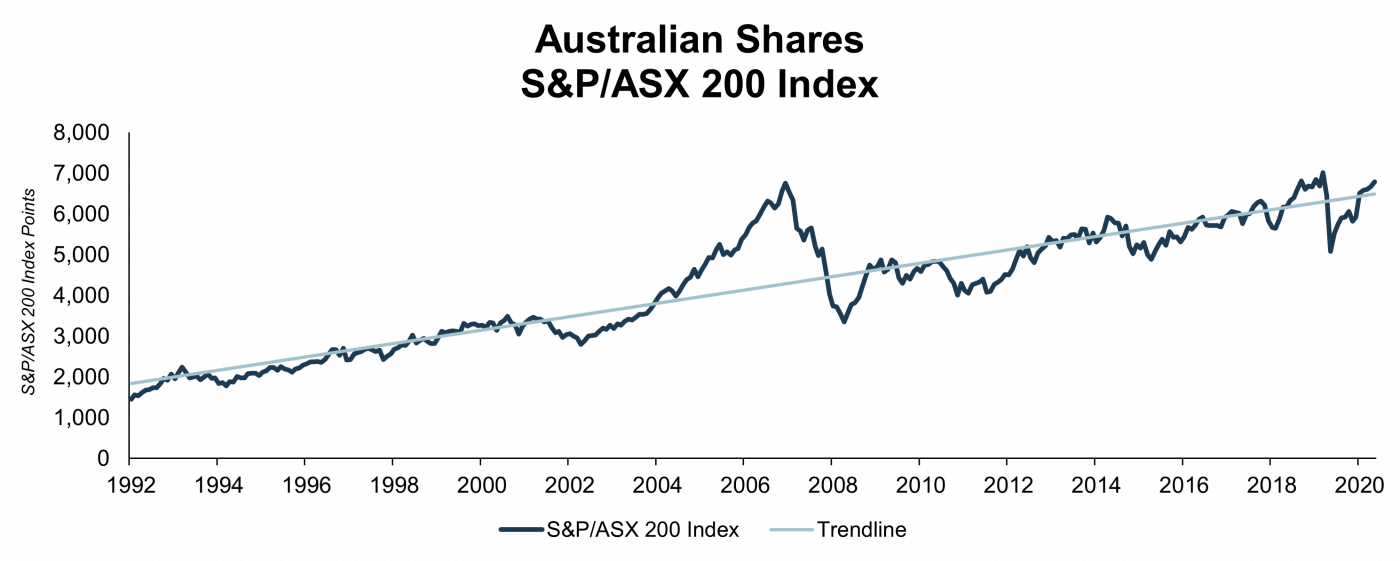

Markets simply don’t go up in a straight line. They tend to overshoot and then flatline, rather than go up at a constant rate. Think of markets like a coil, constantly being compressed before springing back to life.

Looking at the graph above, you can see that the general trend for Australian shares since 1992 has been upwards. However, there have been stretches of time when shares have gone nowhere. From 1999 to 2002, markets were flat. Then between 2003-2007 the market more than doubled.

After 2007, Australian shares had to wait 140 months (July 2019) to reach their previous high.

Markets rarely return to their long-term average for an extended period of time. Instead they tend to overshoot on the upside and the downside.

What do you do during sideways markets?

When markets plunge, it can be framed as an opportunity for investors. When markets soar, some people make a lot of money, and others need to dollar-cost average to be part of the game.

When markets are stagnant, people get confused. But our advice remains the same as any other time.

You can’t predict what’s going to happen next so instead of focusing on market movements, focus on investing into a broad range of different assets, rebalance periodically, keep your costs low and avoid the temptation to get in and out based on market commentary.

Here are some other things to consider when the markets aren’t showing any short term trends.

Dividends make up returns in sideways markets

Dividends can make up most of your returns in sideways markets. Over the past 3 years to September 2023, the Stockspot Topaz portfolio has generated dividends of 3.9% p.a. and capital returns of 3.5% p.a.

Dividends have therefore accounted for more than half of the total return over this period.

Rebalance and reinvest dividends

During stagnant markets, the best way to buy low, sell high and keep your risk level consistent is through rebalancing. This is something we’re continually managing for clients.

Remember, sideways markets can be a friend in disguise if you are still in the accumulation phase of your life. You can buy stocks at lower prices rather than constantly buying higher and higher as markets rise.

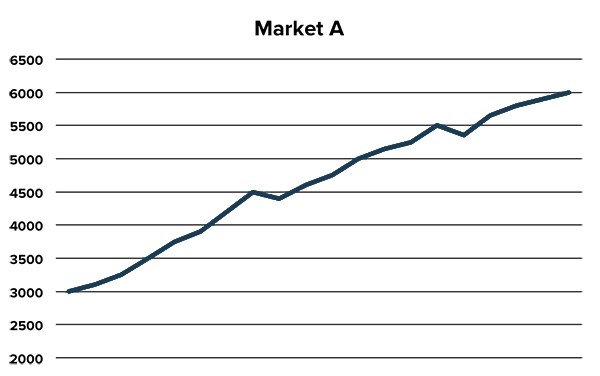

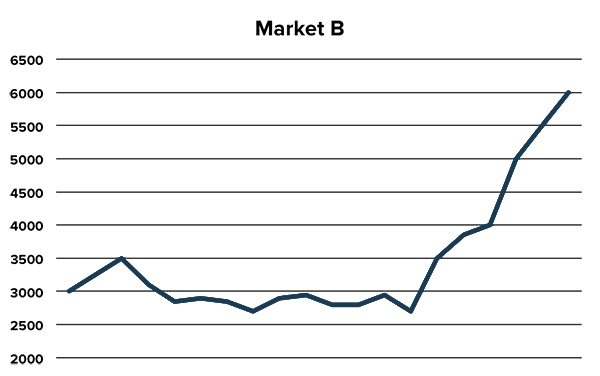

For example, below are two different markets over a five year period. Both start and end at the same point. Which would you rather have invested in if you were periodically topping up your portfolio (dollar cost averaging) over the entire period?

Market A may look more appealing at first glance due to its steady gains, Market B would have given you better returns.

In the Market B scenario, dollar cost averaging would yield an investor the best results, because you’d be able able to buy more at lower prices without having to time the market.

Don’t let market commentary send you off track

Sideways markets are great for long term accumulators – but they’re not so great for ‘market experts’ trying to call a short term trend. The media will tend to exaggerate any move that does happen, no matter how small. Don’t be swayed!

Maintain your investment strategy

If you’ve followed all the steps for investing success (diversification, dollar-cost averaging, rebalancing), then whether the markets are up, down, or sideways shouldn’t worry you.

The secret is to maintain your investment process even if you don’t see returns for months. Patient investors who stick to their process and ignore the noise are the ones who will be rewarded over the long run.