Whether you consider yourself part of the FIRE movement (financial independence retire early) or are simply investing for long-term goals, there’s a growing number of people investing for growth.

A 2021 study by Investment Trends found that 435,000 Australians made their first share market investment over the past year. With interest rates near zero, this is a trend set to continue as more people search for better returning investments than cash.

It’s positive to see so many people dipping their toes into markets for the first time. With the wide range of low-cost ETFs available, it’s much easier and safer compared to when I started investing back in 1996.

A question we have been fielding from a few clients with long-term investing goals is “Why would I invest in defensive assets at all?”

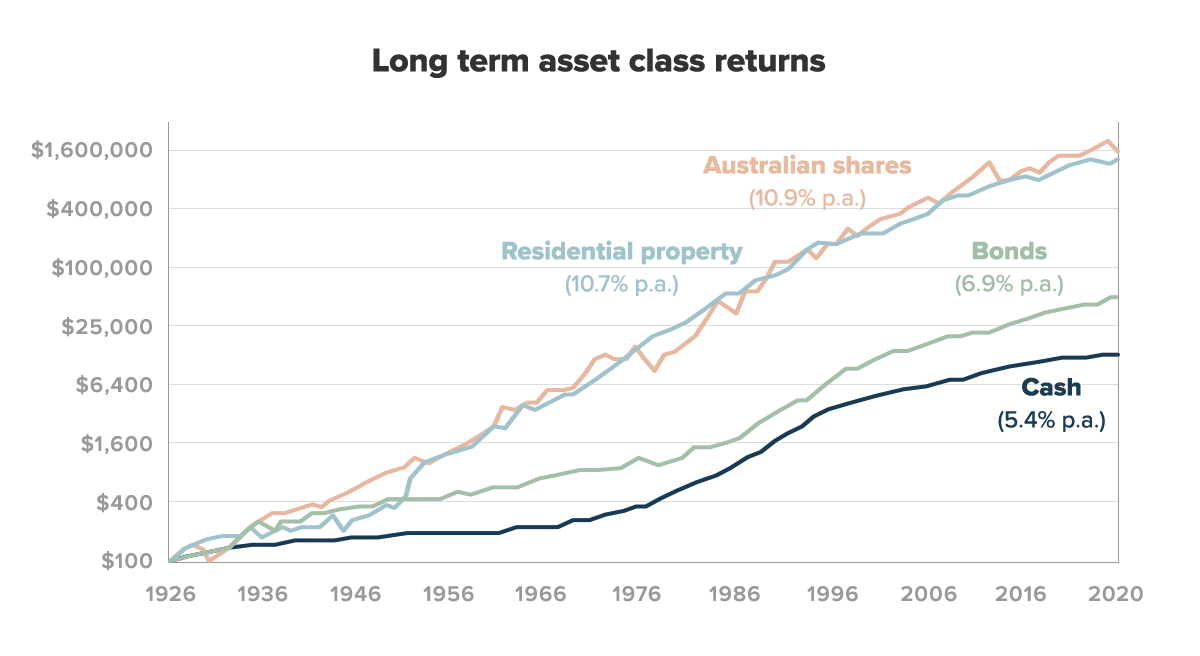

It’s a very fair question, afterall Australian shares have trounced government bonds and cash over the long run. Shares have added on average 10.9% p.a. vs 6.9% p.a. from bonds and 5.4% p.a. from cash over the last century

Yet despite this, our highest risk portfolio, Topaz, still has 22% in defensive assets – split between government bonds and gold. Why would you accept what is likely to be a lower long-term return for even part of your portfolio if you have a 20+ year investment horizon?

There are four key reasons why we believe owning some defensive assets is incredibly important, even if you’re investing for growth and have an investment horizon of several decades.

1. Defensive assets protect you if your circumstances change unexpectedly

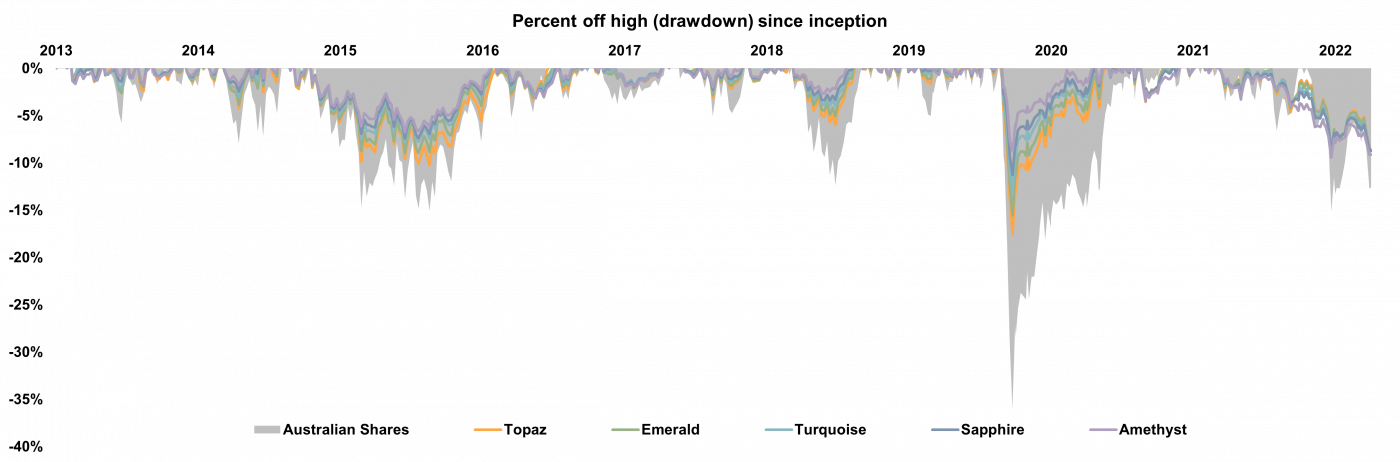

Having a small amount of defensive assets can provide a layer of protection when markets fall. For example, when the COVID-19 crisis hit in March 2020, Australian shares fell by 36% and took 44 weeks to recover it’s all time highs. Our highest risk portfolio only fell by less than half of that amount and recovered in 34 weeks due to having an allocation to government bonds and gold.

This is important because while you may be planning to invest for decades, circumstances can change unexpectedly. Thousands of Australians had to dip into their savings and super to stay afloat when COVID-19 hit. Over the duration of the COVID-19 Early Release of Super Scheme, superannuation funds received 4.9 million applications totalling $37.3 billion. Anyone who cashed out their personal investments or super during that period did so when share prices were low after markets had collapsed. Having some defensive assets would have reduced the amount of shares you needed to sell at a loss.

2. Defensive assets keep you invested when markets have a correction

Behavioural studies also show that your tendency to sell out of fear increases as your paper losses get larger. Once you’ve lost 35% to 50% of your wealth (the share market falls in 2020 and 2008 respectively), loss aversion really kicks in. This tendency to move from shares to cash after markets have crashed to protect against further losses was reported by many super funds in 2008 and 2020.

Not only do defensive assets provide portfolio insurance, they act as a safeguard to your own behaviour. Rather than sell out of fear after markets have fallen you can have an automated strategy in place to rebalance out of some defensive assets and into more shares to take advantage of lower share prices. This is what we were able to do for thousands of clients in March 2020, and it added 1% to 1.9% of additional returns.

3. You may not sacrifice returns by owning some defensive assets

While defensive assets have earned lower returns over 100 years, there have been stretches of time where they have performed very well.

Even though our highest risk portfolio currently has 22% in defensive bonds and gold, it has still outperformed many strategies with a much lower weighting to defensive assets. Over the five years to 30 June 2021 our Topaz strategy which has had 22%-30% in defensive assets over that period has still beaten 98% of similar growth funds. This was due to selecting the best low-cost ETFs and automatically rebalancing at the right times.

4. Defensive assets are an inexpensive insurance policy

The Australian share market has returned 10.9% per year since 1926. However nobody knows the returns over the next 20 years. Defensive assets provide an important insurance policy because they have typically performed well when share markets have not.

Across history there have been periods of time where growth assets like shares have done poorly. For example, in March 2020 when the Australian share market fell over 35%, our portfolios helped cushion investors by taking 50% to 70% less risk because of their broad diversification across other assets like gold.

1970s stagflation

One example was the stagflation episode of the 1970s. During the period from January 1976 to January 1980 the U.S. share market (S&P 500) tracked sideways while gold rose by over 400%.

Having Stockspot’s current allocation of 14.8% of your portfolio in gold over this period would have been the difference between no nominal return and a 60% return over those four years.

1990s Japan

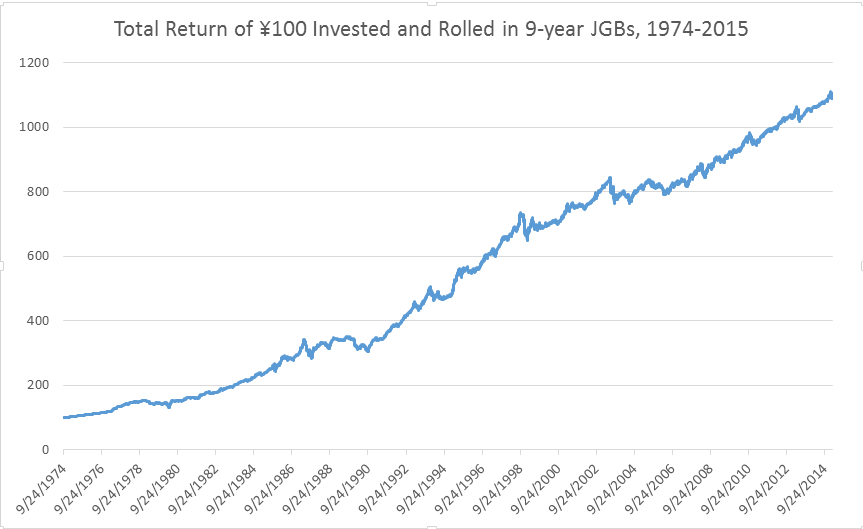

Bonds have performed well in deflationary environments like Japan from the 1990s. Japan is a well cited example of why bonds are important regardless of how low their income yields become.

Japan experienced a share market bubble in the 1980s, after which their share market generated no returns for 25 years. Many Japanese investors avoided Japanese government bonds (JGBs) and gold on the basis of their low/zero yields. As it turns out, having some bonds and gold was critical for growing and preserving your capital if you were a Japanese investor through this period. The yield on a 10 year Japanese government bond has remained under 2% since 1997 yet Japanese JGBs have been one of the best risk-adjusted asset classes over the past 30 years.

The following chart shows the total return of ¥100 invested in 9-year Japanese Government Bonds from a starting point in the 1970s.

Why Stockspot recommends some defensive assets for long term investors

Stockspot currently recommends owning a minimum of 22% of your portfolio defensive assets regardless of your investment horizon. While it can be tempting for growth investors to swap out defensive assets for more shares when markets are rising, bonds and gold play an important role in improving the quality of your portfolio returns. Defensive assets also boost your chances of long-term investing success by reducing your risk of permanent losses.