The Australian property market is hot, and the general consensus is that property is a secure investment yielding good returns over time. However, let’s take a closer look at all the costs and the the long term returns on investing in property.

What are the rental returns of investment property in Australia?

Rental yield is the income you receive each year from the tenant in your investment property, measured as a percentage of the value of the overall property. Gross rental yield is the amount of rent your tenant is paying, and net rental yield is the amount you pocket after all of your costs, such as management, maintenance, rates, water and insurance.

If you have a property worth $1,000,000, your tenant pays $50,000 per year in rent and you pay $10,000 a year in costs, you have a gross rental yield of 5%, and a net rental yield of 4%.

Investment property and negative gearing

For many Australians negative gearing can be attractive. It’s been a popular strategy in Australia but it’s risky as it concentrates your assets into one investment class and increases your debt as you’re likely to take out another mortgage.

Negative gearing means that more of your cash is spent on interest and maintaining a property than the rent received.

The gross yield (rent) on houses in Australia is 3.2% and 4% for units, according to SQM Research. However there are substantial running costs which need to be taken into account to arrive at net yield.

If you own an investment property, you are liable for council rates, management fees, property maintenance and repairs. And if the property value is above the land tax threshold ($734,000 in 2020), there will also be land tax to pay each year.

Short term rentals can yield more than a long-term tenant due to the higher fees to stay for a night. And it’s true – there’s been a boom in the short-term rental market thanks to platforms like Airbnb and Stayz – but this has also increased competition among property owners – virtually pitting them against each other in the bid for the next overnight booking.

According to AirDNA market data, there were 1,034 active listings in Melbourne’s beachside suburb of St Kilda and 812 active Airbnb listings in Sydney’s Bondi Beach alone.

There is also a great deal of additional inconvenience and expense such as managing the property, cleaning and arranging access. And there is a chance that the property is vacant for long periods of time.

Investment properties in Australia: cost of renovations

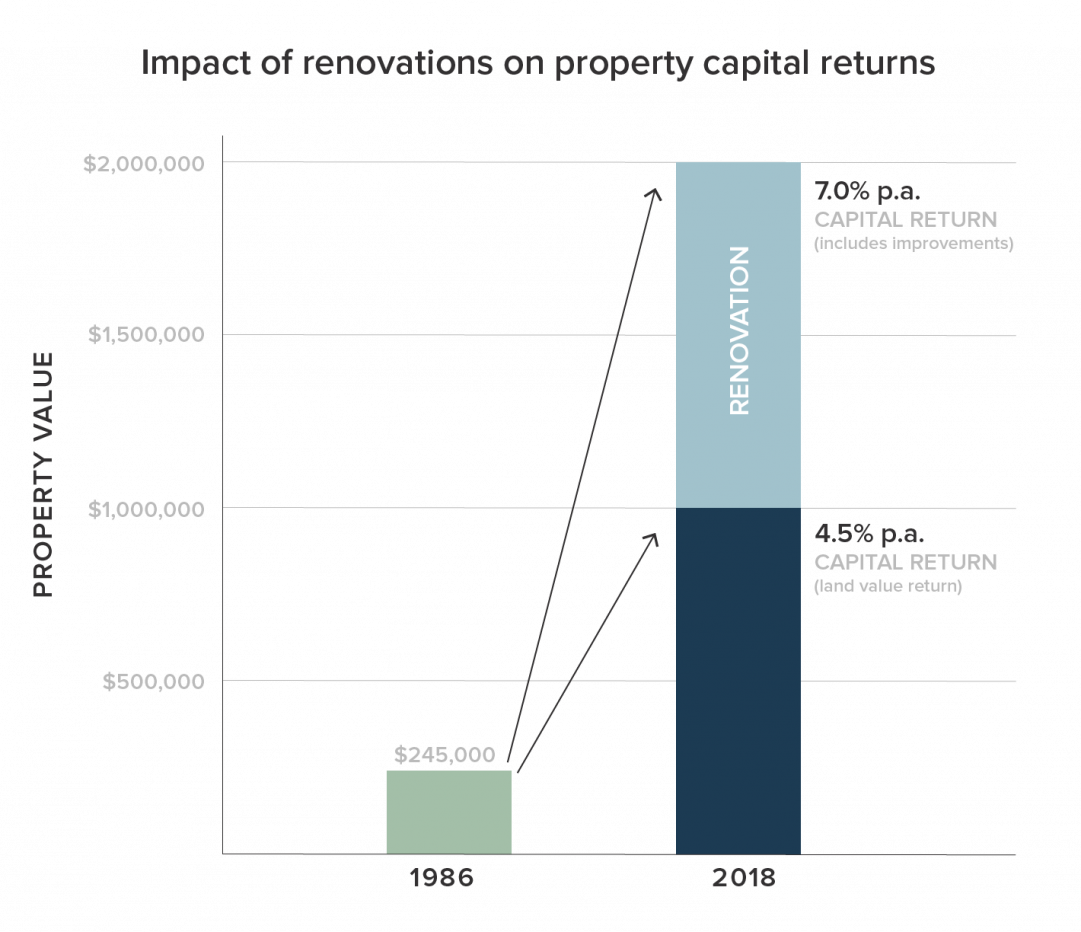

ABS figures from 2019 reveal a price increase of 7% per annum for dwellings in capital cities in Australia over the last 32 years. However, this 7% p.a. fails to account for the cost of renovations, improvements and maintenance over that time.

Here’s a quick example to show the impact of improvements on your return.

Let’s say that a house was purchased for $245,000 in 1986. Nothing has been spent on it in 32 years so the house is quite run down. The property is bought in 2017 for its land value of $1 million. At this point, the ABS would record a price increase of 4.6% p.a. over 31 years.

Since the house is a knock-down, the new owners spend $1 million building a new house on the land. By their calculations, the property is now worth $2 million. If they sell the house at that price, it would be recorded by the ABS as a 100% price increase over 12 months and 7% p.a. over 32 years ($245,000 to $2 million).

However, the actual return – after taking into account the $1m spent on rebuilding the house – would be just 4.5% p.a. This isn’t too far off reality, according to the ATO depreciation schedule a house will need to be rebuilt or majorly renovated every 25-40 years.

What about building an investment property?

The average cost of building a house in Australia is over $1,100 per square metre, so an average size home of 300 square metres will cost around $330,000.

Even if your bank account is healthier than most, it’s a big investment. But that’s only just the start. By the time you add landscaping, outdoor improvements such as fencing, patios or a deck, you’re looking at an investment much closer to $400,000.

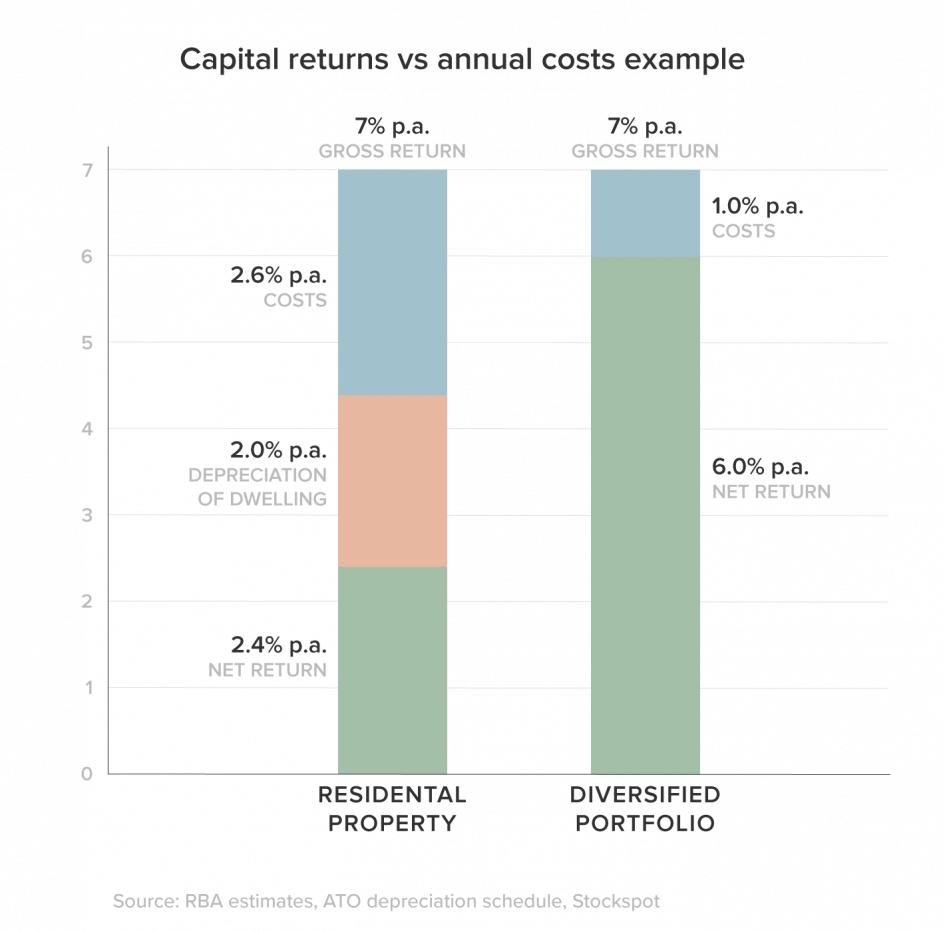

Over time, bathrooms and kitchens need updating or replacing, while decks, pools and gardens also need ongoing maintenance. There’s also ongoing costs like council rates, body corporate fees (for home units and townhouses), water and insurance which the RBA estimates to be at least 2.6% per year.

Even in a low interest rate environment it is easy to see how maintenance costs can exceed rental returns.

Costs of buying and selling a property

When talking about investment property, capital growth is the appreciation of the value of the property itself. This can be a negative return, if the value of the property declines. If you buy a property worth $1,000,000 and it increases in value over 5 years to $1,500,000, then you have achieved capital growth of 50% overall, or 8.44% per annum.

The returns from selling a property can be attractive, but it’s also important to take into consideration the transaction costs of buying and selling a property. The RBA estimates that the costs of buying a house including stamp duty and other costs like conveyancing are around 4% of the value of the property.

The cost of selling a house including real estate agent commissions and advertising add up to about 3%.

This means the total costs of buying and selling a house are in the vicinity of 7% – and that’s before you take in to account tax implications.

Tax implications of selling an investment property

Tax benefits of owning property may be disappearing

Hanging out for capital gains rather than rental yield? Bearing in mind that the property dwelling itself will depreciate over time by around 2.5%-4% per year, the capital gain will be based on the value of the land which historically has increased by between 4%-5% per year.

Once the annual losses are offset against the likely capital gain on sale, the typical long-term return on an investment property in Australia has been marginal.

Tax is a big driver of property investment decisions in Australia. At the highest marginal tax rate of 48 per cent (including Medicare Levy), an annual loss of 4% on a geared property will become 2% after tax.

The favourable capital gains tax (CGT) treatment on sale is also a big motivator for purchasing investment properties. Currently there is a 50% discount for individual investors.

If the profit on sale equates to 4.6% p.a. an investor on the top marginal rate will pay the equivalent of 1.1% p.a. CGT on sale of the property.

What about investing in other assets?

It’s worth considering all options to invest your hard earned money, and whether an alternative to investment property may be better suited to your goals.

We know people can be turned off from investing in the share market because they perceive it as too risky and difficult.

If you create a diversified portfolio of ETFs covering Australian and global share markets, bonds and gold, your typical term returns could range from 6%-10% p.a.

It’s worth considering all your options before you take the plunge – and even if you do invest in property, remember that the golden rule of investing is to diversify as much as possible.