There seems to be an important investment asset that many Australians have forgotten.

This particular asset has proven time and time again to have great diversification benefits and provide steady, reliable income.

What asset is this, you may ask?

The name’s Bond…Fixed Income Bonds.

And like 007’s famous Martinis, when markets are ‘shaken, not stirred’, bonds can be a valuable part of your portfolio.

In this article, we’ll show you why and what we look out for when selecting an Australian bond ETF.

What are fixed income bonds?

A bond (also known as fixed income) is a loan made by investors to a company or government.

Bondholders lend money to the bond issuer for an agreed period (until maturity) and in return for that, they are paid a regular income in the form of interest. At the end of the agreed period, investors also receive their principal back.

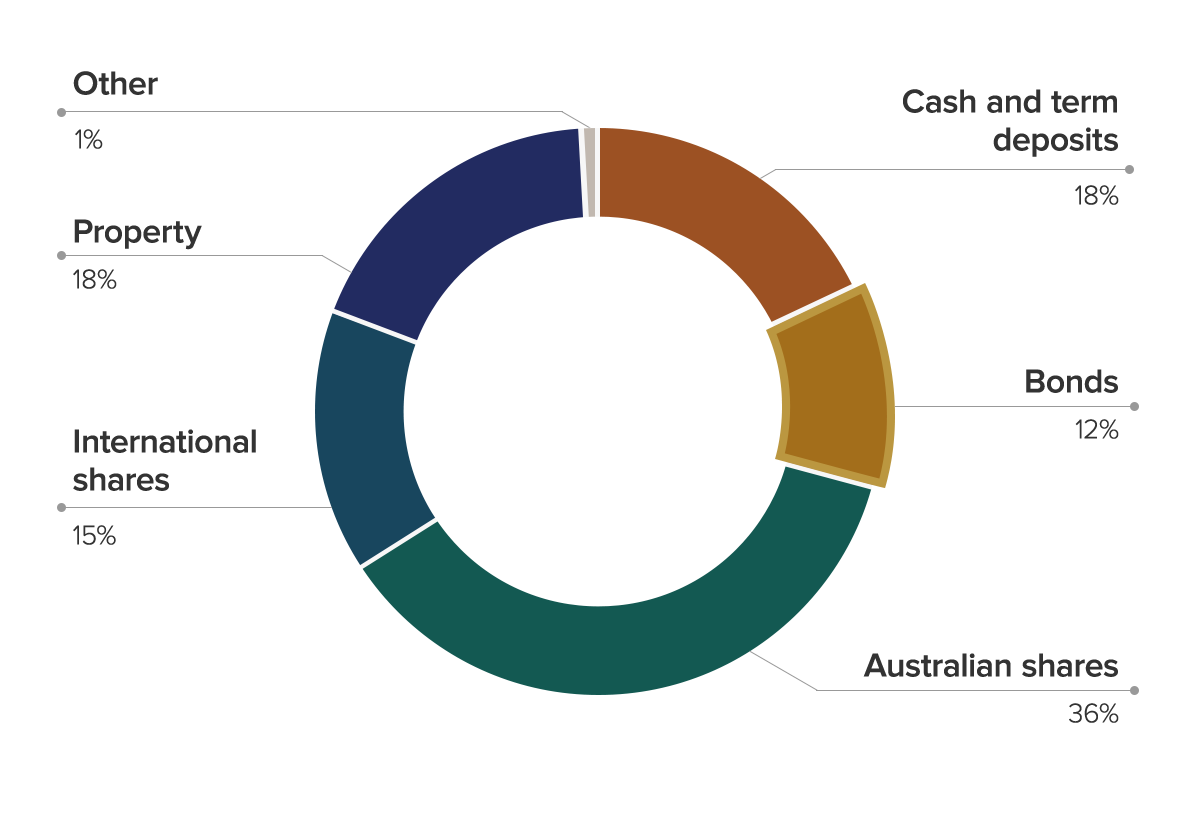

Historically, bonds haven’t made it into most people’s portfolios with Australian investors preferring to invest in the share market.

According to SuperConcepts, self managed super funds (SMSFs) only have 12% of their portfolio in Bonds.

This is incredibly low given the need for defensive income for those in the drawdown and retirement phase, or for those looking for something to cushion share market falls.

Bonds are considered by many to be boring, but at Stockspot, we believe that boring is brilliant – so let’s get into them.

Until recently, it has been difficult for everyday investors to access bonds due to high minimum investment amounts, lack of diversification and costs.

However, with the rise of Exchange Traded Funds (ETFs), Australian investors now have a solution to easily access bonds and make them a part of their portfolios.

The growth of Australian bond ETFs

Australian Bond ETFs enjoyed strong growth over the last 5 years, growing at a rate of 42% per year to ~$19.8 billion and now make up 13% of the overall ETF market.

They experienced a slight fall over the past year due to bonds posting one of their worst returns in decades due to rising interest rates.

We believe this will continue to rise as ETF issuers release more Australian bond ETFs and investors demand more defensive assets to smooth out the returns from investing in shares.

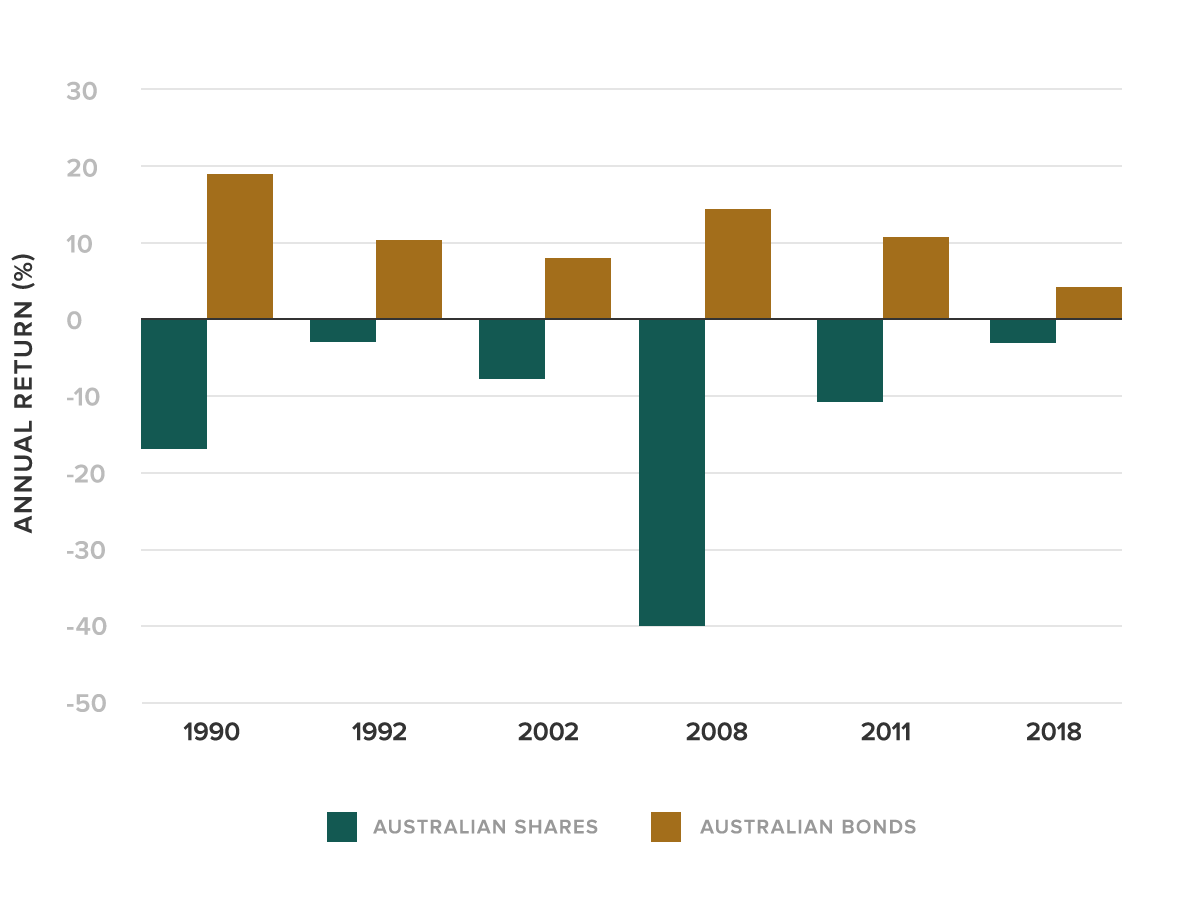

Taking a long lens over the last 30 years, it is clear that when shares fall, high grade bonds do their job as a portfolio cushion and rise.

Australian bonds were one of the few asset classes with a positive return in 2018, for example, when share markets fell. Bonds were also the ballast that helped cushion the fall during the COVID-19 share market fall.

Whilst the actors playing James Bond may change over time, bonds are a bit more consistent, rising when share markets fall – something which has happened six times since 1990.

Australian Bond ETFs offer a few key advantages over buying individual bonds:

-

Diversification – Bond ETFs hold a basket of bonds which improves overall portfolio diversification and reduces the chance of you lending a large amount to a dud company.

-

Transparent pricing – Bond ETFs are tradeable on the ASX whereas most individual bonds trade in more complex markets with pricing that is not very transparent and incurs higher costs to getting in and out.

-

Performance – Bond ETFs track time-tested indexes, which continually do better than active bond fund managers. The 2022 SPIVA Report showed that over 80% of active Australian Bond managers underperformed the index benchmark over 10 years.

-

Yield – Bonds can provide regular, consistent and predictable income, with less volatility than shares, potentially adding another income stream beyond share dividends.

For more information on the basics of bonds as an asset class and the benefits they can provide, our blog on Why Bonds Belong in Your Portfolio is a great place to start.

Australian Bond ETF Road Test

Each year we compare all 250+ ETFs in our Australian ETF Report. Here we road test 4 Australian Bond ETFs:

-

iShares Core Composite Bond ETF (IAF)

-

SPDR S&P/ASX Australian Bond Fund (BOND)

-

Vanguard Australian Fixed Interest Index ETF (VAF)

- BetaShares Australian Government Bond ETF (AGVT)

We compare them across 5 factors:

Size

IAF and VAF are the 2 largest Australian Bond ETFs, managing $2.3 billion and $1.9 billion respectively.

AGVT has accumulated $611 million since it launched in July 2019.

BOND has struggled to gain traction despite being listed at a similar time to its peer group.

This is likely due to a number of factors including BOND having higher costs, lower liquidity and less diversification (it only holds ~160 bonds). It also tracks a less widely known benchmark.

Costs

When it comes to cost, investors pay attention to the headline management fee (known as the Management Expense Ratio [MER]), but this is far from not the only overhead.

Unfortunately, some ETF and Fund Managers bury hidden costs in their Product Disclosure Statements. Think very tiny writing and lots of pages.

This is why it is important to consider the Indirect Cost Ratio (ICR), which incorporates all necessary transactional and operational costs to run the fund.

We also like to examine the slippage (buy/sell spreads) of each of the ETFs. This refers to how much you lose when buying/selling the ETF.

It is calculated as the average percentage difference between the best buyer and seller during market hours.

| ASX Code | Cost (Indirect Cost Ratio) | Buy/Sell Spreads (aka slippage) |

| IAF | 0.10% | 0.03% |

| BOND | 0.24% | 0.10% |

| VAF | 0.10% | 0.04% |

| AGVT | 0.22% | 0.05% |

IAF has the tightest spreads at 0.03%, followed narrowly by VAF with 0.04%. The slippage on BOND is double their peers due to their increased concentrated holdings.

Note: During the COVID-19 pandemic, Bond ETFs had their spreads widen due to market volatility. Importantly, this was not due to the ETFs but due to the illiquid pricing nature of the underlying bonds themselves.

BlackRock reduced fees for its iShares Core Composite Bond ETF (ASX: IAF) from 0.20% to 0.15% in April 2020 and was the cheapest Australian bond ETF on the ASX, until VAF followed suit in October 2021, reducing its fee down from 0.20% to 0.15%.

BlackRock announced in February 2023 to reduce IAF’s fee down to 0.10% to reclaim the title of cheapest Australian bond ETF until VAF matched it at 0.10% in April 2023.

BOND is on the more expensive side charging 0.24% per year and incurring double the slippage of IAF and VAF.

Liquidity

Australian bond ETFs have 2 layers of liquidity: the liquidity of the ETF and the liquidity of the underlying bonds within that ETF.

One measure of liquidity is measured by the average daily volume on the ASX. Volume is a measure of market making activity and trading interest which makes it a reasonable estimate of liquidity.

VAF has the highest level of liquidity with an average trading volume of $5.5 million, while IAF has rocketed to be almost level on $5.2 million per day.

BOND has tiny volumes traded relative to its peers. AGVT saw large trading volumes in the month of September 2023 with $4.3 million traded daily.

Greater trading volumes make it easier to buy and sell an ETF and reduces the spread/slippage involved.

Performance track record

| ASX Code | 1 Year Total Return | 3 Year Total Return (p.a.) | 5 Year Total Return (p.a.) |

| IAF | 0.86% | -2.20% | -0.64% |

| BOND | 0.42% | -2.81% | -1% |

| VAF | 0.55% | -2.18% | -0.65% |

| AGVT | -1.00% | -4.18% | N/A |

AGVT does not have a 5-year track record.

Returns

IAF, BOND and VAF have generated similar returns over the past 1, 3 and 5 year periods. This is because they track a similar underlying portfolio of bonds.

AGVT only has a three-year track record given it’s infancy and has underperformed due to it’s longer duration of bond holdings (which has been impacted by rising interest rates).

Given the performance of the funds are likely to be similar, we place a greater importance on other factors when assessing these Australian bond ETFs.

The longer a track record of an ETF and the index it mirrors, the better understanding you have of how an index reacts to different market conditions as well as how closely the ETF is tracking its index.

Also important is the ‘tracking difference’ which measures how well an ETF does at mirroring its index.

| ASX Code | Index | Index History (Inception Date) | ETF History (Inception Date) |

| IAF | Bloomberg AusBond Composite 0+Yr Index | September 1989* | March 2012 |

| BOND | S&P/ASX Australian Fixed Interest Index | October 2011 | July 2012 |

| VAF | Bloomberg AusBond Composite 0+Yr Index | September 1989* | October 2012 |

| AGVT | Solactive Australian Government 7 – 12 Year AUD TR Index | December 2007 | July 2019 |

| ASX CODE | 5 YEAR ETF PERFORMANCE (P.A.) | 5 YEAR INDEX PERFORMANCE (P.A.) | TRACKING DIFFERENCE |

| IAF | 0.2% | 0.3% | -0.1% |

| BOND | -0.1% | 1.5% | -0.3% |

| VAF | 0.2% | 0.3% | -0.1% |

| AGVT | N/A | 0.9% | N/A |

IAF has the longest track record (albeit marginally), having been listed for 10 years, and tracks the widely used Bloomberg AusBond Composite Index. It’s had strong performance since inception and also had low tracking error to its underlying index.

Other factors

We look at a few other factors when selecting a bond ETF:

- Duration – This is measure of how sensitive a bond is to changes in interest rates. Bond prices and interest rates have an inverse relationship (i.e. when interest rates go up, bond prices fall).

- Credit Quality – this is a measure of how likely a bond is to default (not pay its investors back). The scale ranges from the highest quality (AAA) to the lowest (D), with a rating of BBB- considered to be ‘non-investment grade’ and more risky. For example, Australia has a rating of AAA whereas a country like Mozambique is rated D. The lower the credit quality, the higher the risk of defaulting. Bonds with worse credit quality tend to pay a higher interest rate to compensate investors for taking more risk.

- Yield to Maturity – The rate of return an investor can expect if they hold the bonds until their maturity date. This does not factor in the price return, only the income return (known as coupon payments).

Bonds with shorter durations and better credit qualities provide a better diversification cushion when share markets fall. Poorer credit quality bonds can give you a higher yield but have a more similar correlation to shares so aren’t as helpful as a portfolio diversifier.

| ASX Code | Duration | Yield to Maturity |

| IAF | 5.0 | 4.5% |

| BOND | 5.7 | 4.6% |

| VAF | 5.0 | 4.5% |

| AGVT | 7.8 | 4.7% |

Stockspot’s verdict on Australian bond ETFs

James Bond goes for the Aston Martin as his choice of wheels – and Stockspot adopts the same high quality approach when selecting an Australian bond ETF.

We selected IAF for the Stockspot portfolios due to its size, liquidity, track record, high credit quality and relatively short duration.

It is an effective diversifier for our Stockspot portfolios due to its ability to cushion against share market volatility. Thanks to owning IAF and GOLD, all of the Stockspot portfolios have had 8 successive years of positive returns despite the 2020 share market downfall as a result of the coronavirus.

We also offer international bonds using the Vanguard International Fixed Interest Index (Hedged) ETF (ASX: VIF) as part of our Stockspot Themes range.

VIF invests in a diversified range of high credit quality and income generating bonds issued by governments around the world (such as the USA, Japan, France and the UK).

Other bond themes that Stockspot offers include the Vanguard Australian Corporate Fixed Interest Index ETF (ASX: VACF) and iShares Government Inflation ETF (ASX: ILB).