ETF product innovations and subsequent increased marketing material make it challenging for investors to know which ETFs are the most appropriate. Investors should exercise caution and do their homework in selecting the best ETFs for their portfolio, particularly given the large range of ETFs now available.

Below are some of the ETF selection traps to watch out for to ensure you don’t invest in dud ETFs:

Research the ETF Name and Index

ETF providers can come up with all different kinds of names for their products. As a savvy investor, you need to pay close attention to what the underlying index being tracked is. The 3 biggest index providers (S&P, MSCI and FTSE) account for the bulk of the ETF market and publish their methodology documents of how they select their holdings.

For example, there are 7 Australian Broad Market ETFs on the ASX, with some holding the top 20, 50, 200, and 300 shares in the market. Stockspot uses an ETF tracking the ASX 300 to get broader diversification across the Australian market.

Investing in expensive ETFs

Contrary to popular belief, not all ETFs are cheap. Over the last 5 years the average cost of an ASX-listed ETF has actually increased! This is due to the evolution of new and more expensive products coming to market, and active fund managers launching their expensive strategies as an ETF.

The average cost and weighted asset average cost of ETFs in 2019 was 0.5% and 0.34% respectively. When excluding ETFMs, these two figures drop by 0.12% and 0.07% respectively (i.e. the active excess fee). This is a key reminder that every extra dollar you spend on fees is going to the fund manager, and many investors pay these higher fees for funds that underperform.

Since 2017, the trend of downward pressure on ETF costs has reversed as new “sexy and expensive” ETFs, including more smart beta products have come to market. At Stockspot we avoid these expensive products and prefer low cost passive plain vanilla ETFs to save clients money.

Fees impact returns. Australian Share ETFs charging less than 50bps had double the returns ETFs charging more than 50bps over 5 years. Low cost ETFs returned 7.2% p.a. vs expensive ETFs which returned 2.9% p.a. The same is true for Global ETFs charging less than 50bps which had 25% (relative) better returns than it’s more expensive peers.

Investors should focus on what they can control – reducing fees and costs.

Many of the lower cost ETFs can afford to be so low due to their size and scale. This is why it is important to screen ETF for fund size (i.e. the level of FUM that investors have put into the ETF).

Feed the ducks while they are quacking

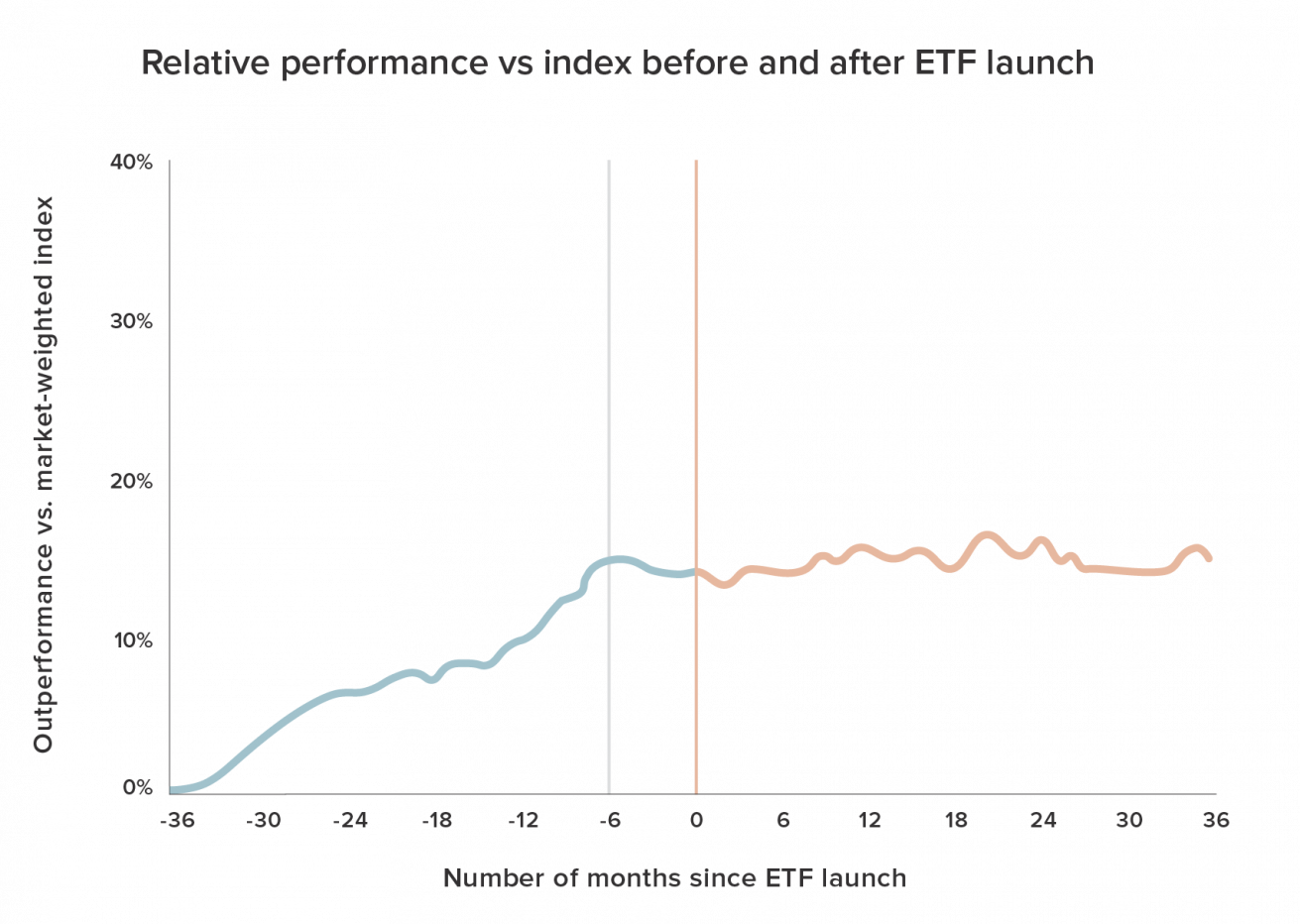

Investing 101 states to buy low and sell high, but unfortunately ETF issuers tend to launch new products when their underlying index has outperformed the general market. ETF issuers will try to sell you a story to buy their product, but it’s up to you to not buy into the narrative.

Avoid being an ETF sucker who chases performance or flows. Research shows that on average, new funds launch about 6 months after the peak in their particular strategy compared to the broad index.

Investors should let ETFs build their own live track record regardless of how much backtesting has taken place. You want to be able to judge the track record of its live experience versus the hypothetical history, as live experience accounts for things like trading costs.

At Stockspot we like ETFs that have built up a sustainable track record of live listing and have been able to see a large takeup in FUM. Instead of performance chasing, focus on rebalancing your portfolios (i.e. taking money away from higher performing asset classes and allocating this to lower performing asset classes).

Find out how Stockspot makes it easy to grow your wealth through ETFs without hassle or cost.