Over the past year since we increased our allocation to gold in February 2021, gold has significantly outpaced the returns of other defensive assets, rising by 18%. This compares to government bonds which have fallen 3% over the same period.

Since the start of 2022 gold has risen 8% to the highest level since 2020 as investors seek refuge in safe-havens after Russian forces attacked Ukraine.

Gold has helped to protect the Stockspot portfolios during market falls and has been a large driver of why the Stockspot portfolios outperformed 99% of similar diversified funds over 5 years.

In this article we discuss why we increased the allocation to gold in all of our portfolios to 14.8% and why gold is more vital in your portfolio today compared to any time in the past.

Ray Dalio, the billionaire American hedge fund manager, who is the chief investment officer of the world’s largest hedge fund (Bridgewater Associates) explains that gold should be part of everybody’s portfolio because it’s an alternative to money.

“If you don’t own gold… there is no sensible reason other than you don’t know history or you don’t know the economics of it.” – Ray Dalio

History supports Dalio’s views.

Gold has historically been the purest form of money and acts like a government bond that doesn’t pay interest and protects against inflation (this is known as a zero-coupon inflation protected bond). Throughout the centuries, has been able to maintain its purchasing power and provide portfolio insurance in times of need.

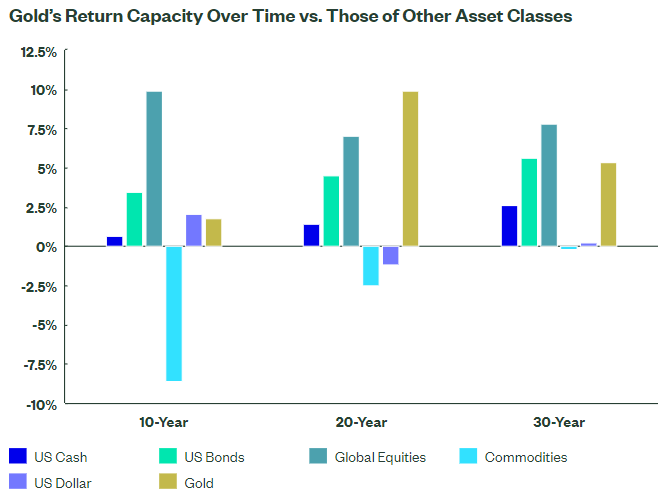

Gold has outperformed other major assets over the last 20 years and has provided competitive returns over other time periods.

Why Stockspot invests in gold

Stockspot Portfolios have included an allocation to gold via the GOLD exchange traded fund (ETF) since 2014. The GOLD ETF is physically backed by gold bullion which is stored in a vault in London. It’s unhedged so investors are also protected from a falling Australian dollar.

Gold is a proven defensive asset, and it’s a better diversifier than cash or any other readily investable asset class. That’s why Stockspot includes it as part of our portfolios.

Increasing our gold allocation in 2017

In late 2017 we increased the GOLD ETF allocation from 10% to 12.3% for all client portfolios because we identified the need for more exposure. The negative correlation between shares and bonds had weakened, which meant that bonds wouldn’t provide as much of a cushion in a share market correction scenario.

Increasing our allocation to defensive assets in 2017 helped protect clients from 50% to 80% of the market falls in March 2020 and the gold allocation has generated much of the outperformance compared to similar funds.

Increasing our gold allocation in 2021

In today’s environment of artificially low interest rates, gold is likely to provide better portfolio diversification compared to government bonds if there is rising inflation or other market risks like conflict.

In the event of deflation or a domestic shock, gold doesn’t have the risk of a country not honouring it’s debt (sovereign credit risk) and gold isn’t limited by zero interest rates like government bonds, so will also provide better portfolio protection.

These characteristics make gold an attractive alternative to government bonds in both an inflationary and deflationary environment. This is why we further increased the portfolio gold allocations to 14.8% in February 2021.

More reasons to own gold

1. Gold is a diversifier

Harry Markowitz won the 1990 Nobel Prize in Economics by showing how to achieve the best return potential by combining assets with a negative relationship to each other (negative correlation).

His seminal work, Modern Portfolio Theory (MPT), continues to be the best regarded theory for managing portfolios, and is how we approach building portfolios.

Gold has a very low or negative correlation with most other investment assets which is why it typically moves in a different direction to shares. This is a rare quality for an asset and it means that gold has the ability to reduce the risk of a portfolio.

Essentially, gold helps to improve the quality of your investment portfolio returns which means you can earn returns with less risk.

2. Gold is an insurance policy

Gold has historically been an effective way to preserve the real value of your wealth since it acts as an insurance policy against currency devaluation.

Currency devaluation happens when your home country currency loses its global purchasing power either because of economic factors or monetary policy.

In 2020, gold was trading at its all-time high in both Australian dollars and US dollars. More recently gold prices have fallen as share prices rise and interest rates start to rise. However, if inflation accelerates quickly and currencies start to weaken, gold will likely be a sought out asset class.

3. Gold is a safe haven

Gold tends to be viewed as a safe haven, because when other assets like shares are falling, gold often rises. This helps to cushion the impact of share market falls, especially during times of political uncertainty.

Government bonds have historically been one of the safest places to park your money. Today, however, there is a record US$18 trillion of government debt issued by creditworthy governments that trades on negative yields. In countries like Japan, Switzerland and Germany you need to pay the government to borrow your money. Australia sold its first negative yielding government bond in December 2020.

While gold doesn’t have a yield, it’s still a more positive yielding asset than negative yielding government bonds which penalise owners. As the amount of negative yielding government debt increases, so too does the attractiveness of gold.

Why gold is a controversial investment

Views on gold as an investment are generally philosophical rather than fact based. Gold is a difficult asset to value, and market commentators love to speculate what is causing the daily moves.

Unlike other commodities like iron ore or oil, there’s little industrial use for gold. It doesn’t power our electric vehicles or enable the production of steel for buildings. The majority of the demand for gold in the world comes from either jewellery or investment. So when investors buy gold they are investing in an asset whose major use is simply as ‘an investment’ – and not much else.

Unlike shares and bonds which generate dividends, gold doesn’t generate regular cash-flows so investors in gold can only benefit from capital returns.

However, ignoring gold just because it doesn’t generate any income is naive. State Street Investors explains why you shouldn’t care that gold doesn’t pay dividends, and debunks other misconceptions about gold in this 2019 report.

It’s just smart to own gold

Gold should be a key part of every diversified portfolio regardless of your investment horizon or risk capacity. It’s absolutely vital today for conservative, balanced and growth focused investors since shares and bonds are dancing to the same tune.

It’s the part of your portfolio you’ll be glad you have when the rest of the investment world isn’t shining.

This article was originally published in July 2019 and has been updated in June 2021 and February 2022.