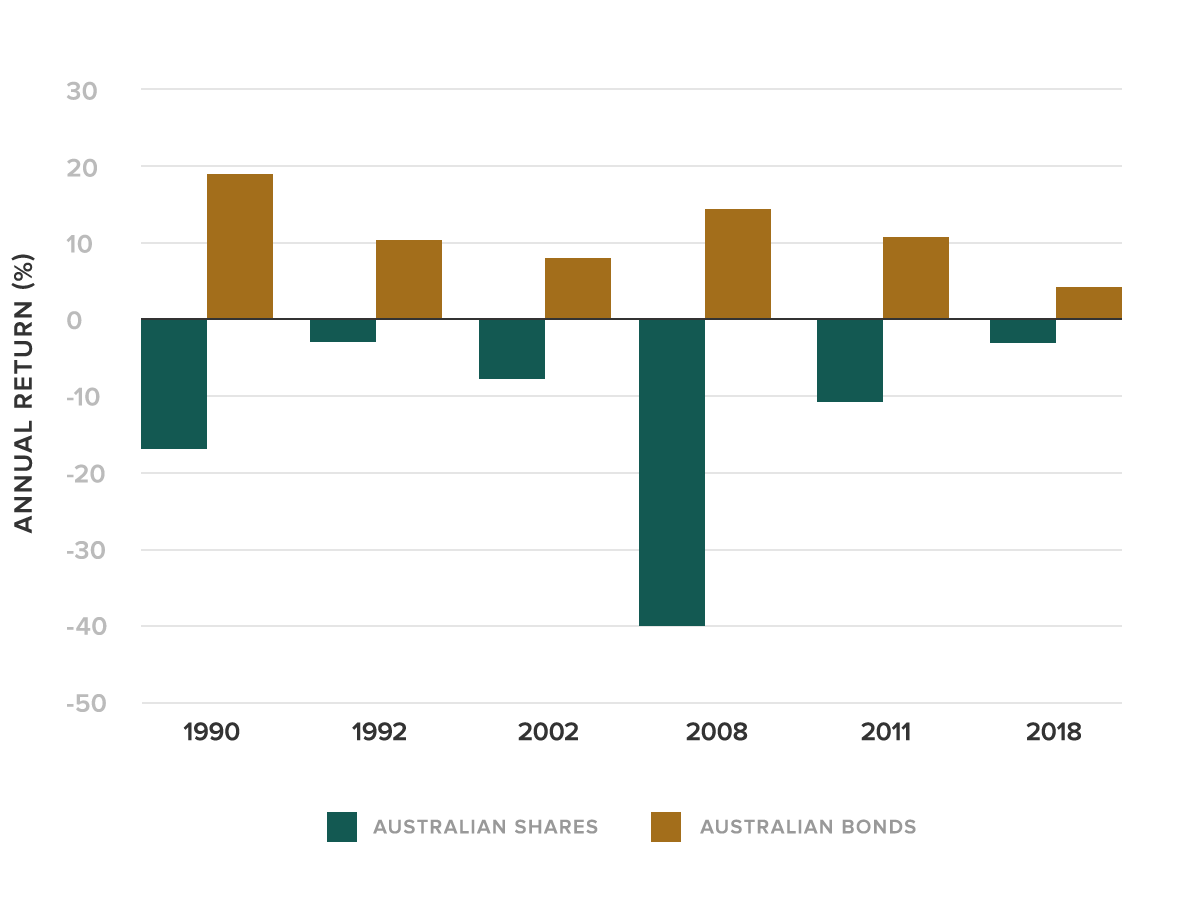

Any SMSFs who owned shares during the financial crisis will appreciate the importance of capital preservation. While shares are a great long-term investment, they can also have some stomach churning dips along the way which is why we advise all SMSF clients to own some high grade bonds as insurance.

High grade bonds have historically risen when share markets fall so can provide some insulation when markets become volatile. Over the past 30 years, most times when shares fell, high grade bonds did their job as a portfolio cushion and generated a positive return. 2022 was the first time in 30 years when this did not happen, both shares and bonds had a negative performing year.

Australian bonds were one of the few asset classes with a positive return in 2018 when share markets fell, as they also did in 2008.

It has been difficult for everyday investors to access high grade bonds due to high minimum investment amounts, lack of diversification and costs. However, with the rise of ETFs, investors can now access bonds and make them a part of their portfolios.

We recommend the iShares Core Composite Bond ETF (IAF) which gives SMSFs exposure to around 500 high quality government, semi government and corporate bonds. This ETF has a yield to maturity of 4.0%

As interest rates fall, bond prices rise in value because their fixed coupon payments become more valuable. This is what makes bonds a much better cushion for falling share markets than cash or term deposits.

For SMSF clients who want also want some global bonds we advise the Vanguard International Fixed Interest ETF (VIF) which has a yield to maturity of 3.3%, a bit lower than Australian bonds. This ETF gives you access to bonds issued by the US, Japanese, French and UK governments as well as some other countries.

| 1 year return | 3 year return (p.a.) | 5 year return (p.a.) | |

| iShares Core Composite Bond ETF (IAF) | -6.2% | -2.9% | 1.0% |

| Vanguard International Fixed Interest ETF (VIF) | -9.9% | -3.8% | -0.1% |

Learn more: Best Australian Bond ETFs

Getting your SMSF asset allocation right

Rather than focus on a single strategy (income, growth or capital preservation), we recommend SMSF clients diversify across a range of ETFs to get exposure to all three. The right mix of ETFs should be based on the SMSF members’ investment horizon, lifestage, risk capacity and cashflow needs.

Getting your SMSF asset allocation right will help your portfolio deliver more consistent performance whether share markets rise or fall. Stockspot offers a free assessment and will suggest the right investment mix of low-cost ETFs for your SMSF.

The strategies we recommend have experienced much lower volatility (risk) than only owning Australian shares and have had consistent returns over 1, 3 and 5 years, outperforming over 97% of similar funds.

Once your portfolio is set up, SMSFs should put into place threshold based rebalancing to make sure that the investments don’t move too far away from their target weights.

This keeps your portfolio nicely balanced over time and takes the emotion out of your investment decisions. We do this automatically so SMSF clients don’t need to watch their portfolio day to day and can get on with their lives.

Finally, a big benefit of ETFs is that they can help simplify your SMSF audit and tax. You can get your SMSF tax as automated as possible to keep costs low and make sure more returns are leftover for you.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.