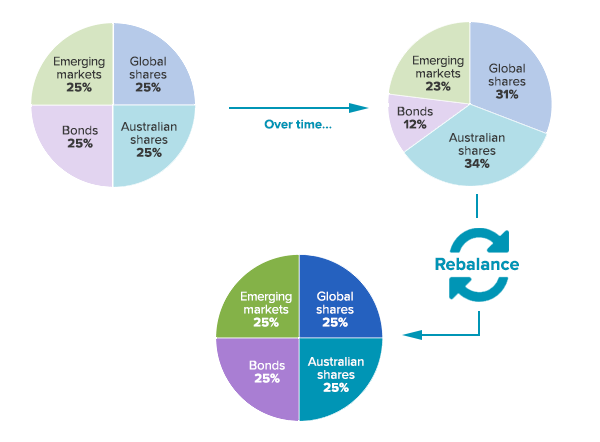

Portfolio rebalancing involves selling investments that have grown faster than others in your portfolio and buying more of the investments that have fallen behind.

Portfolio rebalancing helps reduce the risk you need to take to earn a certain level of return. Portfolio rebalancing can be expensive, time consuming and emotionally exhausting to manage yourself. This is why rebalancing is hard to get right as a DIY investor.

When should you rebalance?

We rebalance our client portfolios in 3 main situations:

-

When a client agrees to a different strategy because their personal situation has changed

-

When our investment team selects different ETFs or portfolio weights

-

After some of the ETFs have performed better than others

How does portfolio rebalancing work?

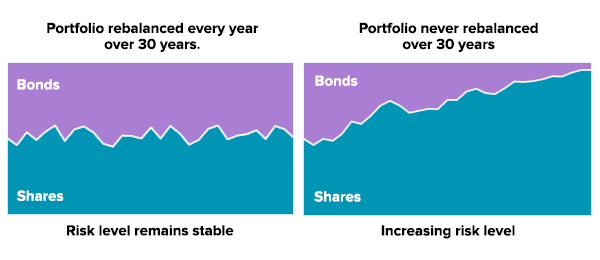

The shares part of a investment portfolio typically grows faster than bonds and gold. Shares are more risky than bonds, so a portfolio slowly becomes more risky over time as the shares portion grows if it’s not rebalanced back to its original allocation.

This is what a portfolio of shares and bonds would look like after 30 years with and without rebalancing.

Source: Vanguard

We monitor our clients’ portfolios and rebalance them back to each client’s target allocation to keep risk consistent for each investment strategy. Complex calculations are required to give the best rebalancing results.

We also rebalance when distributions and dividends from ETFs are received and when clients deposit funds into their Stockspot account. Using cash inflows to buy underweight investments is a sensible rebalancing technique. This is why the Stockspot investment dashboard shows clients how much they need to deposit to trigger the next portfolio rebalance.

How often should you rebalance?

Research shows that rebalancing a portfolio’s holdings makes more sense when each asset class has moved from its target allocation by a certain percentage (known as threshold based) rather than on a set time basis (for example quarterly).

We continually monitor client portfolios and periodically rebalance them back to their target mix. We carefully consider the risk of each asset class and the consequences of selling. We also use deposits and reinvestment of distributions as opportunities for regular portfolio rebalancing. It’s hard to know when the next rebalance will happen because it depends on the performance of each of the asset classes and when they were purchased.

Rebalancing ‘too early’ may mean giving up profits so we are cautious not to rebalance too often which can harm returns.

Some years there will be lots of rebalancing and in other years there will be none. In 2014 and 2015 it was not necessary to rebalance much because Australian bonds and shares had similar returns. In a period where shares rise and bonds lag, rebalancing will happen more frequently.

How does Stockspot rebalance better than I could myself?

Rebalancing is counterintuitive. It’s hard to sell things that have done well because it involves going against the crowd. Investments are usually most risky when they’re popular. History shows that returns always revert to average, after a period of wins it’s sensible to lock in some profits.

It’s also difficult to convince yourself to buy the investment that has performed poorly and everyone is telling you to avoid. Automated rebalancing removes emotion and helps you to buy investments when they’re low and sell when they’re high.

In 2015 and 2016 most market strategists said to avoid the emerging markets ETF (IEM) due to worries about China. We even wrote about the Chinese worries in a blog mid-2015. Emerging markets had been through a difficult 2 years and were a completely unloved asset class.

However since early 2016 the emerging markets ETF has been the best performer in the Stockspot portfolios, rising 22% in the 12 months to March 2017. Rebalancing helped our clients be disciplined and add more emerging markets to their portfolios when it was unloved, rather than sell.

In our benefits of investing on autopilot article, we discuss some of the other advantages of letting Stockspot rebalance for you which includes avoiding brokerage fees.

Why rebalancing is important

Rebalancing helps you make the most of market swings and roundabouts by selling when assets have risen and buying after falls.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.