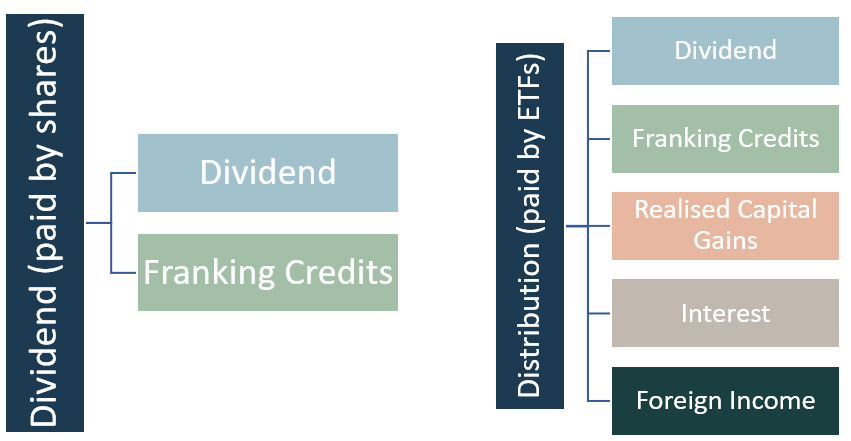

Investors are used to receiving dividends when they own shares. When they receive income from their ETFs it’s called a distribution. These terms are often used interchangeably, but they are quite different, which causes confusion with investors. This article will help you understand the differences between a dividend and a distribution.

What is a dividend?

When you buy a share on the ASX you become a part owner of that business. You can earn a return in a couple of ways, either growth in the share price (known as capital return) or through cash payments from the profits (known as dividends or income return).

When a company earns a profit, it can choose to retain the money in the business to invest in growth, pay it out to shareholders as a dividend or a combination of the two. Companies that pay dividends usually do so at regular intervals (such as quarterly or half yearly).

Australia has some of the highest dividend-paying companies in the world (such as the big banks, BHP and Telstra). This makes them very attractive for Australians looking to receive income, especially in a low interest rate environment.

What is a distribution?

When you invest in an ETF such as the Vanguard Australian Shares Index ETF (ASX: VAS), you benefit from all of the companies within that ETF that pay dividends.

A distribution represents your share of the income earned by the investments held by that fund. It is up to the ETF to collect all the forms of income and profit made by the fund, and pay it out it to the unit holders (i.e. you, the end investors) as distributions.

Rather than receiving the dividends individually (which would be an administrative nightmare), you receive distributions from the ETFs which includes all dividends paid in the most recent period by companies in that ETF as well as some other potential sources of income. It’s a much simpler way of receiving dividends. Better still, if you invest with a service like Stockspot we combine all of your distributions into a simple one-page tax summary document.

A key benefit of investing in an ETF over a LIC (listed investment company) is that all income must be distributed as we discuss in our analysis of ETFs v LICs. An ETF collects dividends and other forms of income on behalf of investors and pays it to them at scheduled intervals. For example, the Vanguard Australian Shares Index ETF pays out its distributions quarterly (January, April, July and October).

A typical ETF distribution can be broken down into five main components:

- Dividends – ETF receives dividends from the companies it owns and will pass on each investors portion and associated franking credits.

- Franking credits – ETFs are eligible to pass on franking credits which we discussed here.

- Interest – like bond ETFs receive interest (i.e. coupon payments) from the underlying bonds they own.

- Realised Capital Gains – from buying and selling the underlying shares (e.g. incurred during rebalancing) with any net capital gain passing on to the investor.

- Foreign income (e.g. ETFs that own overseas shares) and any associated foreign tax credits.

Dividend yield vs distribution yield

When you buy a share you can calculate its historic dividend yield which is their past 12 months total dividends as a percentage of the share price. For example, a company that has paid $0.40 of dividends over the past year and has a share price of $10 would have a dividend yield of 4%.

In a similar way, when you own an ETF or other unit trust, you can calculate the distribution yield which is their past 12 months total distributions as a percentage of the ETF price. For example, the Vanguard Australian Shares Index ETF (ASX: VAS) has paid $3.43 in distributions over the last year and its unit price is $84.10, giving it a distribution yield of 4%.

In both cases you can calculate a dividend/distribution yield that includes franking credits, or excludes them.

Tax on distributions

Similar to dividends, distributions from ETFs form part of your assessable income from a tax perspective.

If an ETF owns shares in Australian tax paying companies it may receive franked dividends. Franking credits are paid to the ETF which then get passed to the end investor as part of the ETF distribution. The ETF provider will show the amount of franking attached to its distribution.

ETFs can make tax quite confusing by issuing a long document at the end of the financial year called an attribution managed investment trusts (AMIT) annual tax statements. This statement will show all the components of the ETF distributions over the financial year.

We’ve built technology to make tax time simple when you own ETFs with Stockspot. We calculate the total distributions received from all the ETFs you owned during the year and summarise it in your one-page annual investor statement.

You can find out more about how ETFs are taxed in our explainer article. Stockspot doesn’t provide tax advice and we encourage investors to seek advice from an accountant or qualified tax professional.