The goal of the Stockspot portfolios is to maximise returns for each level of risk. To achieve this, we place an emphasis on the weight of each asset class, rather than trying to pick winners within an asset class.

Asset classes have different risk profiles. For example, share prices are volatile but tend to outperform other asset classes over the long term. On the other hand, government and high-grade corporate bonds provide safe and steady income but little capital growth.

Additionally, if you invest overseas, you’re not only exposed to the Australian economy. And if you invest in emerging markets, you’ll have an opportunity to share in their accelerated growth.

Investments like gold provide protection against inflation and the monetisation of debt.

You can read more about our investing philosophy here.

Current asset allocation and performance

Since our inception in 2014, we’ve only changed our asset allocation once. In November 2017, we increased the defensive assets in the portfolios (gold and bonds), and reduced the allocation to Australian and global shares.

We make sure our asset allocation reflects current market conditions, including the relationship between different assets. This relationship between assets is known as correlation.

Impact on performance

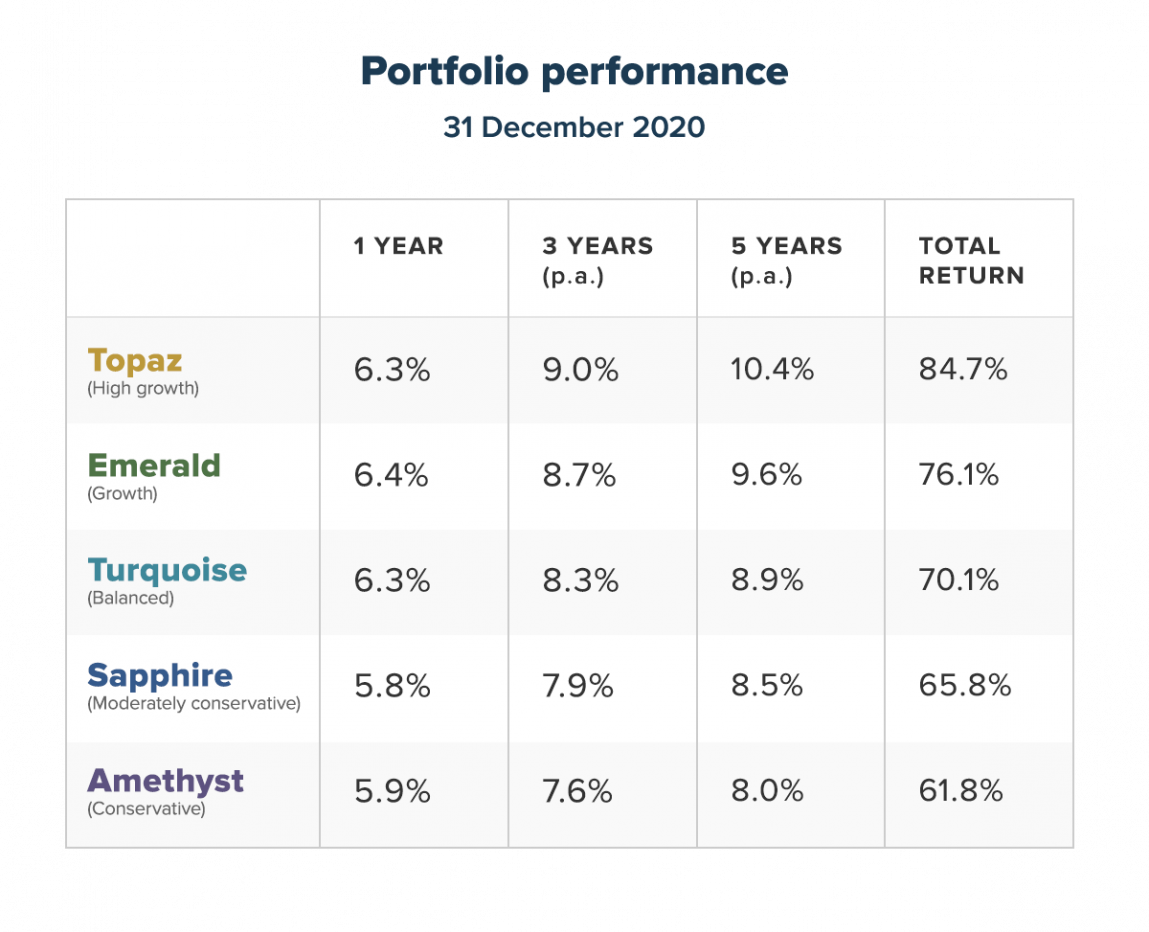

The asset allocation changes we made in 2017 had a positive impact on our performance, improving returns and reducing risk. The impact of this change was also seen during 2020, when, despite the market volatility, all of the Stockspot portfolios had positive returns over 1, 3 and 5 years.

The Stockspot portfolios have also outperformed 100% of similar diversified funds according to Morningstar data covering 600+ multi-asset funds. The average level for outperformance varies by portfolio but is in the range of 23% to 28% over 5 years.

Source: Stockspot, Morningstar website comparison group of investment funds across growth, balanced and moderate multi-sector categories to 31 December 2020. Stockspot Amethyst, Turquoise and Topaz portfolios used for comparison.

Why we make portfolio changes infrequently

Over the long run, making fewer changes to your portfolio leads to better outcomes. It reduces capital gains, minimises transaction costs, and improves after-tax returns.

It’s a common investing mistake to make asset allocations too often, and many people harm their after-tax returns by doing this.

Stockspot’s outperformance of 100% of diversified funds over the last 5 years supports the broader industry research that less is more when it comes to portfolio complexity and asset allocation changes.

Asset allocation changes

Below we explain exactly how and why we’re making asset allocation changes.

Preparing for different scenarios

The market is always unpredictable, but the table below outlines some of the possible outcomes in the next few years.

We tested our asset allocation by considering what could happen to the local and global economy over the next few years and by including different combinations of growth, inflation, employment and interest rates.

| Scenario | Possible drivers |

| 1. Global rising inflation with low interest rates (Global reflation) | Monetary/fiscal expansion in response to COVID-19 and extended stimulus deadlines leading to a higher than normal inflation (i.e. Fed Reserve and RBA new policy). |

| 2. Global falling inflation (disinflation/deflation) with low interest rates (Global deflation) | Disinflation/deflation due to continued demand/supply shocks after COVID-19. Rolling shutdowns, delayed vaccinations, employers not rehiring staff, less stimulus (fiscal/monetary) than expected. |

| 3. Domestic falling inflation (disinflation/deflation) with low interest rates (Domestic shock) | COVID-19 sets off broader economic shock (e.g. housing) which holds Australia back from a global recovery. Consumers focus on using increased savings to pay down debts (i.e. deleveraging) similar to what happened in the U.S. after the Global Financial Crisis. |

| 4. Reversion to ‘normal’ growth and inflation (Back to normal) | Gradual return to normal of employment, growth, inflation. Gradual removal of stimulus. |

1. Reducing exposure to government bonds

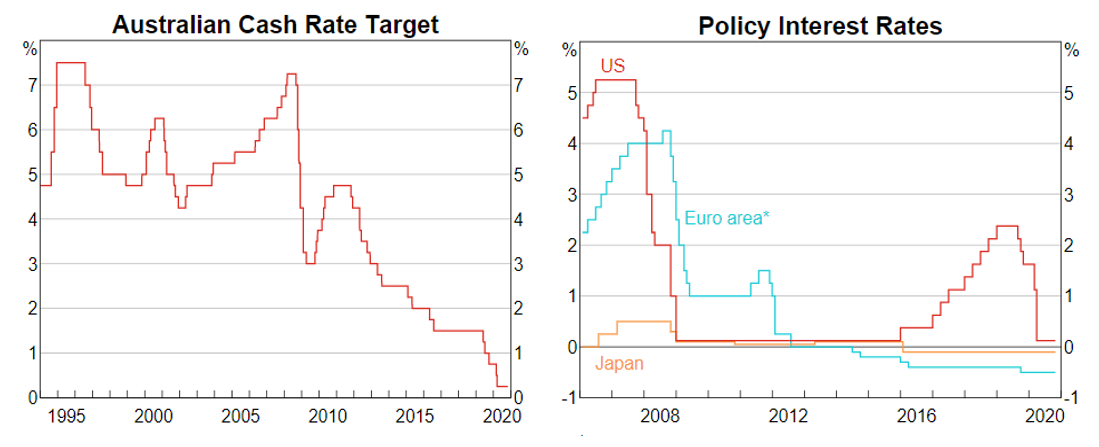

Australian interest rates are now close to zero which is having a significant impact on the benefit of bonds and other similar low risk assets as portfolio diversifiers.

The RBA is reluctant to support negative interest rates, which means that bonds may not provide an effective cushion from future share market volatility. We recognised this when we increased the gold allocation in 2017.

However, the issue is even more significant now as short-term interest rates converge towards zero. If inflation occurs, and interest rates subsequently rise, government bonds could bring risk to a portfolio and fall in tandem with shares as the market discounts future cashflows by a higher rate.

This risk and the continued positive correlation between shares and bonds (both move up and down at the same time) is why we are reducing the allocation to government bonds.

2. Increasing the gold allocation

We’ve increased the gold allocation across our portfolios from 12.3% to 14.8%.

Gold has historically been the purest form of money and acts like a government bond that doesn’t pay interest and protects against inflation (this is known as a zero-coupon inflation protected bond).

This means that gold is likely to provide better portfolio diversification compared to government bonds if there is rising inflation and artificially low interest rates. In the event of deflation or a domestic shock (see table above), gold doesn’t have the risk of a country not honouring it’s debt (sovereign credit risk) and gold isn’t limited by zero interest rates like government bonds, so will also provide better portfolio protection.

These factors are likely to make gold appealing for asset allocators over the next several years as an alternative to government bonds. Gold will also be important for growth focused investors because shares and bonds are moving in the same direction.

This article explains some of the benefits of owning gold in your portfolio.

3. Increasing the allocation to emerging market shares

We’re increasing the allocation to emerging market shares by between 4% to 10% across all our portfolios.

Emerging markets (EM) are countries that have higher economic growth rates and are making an increasing contribution to global GDP. Emerging markets include China, Taiwan, South Korea, India, Brazil, South Africa, Brazil, Russia, Thailand, Saudi Arabia, Mexico.

In the possible reflation scenario (see table above), emerging market shares are likely to perform strongly. They also provide important diversification outside of the Australian economy.

Despite underperforming over the past 10 years in comparison to U.S large shares, emerging markets have now transitioned from commodity and resource dependent economies to economies driven by technology, healthcare and more affluent consumers which will lead to less reliance on commodity cycles.

Split between growth and defensive assets

These asset allocation changes will result in the following splits between growth and defensive assets for the portfolios:

| Growth | Defensive | |

| Topaz (high growth) | 78.0% | 22.0% |

| Emerald (growth) | 70.0% | 30.0% |

| Turquoise (balanced) | 60.0% | 40.0% |

| Sapphire (moderately conservative) | 50.0% | 50.0% |

| Amethyst (conservative) | 40.0% | 60.0% |

What do the asset allocation changes mean for you?

The asset allocation changes will impact clients differently based on the timing of when you’ve invested, your current allocation to each investment, and the rebalancing setting you’ve chosen.

We’ll reach out to you individually if there’s anything you need to do. If you don’t hear from us, your portfolio will be rebalanced automatically by us in February 2021.

In some cases the asset allocation changes will be immediate, and in others we will use future top-ups and upcoming distributions to bring your portfolio in line with the new target weights. This will minimise the impact of realising capital returns.