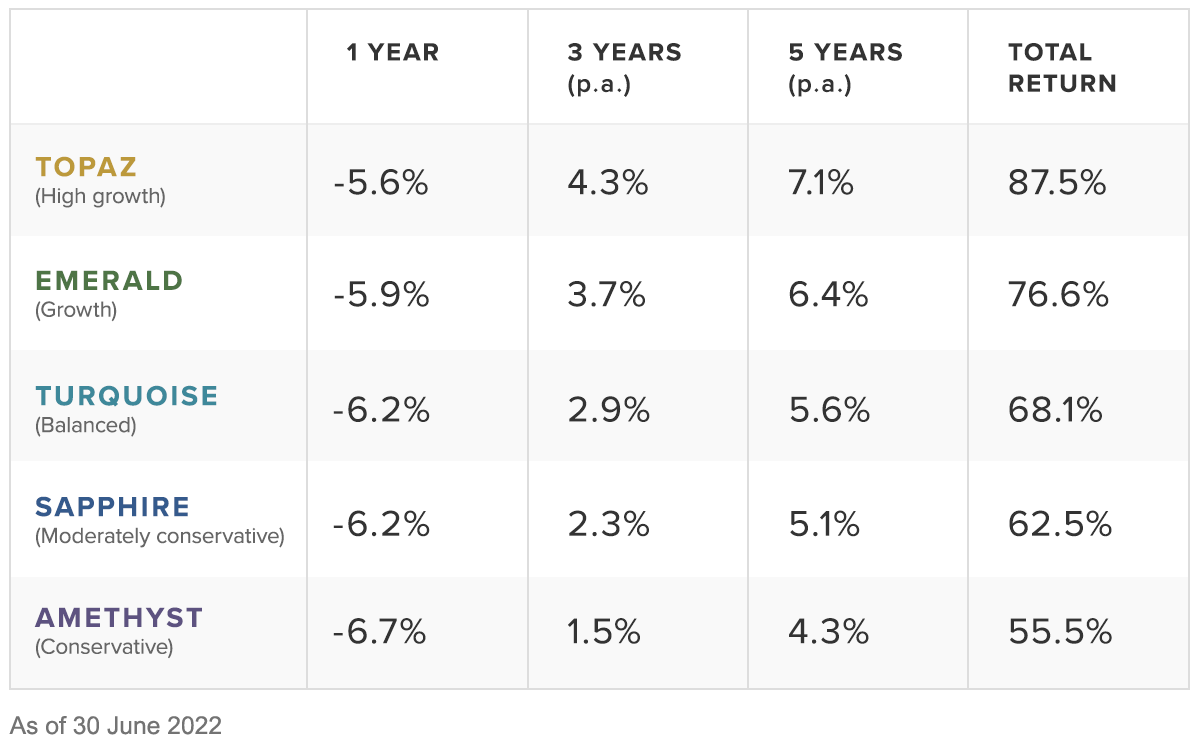

The Stockspot Model Portfolios returned between -6.7% to -5.6% after fees over the last 12 months, while the Stockspot Sustainable Portfolios returned -7.9% to -7.4%.

Despite a negative 12 months, the Stockspot Model Portfolios have continued to outperform 99% of similar diversified funds over five years with returns of 4.3% p.a. to 7.1% p.a. after fees.

In this performance update, we cover:

- What caused the market volatility and how has it impacted different asset classes?

- How diversification across different industries and asset classes helped to reduce losses.

- The best investment strategy when markets dip like they have this year.

What caused the market volatility and how has it impacted different asset classes?

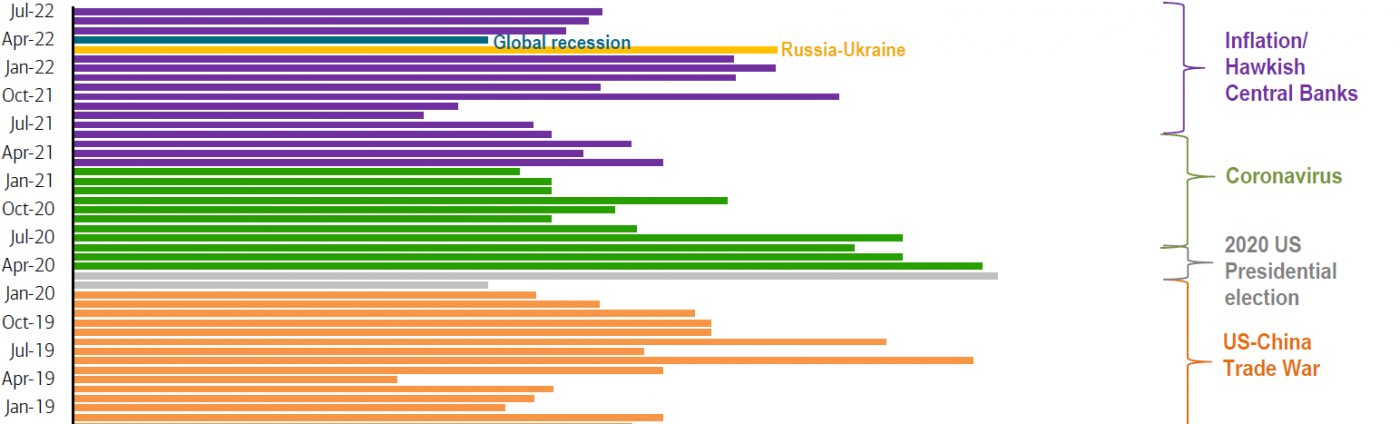

Markets started 2022 with a higher level of volatility due to the Russia/Ukraine war. Investors’ concerns quickly moved from Ukraine to inflation and interest rates. This chart produced by Bank of America Merrill Lynch shows how the biggest worry for investors has changed over time.

Last year, investors believed that inflation would ease so there would be no need for aggressive interest rate hikes. However, economic data in 2022 has continued to show very strong inflation and employment data which has caused interest rates to rise quicker than expected. The market is now expecting the Reserve Bank of Australia to raise interest rates to 3.5% by March 2023 according to interest rate futures.

Interest rates have led to bond yields rising, which has meant that bond prices have fallen. Rising interest rate expectations have also impacted the share market due to higher interest rates impacting household spending and company margins. Optimism about company profitability just reached an all-time low.

Like previous market bottoms in September 2008 and April 2020, there is a lot of negativity factored into share markets already. This could lead to positive surprises if interest rates don’t rise as quickly as anticipated.

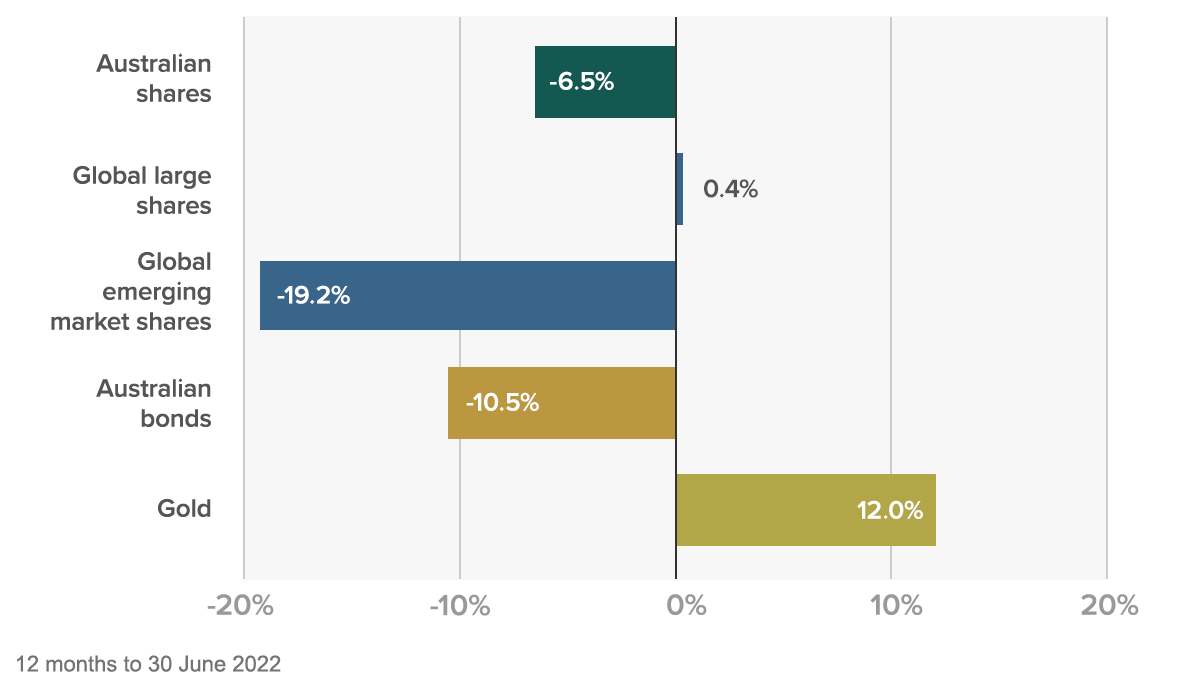

Over the last year gold and commodities have benefited from rising inflation, while the broader share and bond markets are down. Emerging markets have fallen more than Australian share and bond markets. Our global large shares ETF (IOO) rose 0.4%, outperforming both the S&P 500 and Nasdaq indices in the U.S.

Our research into managed funds’ returns found that the Australian shares index ETF (VAS) has outperformed 76% of active fund managers over the last 5 years. The global large shares ETF (IOO) has beaten 97% of fund managers. This reiterates the advantage that ETFs have over active managed funds, including in volatile market environments.

How diversification across different industries and asset classes helped to reduce losses.

Our approach to investing is to be prepared for all market environments and reduce risk by diversifying across the entire market. Owning different assets and sectors has helped to minimise losses during this period of market volatility and outperform in the long run.

Gold has done better than bonds over the past year due to being less impacted by rising interest rate expectations. Like in March 2020, we have recently rebalanced some portfolios out of gold and into other assets like bonds and shares.

If you’re well-diversified, you can avoid large losses from a single investment. This can make a big difference to your capital (and sanity) when markets fall. Catastrophic losses are possible when you own individual shares because some fall to zero over the long run. This is another reason why we prefer owning index ETFs to individual shares. Index funds won’t go out of business even though many companies will.

Now more than ever, it’s important to stay diversified, have an appropriate time horizon and don’t be tempted to make changes to your investment strategy when you see negative news headlines. Staying invested over the long run – including during periods of market falls – has helped investors achieve 10% p.a.

The best investment strategy when markets dip like they have this year

The best strategy when markets fall is to continue investing. Market corrections are a normal and inevitable part of investing. There’s no way to consistently pick the highs and lows. During periods of market volatility, it’s important to not be tempted to bail out or tweak your portfolio. Over the long-term, investment markets have always rewarded disciplined investors with diversified portfolios who keep on investing when others are selling.

June 2022 has been a tough quarter for the share market. However, the positive takeout from this is that poor quarters are often followed by longer stretches of positive returns. There have been 30 quarters since 1970 when the share market fell at least 5%. After a negative quarter of falling at least 5%, the average return of the share market over the next 10 years has been nearly 250%.

The benefit of market falls is that it leads to higher expected returns in the future.

Future returns when the previous quarter falls by at least 5% (1970-2022)

| Previous Quarter | +1 Year | +3 Years | +5 Years | +10 Years | |

| Average Total Return | -12.7% | 10.7% | 41.9% | 75.2% | 246.5% |

While corrections like the one we’re currently going through can be stressful, our advice to clients has always been to stick to your diversified strategy, stay invested, and perhaps top-up if you have the cash reserves.