The UK voted to leave the European Union after 43 years of membership. This surprised markets which had assumed only a small chance of the UK leaving.

What does it mean?

Nobody actually knows what the medium to long term implications are for the UK or global economy, due to uncertainty around how the exit will play out.

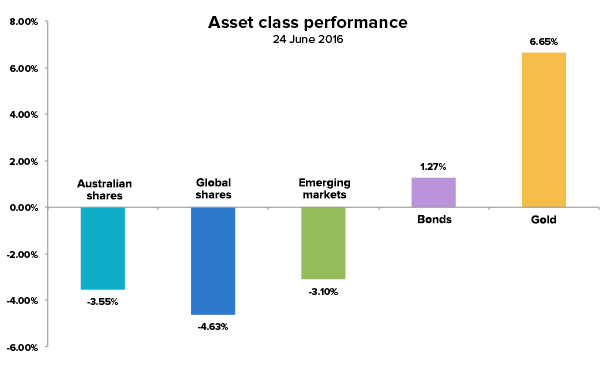

Not surprisingly share markets reacted negatively with all global markets initially falling. The good news is defensive assets like bonds and gold rose. Both assets are key parts of Stockspot’s portfolios and have helped minimise the impact of share market falls.

How have the portfolios performed?

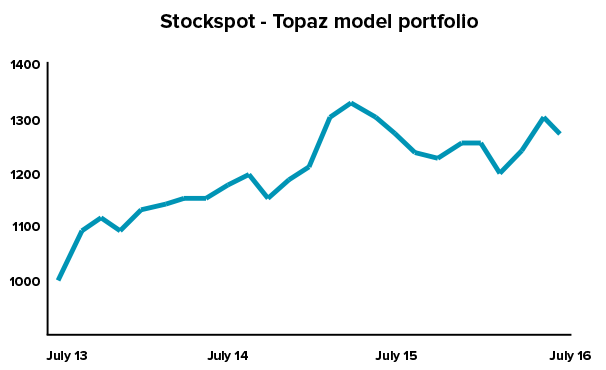

The Stockspot core portfolio fell between -0.2% and -1.9% on the Brexit news which reversed some of the gains of the past 2 weeks.

This compares to Australian shares which fell 3.6% and UK shares opened 9% down. Less than 2% of our portfolios are invested in UK listed shares, so our direct exposure is minimal.

| 1 day | 6-month | Since inception (p.a.) |

|

| Topaz | -1.93% | 0.97% | 7.94% |

| Emerald | -1.28% | 2.26% | 7.54% |

| Turquoise | -0.78% | 2.64% | 7.18% |

| Sapphire | -0.47% | 2.73% | 6.79% |

| Amethyst | -0.16% | 2.79% | 6.51% |

Total return after ETF and management fees as at 24 June 2016

How has asset allocation and diversification reduced losses?

The Stockspot portfolios benefited from their investments in bonds and gold which both rose on the UK exit news. Bonds rose by 1.3% on Friday while gold surged 6.6% which reduced the impact of share market falls.

Why gold and bonds help

We wrote an article about how gold helps your portfolio as well as the benefit of bonds. The upside of owning these 2 assets has certainly been apparent during recent periods of volatility.

Gold tends to move in the opposite direction of shares which helps reduce the risk of our portfolios when markets fall. This week we also published an article on how the portfolios are designed to absorb volatile markets.

What you should do about it?

When markets are falling, the key is not to fight your emotional reactions. Channel them into positive strategies and actions that will improve your long-term returns.

-

Regular deposits ensure that you invest at different parts of the market cycle, so you can take advantage of lower prices when markets fall. Here’s how dollar cost averaging works.

-

Stockspot’s automated rebalancing will help you buy low and sell high when investments move far from their target portfolio weights.

It’s also important to separate short term market ‘noise’ with the long term trend. Any short term market falls have always been overwhelmed by the long term uptrend.

It may be tempting to change course or stop investing altogether, but the real trick is to stick to the plan even during periods of market turmoil.

Positive steps

As we discuss in our blog ‘Making the most of market dips’, there are some positive actions you can take when markets fall to help your long-term performance. These include;

1. Keep investing

If you invest regularly, as many of our clients do, you can take advantage of the market’s dip through dollar-cost averaging, or regular deposits. Automating your investment deposits is the best way to stick to your long-term investment plan and ensure that you avoid the temptation to buy and sell at the wrong times.

2. Take a break from monitoring

If you have a tendency to get nervous when your investments go up and down, consider monitoring your portfolios less frequently. This helps prevent your short-term emotions from overpowering the long-term game plan.

3. Don’t forget dividends

Even though the value of your portfolio might decline over the short-term, it’s likely that you’re still earning returns through dividends and distributions. When markets fall, dividends and distributions can be reinvested at a lower price, helping you benefit even more when markets do recover.

This week both global shares and emerging market shares paid dividends. Australian shares and Australian bonds next pay distributions in early July.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.