Everything you need to know about Labor’s proposed franking credit changes including how the changes could actually be good news for self funded retirees, SMSFs and the Australian economy.

One of the more controversial policies being recommended by the Federal Opposition in the lead up to the 2019 election is the removal of cash refunds for franking credits or dividend imputation credits.

- How do Labor’s proposed franking credit changes work?

- What will the impact be on retirees and SMSFs?

- Is the policy fair?

- Franking credits and retiree portfolios

- Franking credits impact on innovation

- Could the franking credit changes be good for you?

- Our top 3 franking credit tips for self funded retirees and SMSFs

- Franking credit removal could be a blessing in disguise

Dubbed as the ‘retiree tax’, Shorten’s Labour is proposing to remove cash refunds for franking credits for everyone who doesn’t receive a government pension or allowance.

The Parliamentary Budget Office estimates the policy will improve the budget position by $10.7 billion over the four-year budget period.

The policy has polarised voters; younger generations are generally supportive whereas older investors who stand to be directly affected are concerned about their potential loss of income.

Labour appears to accept the policy will cost it votes from self-funded retirees and Self Managed Super Funds (SMSFs), and hopes younger voters will support it on the basis of equity and fairness.

How do Labor’s proposed franking credit changes work?

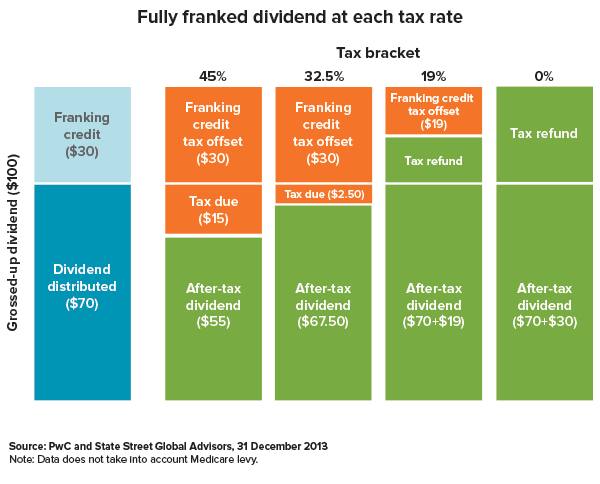

Companies who earn their profits in Australia can pay franked dividends to their shareholders. A franked dividend is a dividend with an attached tax credit – equivalent to company tax paid.

Fully franked dividends are valuable to retirees because the tax credits can be claimed back as cash. Retirees with a 0% tax rate in their account based pension can receive an increase of up to 43% on the cash value of franked dividends.

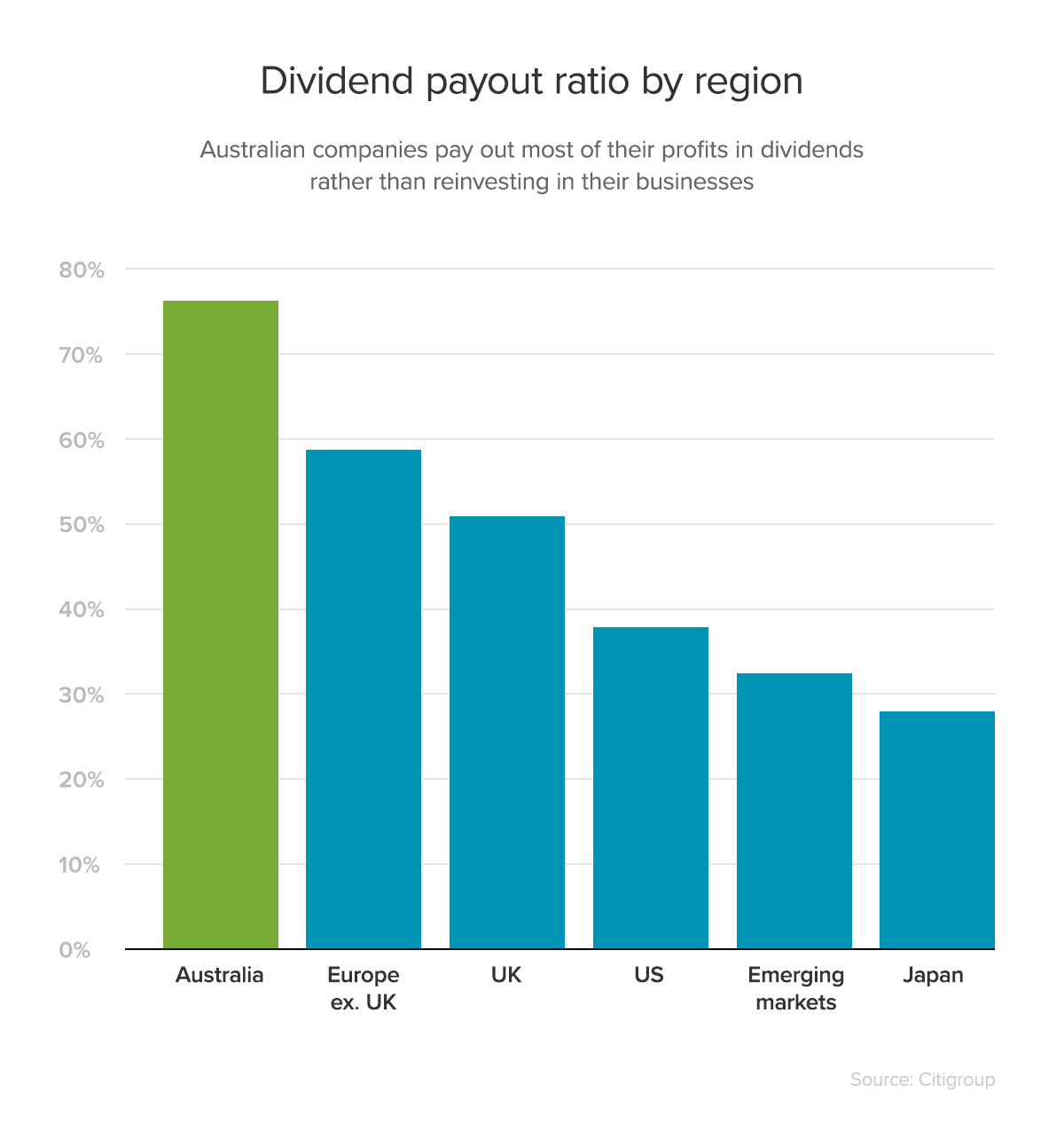

This is one reason large ASX listed companies have such high dividend payout ratios. Compared to the rest of the world, Australian companies pay out a much larger percentage of profits in dividends to satisfy franking-credit hungry investors.

What will the impact be on retirees and SMSFs?

First of all, even if Labour does win and pushes ahead with this policy it still needs to get through parliament which is no guarantee.

If it does, the impact will be most visible for people who have invested a large portion of their portfolio into Australian shares with high dividend yields like Westpac (WBC), Commonwealth Bank (CBA), ANZ Bank (ANZ), National Australia Bank (NAB), Telstra (TLS), Transurban (TCL) and Suncorp (SUN).

In a recent submission to a House of Representatives Inquiry, the Grattan institute explained that the policy would have the greatest impact on self funded retirees with super balances from $800,000 to the $1.6 million limit on tax-free retirement accounts.

Is the policy fair?

This really goes into a theoretical debate about what the dividend imputation system is meant to achieve. Some would argue that you should get a refund because dividends should be effectively taxed at an individual’s marginal rate.

The alternate point of view is that even without a refund the dividend has still only been taxed at the company rate which is 30%, or lower. Australia is also the only country that refunds unused franking credits, so our current policy is unusual by global standards.

Both sides have some valid points. From our perspective there are two problems with the current system that have caused hazardous imbalances in retiree portfolios and the overall economy.

Franking credits and retiree portfolios

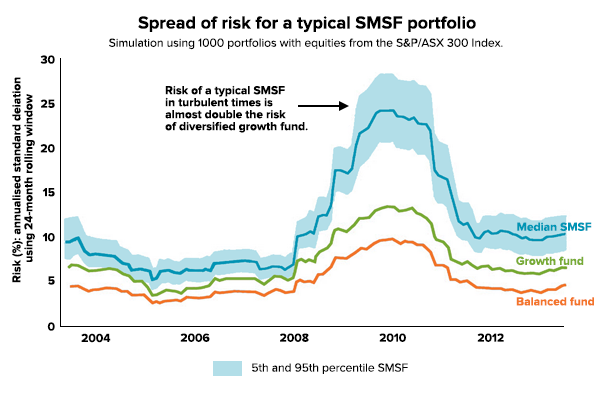

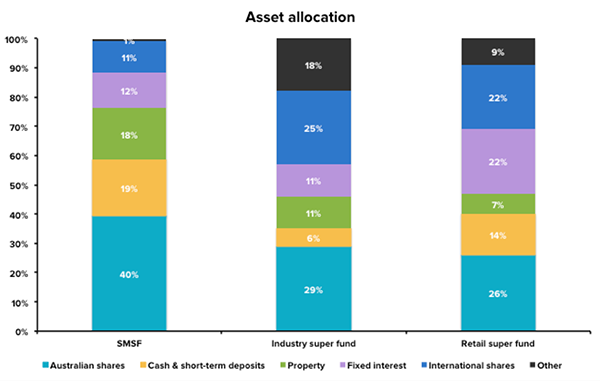

Refundable franking credits lead to retires being encouraged to take too much risk by investing more than they should in Australian shares that pay dividends, rather than diversifying into other companies, countries and assets classes.

This was visible in the financial crisis – the typical self managed super fund experienced about double the risk of a well-diversified, balanced portfolio.

Australia survived the financial crisis relatively unscathed, but a future crisis may not be as kind to those with a concentrated portfolio in Australian bank and resources shares.

Australia accounts for around 2.4% of the global share market yet SMSFs own $223 billion worth of Australian shares, or 30% of total SMSF assets. This home country bias has led to poor diversification, higher risk and lower returns.

Franking credits impact innovation

Australian companies pay out over 70% of their profits in dividends in order to attract local investors, rather than re-investing their profits into growth or new projects like the rest of the world.

The results of this is clear when you see the lack of successful global technology successes that come out of Australia. Stunted innovation in the Australian economy makes our country even more heavily reliant on big banks and resource companies than other global economies.

Could the franking credit changes be good for you?

If you’re a self funded retiree or Self Managed Super Fund looking down the barrel of $10,000 or $20,000 less in income each year as a result of this policy, it’s easy to be outraged. But there is a silver lining that could eventually save you much more in the future, in returns and sleep.

Regardless of whether the changes are passed it should be a wake-up call to review what’s in your portfolio and consider whether it’s right for your goals and lifestage.

A typical SMSF investment portfolio that only includes a few banks, BHP, Rio, Woolworths, Wesfarmers and Telstra is high risk.

By investing in only a few related companies, you’re highly exposed to the Australian economy and run the risk of permanent damage to your capital even if these companies pay decent dividends along the way.

Anyone who has seen Westpac shares fall -32% since 2014 or Telstra shares fall -52% since 2015 can attest to that!

These days there’s really no reason to invest in individual shares and be exposed to single stock risk when an index Exchange Traded Fund (ETF) can give you similar returns with much lower risk, because your money is invested across hundreds or thousands of shares rather than just a handful.

With ETFs you would still receive the benefit of franking credits but are less reliant on them because your portfolio will be diversified across different sectors and asset classes. For example, our Stockspot portfolios returned 0.270% to 0.685% in franking credit value in 2018.

Many retirees are already abandoning direct shares for a better diversified, lower risk strategy. Of the $42 billion invested in ETFs in Australia, about half has come from self managed super funds, and this continues to grow rapidly.

Contrary to common belief, index investing succeeds in down markets too. Last year when Australian shares fell -1.6% for the year all 5 of our diversified ETF portfolios had positive returns thanks to their diversification into global shares, bonds and gold.

Our top 3 franking credit tips for self funded retirees and SMSFs:

Always focus on total return which includes dividends AND capital returns

Dividends are only half of the return equation. An investment that pays high dividends but falls in value is less valuable than an investment that pays a lower dividend but delivers capital growth.

For example Australian shares currently have a dividend yield of 4.4% compared to 1.8% for the S&P 500 in the U.S. but over the past 10 year U.S. shares have risen 311% compared to 96% for Australian shares.

If you’re earning capital growth, particularly if you’re in a low tax environment, you can sell down some capital each year rather than rely on dividends for income.

Consider diversification into global share markets for better return opportunities

We think a mix of global and emerging market share ETFs provides perfect exposure to developed and developing economies around the world.

These markets sometimes move in the opposite direction to Australian shares to smooth your returns along the way.

They can also provide better returns than Australian shares at different points in the market cycle. These are our favourite global share ETFs.

Investing into defensive assets like bonds and gold reduces periods of portfolio losses

Shares, bonds and gold all have a place as part of a balanced ‘all-weather’ portfolio. Australian self funded retirees are lacking defensive investments like bonds and gold in their portfolios.

These types of investments can give you a boost when shares have a bad year. For example in 2018 when Australian shares fell, bonds rose 4.1% and gold was up 8.4%.

SMSFs do hold a lot of cash and term deposits however these don’t tend to offset as much as bonds or gold when shares fall. In 2018 cash still only returned around 2%.

Franking credit removal could be a blessing in disguise

Removing the franking credit led incentive to invest in Australian shares may ultimately have a positive impact for self funded retirees if they can use it as an opportunity now to build a better all-weather portfolio for the next 10, 20 and 30 years.

For large Australian businesses, the franking credit changes are likely to have a longer-term impact on capital management strategies by reducing dividend pay-out ratios over time.

Companies will then have more capacity to invest into innovation and growth initiatives, essentially creating more job opportunities as well as better products and services for us Aussies. That’s not a bad thing for Australia which recently slipped to #19 on the list of most innovative countries globally.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.