Warren buffet loves index funds. He’s sung their praises dozens of times in his annual investor letters since 1993. He’s recommended investors use index funds only rather than pick stocks or pay active fund managers.

He famously won a million dollar bet that a simple S&P500 index fund would beat 10 of the brightest fund managers.

In fact Warren Buffett loves index fund so much he’s instructed that his estate should be invested 90% into a shares index fund and 10% into a bond index fund.

That’s right, no property, no infrastructure, no hedge funds. Just indexed shares and bonds. Buffet said it best in his 1993 Berkshire Hathaway Shareholder Letter:

“By periodically investing in an index fund, the know-nothing investor can actually outperform most investment professionals. Paradoxically, when ‘dumb’ money acknowledges its limitations, it ceases to be dumb.” – Warren Buffett

This should tell you a couple of things – first of all that the best regarded investor in the world believes that index funds are the only ingredient you need to grow your wealth.

Secondly, that there’s no need to over-complicate it. Buffett thinks that if your time horizon is infinite you only need two index funds (shares and bonds), and your portfolio should be weighted heavily towards shares.

How much of my portfolio should be in shares?

Unfortunately for most of us, our time horizon is shorter than Buffett’s ‘forever’ so plonking 90% into shares is too risky. Over the last 100 years 90/10 allocation between shares and bonds would have earned you an annual return of 9.7% p.a.

Although you would have had to ride some big ups and downs along the way including one 39% fall. Even for many growth investors that’s tough to stomach and stay invested through!

Defensive assets to the rescue

The good news is that increasing defensive assets like bonds and gold can significantly reduce how much you lose when markets fall.

But how much of them should you own?

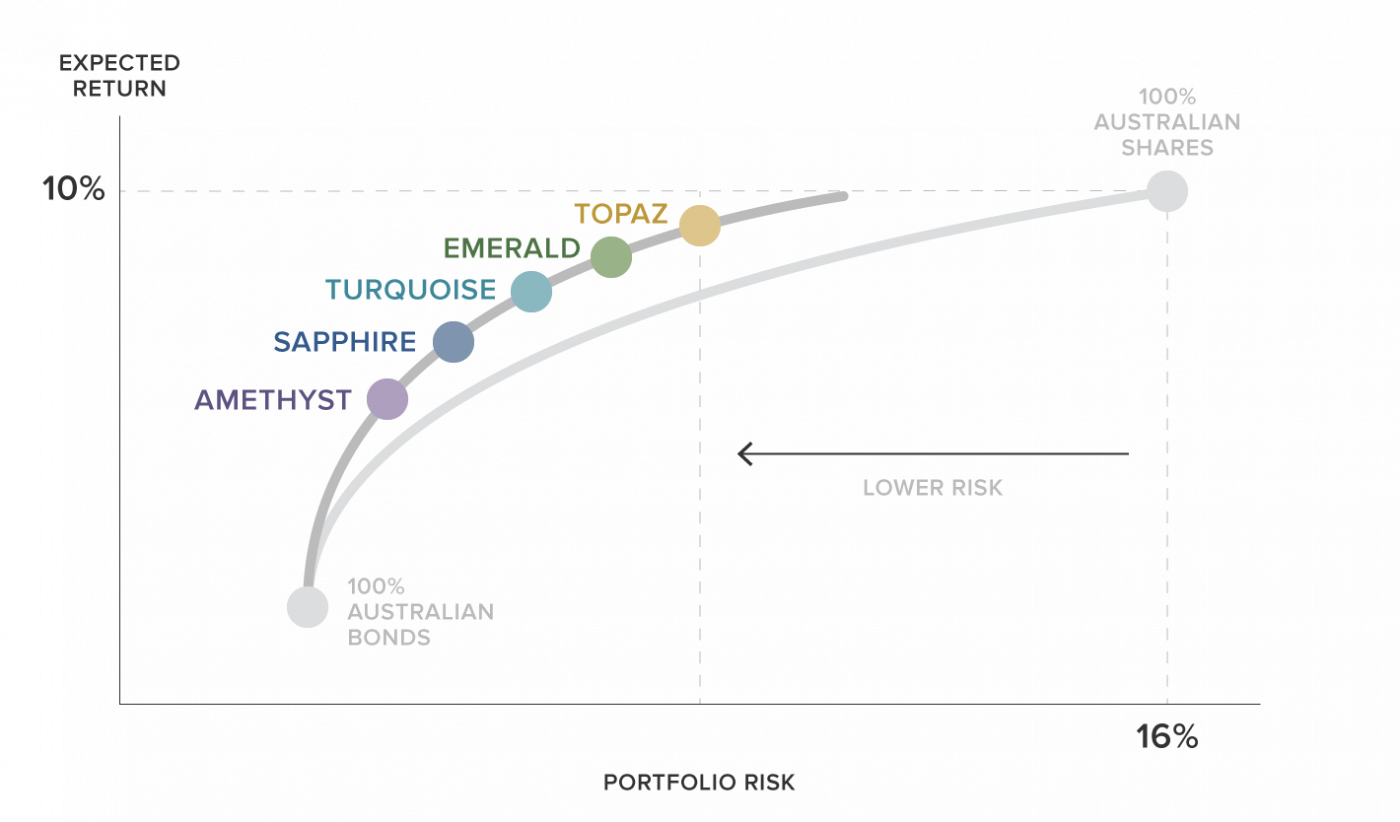

This was answered best by Chicago-school economist Harry Markowitz who won the 1990 Nobel Prize in Economics. He showed how to achieve the best return potential by combining growth assets like shares with defensive assets like bonds and gold.

His seminal work, Modern Portfolio Theory (MPT), continues to be the best regarded theory for managing portfolios, and is what we use at Stockspot. We combine index ETFs to generate the best possible potential for returns while taking the lowest possible risk.

Why defensive assets have become less defensive

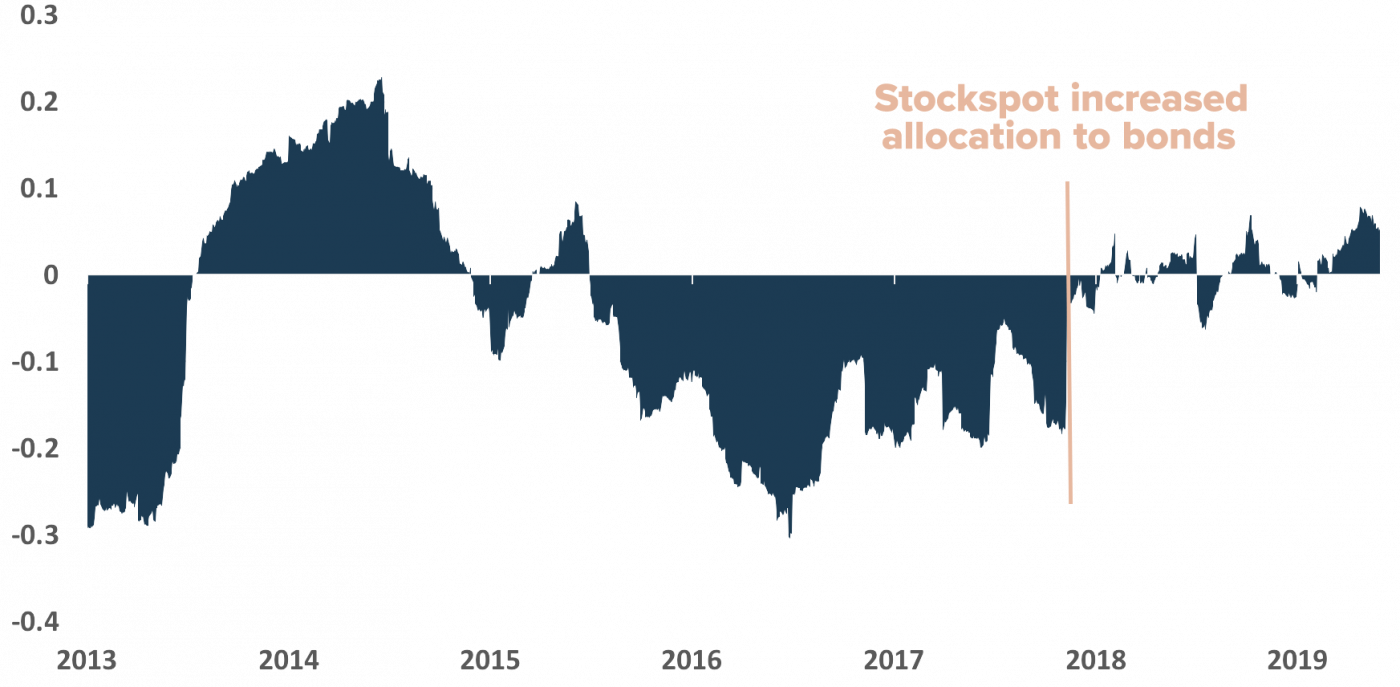

One of the most important factors to consider when using Modern Portfolio Theory is the relationship between assets which is known as their correlation.

Ideally you want a mix of assets that have a low correlation because this means they are less likely to lose money at the same time. This is just as important as understanding an assets risk and returns.

Low correlation assets give your portfolio a smoother path – in finance speak we call it better ‘quality’ returns.

Over the long term, the correlation between bonds and shares has usually been negative. That’s why they work so well together – bonds help to cushion any short term dips in share markets. Over the last 30 calendar years, every time Australian shares have fallen in value, bonds have risen.

But like a chameleon, correlations are always changing colour. Over the last few years the negative correlation between shares and bonds has weakened – and become positive. This is significant.

Australian shares and bonds correlation

This change of tune has happened across the developed world – driven by interest rate policy. With interest rates near zero, people have been forced out of cash into both bonds and shares to earn a return.

So they’re both rising together. Today there is a record US$13 trillion of government bonds around the world with negative yields. i.e. you need to pay the government to borrow your money!

Gold is also benefiting from this world of negative real yields (when bond yields are lower than inflation) because you don’t miss out on any interest by holding gold instead of bonds or cash.

It’s worth noting Buffett isn’t a big fan of gold – but other renown investors like Ray Dalio think you need it.

Total returns – shares vs bonds

Why we made portfolio changes in 2017

The current environment where assets like shares, bonds and gold are all moving in the same direction has led to a situation where it makes more sense to have a higher allocation to bonds and gold than you may normally expect for a ‘growth’ focused portfolio.

It simply gives you the best mix of risk and return based on the current relationship between these asset classes.

This is what led us to increase the allocations to bonds and gold in all of the Stockspot portfolios in November 2017. Importantly we increased the bond and gold allocation in the Growth and High growth portfolios because it gives you the best of both worlds.

Think of it this way…

- If markets rise over the short term, defensive assets are more likely to participate in gains at the moment. Over the last year bonds are up 9.7% and gold is up an impressive 18.8%

- On the other hand if share markets fall over the short term you’ll need a larger amount of defensive assets as a cushion.

So far this has played out as we anticipated. Correlations between assets have remained positive and the higher allocation to bonds and gold hasn’t detracted from performance, it’s helped.

Gold has been the best performing asset in our portfolios since we made the portfolio changes, up 23.6%. This has helped all of our portfolio strategies – from conservative to high growth – deliver after-fee returns of at least 10% over the last year.

| Portfolio | 1 year performance (as of 30 June 2019) |

| Topaz (Aggressive growth) | 11.4% |

| Emerald (Growth) | 11.2% |

| Turquoise (Balanced) | 11.0% |

| Sapphire (Moderately conservative) | 10.8% |

| Amethyst (Conservative) | 10.5% |

Our higher allocation to bonds and gold has helped portfolio returns and risk.

At the same time the higher defensive allocation also helped to cushion market falls. When the Australian share market dipped 14% at the end of 2018, the Stockspot growth portfolio (Emerald) only dipped by 7%, helping our clients stay cool, calm and collected.

The more conservative strategies fell by even less.

All of the portfolios quickly recovered in early 2019.

Why growth investors need more defensive assets today

When shares and bonds are moving in the same direction it makes sense to maintain a higher allocation to defensive assets.

An allocation of at least 30% invested in high grade bonds and gold for growth investors gives the best of both worlds right now – participation in market gains and more protection in any temporary falls.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.