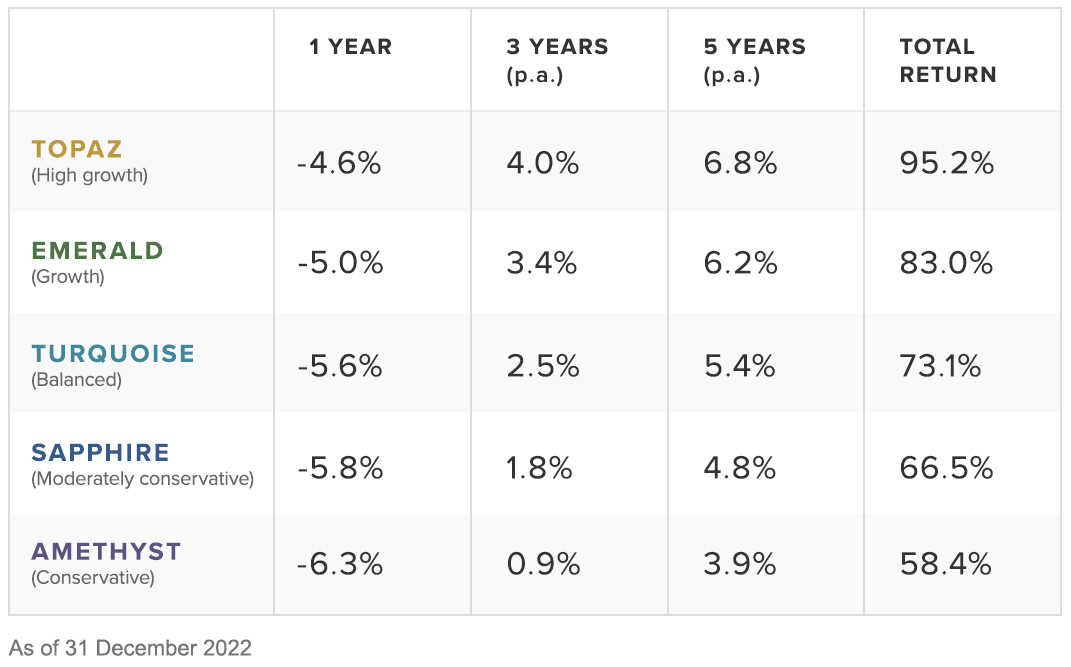

The Stockspot Model Portfolios returned -6.3% to -4.6% after fees during the 2022 calendar year, while the Stockspot Sustainable Portfolios returned -11.3% to -9.2% after fees.

The calendar year 2022 was Stockspot’s first year of negative returns since our founding in 2013. Despite the volatile 2022 year, the Stockspot Model Portfolios have continued to outperform most similar diversified funds over five years.

This was largely due to our higher allocation to gold and Australian shares in all our model portfolios.

In a diversified portfolio it’s normal to see some years of negative returns. History has shown that broad markets tend to rise over the long-term but can succumb to short-term blips along the way.

Gold was the shining light

In 2022, both shares and bonds fell. This has only happened once in the past 30 years (in 1994). Persistent inflation forced global central banks to raise interest rates quicker and higher than expected, which caused many share markets to fall.

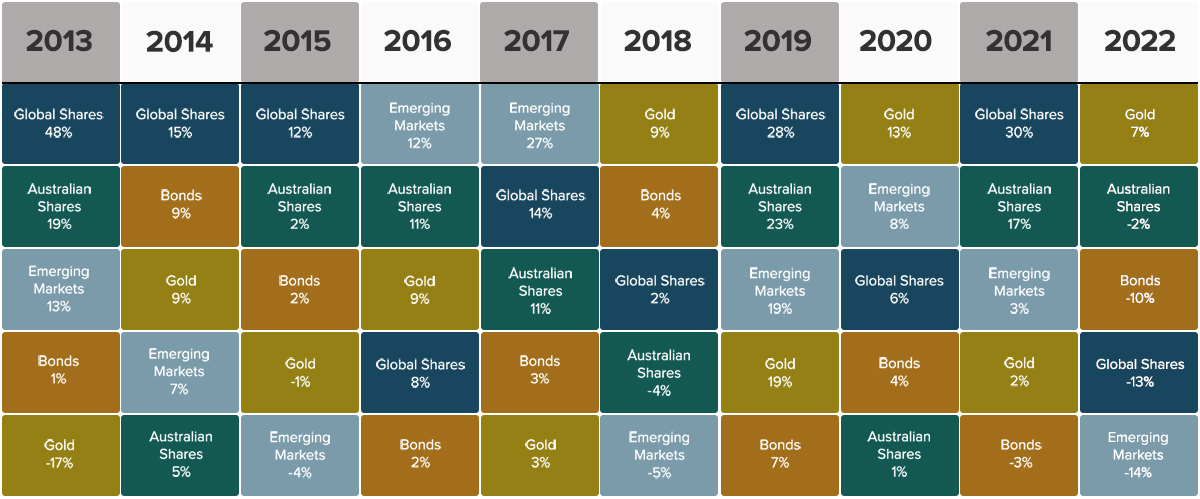

While investment assets such as U.S. technology and cryptocurrency fell 33% and 70% respectively in 2022, gold was one of the best-performing asset classes, up 7% for the year. The precious yellow metal has now had seven consecutive calendar years of positive returns.

Gold provided some protection against inflation and the broader market volatility in 2022. It also benefitted from strong demand by central banks, which purchased the most gold ever for a quarterly period between September and December 2022.

The below chart shows the best- to worst-performing asset classes each year and their returns. As they are constantly changing each year (i.e. the colours keep moving), having a diversified investment portfolio that includes all of them can help to smooth the path to reaching your financial goals.

Stockspot has an allocation to the Global X Physical Gold ETF (ASX: GOLD) in all our model and sustainable portfolios, which has helped cushion the volatility in 2022.

The resilient Australian market

In the face of inflationary pressures, global supply chain disruptions, and geopolitical tensions, the Australian market fared exceptionally well.

Australian shares have benefitted from inflation as our market has a significant allocation to resources and financial companies.

These have done much better than other sectors like technology and consumer discretionary. Resource companies benefit from rising commodity prices, and banks can increase their profit margins through higher net interest margins (the difference between bank borrowing and lending rates).

Australian shares outperformed both emerging and global shares for the first time in a decade. It only fell around 2% (including dividends) whereas developed and emerging markets fell 13% and 14% respectively.

The Stockspot Model Portfolios have a higher allocation to Australian shares to help minimise overall portfolio risk, which has served clients well in 2022.

Passive investing continues to work in down markets

Active managers often suggest that down markets are when they can thrive. However, the evidence shows that active strategies underperform in down markets too. The latest research from S&P shows 74% of professional active funds investing into Australian shares underperformed the index over the most recent five years. Money continues to pour out of active funds and go into passive investment options like ETFs.

Last quarter we also had the privilege to sit down with Bloomberg’s Eric Balchunas who shared further evidence that passive ETFs thrive in bear markets, as it’s their opportunity to take more market share from underperforming active funds.

Simple passive investments, like the ETFs we invest in for our clients, have saved investors hundreds of billions of dollars – in fees and poor performance – since launching and have consistently outperformed the majority of professional fund managers.

Our top tips for investing in 2023

While the start of the year is usually the time when so-called leading market economists make their bold predictions, our advice is to ignore making forecasts and rather focus on your own investing habits.

Many have been talking about economies experiencing a recession. However, going into 2023 our three key pieces of advice are:

- Maintain a cash buffer – especially during volatile times and when interest rates are rising, but cash alone won’t protect against inflation

- Keep a long-term focus – stick with your investment strategy and stay diversified across asset classes

- Top-up if you can (dollar-cost average) – buying in at lower prices allows you to benefit from long-term compounding returns.