- What are Stockspot Themes?

- How are Stockspot Themes implemented in the portfolio?

- How many themes can I select?

- Do I need themes? Aren’t the Stockspot Portfolios already diversified enough?

- How will Stockspot Themes impact my portfolio?

- Ideas for choosing themes – which ones are best?

- Our chosen Stockspot Themes

What are Stockspot Themes?

Stockspot Themes allow clients investing $50,000 or more to add investments to their portfolio that they feel strongly about and would like a higher exposure to. You can add in certain countries (such as China and the U.S.), sectors (such as technology and healthcare) or market factors (small companies and dividend shares).

Exchange traded funds (ETFs) are a great way of accessing different investment themes and have the benefit of instant diversification, low costs, daily liquidity and tax efficiency. We’re proud to be the only automated investment adviser in Australia – and around the world – to offer this level of portfolio personalisation to clients.

How are Stockspot Themes implemented in the portfolio?

We ensure that your investment strategy stays balanced based on your goals and investment time horizon. We optimise themes in your portfolio and integrate them seamlessly so there’s nothing you need to do.

When you select a theme, we will sell down a portion of your existing portfolio, and allocate this portion to your chosen theme. If your rebalancing status is set to “Buy Only”, instead of funding the themes through selling your existing portfolio, the themes will be funded once the minimum investable amount is reached in your Stockspot cash account. Each theme will typically contribute between 5% and 10% of your overall portfolio once fully implemented.

Note that choosing and changing themes may result in capital gains/losses and have tax implications. You can add or change themes via the Portfolio settings section of your dashboard.

How many themes can I select?

Stockspot clients can have up to 3 themes in their portfolio at any one time including a maximum number of growth and defensive themes based on your investment strategy.

Themes are broken down into growth and defensive strategies. Growth themes tend to have higher potential return but come with more volatility, whereas defensive themes tend to reduce the risk of your portfolio.

Do I need themes? Aren’t the Stockspot Portfolios already diversified enough?

Stockspot Themes are an optional product feature for clients investing $50,000 or more. The Stockspot Model Portfolios are designed to provide sufficient diversification to help you achieve your goals.

However, some clients may want to have greater control and wish to implement a tactical view. We’ve outlined some theme ideas below.

How will Stockspot Themes impact my portfolio?

By choosing to implement a Stockspot Theme as part of your investment allocation, there may be an impact to your overall portfolio in relation to:

- Returns: Some themes may underperform/outperform the market at different periods in time, meaning there may be differences to the returns of the core ETFs used in the Stockspot Model Portfolios. This can be primarily driven by country and sector allocations, as well as underlying shares.

- Risk: Themes can both increase and decrease the risk profile of your portfolio. For example, regions like Asia and China tend to be more volatile than global international bonds.

- Asset allocation and diversification: Allocating themes may change the weighting of your portfolio to a particular sector, region or country. For example, adding U.S. shares will decrease your Australian share exposure, but give you more access to the American market.

- Cost: All ETFs charge a management fee. This is an indirect cost deducted directly from the daily ETF price. The ETFs offered through Stockspot Themes charge between 0.04% to 0.74% per year.

Depending on your chosen rebalancing strategy, selecting themes may trigger a rebalance of your portfolio by selling down existing holdings (such as Australian shares and bonds) to fund the new purchases of your Stockspot Themes. Many Stockspot clients use themes to reduce their exposure to Australian shares given the stronger home country bias.

Ideas for choosing themes – which ones are best?

With plenty of themes to choose from, it can sometimes be tough to decide which one would suit your portfolio strategy and goals.

Below are some ideas to consider to help you with the selection process:

Increase specific country exposure

Owning shares from global countries allows you to benefit from companies like Apple, Nestle and Nike that are listed on other share markets. The Stockspot Model Portfolios have an allocation to global developed markets (such as the U.S. and Europe), and global emerging markets (such as China and India).

You may want to increase your exposure to certain countries or regions such as:

- U.S. – access the largest 500 companies in the US (i.e. S&P 500)

- Global (non-U.S.) – access the world’s largest companies listed in major developed and emerging countries outside of the U.S.

- Europe – access the largest 350 companies in European countries such as the UK, Switzerland, France and Germany.

- Japan – access over 300 companies listed on the Tokyo Stock Exchange

- China – access the largest 50 companies that trade on the Hong Kong Stock Exchange

- Asia – access the largest 50 companies from Asian countries like China, Hong Kong, Singapore and South Korea.

Top 10 holdings per geographic/country theme

| Global (non-U.S.) | U.S. | Europe | Japan | China | Asia | |

| 1. | Nestle | Apple | Nestle | Toyota | Meituan | Taiwan Semiconductor |

| 2. | Tencent | Microsoft | Novo Nordisk | Sony | Tencent | Tencent |

| 3. | ASML | Amazon | ASML | Keyence | Alibaba | Samsung |

| 4. | Taiwan Semiconductor | NVIDIA | LVMH | Mitsubishi UFJ Financial | China Construction Bank | Alibaba |

| 5. | Novo Nordisk | Alphabet – Class A | Novartis | Daiichi | Ping An Insurance | AIA Group |

| 6. | Samsung | Berkshire Hathaway | AstraZeneca | Hitachi | Industrial and Commercial Bank of China | Meituan |

| 7. | LVMH | Alphabet – Class C | Roche | Sumitomo | JD.com | China Construction Bank |

| 8. | AstraZeneca | Meta | Shell | Shin-Etsu Chemical | Netease | Hong Kong Exchange |

| 9. | Shell | Exxon Mobil | Total Energies | Tokyo Electron | Baidu | DBS Group |

| 10. | Roche | United Health | SAP | KDDI Corporation | Bank of China | Ping An Insurance |

Increase sector exposure

All share markets are made up of companies from different sectors. The Australian share market is heavily reliant on a couple sectors and a few companies. Financial services (think CBA, ANZ, NAB, WBC) and Basic Materials (think BHP and RIO) collectively make up half of the Australian share market.

That’s why its important for Australians to invest in companies that are operating in other sectors of the global economy, like technology and healthcare.

Sector Breakdown for the Biggest 100 Global Shares, The Australian Share Market (ASX 200), the World Share Market (MSCI World ex Australia), and the USA Share Market (S&P 500). Source: Stockspot, Morningstar as of April 2023.Stockspot themes have many global sectors that are usually underrepresented in client portfolios including:

- Technology – access the leading innovative and technological focused companies in the USA (such as Apple, Amazon and Tesla) or the Asian market (such as Alibaba, Tencent and Baidu)

- Healthcare – The largest healthcare stocks across the world specializing in pharmaceutical, biotechnology and medical devices.

- Consumer staples – The largest global companies that produce essential consumer products such as food and household items.

- Infrastructure – companies involved in activities such as utilities, transportation, railroads and telecommunications.

- Gold miners – Exposure to over 50 of the largest global gold mining companies

Enhance your income

Stockspot offers the following themes which have historically paid higher than average dividends:

- Socially responsible shares – Australian companies that have demonstrated positive environmental, social and governance (ESG) characteristics without significant involvement in activities such as tobacco, alcohol and weapons.

- Australian dividend shares – companies that have paid higher dividends relative to other listed companies. See more here.

- Large companies – the top 50 blue chip companies in the Australian market

- Australian property – real estate investment trusts (REITs) listed on the ASX across the retail, office, and industrial sectors.

- Global property – real estate investment trusts (REITs) and real estate investment companies (REICs) listed on the global markets such as the USA, Japan, and UK.

However, seeking the highest paying dividend options may not always be the best strategy to maximise your total return. We suggest a total return approach which seeks to hold a diversified portfolio aiming at maximising the total overall return (i.e. both income and growth), rather than solely preferring income.

Diversify in to bonds

Global bonds hold over 1000 global bonds from the likes of the U.S., Japan and Europe. Much like Australian bonds, global bonds have 2 main benefits: 1) provide some stable income; and 2) help cushion the return should share markets fall. Global bonds have historically tended to be less risky, acting as a ballast, and may improve the geographical diversification of your bonds.

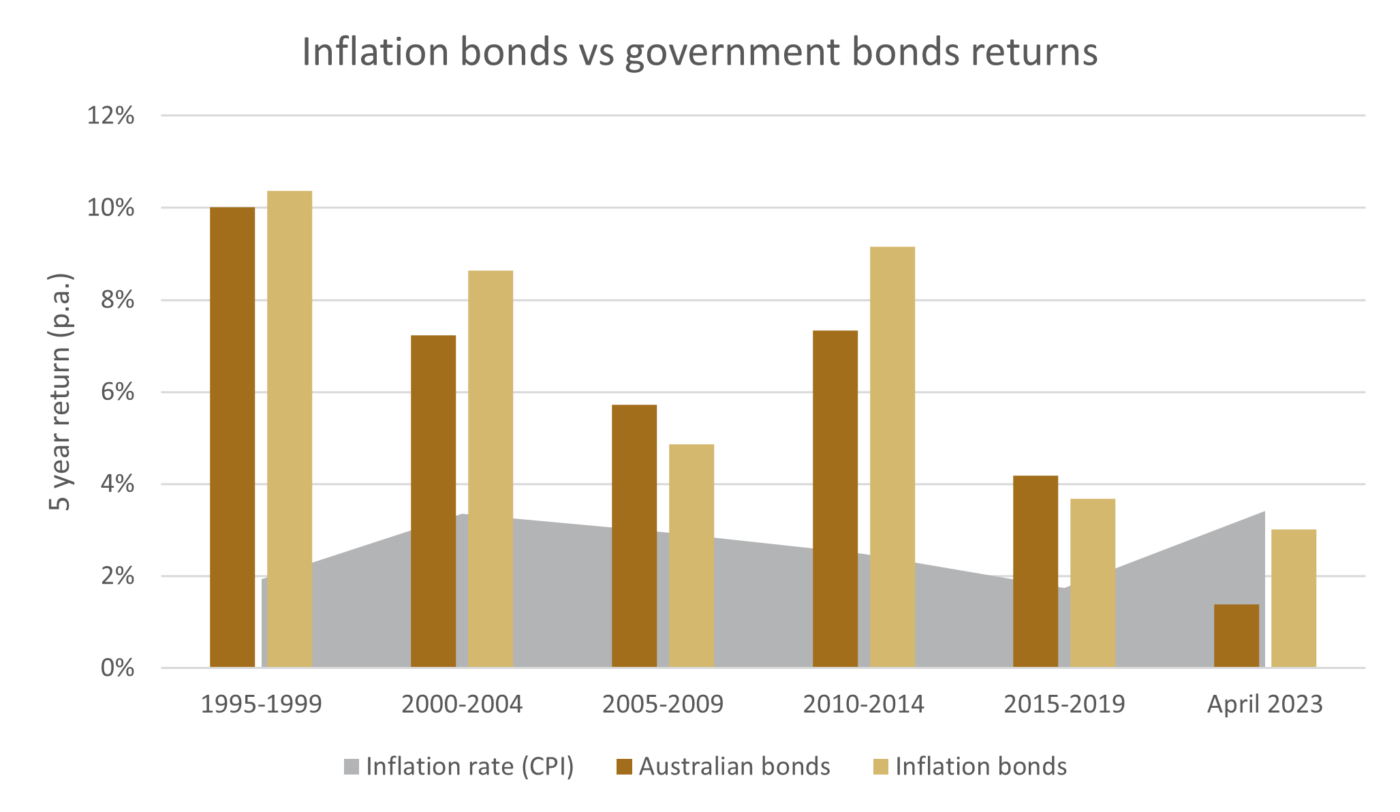

Inflation Bonds are a way to add diversification and protect against rising inflation (i.e. cost of goods and services rising). Inflation bonds are issued by the Australian government to provide an income stream (i.e. a coupon), and have their price indexed to inflation. This means that as the cost of goods rises, the price of the inflation bond will rise too (as will the coupons). Other types of bonds, like government bonds, can fall during rising inflation (such as during the 1970’s). Inflation bonds have traditionally had lower correlation to stocks and government bonds and can help retain purchasing power (e.g. help match your assets to your liabilities that are indexed to inflation).

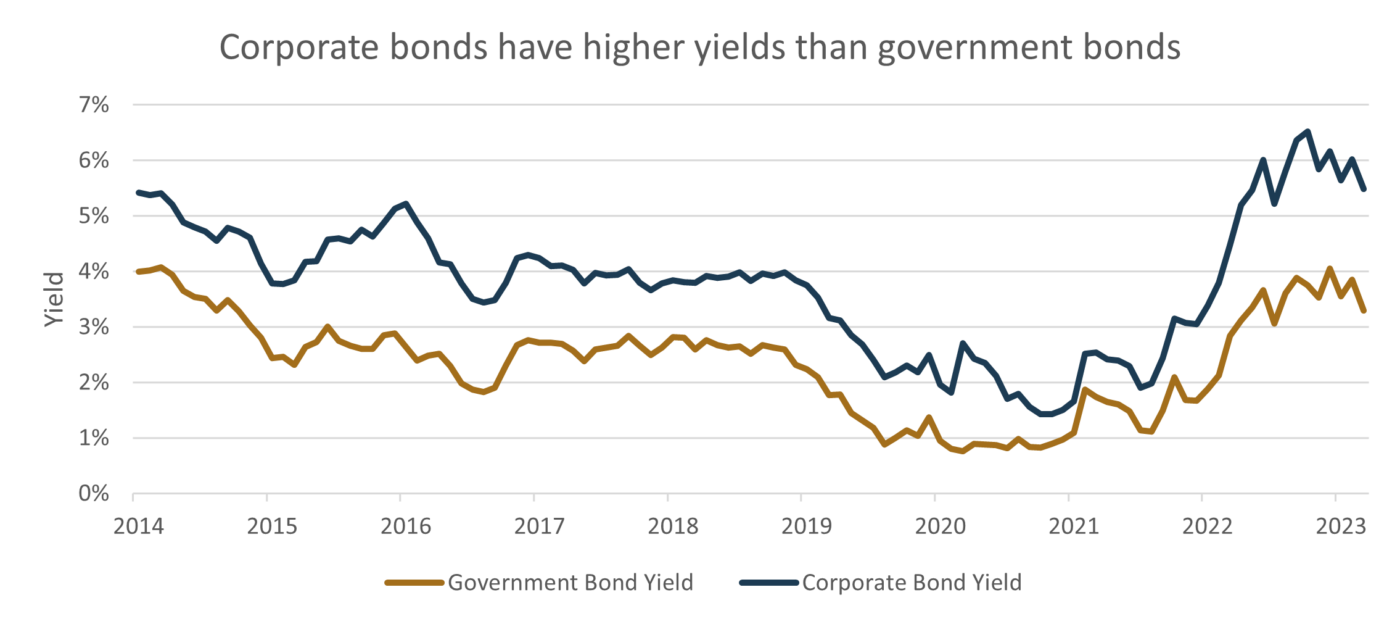

Corporate bonds are issued by the big four banks, offshore financial institutions, and other leading corporations. It’s like a government bond, but instead companies are borrowing money from investors. These types of bonds can provide regular income, that can be more attractive than cash or term deposits, and help cushion share market bumps.

Stockspot’s chosen themes

Global shares

| THEME | ETF TICKER | ETF NAME | COST | 1 YEAR RETURN | 3 YEAR RETURN (P.A.) | 5 YEAR RETURN (P.A.) |

| US shares | IVV | iShares Core S&P 500 ETF | 0.04% | 6.0% | 12.9% | 13.7% |

| Global (non-US) shares | VEU | Vanguard All-World ex-US Shares Index ETF | 0.08% | 10.1% | 8.8% | 5.1% |

| European shares | IEU | iShares Europe ETF | 0.58% | 20.8% | 12.9% | 7.1% |

| Japanese shares | IJP | iShares MSCI Japan ETF | 0.50% | 11.7% | 4.8% | 3.5% |

| Chinese shares | IZZ | iShares China Large-Cap ETF | 0.74% | -0.5% | -10.0% | -5.6% |

| Asian large companies | IAA | iShares Asia 50 ETF | 0.50% | -1.0% | -0.4% | 1.3% |

Global sectors

| THEME | ETF TICKER | ETF NAME | COST | 1 YEAR RETURN | 3 YEAR RETURN (P.A.) | 5 YEAR RETURN (P.A.) |

| US Technology | NDQ | BetaShares NASDAQ 100 ETF | 0.38% | 6.4% | 12.8% | 17.9% |

| Asia Technology | ASIA | BetaShares Asia Technology Tigers ETF | 0.57% | -5.2% | -1.1% | N/A* |

| Healthcare | IXJ | iShares S&P Global Healthcare ETF | 0.40% | 9.2% | 8.7% | 13.1% |

| Consumer staple | IXI | iShares S&P Global Consumer Staples ETF | 0.40% | 11.0% | 9.6% | 10.6% |

| Gold miners | GDX | VanEck Vectors Gold Miners ETF | 0.53% | 4.2% | 0.6% | 12.4% |

| Property | REIT | VanEck FTSE International Property (Hedged) ETF | 0.20% | -21.8% | 3.7% | N/A* |

| Infrastructure | IFRA | VanEck Vectors FTSE Global Infrastructure (Hedged) ETF | 0.20% | -5.6% | 6.9% | 5.6% |

Australian shares

| THEME | ETF TICKER | ETF NAME | COST | 1 YEAR RETURN | 3 YEAR RETURN (P.A.) | 5 YEAR RETURN (P.A.) |

| Australian dividend shares | VHY | Vanguard Australian Shares High Yield ETF | 0.25% | 3.6% | 18.0% | 9.1% |

| Australian large companies | SFY | SPDR S&P/ASX 50 Fund | 0.29% | 3.9% | 13.8% | 8.4% |

| Australian small companies | VSO | Vanguard MSCI Australian Small Companies Index ETF | 0.30% | -5.2% | 14.3% | 7.2% |

| Australian socially responsible shares | RARI | Russell Australian Responsible Investment ETF | 0.45% | -0.7% | 12.7% | 5.9% |

| Australian property | VAP | Vanguard Australian Property Securities Index ETF | 0.23% | -10.3% | 10.8% | 5.2% |

Bonds (fixed income)

| THEME | ETF TICKER | ETF NAME | COST | 1 YEAR RETURN | 3 YEAR RETURN (P.A.) | 5 YEAR RETURN (P.A.) |

| Global bonds | VIF | Vanguard International Fixed Interest Index (Hedged) ETF | 0.20% | -3.9% | -4.2% | -0.2% |

| Australian corporate bonds | VACF | Vanguard Australian Corporate Fixed Interest Index ETF | 0.20% | 3.2% | 0.0% | 1.8% |

| Australian inflation bonds | ILB | iShares Government Inflation ETF | 0.18% | 3.9% | 1.5% | 2.8% |

Data as of 30 April 2023

*Does not have a 5 year track record