Lack of diversification can expose SMSFs to unnecessary risk if a significant investment fails to perform as expected. ATO data suggests that many SMSFs are over-concentrated in their asset allocation.

In this article we discuss how SMSFs can reduce risk in their investments in 5 ways:

- Better return opportunities with international shares

- Bonds help you weather all markets

- Don’t look for the needle in the haystack – buy the haystack!

- Gold is your last line of defence

- Avoid income and dividend traps

Benefits of diversification

Diversification is important for any SMSF who doesn’t want to experience stomach churning ups and downs as your portfolio value changes when individual investments rise and fall during a market cycle.

Which is exactly what happens when you only own a few shares or investment properties. The theory on how to use portfolio diversification was pioneered by Harry Markowitz in his paper “Portfolio Selection” published in 1952.

He showed that by owning shares in different industries and countries as well as other asset classes like bonds, you could get a smoother portfolio return without sacrificing return. Markowitz later won the 1990 Nobel Prize in Economics for his work (and it’s what we use to build Stockspot portfolios).

1. International shares give your SMSF better return opportunities

International shares represent only 16% of typical SMSF portfolios in Australia1. However, Vanguard research shows a portfolio with a mix of 48% global shares and 52% Australian shares has given the best mix of risk and return over the last 20 years.

At Stockspot, our portfolios are currently split between 40-54% in global shares and 46-60% Australian shares. The reason that investing globally makes sense is because other regions can do better than Australian shares at different points of the market cycle.

US shares have risen almost 270% since 2010 whereas Australian shares are only up 53%.

These days, Exchange Traded Funds (ETFs) make it easy to diversify into international shares too. Stockspot SMSF portfolios include a Global 100 ETF (investing in the world’s largest 100 companies) and an emerging markets ETF (IEM) which invests in developing high-growth economies.

Here’s how we select global share ETFs for clients.

2. Bonds will help your SMSF weather all types of markets

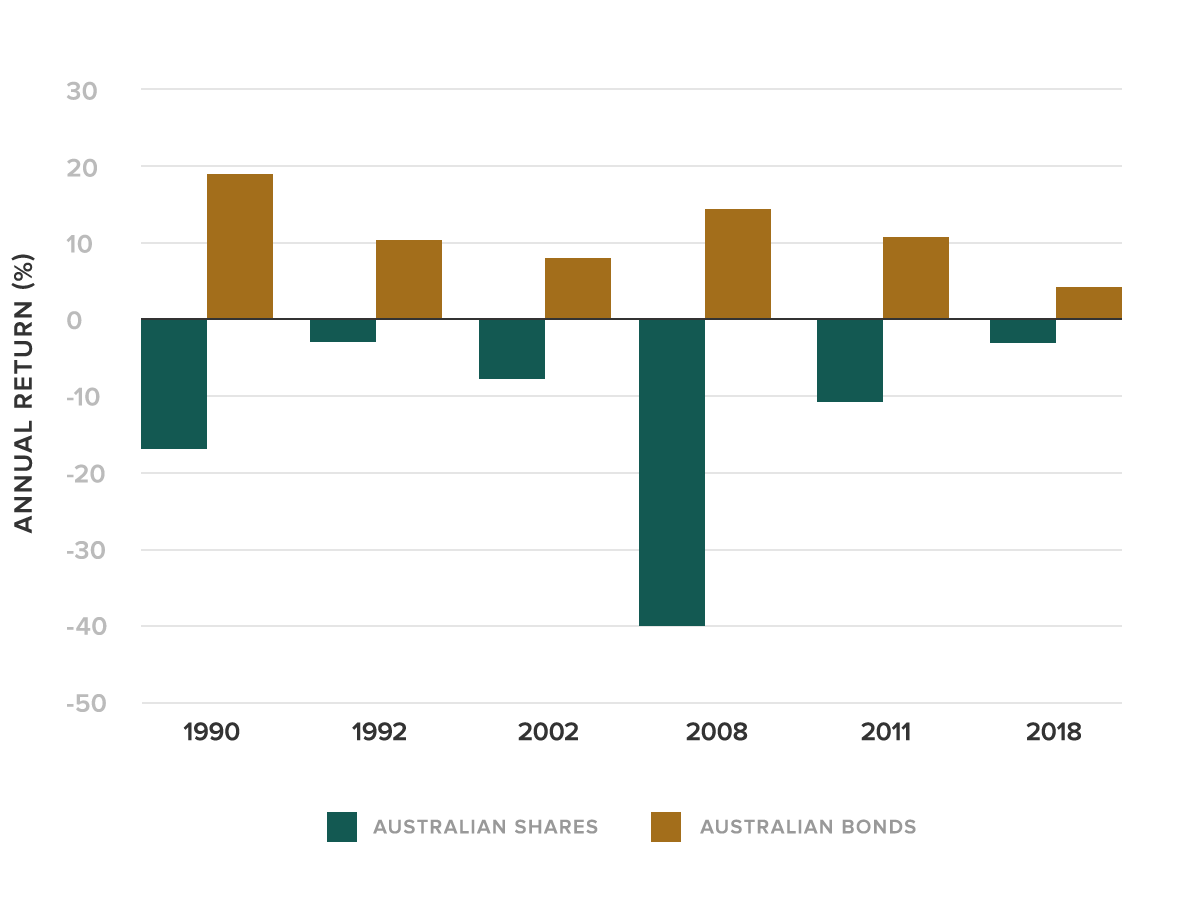

Another piece of the diversification puzzle is the benefit of owning defensive assets. When Australian and global shares suffer setbacks, it usually happens at the same time.

That’s when you want to own some defensive assets that move in the opposite direction to give your portfolio some cushion. We like high-grade Australian bonds and gold for their proven defensive qualities.

In 2018 when Australian shares fell by -2% for the year, Australian bonds rose by 4% and gold by 8%. In fact, the last 7 times Australian shares fell in a calendar year, Australian bonds rose on every occasion!

This is the beauty of diversification. Timing the share market is difficult but by owning some defensive assets your SMSF will be able to weather all types of markets.

Even though every global share market fell during the COVID-19 crisis, all of the Stockspot portfolios had positive financial year returns thanks to their allocation to bonds and gold.

3. Why look for the needle in the haystack when you can buy the haystack!

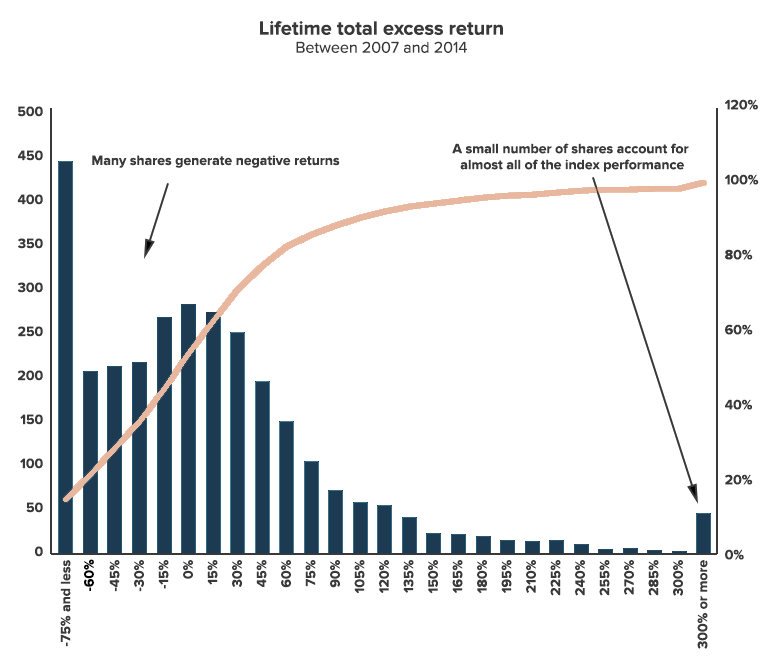

Broad diversification guarantees that you’re invested in the best performing companies which drive most of the market’s return. A study of share market returns between 1983 and 2006 showed that 39% of shares actually fell in value (even before inflation!).

Less than 4% of shares accounted for all of the wealth creation in the share market. This mathematical reality is one of the reasons 80% of professionals do worse than the market.

That 4% handful of winning shares is always changing– over the past 5 years it’s been Apple, Google, Facebook and Amazon. In the 90s in the US it was Dell, Lucent, Pfizer and Walmart.

Owning the entire market via an index fund or ETF is the smartest way of earning consistent returns and not missing out on these shares.

4. Gold is your last line of defence

Harry Markowitz won the 1990 Nobel Prize in Economics by showing how to achieve the best return potential by combining assets with a negative relationship to each other (correlation).

His seminal work, Modern Portfolio Theory (MPT), continues to be the best regarded theory for managing portfolios, and is how we approach building portfolios at Stockspot.

Gold has a very low or negative correlation with most other investment assets which is why it typically moves in a different direction to shares. This is a rare quality for an asset and it means that gold has the ability to reduce the risk of a portfolio.

In finance-speak, gold helps to improve the quality of the portfolio returns which means you can earn a similar return with less risk. Gold has historically been an effective way to preserve the real value of your wealth since it acts as an insurance policy against currency devaluation.

This is when your home country currency loses its global purchasing power either because of economic factors or monetary policy. While gold in US dollars is well below where it traded in 2012, in Australian dollars it trades at an all-time high due to our weak currency.

In late 2017 we increased the gold ETF allocation from 10% to 12.3% for all Stockspot portfolios because we identified the need for more exposure. The negative correlation between shares and bonds had weakened which meant that bonds may not provide as much of a cushion in a share market correction.

In early 2021, we increased our gold ETF allocation to 14.8% to protect portfolios against potential rising inflation and be a ballast if government bonds did not provide adequate defence in a low-interest rate environment.

The yellow metal has since performed better than most asset classes including Australian and global shares. During the 2022 financial year, gold notched up a return of 12%, outperforming Australian shares and global shares too.

5. Avoid income and dividend traps

Aussies have an unhealthy obsession with income from dividends. Income focused portfolios (e.g. high dividend shares like banks and Telstra, hybrids and high-yield debt) are riskier than a diversified portfolio.

What you get in one hand (income) you could just as easily lose from the other (capital). Our advice is to always focus on your total return (income + capital growth) rather than just your income or dividend yield.

Today a well diversified portfolio of Australian and global shares and bonds should be able to give you income of 2-3% p.a. plus capital growth of 3-6% p.a. (total return of 5-9% p.a.) The capital growth component of returns will vary year to year but that’s just the nature of investing.

When you only focus on boosting income it comes at the expense of growing (and preserving) your capital. Even if you’re at pension stage you shouldn’t be afraid to draw down from income and from capital growth.

Trying to ‘juice up’ the dividends in your portfolio is riskier than you may think which is why we don’t recommend yield chasing strategies to our clients.

Learn more about the dangers of dividends.

Getting your SMSF asset allocation right

Rather than focus on a single strategy (income, growth or capital preservation), we diversify Stockspot’s portfolios across a range of ETFs to get exposure to all three.

The right mix of ETFs should be based on your SMSF members’ investment horizon, lifestage, risk capacity and cashflow needs.

Getting your SMSF asset allocation right will help your portfolio deliver more consistent performance whether share markets rise or fall. Stockspot offers a free portfolio recommendation which will suggest the right investment mix of low-cost ETFs for your SMSF.

Because of the strategies we recommend, Stockspot portfolios have experienced much lower volatility (risk) than only owning Australian shares and have had consistent returns over 1, 3 and 5 years.

The final word

Stockspot can help you create a diversified portfolio of investments for your SMSF without all the hassle or cost. We also let you take more control of your SMSF investments through Stockspot Themes.

You can add extra assets, countries or market sectors to your portfolio. Then, we ensure that your SMSF investment strategy stays balanced based on your goals and investment horizon.

Find out how SMSFs can even beat the best super funds with better returns and less hassle and cost.