Whenever markets fall, funds who use active stock picking or market timing strategies fire up their sales engines. Their pitch? That if you put your trust in their active strategy you won’t have to withstand the down periods that come with a ‘buy and hold’ strategy.

It’s a tempting story! Why go through the emotional roller-coaster of down markets if that part of investing is optional…

Unfortunately the sales pitch is just a mirage

As enticing as it is to believe that active investing can give you a ‘parachute’ to protect against market falls, the evidence shows it’s just not true. Just like in up markets, most active fund managers do worse than a simple indexing strategy in down markets too.

Take last month for example when global markets got thumped (I should add that down months are perfectly normal).

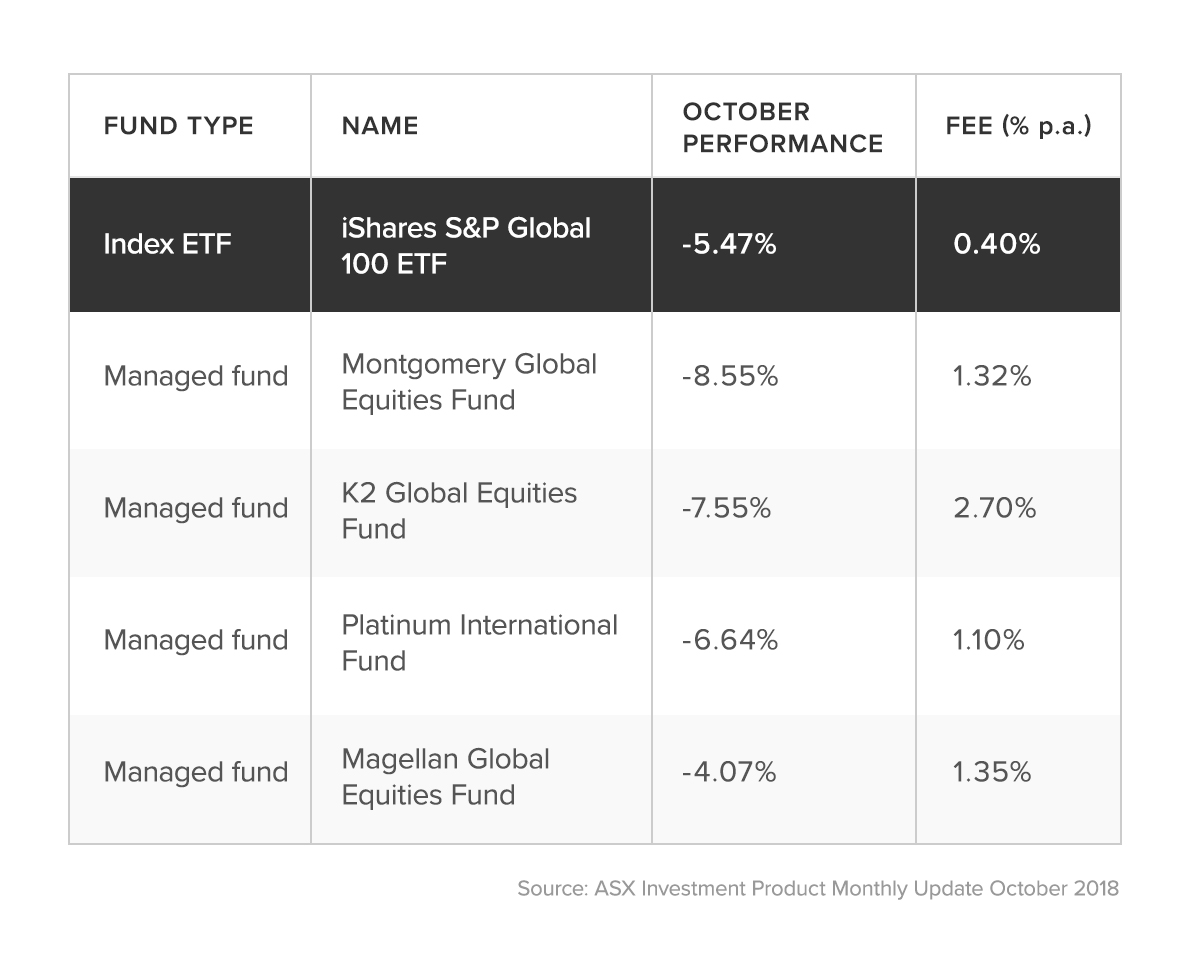

How did Australia’s listed active managers perform compared to our recommended global index fund which simply invests in the world’s largest 100 companies?

Three of the 4 active funds (75%) did worse than the index ETF. The Magellan fund did 1.4% better in October, however it has lagged the Global 100 ETF by 5.2% over 3 years.

The odds of finding a stock picker who can do better in down markets is less than 50/50

Rui Dai, an analyst at Wharton Research analysed fund performance in the US and found that in 2007-2009 when the market fell 50.2%, the average active fund fell by 49.7%.

In the tech wreck of 2000-2002 when the market fell 43.4%, the average active fund lost 43.2%. In the declines of 2015-2016 the typical active fund did worse than the market.^

There’s no golden parachute when markets fall

To access the power of long-term market returns you need to accept that markets can be volatile over the short term. Spreading your money across a globally diversified portfolio of shares and defensive assets like bonds and gold can reduce some (but not all) of that risk.

There are other time-tested ways you can make the most of these down periods, however paying higher fees to have your money managed by a stock picker is not one of them.

Healthy long term investing includes a diet of diversified investments, keeping your costs low and having the emotional discipline to stick with the plan even when markets go down.

Don’t fall for the spin that stock picking can give you a miracle when markets fall.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.