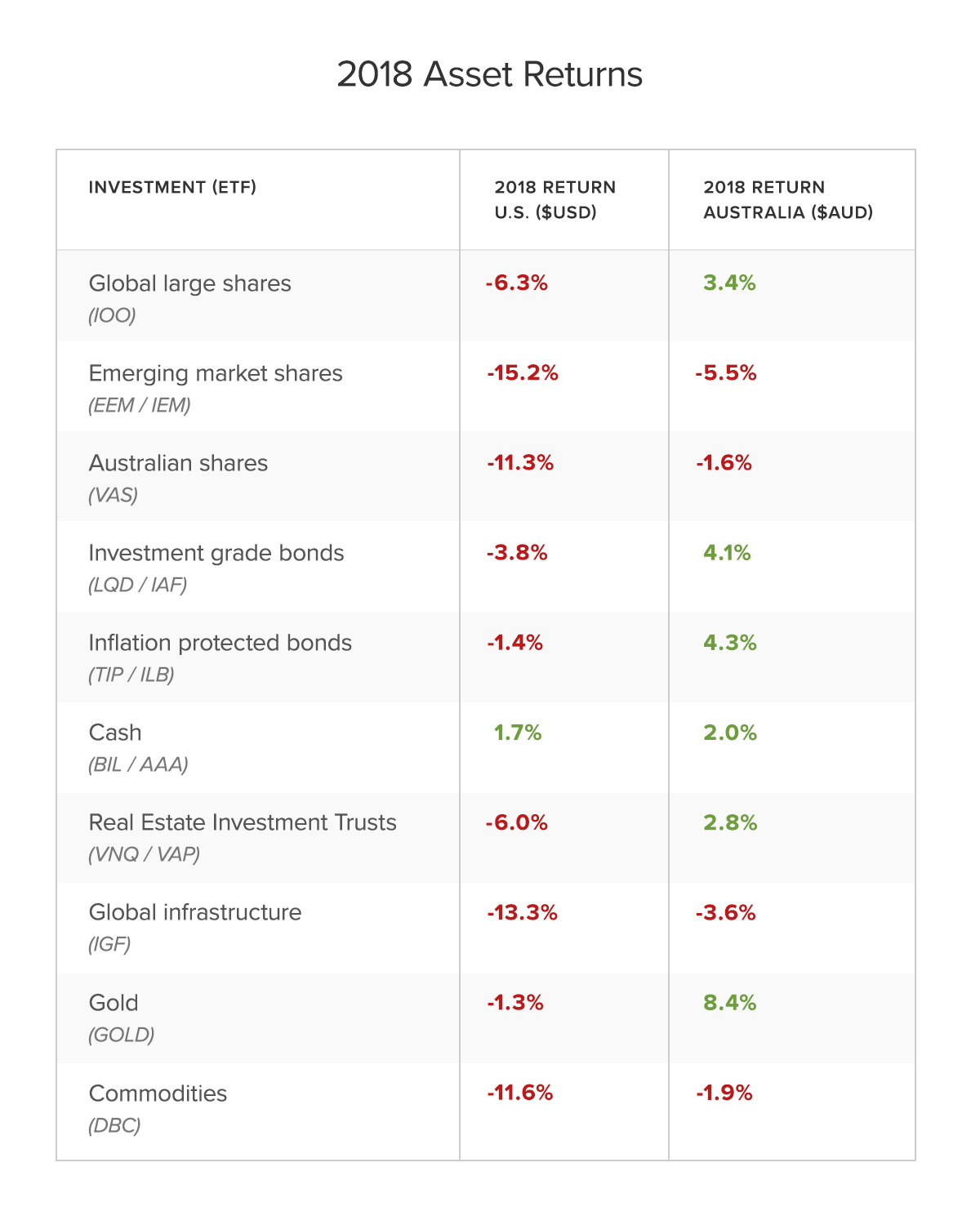

2018 was a down year for investment returns across the board.

In US dollar terms, every major asset class apart from cash fell in value. That’s an even larger percentage of assets falling than the financial crisis in 2008! If you didn’t lose money as an investor in 2018, you’ve done very well.

The Australian dollar also got hit, falling 9.7% during the year. The falling dollar had a silver lining since it helped to boost returns for Australians investing overseas who had not hedged the currency.

Stockspot performance in 2018

We’re pleased to report that all 5 of the Stockspot strategies had positive returns in 2018 after fees. The positive performance was thanks to broad diversification (including bonds and gold), low cost funds and the discipline to stay invested.

Gold and bonds served their purpose as counterbalances when shares fell. Having unhedged global share ETFs benefited clients when the Australian dollar fell.

| 2018 calendar year return | 2018 financial year return | |

| Topaz | 0.09% | 9.33% |

| Emerald | 0.57% | 8.43% |

| Turquoise | 1.19% | 7.57% |

| Sapphire | 1.51% | 6.85% |

| Amethyst | 1.93% | 5.78% |

Total return after ETF and management fees.

It was a hard year to predict, and most forecasters got it horribly wrong. That’s a good reminder that nobody knows what the market has in store so listening to predictions is a waste of your time.

Instead, by sticking with a diversified, low-cost strategy and ignoring the ‘noise’, you can maximise your chance of reaching your investing goals. We think you do better when you avoid the temptation to chase hot sectors like technology and accept that markets can be volatile over the short term.

Once again indexing beat active management and stock picking in 2018.

What does 2019 have in store?

The year has started on a positive note with share markets around the world up strongly in January. We would love to be able to tell you what’s coming up next but the truth is nobody knows.

Rather than try and predict what lies ahead (a fool’s errand), we’re focused on ensuring that the portfolios have the right selection of low-cost index funds to grow and protect our clients’ wealth in all types of market conditions.

You don’t need to predict when you prepare

History has proven that staying the course in a diversified index strategy succeeds in all types of markets, including when they occasionally fall.

As the late Jack Bogle rightly said, “stay the course and don’t let changes in the stock market change your mind… if you trade in and out of the market your emotions will defeat you”.

All the best for your investing in 2019 from the Stockspot Team.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.

Investment in financial products involves risk. Past performance of financial products is no assurance of future performance. Please read our Advice Disclaimer. Actual performance of your portfolio may vary from our published returns due to the timing of investments, rebalancing and your fee tier. Published returns are based on the Silver fee tier. More information on the portfolio construction process is available here. More information on how we calculate returns is available here.