As an investor your aim is to make money, which happens when markets rise. So naturally it’s tempting to try and time your entry point to ‘buy low and sell high’.

The problem with this strategy is that nobody really knows where markets are headed next. Australian shares have returned around 10.9% per year over the last 100 years but those returns aren’t spread out evenly.

Over short periods of time like a week or a month it’s actually a flip of a coin whether markets will be up or down. Short term movements in markets are random ‘noise’ around the long term uptrend.

You can ignore the professional fund managers and TV commentators too. Most of them get their market timing calls wrong. This is one reason 80% of them do worse than simply buying and holding the Australian share market index and doing nothing.

When is the right time to invest?

If you wait for prices to fall to grab an bargain you’ll need to get two decisions right – when to be out and when to get back in. That’s easier said than done!

Even if markets do fall in the first place, if you wait too long to buy back you’ll miss out on returns as they go back up. Then if you’re completely out of the market you have no way to benefit from the gradual increase in share prices over time.

Thankfully, there is a way you can avoid the anxiety of investing everything at once! It’s a simple investment strategy called dollar cost averaging.

The best time to invest is… regularly.

Dollar cost averaging is one of the most powerful ways to get ahead when you invest. Instead of waiting for the ASX to fall to time your next investment, dollar-cost averaging is a strategy to invest your money gradually over a few weeks or months.

If you invest small amounts regularly over a period of time you’ll buy your investments at an average price over time. That way you get to take advantage of any market dips (and pay a lower price) or gains if markets rise.

Procrastination is the enemy of investment returns

Trying to time the market is fraught with psychological barriers. When markets fall and it seems like everyone is abandoning the investment ship it’s extremely difficult to pile in. That’s why most people who wait on the sidelines for the next market correction end up waiting too long and missing out all the way back up!

Take December 2018 as an example. The S&P ASX/200 (Australian share market) had fallen 15% in 3 months and most people were sitting on their hands. Fast forward six months and the share market is up 20% from its December lows.

Those who held off from investing in December 2018 because of either: a) fears of further market falls or b) hope of even cheaper prices; missed out on dividends and capital growth.

On the other hand, in September 2020 the market had risen 11 months in a row and it might be tempting to wait on the sidelines. In this video Stockspot founder, Chris Brycki explains why waiting can also be a risky strategy.

If you wait to save up large lump sums to invest you potentially risk:

a) Missing out on compound returns while you wait and,

b) Being more impacted by short term market movements once you’re invested.

Ultimately, if you have a long-term investment mindset dollar cost averaging can reduce anxiety about losing money while you invest. Even if markets don’t dip, you’ll end up buying as markets rise and be making a profit on your earlier purchases.

How do I dollar cost average?

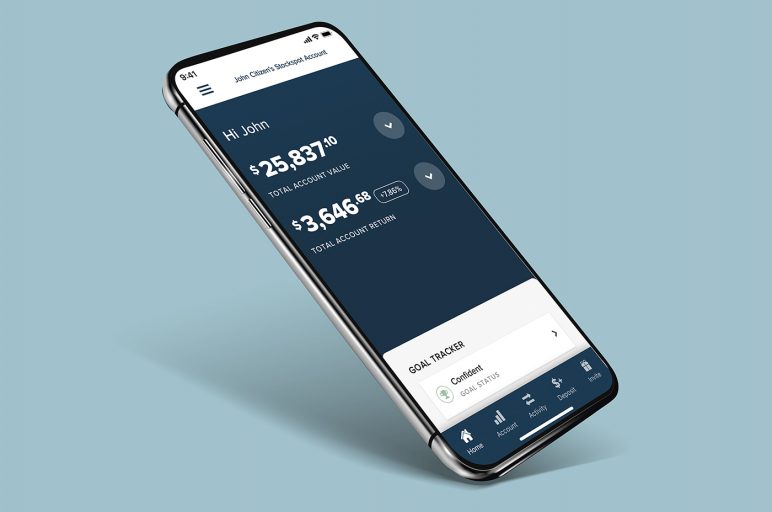

A dollar cost averaging investment strategy is easy. Simply make a plan of how much you want to invest and set up a regular top-up. The easiest way to do this is by setting up an automatic transfer from your bank account. Our Head of Client Care and Advice, Sarah King recently wrote this guide on how to dollar cost average.

Checklist before you start investing

At Stockspot we believe you should only consider investing once you have:

- 3-6 months worth of expenses saved as a ‘rainy day fund’

- A minimum of $2,000 to invest. It could be from savings, a bonus or tax return

- A time horizon of at least 3+ years to give you the best chance of great results

Since Stockspot’s portfolios are spread across a mix of Australian, global and emerging market ETFs as-well as some bonds and gold to cushion market falls, you don’t need to worry about timing the market.

This article was originally published in June 2018 and has since been updated.