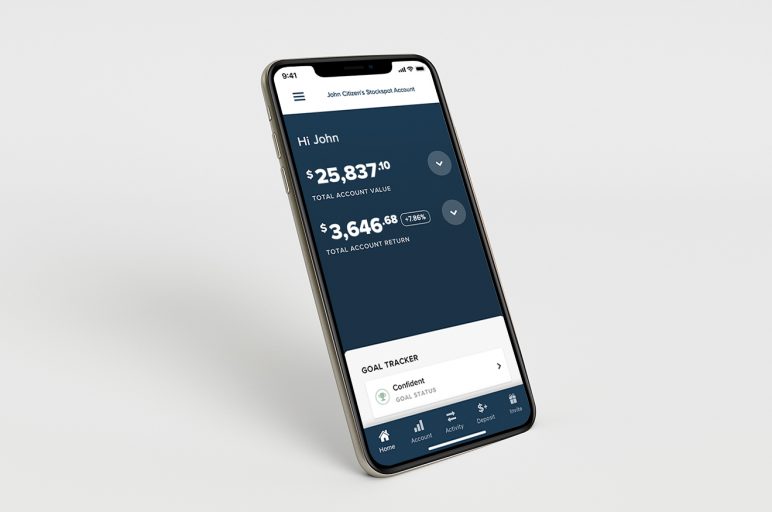

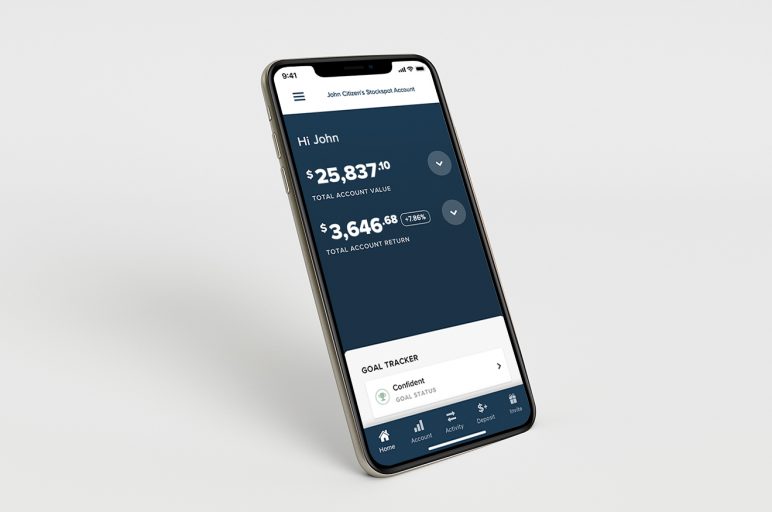

Stockspot Performance Update: December 2025

The Stockspot Model Portfolios delivered strong positive returns in 2025. The portfolios returned 14.6% to 19.3% after fees.

News, stories and articles from Stockspot

The Stockspot Model Portfolios delivered strong positive returns in 2025. The portfolios returned 14.6% to 19.3% after fees.

No Results Found