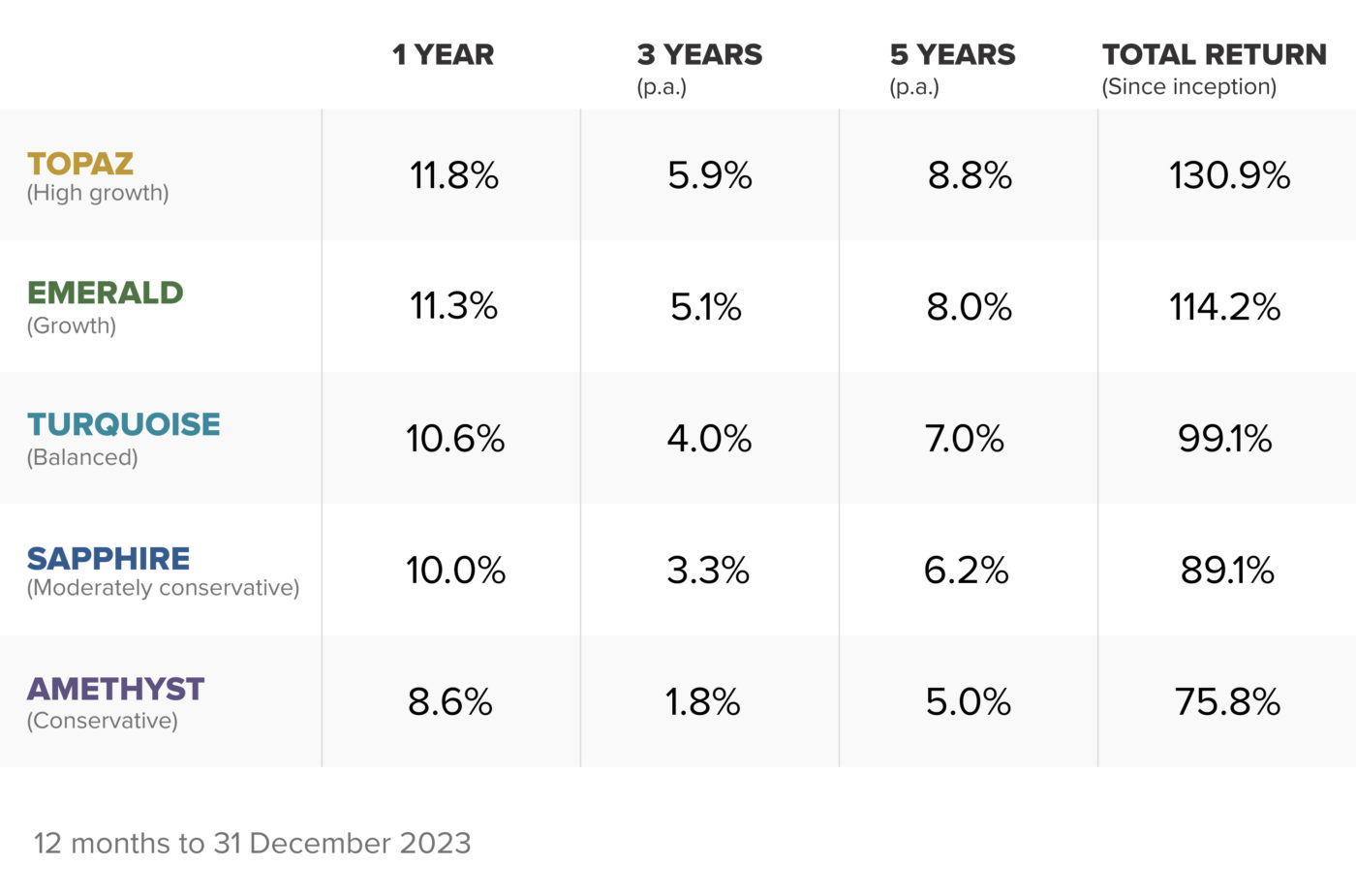

For the ninth year in the past decade, the Stockspot portfolios have all delivered positive returns. Our high-growth portfolio, Topaz, achieved a return of 11.8% in 2023. With the exception of our conservative strategy, Amethyst, all our portfolios outperformed the average balanced super fund return of 9.6% in the past year.

The Stockspot portfolios have also outperformed 99% of similar diversified funds in Australia over the last 5 years.

The Stockspot Model Portfolios returned 8.6% to 11.8% after fees over the 12 months to 31 December 2023, while the Stockspot Sustainable Portfolios returned 10.1% to 14.0% after fees. In a reversal of the 2022 trend, our Sustainable Portfolios experienced greater returns in 2023, primarily driven by the robust performance of technology stocks compared to resources shares.

Our newly launched Topaz Income Portfolio and Topaz Inflation Portfolio delivered returns of 6.5% and 3.1% over three months, having been introduced in October.

Should your investment strategy be different if you have more money?

It’s a common misconception among investors that the strategies for handling larger sums of money should fundamentally differ from those for smaller investments. However, we believe this is not the case. Whether you’re an individual investing $10,000 or an institution investing $10 billion, we maintain that the core principles of your investment strategy should remain consistent.

A recent article published by the CFA Institute sheds light on why many large institutional investors, including super funds, sovereign wealth funds, and endowments, are often enticed towards pursuing more complex and costly investment strategies, despite the fact that a simpler portfolio consisting of diversified index funds are likely to yield superior results.

For instance, the Future Fund, entrusted with managing $212 billion on behalf of Australians, invests into a complex array of assets, including private equity, infrastructure, timberland, credit, and alternative investments. In stark contrast all our portfolios simply invest into transparent, listed index ETFs. Our portfolios not only outperformed the 8% return achieved by the government’s Future Fund over the span of one year but Topaz and Emerald surpassed the Future Fund’s annual return of 7.6% over the past five years.

Investment asset returns

Markets performed strongly in 2023 because investors started to anticipate interest rate cuts in 2024, and we also saw inflation numbers that were not as high as expected. These factors made many investors think that the global economy will have a soft landing in 2024.

Now, what does a “soft landing” mean? It’s basically a situation where the economy slows down gently without any big problems. Many now believe this is the most likely outcome.

The idea of a soft landing has become popular because inflation numbers have been lower than expected, and the economy is still doing okay. In the U.S., for example, the inflation rate fell to 3.1%, and in Australia, it was 4.9%.

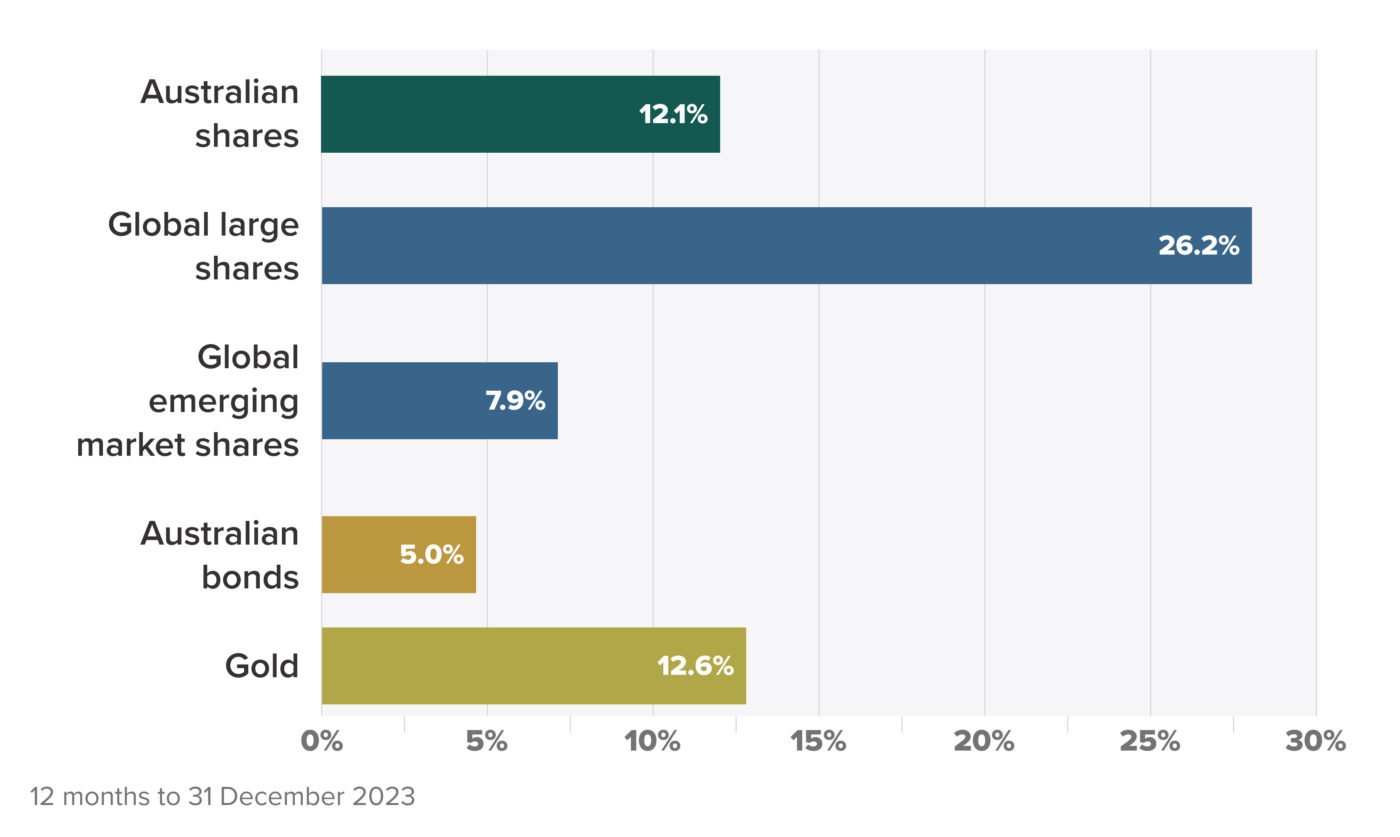

Our Global large shares ETF (ASX: IOO) led gains with a return of 26.2% due to the remarkable performance of the “magnificent 7” stocks that constitute a significant portion of this ETF. These seven stocks include Alphabet (GOOGL), Amazon.com (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA). Our selected global ETF has continued to outperform other global share ETFs due to its large company focus and because we have retained exposure to the US dollar since it is unhedged.

Our Australian shares ETF (ASX: VAS) rose 12.1% as resources and financials performed strongly despite higher interest rates. Large companies also performed better than small companies in Australia.

Our Gold ETF (ASX: GOLD) also outpaced inflation with a return of 12.6%. Gold’s positive performance has been shaped by a variety of factors, including central bank buying, political uncertainties, inflationary pressures, and the depreciation of the Australian dollar. Gold is also strong insurance against the risk that bonds and shares fall in unison, as experienced in 2022. It’s worth noting that gold has recorded annual increases in value every year since 2017.

Our Australian bonds ETF (ASX: IAF) and emerging market shares ETF (ASX: IEM) were up 5.0% and 7.9% for the year respectively. Bonds have experienced a remarkable return in investor popularity this year, primarily due to the more attractive yields now on offer relative to bank deposit rates. Emerging markets were buoyed by the flourishing Indian stock market, which offset weaknesses stemming from the Chinese share market.

How to invest when interest rates are high

It’s important to highlight that while interest rates are as high as they’ve been for many years, holding significant amounts of cash over the long-term ensures that you won’t be able to buy as much with your money in the future.

To put that in perspective, $10,000 safely deposited into a bank account five years ago would be worth around $10,615 today.

Meanwhile, $10,000 worth of goods and services five years ago now costs $11,820, which your bank interest wouldn’t be able to cover.

While inflation remains above bank interest rates, the value of your money is slowly being eroded when left in savings accounts.

On the other hand, investing into a diversified high growth portfolio five years ago would be worth around $14,306 today.^^ Share markets were of course volatile over that period but investing would have preserved the value of your money.

Market predictions for 2024

What can we anticipate from markets in 2024?

To get a comprehensive overview of the year ahead, you can tune in to our year-end webinar.

I have also outlined my predictions for 2024 in an interview with Livewire, which you can find here.

In short, rather than trying to predict the unpredictable, we encourage preparation. We believe that the most successful investors are those who recognise the inherent uncertainty of the future and have the discipline to follow an investment strategy that embraces this reality.

Our strategy is quite simple: invest in a diverse mix of low-cost index funds for the long term and filter out the noise. In other words, concentrate on the aspects you can control and let go of the things beyond your control. We firmly believe that this approach not only aligns with the available evidence but also presents a more sustainable path to financial success.

Stockspot comparison group is defined by the Morningstar multi-sector asset allocation ranges: Growth (61%-80% growth assets), Balanced (41%-60% growth assets) and Moderate (21%-40% growth assets).

^^The growth figures presented for the five-year period are based on the following: 1.2% from the Bloomberg AusBond Bank Bill Index, 3.4% from the ABS Consumer Price Index and 7.4% from Stockspot Topaz after-fee returns.