Three of the most common questions we get about the Stockspot portfolios are “Why does Stockspot invest in gold?“, “Can I access more international shares?” and “Can I focus my portfolio on high-dividend shares?”.

Having discussed the first 2 questions in earlier posts, we wanted to address the third question on dividends.

The dividend theme has become increasingly popular over the past few years and we’ve noticed a growing number of investors seem to be solely focused on dividend yield without considering total return.

This has been partly fuelled by the media and product issuers who have promoted high-dividend strategies as a way to cope with historically low interest rates. However, such strategies come with their own set of risks that are often ignored.

What are dividends?

Dividends are payments that companies make to their shareholders (if they choose to) from retained profits and are usually paid once or twice a year around when financial results are announced.

Companies have several choices of what to do with their profits – they can chose to re-invest them in their business, buy back their own shares, buy other companies, or pay dividends. The decision on what to do with profit is collectively known as their capital management strategy.

Some companies choose to pay out a majority of their profits in dividends. For example in 2015, Telstra (TLS) had earnings per share of 34.5c and paid a dividend of 30.5c per share.

The percentage of profits that are paid out to shareholders is known as the payout ratio. In the Telstra example this was about 90%. Mature businesses will often have high payout ratios because they don’t need the profits to invest back into their business.

On the other hand, growth businesses and companies with a high level of R&D costs tend to re-invest profits in their business with the aim of growing future profits.

The Exchange Traded Funds (ETFs) that we invest in include many hundreds of companies, each with their own dividend policy. Our ETFs receive dividends from many different companies and then combine them before passing them on to investors via distributions a few times per year. Some of our ETFs pay distributions quarterly (VAS) while others pay half-yearly (IOO).

Dividend yield represents the dividend amount as a percentage of the share (or ETF) price.

For example, if the Vanguard Australian Share Fund ETF (VAS) is currently trading at $65 and it has paid annual dividends of $3.00 over the last year then its dividend yield was $3/$65 x 100 or 4.6%. Equally if you own a property worth $500,000 and earned rent of $23,000 last year then your rental yield was 4.6%.

Keep in mind that these are both examples of historical yield because they are backward looking (we’ll get to that later).

Both return and dividend yield are used to describe the performance of an investment, but they are not the same thing. Dividend yield represents just the income earned on an investment that is paid out as a dividend or distribution in cash. It ignores changes in capital value – also known as capital gains (or loss).

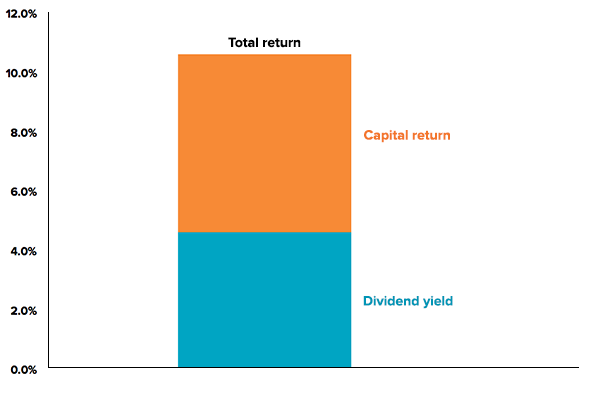

Total return includes both the dividend received and the capital gain (loss) earned on an investment.

i.e. Total return = dividend return + capital return

Using the above examples, if VAS has risen from a purchase price of $61.00 to $65.00 it has generated a capital gain of $4 or 6% and if the property has risen in value from $470,000 to $500,000 it has generated a capital gain of 6%.

Therefore, the total return would be 10.6%.

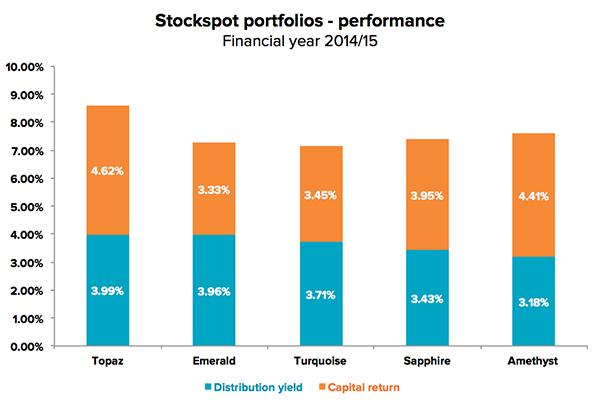

Total return is the figure investors should be concerned with when making any investment – not dividend yield. For instance in the last financial year our Turquoise portfolio generated a total return of 7.2% and this was made up of dividends and distributions of 3.7% and a capital return of 3.5%.

* Performance after ETF and management fees

Why have dividends become so popular?

With low interest rates, investors are naturally searching for higher yields than the interest on offer in savings accounts or term deposits. Shares, ETFs, property and hybrid investments that pay out streams of income lead some investors to chase this yield rather than focus on total returns. However it’s important to understand that focusing on income or yield can mean you are ignoring the risk of a negative capital return.

Dangers of ignoring capital returns

It’s critical when making investment decisions to distinguish between yield and total return. An investor just focused on yield may have a negative total return despite a positive yield because of a capital loss. Our Buy vs Rent post showed the devastating effects that a negative capital return had on the US property market. This fall in prices occurred despite US property appearing to have a positive yield.

Historical dividends are not future dividends

Looking only at the historical yield of an investment may lead an investor to concentrate their portfolio in high yield, low quality assets.

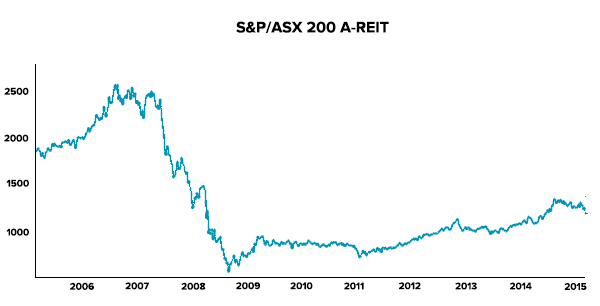

At the start of 2008, the historical dividend yield of many Real Estate Investment Trusts (REITs) listed on the ASX started to rise as their share prices fell. At first glance this would indicate that they were more attractive investments.

However, below the surface some REITs were highly leveraged and their historical yields were not sustainable going forward once tenants stopped paying rent and the realisable value of their property assets fell.

Many REITs drastically reduced or completely cut their distributions in 2008/2009. As a result, their share prices collapsed. In this instance, rising historical yields were signalling that the businesses were in trouble.

As the Global Financial Crisis (GFC) showed, dividend yields are by no means guaranteed – even by large, seemingly stable businesses like REITS. The REIT index in Australia fell by 77% between 2007 and 2009 and hasn’t recovered yet.

Concentration risk

Another downside to chasing dividends is concentration risk. The top-yielding shares on the ASX are concentrated in sectors like banks, property (REITs) and utilities, which tend to grow less in rising markets. They are also sectors which tend to underperform the broader market when interest rates rise. We looked in detail at the dangers of concentration risk in our post on SMSF risks.

Dividends bring forward your tax bill

The impact of taxes can further reduce the attractiveness of focusing on dividend yield for tax-paying Australian investors.

Many of our clients re-invest dividends back into their Stockspot portfolios. Investing a larger amount in ‘high dividend paying stocks’ would increase the tax bill they have each year.

Therefore any dividend yield more than what is required for spending or pension drawdown is essentially slowing their total portfolio growth. All else being equal, and depending on your circumstances, delaying taxes and letting untaxed returns compound can be a more tax-efficient strategy.

High dividend does not equal low risk

Companies that issue dividends have decided that there are not better opportunities to deploy their cash by investing in new projects or acquiring other companies.

Paying dividends in itself does not provide any certainty about a company’s financial well-being or ability to sustain future dividends. All a dividend shows is that the company had nothing better to do with the cash so decided to give it back to shareholders who can choose themselves.

Investors have a long history of chasing the latest investment fad and getting burnt when the risks of that strategy become apparent. We believe that investors ignoring total return and focusing solely on dividend yield are underestimating the importance of capital returns in the investment equation.

That’s not to say that we don’t believe yield is important. Historically yield has contributed a significant portion of our portfolio returns. However rather than focusing on a single theme like dividend yield, we believe long-term investors should seek diversification across asset classes, countries and industries — as well as buying shares with a range of different dividend yields to generate long-term wealth.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.

Past performance of financial products is no assurance of future performance. Actual performance of your portfolio may vary from our published returns due to the timing of investments, rebalancing and your fee tier. The Stockspot indices have been published since July 2013 and open for investment since May 2014.