In this blog, we tell you everything you need to know about dollar-cost averaging (DCA), what it is and how it could help you gain more of life’s most valuable asset – time.

Dollar-cost averaging sounds quite technical doesn’t it? As with most things finance related it’s another jargony term for quite a simple investment strategy that involves making small, regular, contributions to your investments.

The sophistication doesn’t come from the strategy itself, but how it could help you gain more time, sleep and peace of mind. Whether you’re new to investing or a professional, the decision of when to invest your money can be a challenging one.

Should you invest everything at once or dip your toes in by investing smaller amounts over time? What if the market is rising? Falling? Or doing not much at all. Often we get caught on the hamster wheel trying to work out which is better. This procrastination can paralyse us from making any decision – which is the worst decision of all.

As Chris discusses in this video, not investing just because the market is at an all-time high is usually a mistake. It’s better to at least get started investing, even if you spread it out over a few months.

The truth is, both dollar cost averaging and lump sum investing have their own merits and limitations, but often our choice of one over the other is linked to our desire to reduce our sense of short-term regret.

So, what is the best approach?

In this blog we’ll cover:

- What is dollar cost averaging: How it works

- Lump sum vs dollar-cost average

- Is Dollar Cost Averaging a good idea?

What is dollar cost averaging: How it works

Let’s say you have a lazy $24,000 in your bank account earning a low interest rate. In the back of your mind you’re thinking “I should really be doing more with my money”.

Now let’s assume you’ve taken the next step and decided to invest that money. What next? You broadly have two choices:

-

Lump sum: invest the whole $24,000 in one go; or

-

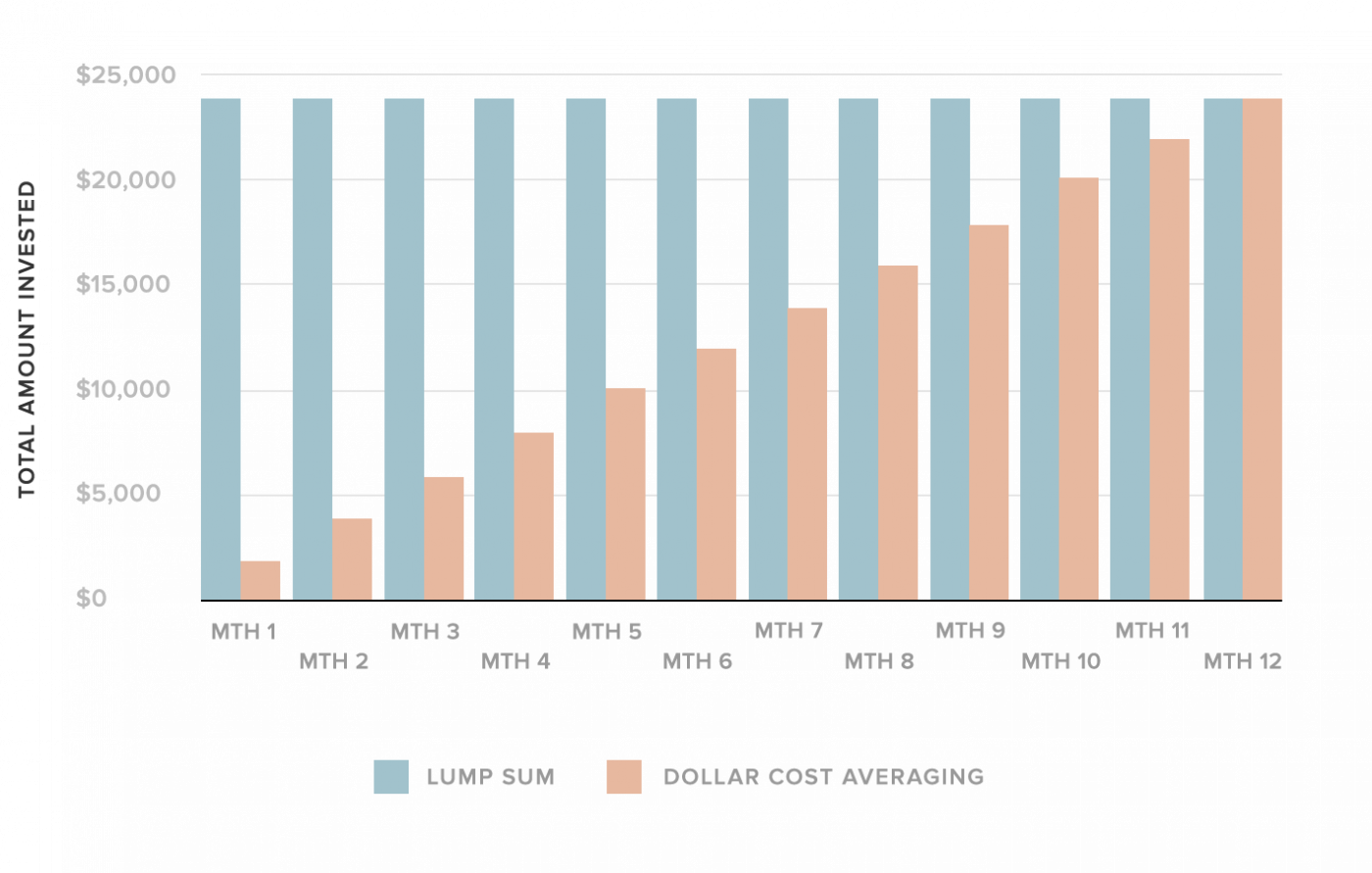

Dollar-cost average: Divide the $24,000 into smaller amounts and drip-feed it into the market over a period of time. Say $2,000 per month over 12 months or $1,000 per fortnight.

When you dollar cost average you purchase some investments at higher prices when markets are up and at a lower price when markets are down. The aim is to ‘average’ out the purchase price for your investments over a set period and calm your nerves along the way.

The chart shows how much you have invested in markets each month based on investing $2,000 over 12 months compared to investing $24,000 upfront. A good question to ask yourself is how comfortable you’d feel investing the full $24,000 straight away compared to small, regular amounts each month.

How would you feel if the market kept going up? How would you feel if markets fell? These questions can help you decide where you’d feel the biggest regret and if it’s better for you to dollar cost average. Dollar cost averaging can help you avoid the feeling of regret – either regret that markets fell straight after you invested. Or regret that you missed out by not investing and markets kept rising.

Lump sum vs dollar-cost average

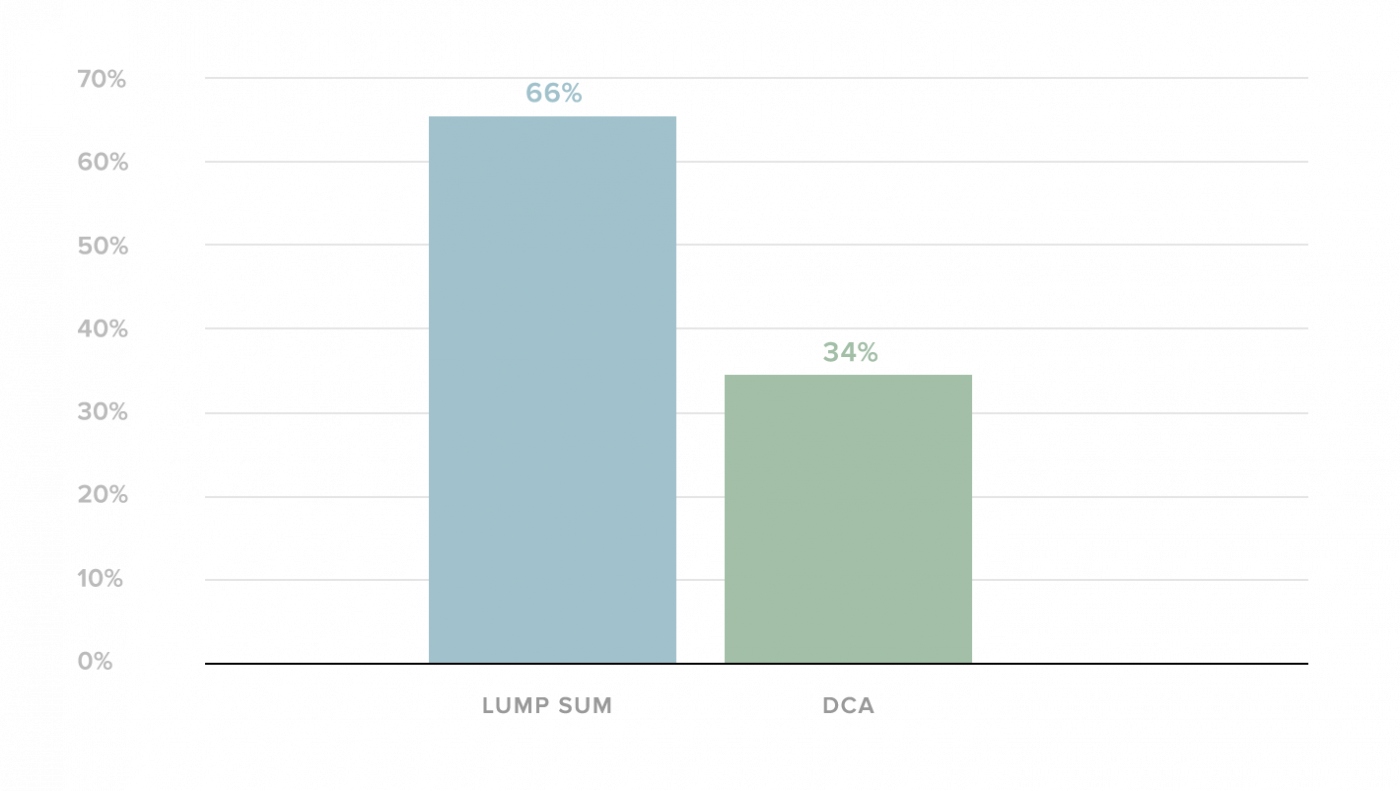

Vanguard found that Australian investors achieve better returns investing as a lump sum 66% of the time.

This makes sense because markets tend to go up most of the time, so you’ll usually be better off investing now rather than leaving money on the sidelines. Dollar cost averaging really just delays when you start to take investing risk and earn investing returns.

So why would you dollar-cost average if research shows investing as a lump sum leads to better results most of the time?

Having some money waiting on the sidelines can be appealing because it helps us avoid regret on the small chance the market has a temporary fall.

If markets fall and you’re dollar cost averaging you get to top-up up at the lower prices. Investing smaller amounts regularly can help you feel less nervous, even if it can also mean buying at higher prices.

One reason for this is because humans feel the impact of losses about twice as much as gains. The real appeal of dollar cost averaging is it helps you spend less time procrastinating about investing and can help you sleep better at night as you get started.

Pros and cons of lump sum vs dollar-cost averaging

| Pros | Cons | |

| Lump sum | Most of the time you’ll be better off since markets trend up. | Occasionally if markets fall you’ll have to stomach an initial fall in your portfolio. |

| Dollar-cost averaging | May help you sleep better and minimise regret along the way. On the chance markets fall you’ll be better off. | Most of the time worse off since you’ll be buying at higher prices later on. |

Is Dollar Cost Averaging a good idea?

What kind of investor are you? If your emotions make you nervous about what markets may do over the short-term then a dollar-cost averaging plan could be right for you.

It will help keep you disciplined, patient, and reduce any anxiety along the way – everything you need to be masterful investor!

However we don’t recommend dollar cost averaging for more than a year because the longer you manage a dollar cost averaging plan, the higher the chance that this strategy will underperform investing a lump sum, as the following chart from Of Dollars And Data shows:

On the flipside, if you’re confident to invest it all today, then go for it! Just try not to lose sleep at night over your decision and make sure you plan to invest for at least a few years to give you the best chance of success.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.