Phil Ackman is a current affairs radio host for Cairns FM 89.1. He’s a journalist who has lived everywhere. He now calls far north Queensland home, where he’s made it his mission to provide intelligent discussion and stoke the curiosity of listeners on the airwaves. He’s married and has a cat he plucked from a drain and a dog rescued from the outback.

Probably the least interesting thing about Phil is that he recently became a Stockspot client in September 2019.

We first spoke to Phil just over a year ago where he interviewed Chris Brycki, Stockspot’s CEO, on his radio show to chat about Stockspot Fat Cat Funds research. Since then he’s interviewed Chris a few times about Stockspot’s views on various topics like the Royal Commission and investing in general.

Not an investing expert

Phil says like many people he has no idea where to invest his money. He’s struggled to find where he can get a decent return on his money without being ripped off by high fees or being shoehorned into an ‘investment opportunity’ which plays more into the back pocket of the investment adviser, than his own.

In September 2019, Phil decided to invest with Stockspot. He also laid down a challenge for Chris: “Come on my show every few months to discuss the portfolio”. Naturally Chris jumped at the opportunity to talk about investing.

You can listen to both interviews here. Phil has some insightful questions.

Here is a summary of Chris’ first two radio interviews with Phil.

How Phil’s Stockspot portfolio was selected

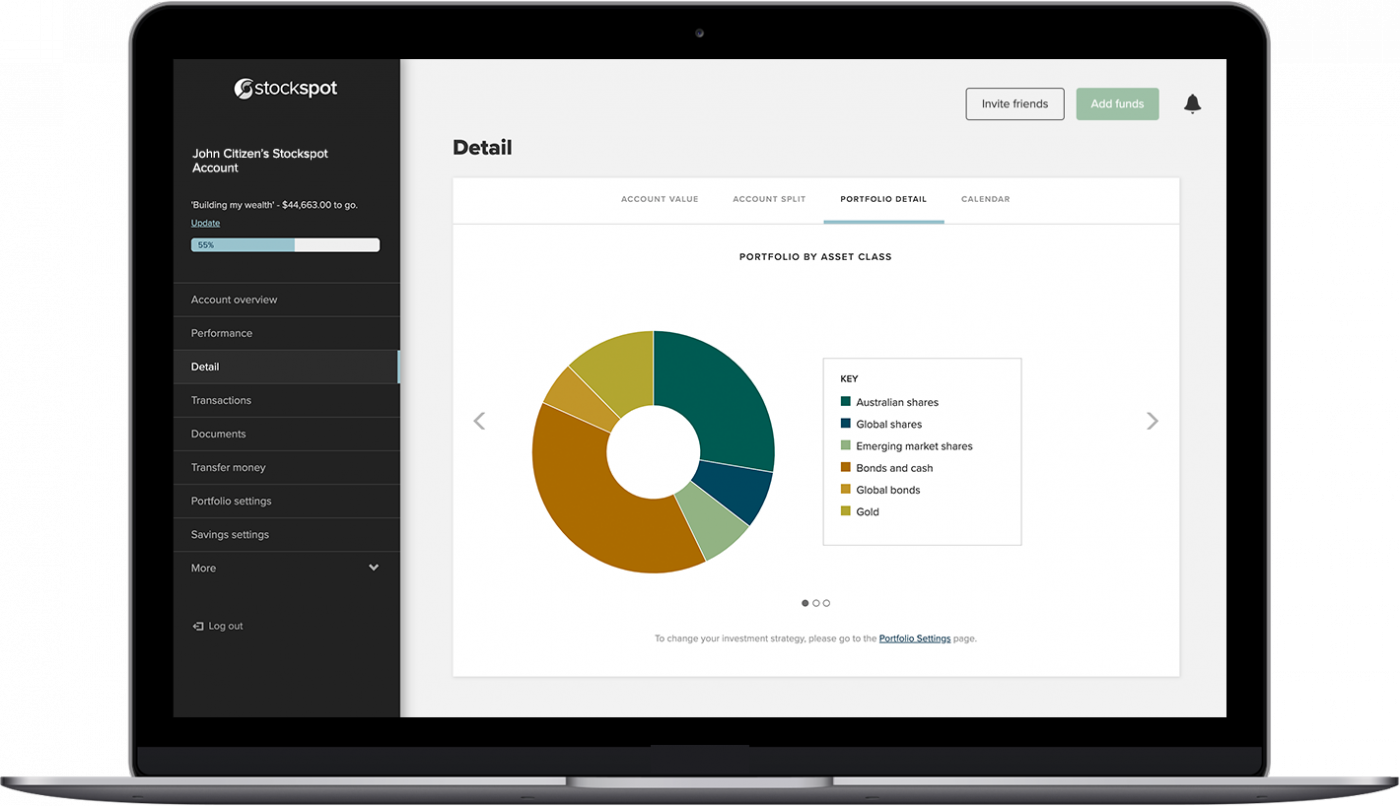

Phil is in Stockspot’s Sapphire portfolio. It’s a moderately conservative portfolio that contains a mix of defensive investments (56% bonds and gold) and some growth investments (44% Australian, global and emerging market shares).

Like all Stockspot clients, Phil completed the online advice questionnaire. The questions help our sophisticated technology engine to determine which portfolio is best suited to his situation. It covers questions age, investment horizon, investment experience, and comfort with risk.

Age is important, but it’s more about ‘time horizon’

In Phil’s first interview with Chris, he was keen to understand how he was placed in the Sapphire portfolio and if age came into it.

Chris explained that while age is important, it’s your time horizon that is more meaningful. That is: how long you want to invest for.

“Some clients are in their 20s or 30s and have another 20+ years of investing ahead of them. They can afford to be in a portfolio that targets higher growth, but is riskier.

“Other clients invest for fewer years because their goal is to gather enough money for a house deposit. That’s a shorter term goal, so a portfolio with more defensive investments, that takes less risk, is better for them”.

In the questionnaire Phil indicates he’s comfortable with a bit more risk in his portfolio. He said he’d be okay with the value of his portfolio falling 20% in order to target higher returns in the long-run.

However, as he only plans to invest for three years, a more conservative portfolio is more appropriate. Our ‘Sapphire portfolio’ has a higher percentage of defensive investments like bonds. This should help to protect Phil’s portfolio from any potential falls in his growth investments like the Australian and global shares over the short run.

“We want to give you the best potential for returns over your time horizon”.

How’s the portfolio doing?

The second interview about Phil’s investment portfolio we looked at how much he had made. “I invested in September and looking at my Stockspot Client Dashboard it looks like I’ve made $700, so about 1.4%.”

Chris reckons this is about right, and remember Phil’s only been a client for a couple of months. As a general rule we encourage clients to focus on the long-term as over one or two years markets could go up or down or do nothing. It’s when you invest for longer and longer your chance of getting a good return improves every year.

In the last 12 months Stockspot portfolios have returned between 16.1% – 21.7%. The share market rallied at the beginning of the year, so people invested from January 2019 onwards have had outstanding returns.

Why invest outside of Australia?

Phil also wanted to know why his portfolio had investments outside of Australia: “From the online dashboard I see I’m not only invested in Australian shares but global and emerging market shares, what’s the rationale behind that?”.

This is central to Stockspot’s investment strategy of broad diversification. Chris explained that if Australian shares have performed poorly, often markets overseas like the US, Europe and China are doing well. For example Australian shares haven’t done anywhere near as well as the US over the last decade. So owning global shares can give you more performance.

The top 100 global companies ETF Phil holds in his portfolio returned 6% since he started investing with Stockspot, which helped boost his overall portfolio returns.

Why do you want me to invest in gold?

All Stockspot clients get access to an online ‘Dashboard’, which shows you how much you have invested, your investment returns and what you’re money is invested in. It also tells you how much you need to deposit to make your next invest and what that investment will be.

Phil wanted to know why the dashboard is inviting him to tip in more money into gold.

Chris explained that gold is an investment in a diversified portfolio that acts like insurance.

Most of the time share markets rise, but during the times share markets do fall, what you want is some investments that do well when share markets do badly. In our portfolios those two investments are bonds and gold.

It’s not just for armageddon

Gold has a fabulous history of rising when share markets fall or are volatile, the value of gold goes up. It cushions your portfolio if there is a share market fall. “It’s a wonderful diversifier”.

The fees seem like very good value

The important issue of cost also came up.

“It looks like I’ve paid you $40 in fees. Given I was paying a retail super fund well over that it seems on the face of it very good value. What do the retail super funds do for the money that you’re not”. Phil said.

The answer is, they don’t do much to justify their fees. There are a lot of bells and whistles in investing that you just don’t need. The three most important things to do when you invest is:

- Stay well diversified

- Keep your costs low, which is what we do for you by investing in low cost ETFs

- Stick to your plan and ignore the noise from media and market commentators

Thanks Phil for having Chris on the show. We look forward to the next instalment and we’re happy you’re a Stockspot client.

You can listen to both of the interviews below.

They’re only 12 minutes long and cover a lot of different topics like bonds and the economy. It’s well worth the listen!