Like the rest of the world, we have been deeply saddened by the escalating conflict in Ukraine and its impact on the Ukrainian people. The costs of this war continue to mount including the growing human cost. It is too early to know how this war plays out in Europe and the rest of the world.

In this article we answer some common questions from clients:

- What impact is the Russian invasion of Ukraine having on markets?

- How have the Stockspot portfolios performed?

- How much Russian exposure do the portfolios have?

- Should you change your investment strategy?

- Investing tips for volatile markets

What impact is the Russian invasion of Ukraine having on markets?

Since the start of 2022, global sharemarkets have fallen 11-13% due to the increased uncertainty caused by war and the existing worries about the need for interest rate hikes to curb inflation.

While war and other shocking geopolitical events have an awful human toll, their impact on sharemarkets tends to be short-lived.

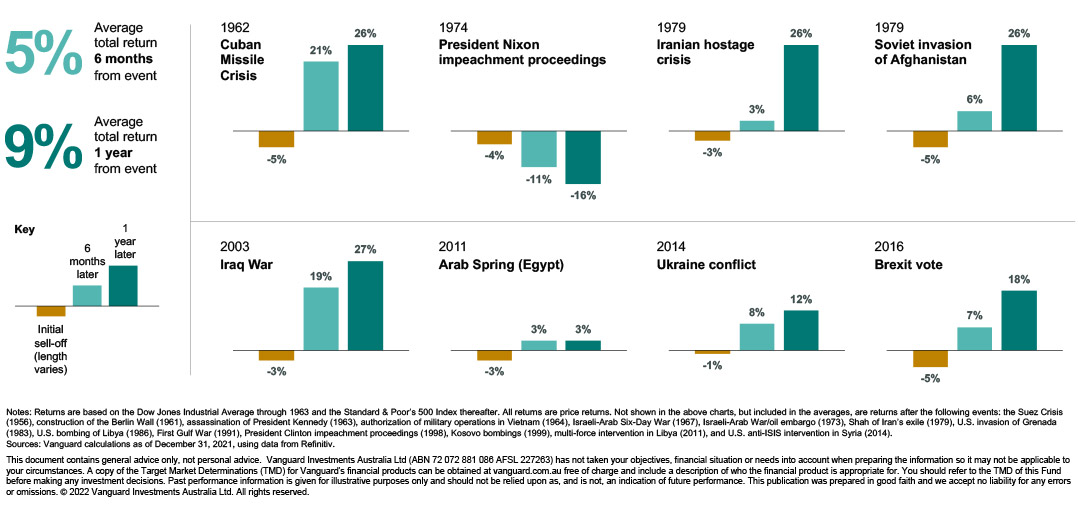

Throughout history there have been numerous geopolitical events which have resulted in short-term market panic. Vanguard recently analysed 22 geopolitical events and found that despite causing some initial market volatility, the average total return 12 months after the event was 9%. This highlights the danger of selling when the news seems bad, because markets do recover with time.

How have the Stockspot portfolios performed?

Since the start of 2022 through to 7 March 2022 the Stockspot portfolios are down 3.4% to 4.8%.

Despite this, the longer term returns for Stockspot clients are still strong at 7.1% to 10.1% p.a. over 5 years.

The Stockspot portfolios have been insulated due to their allocation to gold, which has risen 7% so far in 2022. We have previously written about how gold provides protection during geopolitical uncertainty. This is a key reason why we own some gold in all of the Stockspot portfolios.

Oil prices and some other commodities have risen strongly. Australian shares have performed better than international shares due to a strong performance from commodity companies like BHP. Market volatility is normal. In fact, nearly every year there’s a temporary 10% fall in the market at some point.

How much Russian exposure do the portfolios have?

Russian shares made up around 2% of the Emerging markets ETF at the end of January.

The impact of their decline on the overall Stockspot model portfolios has been small, at less than 0.4%. There was zero allocation to Russian shares in the sustainable portfolios so there has been no impact.

The index provider, MSCI, recently indicated that they will remove Russia from their underlying indices on 9 March at a price of “effectively zero”. The emerging markets ETF has already fallen to reflect that Russian shares will be removed at nil value.

This will mean that the Stockspot portfolios will no longer have any exposure to Russia. This is one of the benefits of broad diversification via an index ETF. There are always components being upweighted, downweighted, added or removed in a continual cycle of renewal.

We still consider emerging market shares to be an important part of our model diversified portfolios for our clients. Emerging markets as a group are known to have higher risk than developed market shares and their long-term returns are also higher, reflecting the long term reward for taking this higher risk.

Should you change your investment strategy?

At Stockspot, we prepare for uncertainty and dips in the market by investing across a mix of different investments, which helps your portfolio to weather a range of different market outcomes. The inclusion of defensive assets like gold and bonds can help cushion your portfolio in times of volatility and significantly reduce how much you temporarily lose when markets fall.

Our advice during market volatility is always to stay invested and do nothing.

We gave clients this advice during the market volatility associated with Brexit, the 2016 U.S. election, and the COVID-19 market correction. During each of these past events, moving to cash or a lower-risk strategy would have harmed your long-term returns. Timing when to get in and out of markets is almost impossible, even for professionals, which is why our advice is always to stay invested. For the same reason we don’t change the strategic asset weights within the portfolios in response to market events. Instead allowing automated rebalancing to take place when assets move a significant distance from their target weights.

Stockspot’s advice for investing during volatile markets

When markets are volatile or falling, look to positive strategies and actions that will improve your long-term returns.

1. Keep investing

Regular deposits ensure that you invest at different parts of the market cycle, so you can take advantage of lower prices when markets fall. Dollar cost averaging is a great way to do this.

Automating your investment deposits is the best way to stick to your long-term investment plan and ensure that you avoid the temptation to buy and sell at the wrong times.

Meanwhile, Stockspot’s automated rebalancing will help you buy low and sell high when investments move far from their target portfolio weights. We’re doing this every day for clients to take advantage of lower prices.

2. Take a break from monitoring

If you have a tendency to get nervous when your investments go up and down, consider monitoring your portfolios less frequently. This helps prevent your short-term emotions from overpowering the long-term game plan. It’s also important to separate short-term market ‘noise’ with the long-term trend.

3. Stay diversified and keep investment costs low

The low-cost diversified ETFs that Stockspot uses gives you access to market returns without paying high fees that eat into your returns. Trying to time the market will lead to higher costs getting in and out as well as tax consequences – both of which harm your returns. It’s why index investing works better in down markets too.

4. Don’t forget dividends

Even though the value of your portfolio might go up and down over the short term, you’re still earning returns through dividends and distributions. When markets fall, dividends and distributions can be reinvested at a lower price, helping you benefit even more when markets do recover.