Stockspot has a set of principles that guide how we advise clients and invest their savings. This is our DNA and what sets us apart from other products and investment managers.

The importance of compounding returns

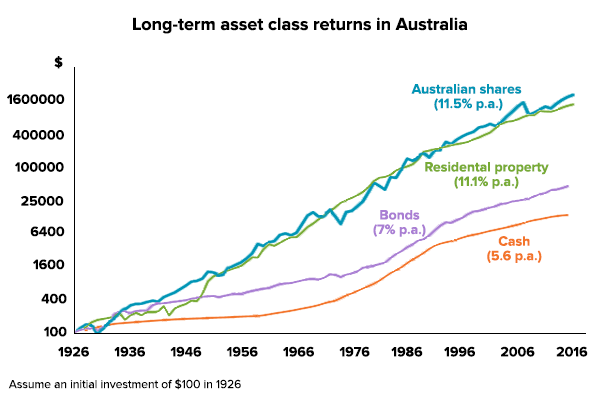

Market timing or picking the right stocks is almost impossible to do consistently, even for experts. It is far more important to be invested for a sensible amount of time across a broad range of different investments. The assets you’re invested in determines 89% of your returns.

Therefore the investment strategies we recommend are designed to weather different market conditions by combining assets in the best possible combination based on your personal financial goals and situation. We focus on helping clients achieve long term compounding returns without needing to time the market or pick individual stocks.

Sources: ABS, REIA, Global Financial Data, AMP Capital

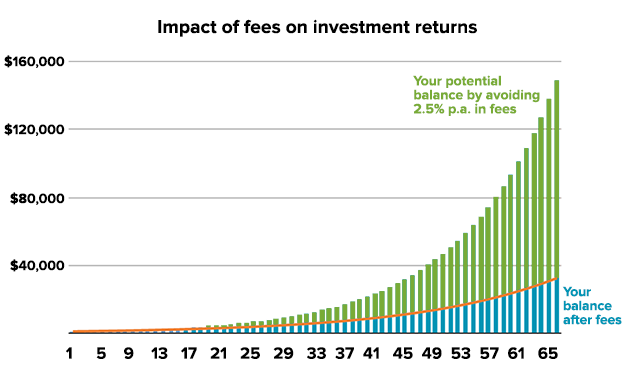

The less you pay, the more you get

Investing is one of the few times in life when paying less is proven to give a better result. The lower the fee you pay to the seller of investment services (your broker, agent, adviser or fund manager), the more money there is left for you. High fees reverse the benefits of compound returns.

Stockspot has used automation and software to remove many of the unnecessary costs associated with wealth management so more money stays with our clients.

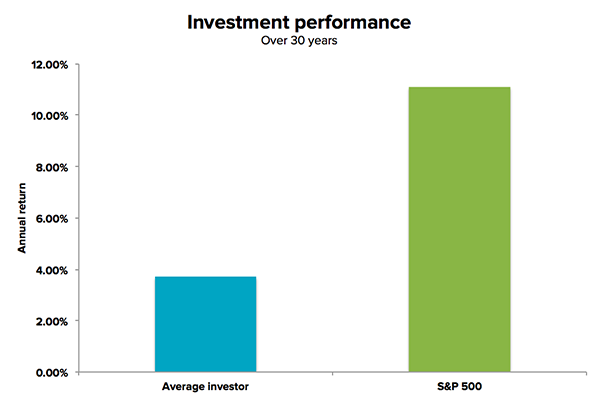

Stick to the plan and be disciplined

A crucial part of our job as an investment adviser is to keep clients on the right course. Investing in the right low-cost products is only part of our work because people tend to make poor decisions because of their emotions.

Over the past 30 years the average self-directed share market investor earned an average annual return of just 3.7% compared to the market’s 11.1% annual return because of over-trading. This is why it’s important to have an adviser to keep you on the right path.

At Stockspot we first ensure clients are in an investment strategy that matches their risk capacity and goals. We continuously educate them on how to separate investing from their emotions. This helps clients avoid acting on impulse or falling into the common traps of over-trading, chasing returns or panicking when the market falls.

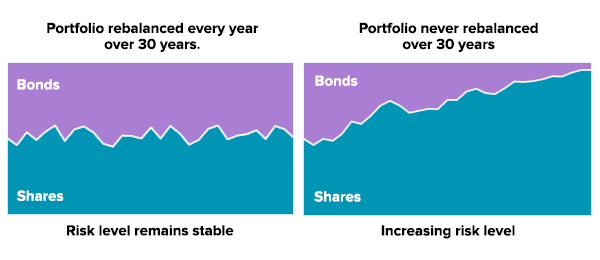

Rebalancing reduces risk

All sectors, assets and markets go through periods of strong relative performance followed by weak relative performance. These cycles are extremely difficult to pick. Fund managers who try to pick the market highs and lows often get their timing wrong and lose money.

Rather than guess when markets are cheap or expensive, we periodically rebalance portfolios. This helps clients profit from investments that have had strong performance and invest in others that have lagged. This also avoids the risk of missing out on returns by sitting on the sidelines.

Source: Vanguard

Avoid marketing hype

When it comes to investing, there is return, risk and cost. Everything else is just marketing. The investment industry goes to great lengths to add extra complexity and choice to justify high fees. Be very sceptical of any investment product that comes with a ‘blue sky’ story and high fees. If it sounds too good to be true, it almost definitely is.

We help clients distinguish between sensible investments and marketing hype. Unfortunately there are many more products in the latter category than the former because investment ‘junk food’ is much easier for the investment industry to market and get paid to sell.

Alignment of adviser and client

We believe it’s crucial to not receive commissions from the ETFs we recommend as part of our service. Many banks and investment businesses recommend their own internal funds or only offer funds that pay for ‘shelf space’. This is not advice. It is product sales.

Stockspot does not earn fees from or have a commercial relationship with the ETFs we recommend. We don’t pay professionals for recommending our service to their clients.

Simplicity rules…

Investors do best when they invest in a well diversified portfolio, ride out market noise, rebalance to reduce risk, and top up their balance regularly. This advice is simple in theory, but many people fall short in practice. The reality is that human emotion and the temptation to buy financial ‘junk food’ makes smart investing difficult for most people to do.

Stockspot uses software and automation to help clients put these principles to work to achieve their goals while avoiding investment traps and temptations along the way.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.