Actively managed funds aim to beat the returns of a given investment market. Passively managed funds, on the other hand, are designed to mimic the returns of a specific market as measured by a particular index like, for instance, the S&P/ASX 300. This is why they are also known as ‘index’ funds.

Most of the money in Australia is managed by active funds but passive investing has been growing fast, particularly since 2008. We look at some of the key differences and why index investing has been growing in popularity.

How active and index investing work

Active investing

Active investing involves trusting your money to a fund manager who uses their investment skills to try and beat the market return. Active funds management gives you the chance to beat the market return if your fund manager gets their market timing and stock selection right.

Over the past 10 years, active investing has become less popular because fund managers are finding it harder and harder to beat each other. It’s not because active fund managers are getting less skillful but rather because funds management is extremely competitive. As more fund managers have joined the industry, it gets more difficult for them to beat the market because active managers are the market.

Investing is a ‘zero sum game’; in the long-term fund managers in aggregate can only earn the market return minus their fees. Since they tend to charge relatively high fees, about 75% of active fund managers do worse than the market after fees are taken out!

Of course some fund managers will beat the market over a given period and some will underperform. Unfortunately there’s no magic formula to picking the fund managers likely to beat the market in the future.

In fact, managers who recently beat the market tend to underperform in the future. Most top-performers can’t maintain superior returns over even a couple of years. Of the 664 U.S. active funds in the top 25% in 2012, only 3 of them remained in that top 25% in the following 4 years!

Index (passive) investing

Instead of buying and selling regularly, passive index funds buy and hold investments that track the performance of a particular market or index. For example, the S&P ASX/300 index tracks the largest 300 companies listed on the Australian Securities Exchange (ASX) or the S&P 500 index tracks 500 of the largest companies listed in the United States.

Index investing has several benefits over active investing:

-

Fees tend to be lower than active funds, so historically passive investors have earned higher after-fee returns.

-

Passive funds tend to be more tax efficient as they turn-over their portfolio less, so realise less taxable capital gains.

-

They’re generally less risky since they aren’t focused on a particular investment style like active funds do.

Billionaire investor Warren Buffett agrees that passive investing is the smartest way to invest. He has gone on record saying that if his wife survives him, his estate plan will recommend keeping 90% of her inheritance in a passive index fund, with the rest in government bonds.

Perhaps not so surprising given Warren Buffett’s own portfolio company Berkshire Hathaway, which charges no fees, has underperformed the US stock market index for 5 of the last 6 years. Mr Buffett understands how difficult beating the market really is!

So why does the financial industry continue to promote active funds and other expensive and complicated products rather than sensible low-cost index funds? John Oliver explains (watch from 7 min 54 sec):

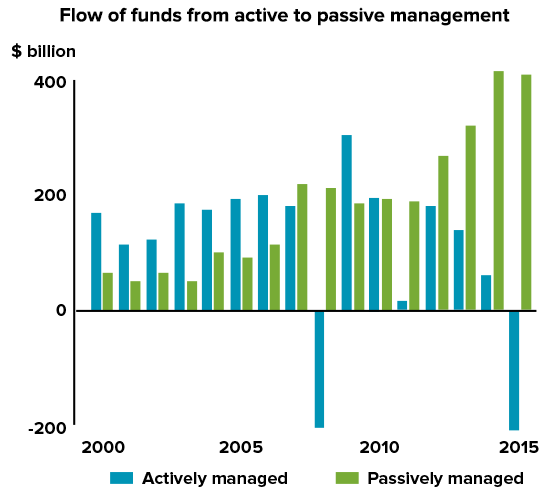

Passive investing is becoming more popular as investors realise most active funds aren’t worth their cost. It is why hundreds of billions of dollars have been moving out of active funds and into passive index funds.

We expect this trend to continue as passive index funds still only make up a small percentage of the overall funds management market. In Australia, passive exchange traded funds (ETFs) make up only about 1% of the $2 trillion in investable savings.

No investment strategy can guarantee returns, but you can have better control over the risk you take and the fees you pay if you adopt a passive approach.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.