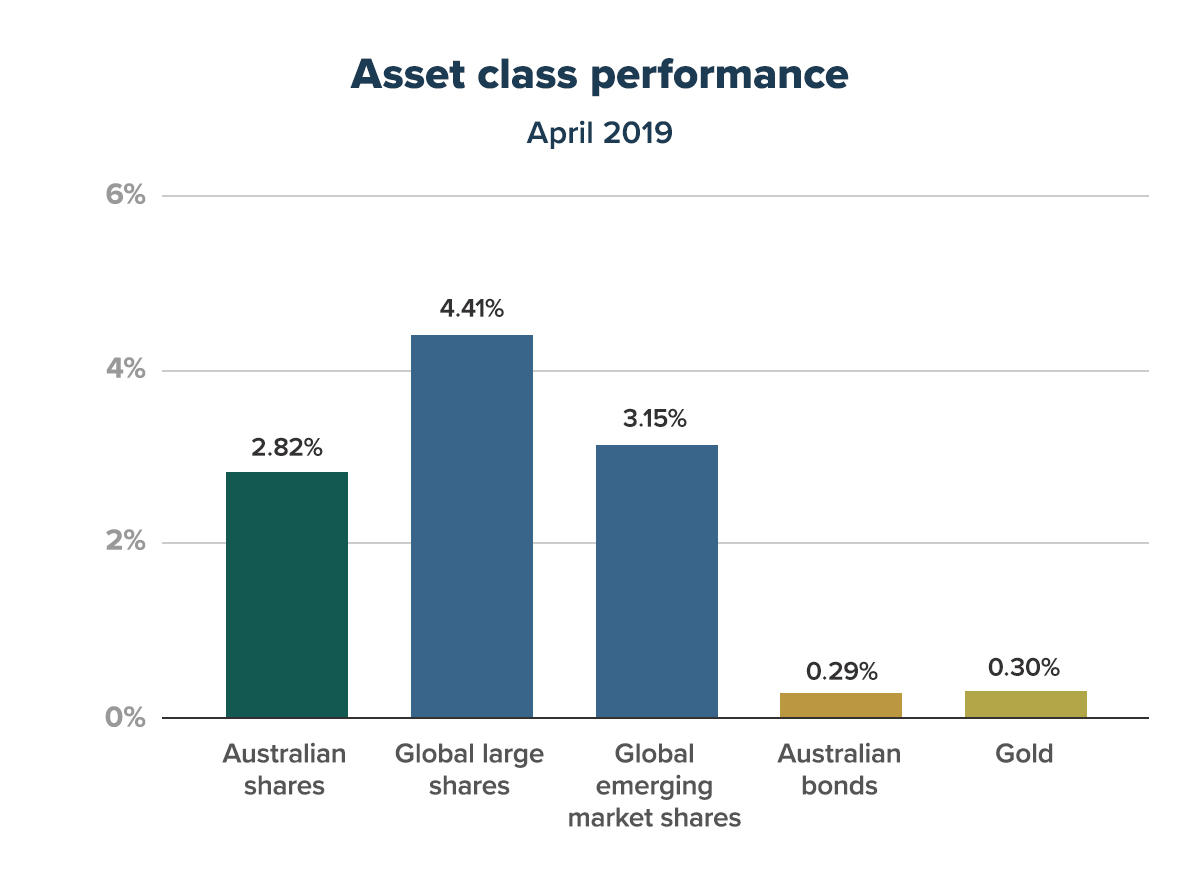

Share markets around the globe continued to rise for a fourth consecutive month up 2.8% to 4.4% for April. Since the start of the year share markets have risen 10.8% to 15.9%.

Bonds and gold also edged higher by 0.3% in April. The recent election result and the possibility of an imminent interest rate cut have also buoyed Australian markets. Australian shares have been one of the best performing share markets in the world to start 2019.

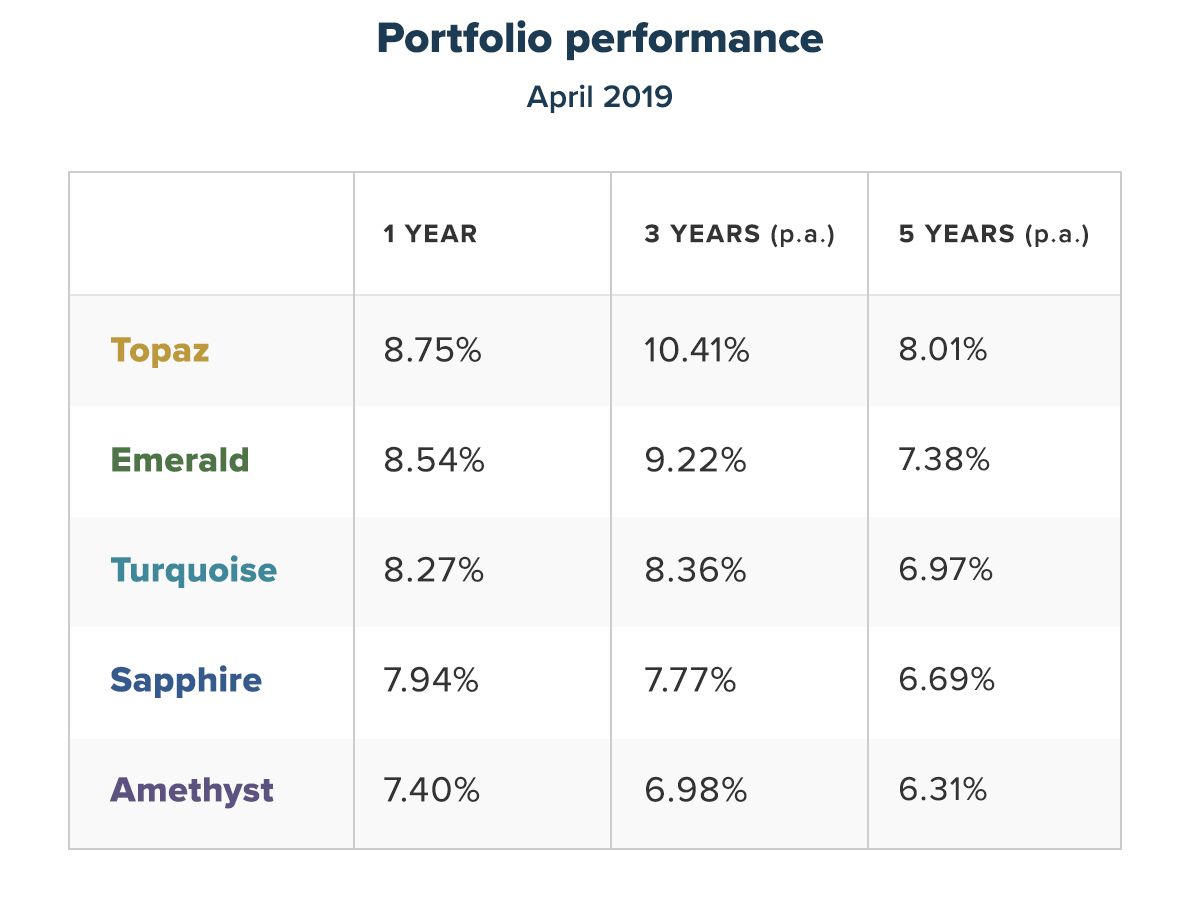

Stockspot portfolios have now delivered consistent returns across 1, 3 and 5 years for our clients with only around half the risk of owning a portfolio of just Australian shares.

How is a Stockspot portfolio ‘less risky’

It’s useful to step back in time to six months ago in December 2018. Markets were down across the globe, the Australian market (S&P ASX/200) had fallen 14% from its peak and the majority of fund managers had negative returns for the calendar year.

In contrast Stockspot’s 12 month returns to 31 December 2018 were positive for all strategies. In a year when most investors lost money, Stockspot’s performance was positive thanks to our Nobel Prize winning strategy of diversification across ETFs.

This ensured our clients had less risk in their portfolio and experienced less volatility than if they’d just invested in Australian shares like the banks, Telstra and BHP, like many Aussies do.

Keep calm and carry on

Fast forward to May 2019 and the Australian sharemarket has surged ahead. It’s a good reminder about why we recommend ‘time in the market’, not timing the market.

It’s hard to overcome the belief many people have that they must make more decisions to achieve better returns. In most of life’s pursuits it’s true, the harder you work the better your results. However with investing it couldn’t be further from the truth. Better results are available by simply doing nothing in an ETF rather than picking shares, trying to time the market or giving your money to an active fund manager.

With stock picking or market timing, there’s always a chance you’ll beat the market and earn higher returns. With index ETFs you will definitely earn the returns of the market (minus low fees), and those returns have historically been better than the returns of most professional fund managers. Would you rather have the certainty of earning market returns or the unlikely possibility of beating those returns?

If your goal is to build wealth in the long term we recommend you invoke the British mantra ‘keep calm and carry on’. You can ignore the news headlines and market pundits on TV, the best thing to do is to simply have the patience and discipline to do nothing.

With Stockspot, your money is spread across a broad mix of low-cost ETFs to earn market returns and benefit from diversification. Stockspot’s portfolios aim to minimise risk while maximising returns across both Australian and global shares, as well as bonds and gold.

Depending on your portfolio you should plan to be invested for at least 3 years for the best chance of success. The best thing to do is stick to your plan, whether that’s to invest a lump sum and set and forget, or make regular portfolio top ups with a dollar cost averaging strategy.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.