Since launching in July 2020, Stockspot’s Sustainable Portfolios have been popular with our clients. In this blog we discuss how these portfolios have performed.

Sustainable Portfolios Performance

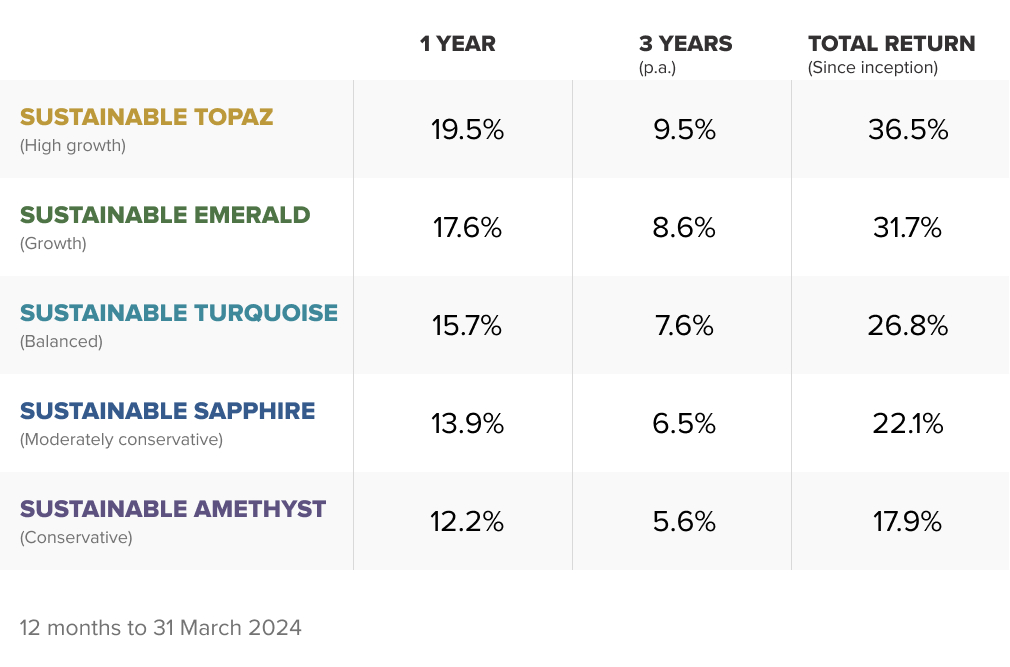

Over the 12 months to 31 March 2024, the Stockspot Sustainable Portfolios have delivered returns of 12.2% to 19.5% (after fees). Our Sustainable Portfolios continued to perform strongly, primarily driven by the strong performance of global technology shares and the weak Australian dollar.

How has performance varied from the Model Portfolios?

The Sustainable Portfolios have had slightly better performance compared to the Stockspot Model Portfolios over the past 1 year and 3 years.

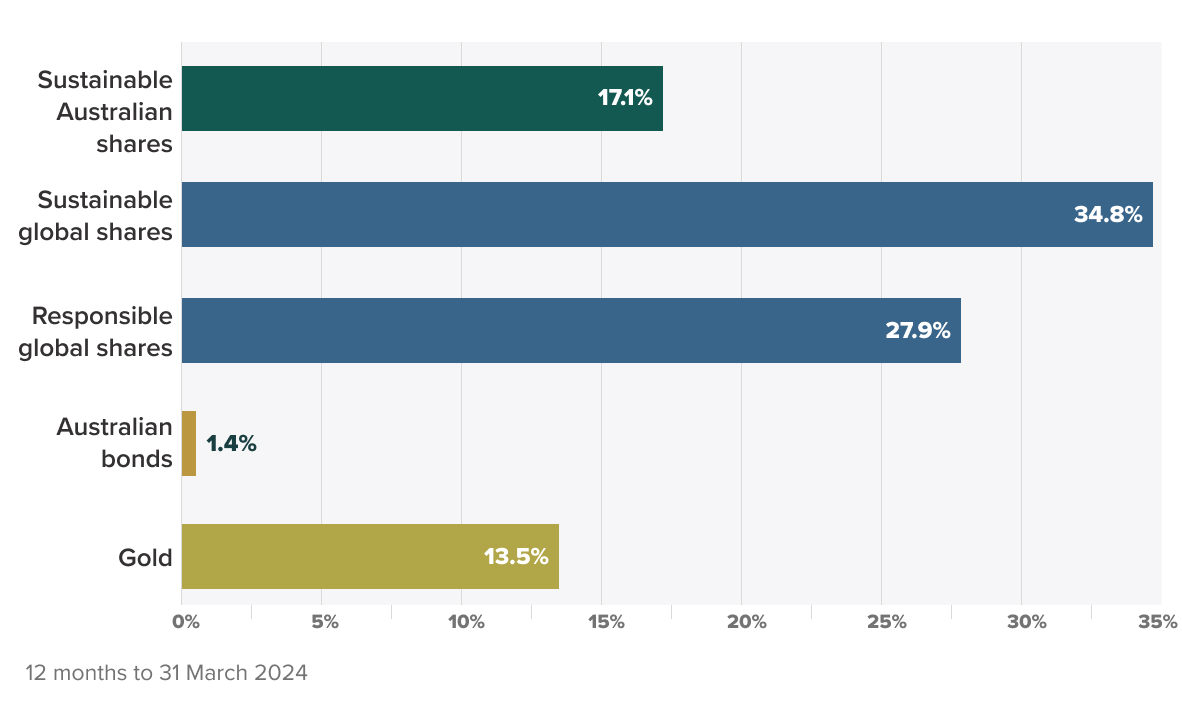

The Stockspot Sustainable Portfolios have a higher exposure to technology shares and lower exposure to the energy and financial sectors because of our screening process which focuses on positive impact scoring (e.g. removing many fossil fuel, coal, thermal mining and financial companies). This has helped their returns since technology companies performed strongly while energy companies underperformed the market over the past 12 months.

Other reasons for performance variations

Performance differences between the Stockspot Model and Stockspot Sustainable portfolios may also arise due to the timing of distributions/dividends, the frequency of rebalancing, and when each ETF was phased into your portfolio.

It’s important to focus on long-term returns and your long-term strategy rather than focus on monthly returns or short-term returns which are often impacted by short-term trends. After all, one of the key tenets of investing is the compounding effect that takes place over many years. Sustainable investing – like all types of investing – will go through periods of ups and downs. Ideally, it’s a way of investing that aligns more closely with your values that can lead to returns over the long-term.

What’s next for Sustainable Investing

Large players focusing on sustainability

A larger number of asset managers are making sustainability a key component of their investment approach. Sustainability-conscious investors are shifting their allocation from traditional funds to sustainable funds with the majority focusing on climate change and clean energy as the biggest driver.

Continued demand for sustainable investing

Many global political leaders are looking to enact legislation to combat climate change, there is increasing research and demand for electric vehicles and renewable energy and countries around the world have pledged to join the Paris Agreement and be carbon-emission free by 2050. The market reflects global and societal sentiment, and sustainability is firmly on the agenda.

Long-term performance of your sustainable investments

Both Sustainable Portfolios and Model Portfolios are built using Nobel Prize Winning Research of diversification across asset classes using low-cost exchange traded funds (ETFs).