Listed investment companies (LICs) used to be one of the best ways for investors to gain access to a range of shares in one transaction.

Throughout the 20th century, ASX-listed LICs became popular with everyday Australians due to the diversification they offered across sectors and countries.

Fast forward to 2022 and the case for LICs no longer stacks up for investors when compared to exchange traded funds (ETFs). Our analysis reveals ETFs are superior across most measures: transparency, liquidity, certainty, fees, tax efficiency, and most importantly, returns.

When you look at the data, this becomes even more evident:

- 80% of LICs tracking broad global markets failed to beat a global market index ETF over the past year.

- The average management fee of a LIC is over 1% p.a. (5x a typical ETF). This doesn’t include performance fees and the tax drag of a LICs higher portfolio turnover from more active trading.

- LICs regularly trade at a discount to their asset value (on average 10%). Investors have no certainty they’ll be getting fair value when they buy and sell. LICs can also issue new shares which dilute the shareholding of existing investors.

Why are LICs still popular?

Unfortunately, many stockbrokers and financial advisers continue to recommend LICs instead of lower cost index ETFs. This baffles us since ETFs have clear benefits over LICs, including lower fees, greater transparency, and better performance.

As with most aspects of the finance industry, the motivation is largely self-interest. Stockbrokers and financial advisers were paid a healthy commission, known as a stamping fee, to recommend new LICs to their clients.

Once the LIC is listed and the stockbrokers and advisers have collected their commissions most LICs trade well below their net asset value (NAV).

LICs were an excellent example of a loophole in the Australian investment industry that prioritised the financial remuneration of those selling investments over the financial wellbeing and best interest of their clients, everyday Australians.

Stockspot has long campaigned against unfair fees in superannuation and managed funds. LICs are no different. Thankfully, the government banned these commissions in May 2020. Stockspot’s research featured in ASIC’s recommendation to the Treasurer.

This has levelled the playing field for investors so Australian consumers start to get better advice from their advisers and stockbrokers.

- What is a LIC?

- Why is the share value of a LIC different from the underlying value of its assets?

- Compare LICs vs ETFs

- Performance of the largest Australian share market LICs vs ETFs

- Performance of the largest global share market LICs vs ETFs

- Best-performing LICs for 2022

- Worst-performing LICs for 2022

- Stockspot’s view

- LIC Performance tables

What is a LIC?

A listed investment company (LIC) is an actively managed fund listed on the Australian Securities Exchange (ASX). Like a managed fund, LIC money is pooled together from investors to buy a range of investments.

Unlike managed funds, LICs have a company structure, so shareholders own shares in the company (as opposed to units in a fund). Investors buy and sell shares in the LIC to each other. This means no one can sell shares in a LIC unless someone is willing to buy them at the offered price.

LICs pay company tax (currently 30%) on earnings and can choose to pay distributions to investors in the form of dividends, including any attached franking credits.

The 95 LICs on the ASX are worth $47 billion. The LIC market has shrunk more than 18% over the past year, whereas ETFs maintained their 7% growth during the same period.

Nearly two-thirds of LICs invest only in Australian shares, with the remainder investing in global shares and bonds, and a small number in infrastructure and property.

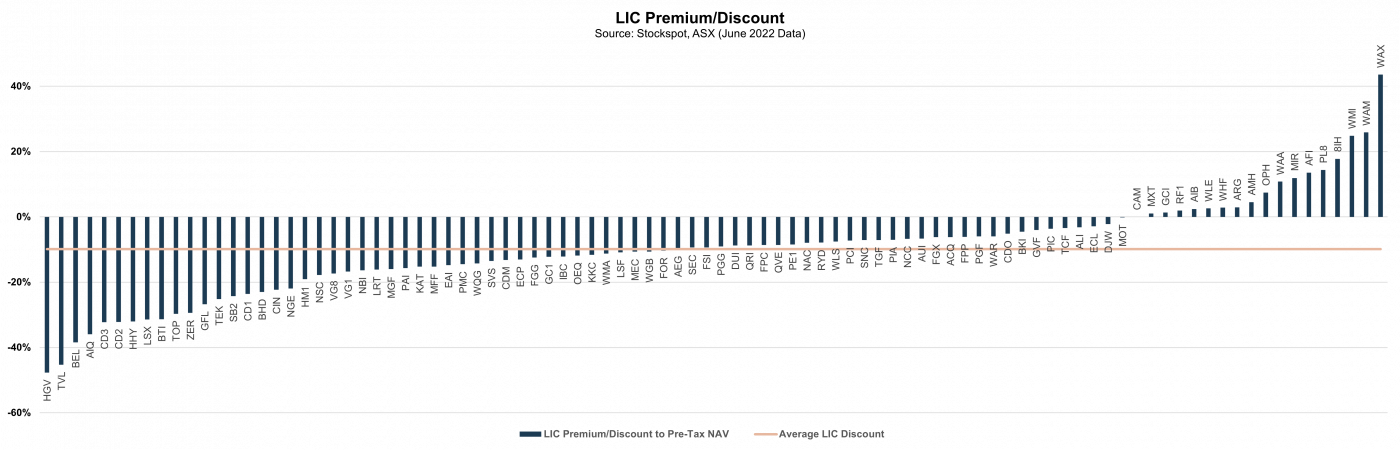

Most LICs trade at a discount to their Net Asset Value or NAV (average discount is 10%). For example, if the investments inside a LIC are worth $1, a typical LIC would trade on the ASX at $0.90.

Here in lies one of the main problems with LICs: investors rarely get what they pay for as they rely on other investors in the same LIC to buy off them when they decide to sell.

This discount has increased over the last few years which has hurt their overall performance. These discounts may never close, trapping investors in LICs that have both underperformed and trade at a discount to their asset value.

Why is the share value of a LIC different from the underlying value of its assets?

One reason for this difference is the shareholders’ view of the additional value brought by the fund manager. If LIC shareholders think that the fund manager will provide no additional value the LIC will trade at a discount to the value of the underlying assets.

The size of the discount depends on the management fee – which is a drag on future returns. For example, if the underlying assets are expected to produce a 10% p.a. return and the management fee is 1% p.a. the shares are likely to trade at a 10% discount (given the total return after fees is 9%).

If shareholders think that management can deliver an additional 1% p.a. return and the management fee is 1% p.a. then the shares will trade at the value of the underlying assets.

Most LICs trade at a discount to their Net Asset Value (NAV) as shown in the following table of the ASX-listed LICs. Note that the average discount to NAV is around 10%. This means, on average, if the assets that make up a LIC are worth $100, then they are trading at $90.

However, many LICs trade at discounts much greater than just taking into account their management fee. This is partly because investors have formed the view that management will underperform the market and partly because of the illiquidity of the LIC itself. A seller of an unloved and ignored LIC may have trouble finding buyers at any price.

Comparing LICs vs ETFs

We recently discussed the key differences between ETFs and LICs and also provided some context as to why ETFs have been growing faster.

| ETFs | LICs | |

| Transparency | ETFs must disclose their portfolio at the end of each trading day. | LICs do not disclose their portfolio until a reporting deadline, generally monthly. The portfolio which is disclosed is already out of date. |

| Liquidity | ETFs have market makers which stand in the market to buy or sell at prices very close to NAV. Indicative NAV (iNAV) is updated every 30 seconds allowing the market makers to trade at close to real time values. | LICs rely on buyers and sellers for liquidity. |

| Tax | ETFs put taxable income in the hands of the unitholder and there is less turnover of underlying assets and therefore lower realisation of capital gains. | LICs are entities that pay tax and dividends. The investor is therefore at the mercy of the LIC dividend and franking credit policy as well as realisation of capital gains. |

Tax differences between LICs and ETFs

LICs pay company tax on their income before distributing it to shareholders. This means LIC investors are entitled to receive fully franked dividends.

However, LICs tend to have much higher portfolio turnover than index ETFs, which creates an ongoing ‘tax drag’ from realising more capital gains each year.

ETFs distribute income on a pre-tax basis and pass on any franking credits received by Australian companies they’ve invested in. Distributions from the Vanguard Australian Shares Index ETF (VAS) are about 70% franked.

The creation and redemption process for ETF units is also tax efficient since there is no asset sale and no capital gains when units are created or redeemed. The ETF issuer can select which shares to use, so it will pick those with a low cost base, reducing the ETF’s tax burden.

The reason most LICs underperform is high fees

On average LIC costs are 5x more than a typical index ETF and that’s before the LICs costs of buying and selling shares, performance fees, tax impacts of high portfolio turnover, and the dilution impact of LICs issuing more shares.

The impact of high costs becomes more apparent with each passing year as LICs find it more and more difficult to generate sufficient returns to make up for the drag of their costs.

This is one reason why we have since 2014 advised clients to invest in the Vanguard Australian Shares Index ETF (VAS) rather than use LICs that invest in Australian shares.

Performance of the largest Australian share market LICs vs ETFs

Many Aussie investors would be familiar with the Australian Foundation Investment Company Limited (AFI), which is by far the largest and most popular LIC with $9.2 billion in FUM. It’s also the oldest LIC in the market having listed in 1936.

Argo Investment Limited (ARG) comes in second in popularity after building up FUM of $6.6 billion, listing more than 70 years ago. Milton (MLT) delisted their LIC in October 2021 after merging with Washington H. Soul Pattinson – a common occurrence of shrinking LICs over the years.

Wilson Asset Management has a number of popular LICs such as WAM and WLE managing $1.9 billion and $1.5 billion respectively. BKI Investment Company Ltd (BKI) and Australian United Investment Company Ltd (AUI) are also all more than $1 billion in size.

| TICKER | NAME | FUM ($B) | 1-YEAR RETURN | 5-YEAR RETURNS (P.A.) |

| S&P/ASX 200 Accumulation (market index) | -6.47% | 6.83% | ||

| AFI | Australian Foundation Investment Company Limited | $9.2b | -0.01% | 11.14% |

| ARG | Argo Investments Limited | $6.6b | 2.96% | 8.27% |

| AUI | Australian United Investment Company Limited | $1.2b | -2.79% | 8.93% |

| WAM | WAM Capital Limited | $1.9b | -13.08% | 3.31% |

| BKI | BKI Investment Company Limited | $1.2b | 8.86% | 7.24% |

| WLE | WAM Leaders Limited | $1.5b | -0.11% | 13.33% |

| Average LIC Return | -0.70% | 8.70% | ||

| VAS | Vanguard Australian Shares Index ETF | $10.4b | -5.24% | 8.25% |

| STW | SPDR S&P/ASX 200 | $4.2b | -4.64% | 8.09% |

| Average ETF Return | -4.94% | 8.17% |

Research by S&P through their SPIVA report shows that 83% of active Australian share funds have underperformed over 15 years and this is also evident with LICs with almost all of them underperforming the index and ETFs.

Nearly 60% of Australian share LICs underperformed the Vanguard Australian Shares Index ETF (VAS) over the last year and 5 years.

Performance of the largest global share market LICs vs ETFs

It’s a similar story for global share LICs with 80% of global share LICs failing to beat the Global 100 ETF (IOO) over the last year. Worse still, 80% of global share LICs had negative returns while IOO had a positive year returning +0.4%!

| TICKER | NAME | FUM ($B) | 1-YEAR RETURN | 5-YEAR RETURNS (P.A.) |

| MSCI World Ex Australian Index Unhedged (market index) | -6.52% | 10.12% | ||

| MGF | Magellan Global Fund – Closed Class Units | $2.1b | -22.92% | n/a |

| LSF | L1 Long Short Fund Limited | $1.6b | 4.47% | n/a |

| MFF | MFF Capital Investments Limited | $1.3b | -20.40% | 6.73% |

| PGF | PM Capital Global Opportunities Fund Limited | $0.6b | 4.50% | 13.03% |

| WGB | WAM Global Limited | $0.6b | -31.05% | n/a |

| VG1 | VGI Partners Global Investments Limited | $0.6b | -35.41% | n/a |

| Average LIC Return | -16.80% | 9.88% | ||

| IOO | iShares Global 100 ETF | $2.4b | 0.37% | 13.20% |

| VGS | Vanguard MSCI Index International Shares ETF | $4.4b | -6.73% | 10.16% |

| Average ETF Return | -3.18% | 11.68% |

We’ve published articles in the past about Australians’ preference to invest in Australian shares. For investors wanting exposure to shares in global markets like the USA, Europe and Asia, ETFs provide more consistent performance and are a better, transparent way to access these markets.

Sometimes a LIC will perform well but performance tends to fluctuate. According to S&P, only 1 in 10 U.S. share funds have beaten the index over 15 years.

This is why we advise clients to invest in the iShares S&P Global 100 Index ETF (IOO) rather than use LICs that invest in global shares.

Best performing LICs in 2022

More than 20% of LICs on the ASX had a negative one-year return to 30 June 2022. The average LIC return was -11.5% compared to the average ETF return of -8.5%.

Private equity strategies were the best performing over the last year. We have previously spoken about the danger of funds investing in illiquid and unlisted assets like private equity and raised this in our 2022 Fat Cat Funds Report.

The best-performing LIC was the Cordish Dixon Private Equity Fund III (CD3), which gained 41.5%. Its other private equity fund, the Cordish Dixon Private Equity Fund II (CD2) was the second best performer, delivering a total return of 28.6% over the last 12 months. CD2 and CD3 were some of the worst-performing LICs in 2020 down more than 25%. The funds have recently been involved in a controversial merger plan. The Pengana Private Equity Trust (PE1) was the third best performer, up 27.3% over the same period.

The Excelsior Capital Limited (ECL) was the fourth best performing LIC returning 18.7% over the last year as the company invests in smaller companies which can come with bigger returns but with more risk.

The Katana Capital Limited (KAT) rounded out the top five performing LICs for the year, up 13.7% due to its large cash holding and higher weighting in materials.

| ASX CODE | LIC NAME | 1-YEAR RETURN |

| CD3 | Cordish Dixon Private Equity Fund III | 41.5% |

| CD2 | Cordish Dixon Private Equity Fund II | 28.6% |

| PE1 | Pengana Private Equity Trust | 27.3% |

| ECL | Excelsior Capital Limited | 18.7% |

| KAT | Katana Capital Limited | 13.7% |

Worst performing LICs in 2022

The worst-performing LIC was 8I Holdings Ltd (8IH) which lost 73% over the year. Their heavy position in both the U.S. and Chinese market, with a particular focus on thematics like renewable energy and technology has led to poor performance.

There is risk when choosing funds that only hold a handful of companies, particularly those marked as “high conviction” (i.e. hand-picked with strong confidence) that have a tilt towards sectors like technology. This caused issues for many LICs.

The Thorney Technologies Ltd (TEK) and Hearts and Minds Investments Limited (HM1) both shaved half their value, losing 51.2% and 50.1% respectively over the past year.

For example, HM1 only holds just 26 companies. In contrast, the Stockspot global shares ETF holds more than 100 companies, increasing its diversification. Ophir High Conviction Fund (OPH) was the fourth worst-performing LIC down 38.9%, while the Bentley Capital Limited (BEL) LIC was down 35.4% completing the bottom five list. BEL at one stage had over 80% of its portfolio in a single stock.

| ASX CODE | LIC NAME | 1 YEAR RETURN |

| 8IH | 8I Holdings Ltd | -73.0% |

| TEK | Thorney Technologies Ltd | -51.2% |

| HM1 | Hearts and Minds Investments Limited | -50.1% |

| OPH | Ophir High Conviction Fund | -38.9% |

| BEL | Bentley Capital Limited | -35.4% |

Stockspot’s view

Every year a handful of LICs perform well, but fund manager performance is inconsistent and almost impossible to predict. Of the top 25% of active Australian share funds in 2017, only 3% remained in the top quartile by 2022.

LICs served a purpose about 30 years ago but the investment world has moved on. In a country like Australia, it was puzzling that stock brokers and financial advisers were not regulated to act in the best interests of their clients.

After years of loud voices from LIC lobby groups, the Australian government has finally acted to close the LIC stamping fee loophole.

It has further accelerated the trend we are seeing of more Australians turning to low cost investment options like ETFs to help manage their money. ETFs have clearly demonstrated, even during market downturns, their liquidity, superior performance and tax efficient structure.

LIC performance tables

Australian share LICs

| ASX CODE | NAME | FEE %* | 1 YR RETURN | 3 YR RETURN (P.A) | 5 YR RETURN (P.A) |

| ACQ | Acorn Capital Investment Fund Limited | 0.95% | -16.7% | 13.5% | 13.6% |

| AEG | Absolute Equity Performance Fund Limited | 1.50% | -20.1% | 5.5% | 0.6% |

| AFI | Australian Foundation Investment Company Limited | 0.18% | 0.0% | 11.5% | 11.1% |

| AMH | AMCIL Limited | 0.77% | -6.3% | 12.7% | 10.2% |

| ARG | Argo Investments Limited | 0.18% | 3.0% | 7.9% | 8.3% |

| AUI | Australian United Investment Company Limited | 0.13% | -2.8% | 6.7% | 8.9% |

| BEL | Bentley Capital Limited | 1.00% | -35.4% | -6.1% | -5.9% |

| BKI | BKI Investment Company Limited | 0.19% | 8.9% | 8.3% | 7.2% |

| BTI | Bailador Technology Investments Limited | 1.75% | 10.2% | 13.0% | 11.0% |

| CAM | Clime Capital Limited | 1.00% | -6.7% | 2.5% | 7.6% |

| CDM | Cadence Capital Limited | 1.00% | -13.2% | 12.8% | 0.9% |

| CIN | Carlton Investments Limited | 0.10% | -2.0% | 1.3% | 3.0% |

| DJW | Djerriwarrh Investments Limited | 0.39% | -1.4% | 0.0% | 2.0% |

| DUI | Diversified United Investment Limited | 0.17% | -7.5% | 6.6% | 9.5% |

| ECL | Excelsior Capital Limited | 1.40% | 18.7% | 20.9% | 18.6% |

| ECP | ECP Emerging Growth Limited | 1.11% | -23.5% | 10.0% | 9.8% |

| FGX | Future Generation Australia | 1.00% | -12.2% | 5.5% | 6.9% |

| FOR | Forager Australian Shares Fund | 1.88% | -20.0% | 6.1% | -4.8% |

| FSI | Flagship Investments Limited | 0.00% | -28.4% | 3.5% | 7.5% |

| GC1 | Glennon Small Companies Limited | 1.00% | -12.7% | -3.3% | -1.3% |

| HHY | HHY Fund | 0.00% | n/a | n/a | n/a |

| IBC | Ironbark Capital Limited | 0.65% | 0.8% | 5.8% | 5.8% |

| KAT | Katana Capital Limited | 1.25% | 13.7% | 18.0% | 13.6% |

| LAN | Lanyon Investment Company Limited | n/a | n/a | n/a | n/a |

| MIR | Mirrabooka Investments Limited | 0.70% | -14.1% | 11.9% | 8.8% |

| NAC | NAOS Ex-50 Opportunities Company Limited | 1.75% | -19.5% | 10.6% | 5.1% |

| NCC | NAOS Emerging Opportunities Company Limited | 1.25% | -12.0% | 7.8% | -0.4% |

| NGE | NGE Capital Limited | 0.00% | 8.3% | 7.2% | 9.7% |

| NSC | NAOS Small Cap Opportunities Company Limited | 1.25% | -18.8% | 18.9% | 5.5% |

| OEQ | Orion Equities Limited | 0.00% | -32.3% | n/a | 5.9% |

| OPH | Ophir High Conviction Fund | 1.23% | -38.9% | 2.9% | n/a |

| PIC | Perpetual Equity Investment Company Limited | 1.00% | -5.2% | 12.2% | 10.8% |

| PL8 | Plato Income Maximiser Limited | 0.80% | -0.6% | 9.3% | 9.6% |

| QVE | QV Equities Limited | 0.90% | 0.3% | 4.0% | -0.6% |

| RYD | Ryder Capital Limited | 1.25% | -22.3% | 6.8% | 8.3% |

| SB2 | Salter Brothers Emerging Companies Limited | 1.50% | -27.1% | n/a | n/a |

| SEC | Spheria Emerging Companies Limited | 1.00% | -11.7% | 10.2% | n/a |

| SNC | Sandon Capital Investments Limited | 1.25% | -23.6% | 4.5% | 4.2% |

| TOP | Thorney Opportunities Ltd | 0.75% | -8.7% | -6.3% | -3.4% |

| WAA | WAM Active Limited | 1.00% | -27.0% | -2.0% | -0.3% |

| WAM | WAM Capital Limited | 1.00% | -13.1% | 4.9% | 3.3% |

| WAR | WAM Strategic Value | 1.00% | -23.0% | n/a | n/a |

| WAX | WAM Research Limited | 1.00% | -14.6% | 8.7% | 6.2% |

| WHF | Whitefield Limited | 0.35% | -14.9% | 6.7% | 7.9% |

| WLE | WAM Leaders Limited | 1.00% | -0.1% | 18.6% | 13.3% |

| WLS | WCM Global Long Short Limited | 0.95% | -9.7% | -7.3% | -5.4% |

| WMA | WAM Alternative Assets Limited | 1.20% | 10.4% | 17.8% | 4.1% |

| WMI | WAM Microcap Limited | 1.00% | -2.5% | 20.9% | 15.8% |

Global share LICs

| ASX CODE | NAME | FEE %* | 1 YR RETURN | 3 YR RETURN (P.A) | 5 YR RETURN (P.A) |

| 8IH | 8I Holdings Ltd | 0.00% | -73.0% | 10.5% | -28.9% |

| AIB | Aurora Global Income Trust | 1.33% | -8.0% | 0.4% | -29.7% |

| AIQ | Alternative Investment Trust | 0.75% | -11.8% | 6.1% | 7.3% |

| ALI | Argo Global Listed Infrastructure Limited | 1.20% | 11.6% | 5.9% | 8.9% |

| BHD | Benjamin Hornigold Limited | 3.00% | -29.0% | n/a | -24.2% |

| CD1 | Cordish Dixon Private Equity Fund I | 0.33% | 7.2% | 17.7% | 13.6% |

| CD2 | Cordish Dixon Private Equity Fund II | 0.33% | 28.6% | 11.8% | 10.9% |

| CD3 | Cordish Dixon Private Equity Fund III | 0.33% | 41.5% | 23.8% | 12.4% |

| CDO | Cadance Opportunities Fund Limited | 1.25% | n/a | n/a | n/a |

| EAI | Ellerston Asian Investments Limited | 0.95% | -27.1% | 1.5% | 1.2% |

| FGG | Future Generation Global | 1.00% | -26.5% | -3.8% | 2.2% |

| FPC | Fat Prophets Global Contrarian Fund Ltd | 1.25% | -27.0% | 7.5% | -2.5% |

| FPP | Fat Prophets Global Property Fund | 1.03% | 4.2% | -0.1% | n/a |

| GFL | Global Masters Fund Limited | 0.85% | -13.0% | 3.1% | 0.7% |

| GVF | Global Value Fund Limited | 1.50% | 4.7% | 12.8% | 6.7% |

| HGV | Hygrovest Limited | 0.00% | -17.9% | -36.0% | -27.7% |

| HM1 | Hearts and Minds Investments Limited | 0.00% | -50.1% | -7.9% | n/a |

| LRT | Lowell Resources Fund | 2.16% | -7.3% | 56.2% | n/a |

| LSF | L1 Long Short Fund Limited | 1.40% | 4.5% | 23.9% | n/a |

| LSX | Lion Selection Group Limited | 1.50% | 10.9% | 12.3% | 4.9% |

| MEC | Morphic Ethical Equities Fund Limited | 1.25% | -11.7% | 10.8% | 1.8% |

| MFF | MFF Capital Investments Limited | 1.25% | -20.4% | -3.4% | 6.7% |

| MGF | Magellan Global Fund – Closed Class Units | 1.35% | -22.9% | n/a | n/a |

| PAI | Platinum Asia Investments Limited | 1.10% | -22.4% | 2.1% | 4.6% |

| PE1 | Pengana Private Equity Trust | 1.25% | 27.3% | 10.3% | n/a |

| PGF | PM Capital Global Opportunities Fund Limited | 1.00% | 4.5% | 19.5% | 13.0% |

| PIA | Pengana International Equities Limited | 1.77% | -29.5% | 0.9% | 2.9% |

| PMC | Platinum Capital Limited | 1.10% | -11.4% | -0.6% | 1.6% |

| RF1 | Regal Funds Management Limited | 1.50% | -28.8% | 20.8% | n/a |

| SVS | Sunvest Corporation Limited | 0.00% | n/a | n/a | n/a |

| TEK | Thorney Technologies Ltd | 0.75% | -51.2% | -4.8% | -0.8% |

| TGF | Tribeca Global Natural Resources Limited | 1.50% | -13.2% | -0.2% | n/a |

| TVL | Touch Ventures Limited | 0.00% | n/a | n/a | n/a |

| VG1 | VGI Partners Global Investments Limited | 1.50% | -35.4% | -11.8% | n/a |

| VG8 | VGI Partners Asian Investments Limited | 1.50% | -20.6% | n/a | n/a |

| WGB | WAM Global Limited | 1.25% | -31.1% | 0.1% | n/a |

| WQG | WCM Global Growth Limited | 1.25% | -24.9% | 5.7% | 3.7% |

| ZER | Zeta Resources Limited | 0.50% | -23.3% | -2.4% | -1.7% |

Bond LICs

| ASX CODE | NAME | FEE %* | 1 YR RETURN | 3 YR RETURN (P.A) | 5 YR RETURN (P.A) |

| NBI | NB Global Corporate Income Trust | 0.85% | -23.1% | -8.3% | n/a |

| KKC | KKR Credit Income Fund | 1.21% | -15.4% | n/a | n/a |

| PCI | Perpetual Credit Income Trust | 0.88% | -5.7% | -1.8% | n/a |

| PGG | Partners Group Global Income Fund | 1.54% | -4.9% | n/a | n/a |

| GCI | Gryphon Capital Income Trust | 0.96% | 1.4% | 3.2% | n/a |

| MOT | Metrics Income Opportunities Trust | 1.03% | -2.2% | 4.5% | n/a |

| MXT | Metrics Master Income Trust | 0.86% | 0.0% | 3.3% | n/a |

| QRI | Qualitas Real Estate Income Fund | 1.54% | -10.5% | 0.6% | n/a |

| TCF | 360 Capital Enhanced Income Fund | 1.35% | -5.0% | 0.6% | 2.6% |