The start of the new year is a popular time to make predictions about the market.

A lineup of experts will confidently tell you which shares to buy, if property is going up or down, whether the RBA will raise or cut rates, where the Aussie dollar is heading and if the stock market will crash.

Expert market forecasts have been a pet peeve of mine for a long time. I’ve never understood why they’re so popular (to give or receive) in light of how terrible forecasters track records are.

One of the early blog articles I wrote back in 2013 showed how far off the experts were in predicting the market performance that year. Some were wrong by a whopping 20%. That’s like the expert weatherman mistaking an imminent category 5 hurricane for clear skies and sunshine.

2013 wasn’t an anomaly. Experts get it very wrong more often than you’d think. We’re just tuned to forget the times they were wrong and constantly reminded of when they got it right.

At the start of 2018 most experts predicted tech stocks would keep leading share markets higher. What happened? Every share market around the world fell and tech stocks were hammered. Facebook and Apple, two of the most popular technology stocks fell over 40% from their highs.

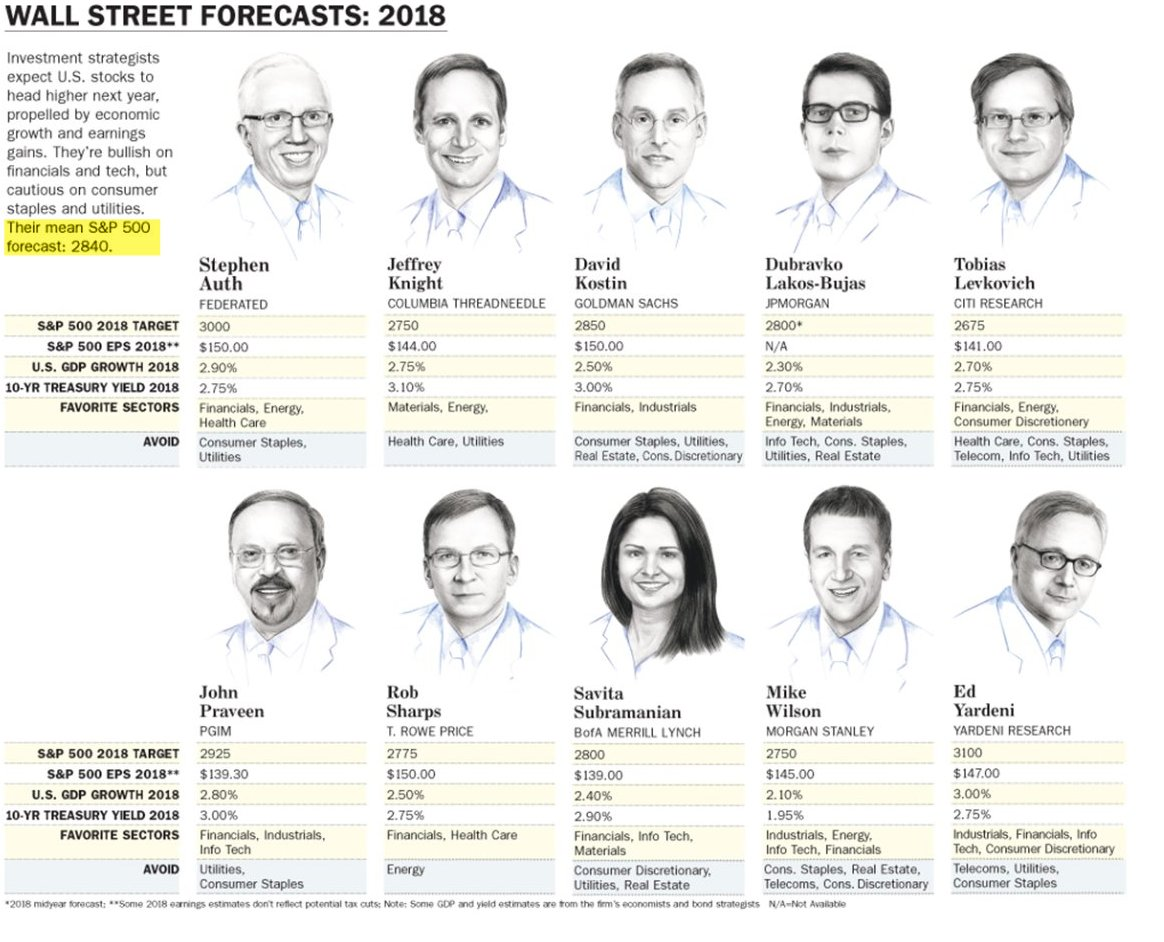

The S&P500 (US market) ended the year at 2,500, a far cry from the 2,840 predicted by this panel of 10 experts.

Barrons: The Bull Market’s Next Act

Not a single one predicted the market would fall. Why? Forecasters tend to fall into two groups which I like to call ‘Steady as she goes’ or ‘Broken clocks’.

Steady as she goes

This group of forecasters typically work for large investment banks (like the ones above). They have a strong motivation to keep their job which leads them to make rather predictable predictions.

Historically the market goes up 5-10% most years so they go for the safe option and pick something in this range plus or minus a few percent. Most of the time this group of forecasters will look like they’ve got pretty close.

Occasionally when markets fall (like 2008 or 2018) they’ll get it wrong but in those years most of the other forecasters will be also be wrong so they won’t stand out too far from the rest of the pack and therefore keep their job. Success (for them at least)!

Broken clocks

This group of forecasters are continually predicting a market crash. Occasionally they get it right but when they do they fail to mention they’ve predicted a market crash every year for the last decade.

Meanwhile, because of confirmation-bias they remain bearish at the bottom and all the way up again. I think this group are the most dangerous for the average investor since they can scare you into not investing at all. That’s a mistake that could cost you millions over your lifetime.

Forecasters rely on you forgetting

Where the ‘steady as she goes’ forecasters hope you don’t remember the 1 in 10 years they missed a market correction, the ‘broken clocks’ hope you don’t remember the 9 in 10 years they predicted a correction and it didn’t happen.

Few forecasters have the motivation or skill to toggle between being optimistic and pessimistic and get their timing right.

Lack of accuracy is just the tip of the iceberg when it comes to my frustration with forecasting.

The bigger problem I have is forecasters’ lack of self awareness to recognise the limits of their own skill. Part of being an expert is surely recognising the limits of your own ability? In market forecasting this doesn’t seem to be the case.

Despite all evidence that markets are unpredictable over short periods, forecasters continue making predictions over ludicrously short timeframes with an insane amount of certainty.

This can be partly explained by the Dunning Kruger Effect (a misguided belief in one’s own ability) and partly by the fact most forecasters work for businesses that rely on making regular active investment decisions (stock tipping newsletters, brokers or active funds).

Forecasting is an important part of their sales pitch!

Why do we keep listening?

If the weatherman got it totally wrong most days I’m quite certain viewers would switch off!

A key reason market forecasters keep making predictions is that people keep listening to them! Humans don’t like accepting that the future is uncertain and feel comfort in believing they have some insight about what’s coming up.

Like horoscopes, market forecasts provide a security blanket that gives people a feeling of comfort and certainty. Even if that comfort and certainty is a short-lived placebo.

On that note, here’s your 2019 horoscope…

Markets are unpredictable

Society also does a poor job at tracking predictions and keeping forecasters accountable.

Outside of our Annual Fat Cat Funds Report I’m not aware of many others tracking the success of investment forecasters (in Australia at least).

I wish there were more! Most bad forecasts simply disappear into the ether and are replaced with the next click-inducing headline….

How often do you see the financial newspaper or TV channel review the predictions of last years’ forecasters to help them decide which ones to invite back? Sadly, not very often.

On the rare occasion they do bring up a prediction that went awry, forecasters are quick to blame an ‘unexpected’ event rather than accept that markets are inherently unpredictable.

How to avoid being tricked by predictions

The next time you hear or read a market prediction and are tempted to act, there are a few questions you can ask yourself first;

-

How accurate have they been in the past? Luckily the internet leaves some good breadcrumbs when it comes to someone’s past track record and predictive ability.

-

Is the track record verifiable? I often see stock tipping newsletters claiming “20% per annum” past returns. The problem with this sort of forecast is that it’s self-audited with arbitrary buy and sell dates, doesn’t include trading costs and was never actually observed in real life. Imaginary track records are pretty close to useless and can be ignored. Even many real track records are misleading. Many of Australia’s worst performing share managers have carefully selected which time periods they display on their websites to best convey their ‘success’.

-

What are the motivations behind their prediction? It shouldn’t be a surprise every year stock brokers will tell you it’s a ‘stock trading’ market and active fund managers will tell you it’s an ‘active investors’ market. Real estate agents will always tell you house prices are about to go up. As Warren Buffett once said ‘Don’t ask the barber if you need a haircut’.

-

Is the prediction supported by data or just a narrative? Humans are quick to believe stories, but stories should be verified or debunked with data. We recently debunked the popular story told by many active fund managers that they will outperform when markets fall. The data shows they haven’t, didn’t and won’t. I also discussed the danger of narrative fallacy in this article about ‘hot tech stocks’ last year.

Can you make money without making predictions?

There seems to be a prevailing belief that in order to succeed as an investor you need to make precise predictions about the future. I’d like to suggest there’s an alternative which is preparation.

When it comes to the future, you can chose to predict or prepare.

Prediction is about trying to be right about what is going to happen.

Preparation is about being aware of the range of possibilities that could happen and having a strategy and mindset that will succeed regardless.

One of the best ways you can prepare for an unknown future is by having a balanced portfolio, occasionally rebalancing to reduce risk and having realistic expectations of the range of possible outcomes.

When global share markets rose in late 2017 and early 2018, we were automatically rebalancing out of shares into bonds and gold for clients. It wasn’t a prediction, it was preparation.

We didn’t predict that Apple and Facebook would fall 40% from their highs (even though we noted it as a risk), but because our clients had well-balanced portfolios including bonds and gold, they weren’t overexposed to tech shares when markets fell.

In a year when most investors lost money, I’m proud to say we helped our clients keep their heads above water and it didn’t require a single short-term market prediction.

You can prepare for unpredictable markets

There are some simple steps you can take to prepare for all types of markets so you can ignore the cacophony of market predictions… invest in a broad mix of assets, don’t pick individual stocks, keep your costs low, rebalance periodically, and resist the temptation to override your strategy because of a prediction.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.