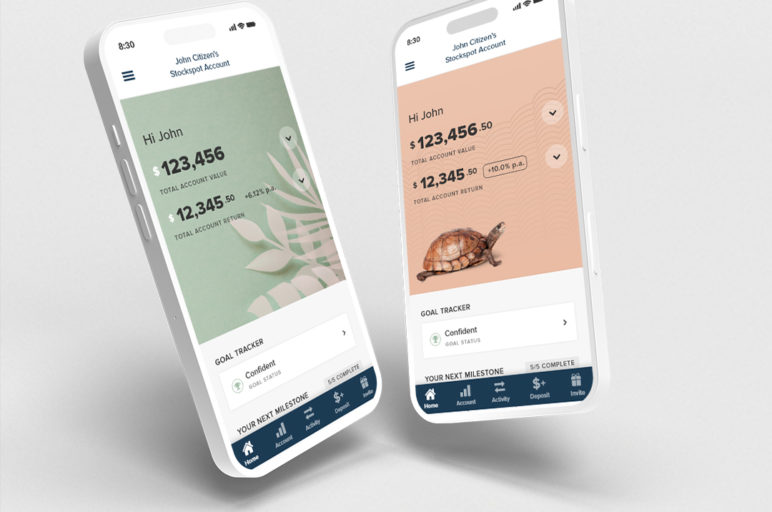

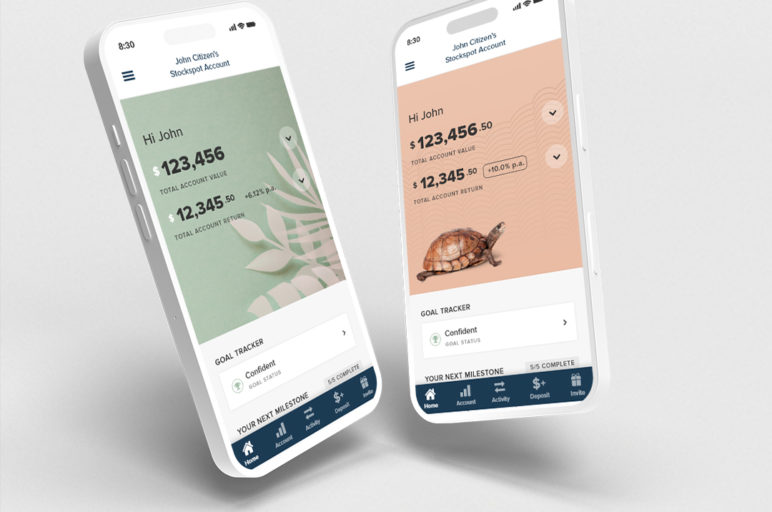

Stockspot Performance Update: March 2024

The Stockspot Model Portfolios returned 8.8% to 14.5% after fees over the 12 months to 31 March 2024.

News, stories and articles from Stockspot

The Stockspot Model Portfolios returned 8.8% to 14.5% after fees over the 12 months to 31 March 2024.

No Results Found