It can be gut wrenching seeing your investments fall in value, particularly after a sustained period of gains.

In 2019, the Australian share market had a stellar year rising 24% (including dividends) leaving investors cheering. Fast forward to 2020, and Australian shares fell by over 35% in February/March, wiping out the prior year gains. As the old adage goes, share markets often take the escalator up and the elevator down.

The market has now bounced 30% off it’s lows but still remains down over 12 months.

How common is a negative 12 month return for shares?

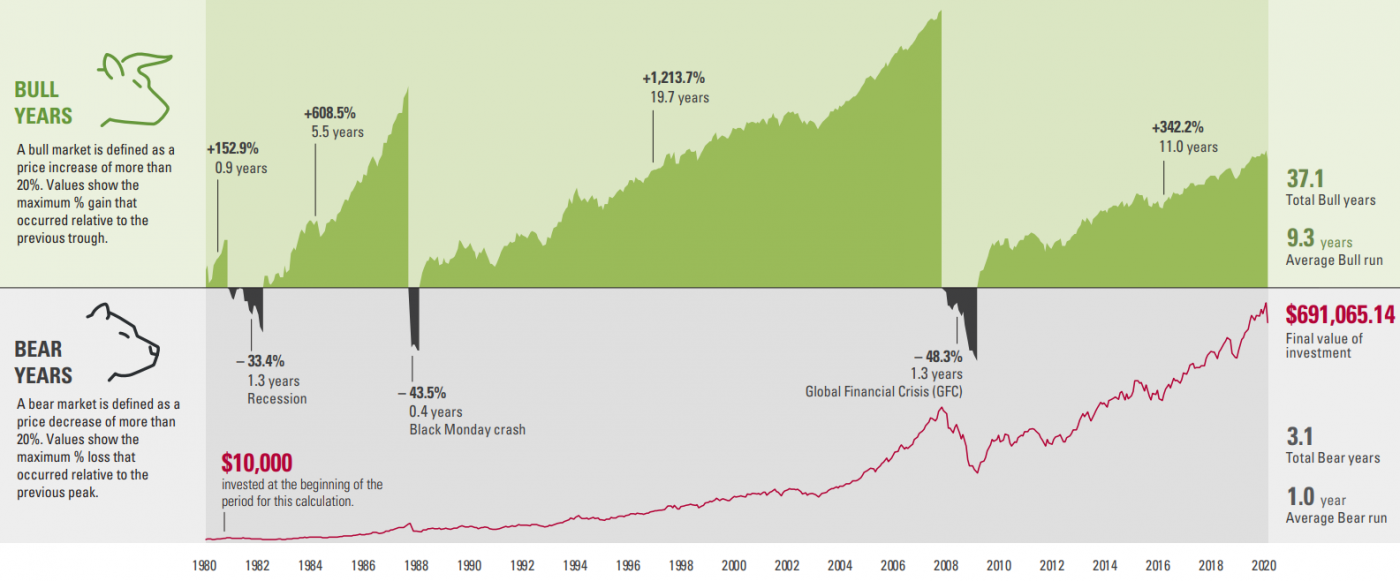

Negative annual returns in shares have occurred every 5 years on average. In other words, it’s a very normal part of the investing cycle. The good news is share markets always recover. Research has shown the average bull market run (when share markets rise more than 20%) lasts over 9 years, whereas the average bear market (when share markets fall by more than 20%) only lasts 1 year.

Bear markets feel more painful

While bear markets usually come and go quickly, investors face many behavioural biases when they arrive.

- Recency bias means we recall recent events more than those in the distant past, amplifying the pain of recent market volatility.

- Loss aversion means we prefer avoiding losses rather than achieving equivalent gains. This can lead to people selling after markets have already fallen to protect against further losses.

The last century of Australian share market returns provides insight into the opportunities that market corrections can create for investors to achieve future positive returns.

The opportunity following a correction

Since 1900, the Australian share market (as measured by the ASX All Ordinaries Accumulation Index) has risen in 80% of years1. This means 20% of the time, the Australian market has fallen.

When the share market has fallen in a calendar year, the return in the next calendar year has averaged 28%. That’s much better than typical one year returns. In other words, strong bounces back are common.

One year returns after a market dip

Since 1979, the Australian share market has experienced 11 negative years (averaging -11.8%). In ten of those eleven occurrences, the next 12 months were positive for share markets, with the exception being 1981 which had 2 consecutive negative returning years.

However the next year in 1983 the share market was up an incredible 67%!

| Calendar Year | Return | Next 12 months return |

| 2018 | -3.5% | +24.1% |

| 2011 | -11.4% | +18.8% |

| 2008 | -40.4% | +39.6% |

| 2002 | -8.1% | +15.9% |

| 1994 | -8.8% | +20.7% |

| 1992 | -2.8% | +40.5% |

| 1990 | -17.5% | +34.2% |

| 1987 | -7.9% | +17.9% |

| 1984 | -2.3% | +44.1% |

| 1982 | -13.9% | +66.8% |

| 1981 | -12.9% | -13.9% |

| Average | -11.8% | +28.1% |

Five year returns after a market dip

When the share market has fallen during one calendar year, the next five years on average have delivered a total return of 128% (i.e. 18% p.a.). That’s over double the 5 year return after positive years.

Making the most of market dips

Acting on emotion and selling or sitting on the sidelines after a market fall is therefore likely to harm your long term performance. Knowing when to be in or out by timing the market is extremely hard to do consistently. This is why automating your investing behaviour is a great way to overcome behavioural and psychological challenges.

Dollar cost averaging is a great strategy to automate your investing. It helps reduce the impact of falling prices, but also allows you to participate if the market goes up. This helps protect against psychological biases and is a great way to minimize regret.

Automated rebalancing is another way to take advantage of dips. We rebalanced for thousands of clients in March, selling gold or bonds which had performed well and investing into shares markets that had collapsed. As a result of the market bounce, many clients who we ‘rebalanced’ during the COVID-19 market dip are already up 25% on the extra shares we bought for them.

How should I invest during a market correction?

Our advice on investing after a market correction are:

- Keep your portfolio diversified – having access to a broad range of assets like shares, bonds and gold to stabilise your returns.

- Keep your costs low – the less you pay the more you get, and exchange traded funds (ETFs) are a great low cost investment vehicle. Active investing or having more complexity in your portfolio are unlikely to beat a more simple indexed portfolio.

- Stick with your long term plan – don’t worrying about market movements over the short term. Focus on your long term goal of growing your wealth. Have a regular investment plan, and stick with it when markets fall.

- Don’t let emotions dictate your decisions – channel them into positive strategies and actions that will improve your long-term returns.

- Let our automated rebalancing do it’s thing – it might feel uncomfortable at the time, but selling some of your defensive assets to buy shares when after a correction will boost your long term returns.

Good investment opportunities can emerge when there is overwhelming pessimism.

For those with cash on the sidelines, and who have been waiting for a pullback in share markets to deploy some cash, 2020 is likely to be looked back at as a great chance to invest.

Sources

1http://www.marketindex.com.au