What Factor Investing?

Factor investing is a type of smart beta investing and refers to grouping investments based on a trait or characteristic. It has flooded the market and gained in popularity but has also confused investors.

Most of the attention is on the higher returns factors, but little attention is devoted to their risks and volatility, meaning investors could be unprepared for a bumpy performance ride.

What’s the difference between factor investing and smart beta?

Smart beta is a rules based method to pick stocks that focuses on certain factors other than traditional market capitalization (i.e. size) weighting (which is what standard market tracking ETFs are based on).

Factor investing is a type of smart beta strategy and involves selecting stocks based on a similar type of characteristic or investment style. In the early 2000’s there was increasing research that factors may be a key driver of long term performance instead of individual stock selection, which led to the rise of factor investing.

Types of Investing Factors

There are many types of factors that can be used in an investment strategy. Majority relate to a style or type of fundamental metric or a macroeconomic cyclical factor (e.g. inflation, growth, interest rates, liquidity). Below are seven main factors explained as well as the ASX ETFs that incorporate these factors.

| Factor | Characteristics | ASX ETFs – Australian Shares | ASX ETFs – Global Shares |

| Value | Inexpensive stocks with low prices relative to their fundamental value | QOZ | VLUE, VVLU |

| Low Size | Smaller stocks based on market capitalization who tend to have higher growth rates | MVW, EX20, ISO, MVE, MVS, SSO, VSO | VISM, IJH, IJR |

| Momentum | Strong past performance | N/A | N/A |

| Low Volatility | Stocks who do not react wildly to share market movements and are more defensive | MVOL, AUST | WRLD, WVOL, VMIN |

| High Yield | Paying high dividend yields for income focused investors | ZYAU, IHD, RDV, SYI, VHY | INCM, WDIV |

| Quality | Demonstrating stable earnings growth, profitability, strong balance sheets, and low levels of debt | ETF | QLTY, QUAL, QHAL |

| Multi-factor | Combines numerous factors into one tradeable index | AUMF | WDMF, QMIX, ZYUS, QSML |

Risks of factor investing

De-prioritisation of certain factors. By offering enhanced exposure to some factors, like value and size, smart beta strategies must also de-prioritise other factors. Because current price reflects every factor used by any investor to estimate a company’s value, a market-size-weighted index also represents an all-factor approach to investing.

Increased fees. Factor investing is more expensive. For example, the average Australian factor ETF charges 0.30% per year in fees which is three times the amount as a simple Australian share ETF.

Timing risk. Sometimes factor ETFs may overlap. For example, a momentum ETF may have similar constituents as value ETFs, if the value factor starts to outperform. This introduces timing risk as being able to predict factors. Investing in factors may cause portfolios to largely deviate from the market (in both positive and negative ways). Value investors have been slaughtered over the past decade as growth investing (through the rise of technology stocks) significantly outperformed.

Benefits of factor investing

Could save time. Factor investing allows investors to gain exposure to a particular investment strategy without having to spend hours researching companies and gaining access to large databases and tools. It gives investors access to quantitative strategies without having to do the number crunching.

Potential outperformance. Factors can go through periods of outperformance leading to higher returns. For example, during COVID-19 there was a flight to quality stocks given their strong balance sheets and defensibility. High yielding strategies had strong performance in the early 2010’s as income investing was favoured.

Enhance diversification. Factor investing can also help enhance the diversification and reduce risk in your portfolio. For example, if you have exposure to the largest five companies in Australia, you can blend this with a small-size factor ETF to increase your size diversification.

Performance of factor investing

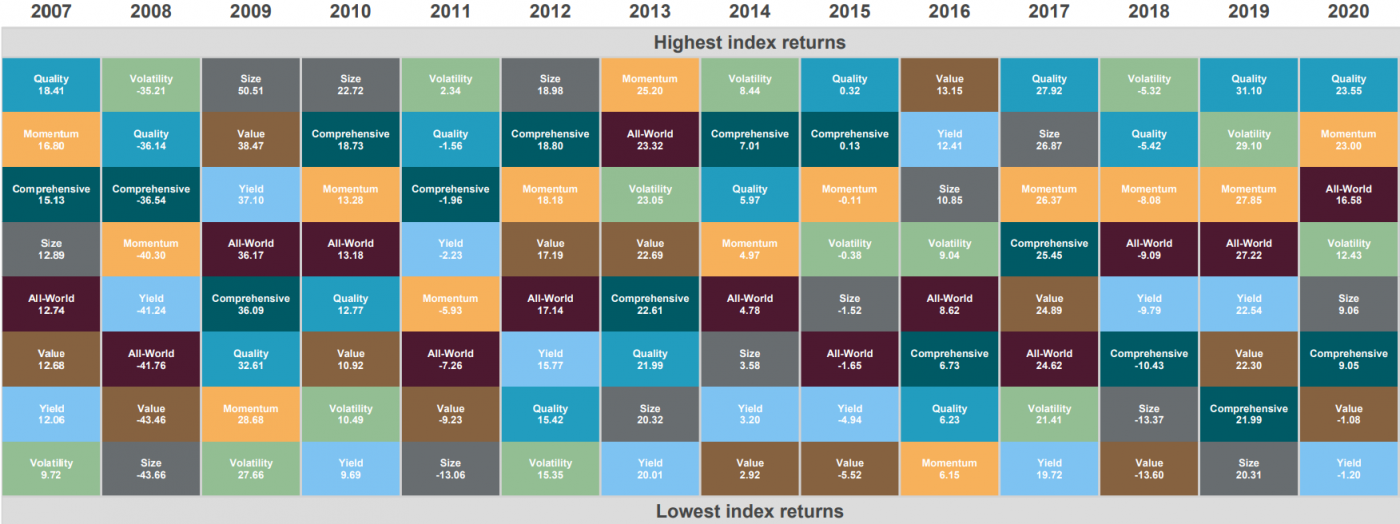

Factor investing is another form of active investing, and the performance of these factors are difficult to predict, meaning performance will be inconsistent.

No single factor can work all the time, as returns tend to be cyclical. Factors come in and out of favour. Like any “active” strategy, timing of factors is extremely difficult to predict on a consistent basis. This is demonstrated in the next chart.

Factor investing and backtesting

Backtesting is a method for identifying how certain strategies would have done based on actual results rather than forecasts, discovering how it would play out using historical data.

Attractive characteristics in backtesting are often based on data mining, which results in far less attractive performance once the product is available for the public to invest in.

Data mining involves finding spurious relationships in the otherwise random data. Translation – things can look good purely by luck. Voila! Think of an index like a deck of cards.

Backtesting lets you shuffle a deck of cards thousands of times until a favourable “shuffle” emerges to match the order you want to show.

Investors should remember correlation does not always equal causation. There is also a premium to pay for smart beta products as factors requiring higher turnover tend to have prohibitively high transaction costs.

Stockspot’s view

Despite more and more factors being “discovered” every year, we continue to prefer broad market cap index investing. While factors can go through periods of outperformance, we believe that boring investing is brilliant.

If you’re considering investing in a factor ETF, it’s important to understand that you are actually taking bets on certain market factors beating others. You should be comfortable with what those factor bets are, and why you’re taking them.

Factor ETFs may be classified as passive (given it follows a rules based framework), but differs from plain beta (i.e. market cap weighting) due to it’s passively active nature of tilting towards an investment style in order to try and outperform the market.

If you don’t understand the bets you’re taking and the only reason you’re investing in factor investing is backtesting or recent performance, then what you’re buying into isn’t smart beta as much as it’s smart marketing, and that’s not smart investing.

We continue to support research* which concludes the approach of staying disciplined, sticking to a diversified portfolio of uncorrelated factors and assets, and holding for the long term instead of trying to actively time them.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.

Sources:

* AQR Capital: Contrarian Factor Timing is Deceptively Difficult (2017)