Welcome to our new series of reviews and discussions of all the trading platforms and share trading apps in Australia. It’s important to understand exactly what each platform or app does, so you can choose the best investment strategy for you.

See: Our review and discussion Superhero

See: Our review and discussion of SelfWealth

See: Our review and discussion of Stake

See: Our discussion and review of Sharesies

See: our discussion and review of the Pearler investing platform

What is eToro?

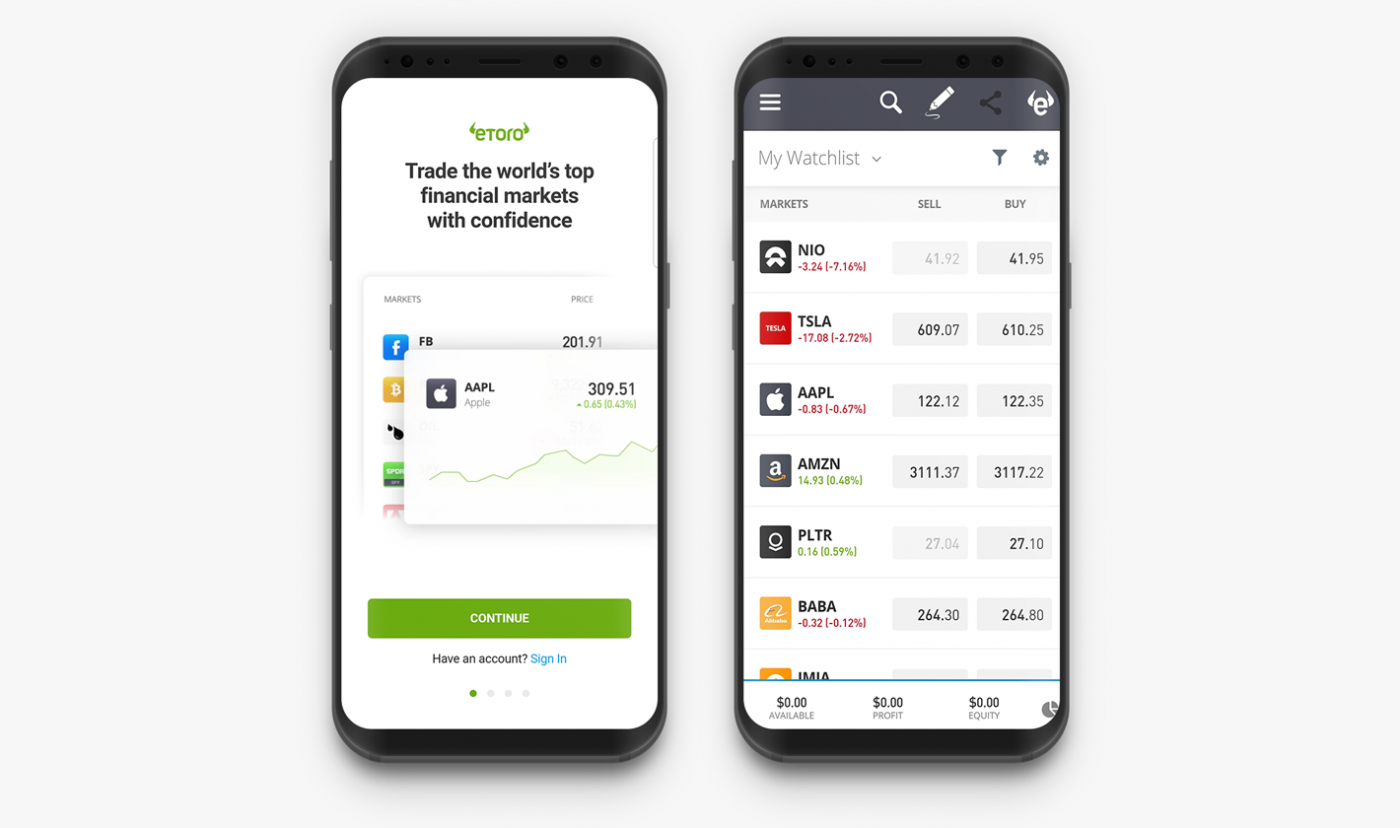

eToro is an Israeli founded online trading platform available in many countries around the world, including Australia. You can buy and sell shares like many other share trading apps, but the platform has some differentiating features.

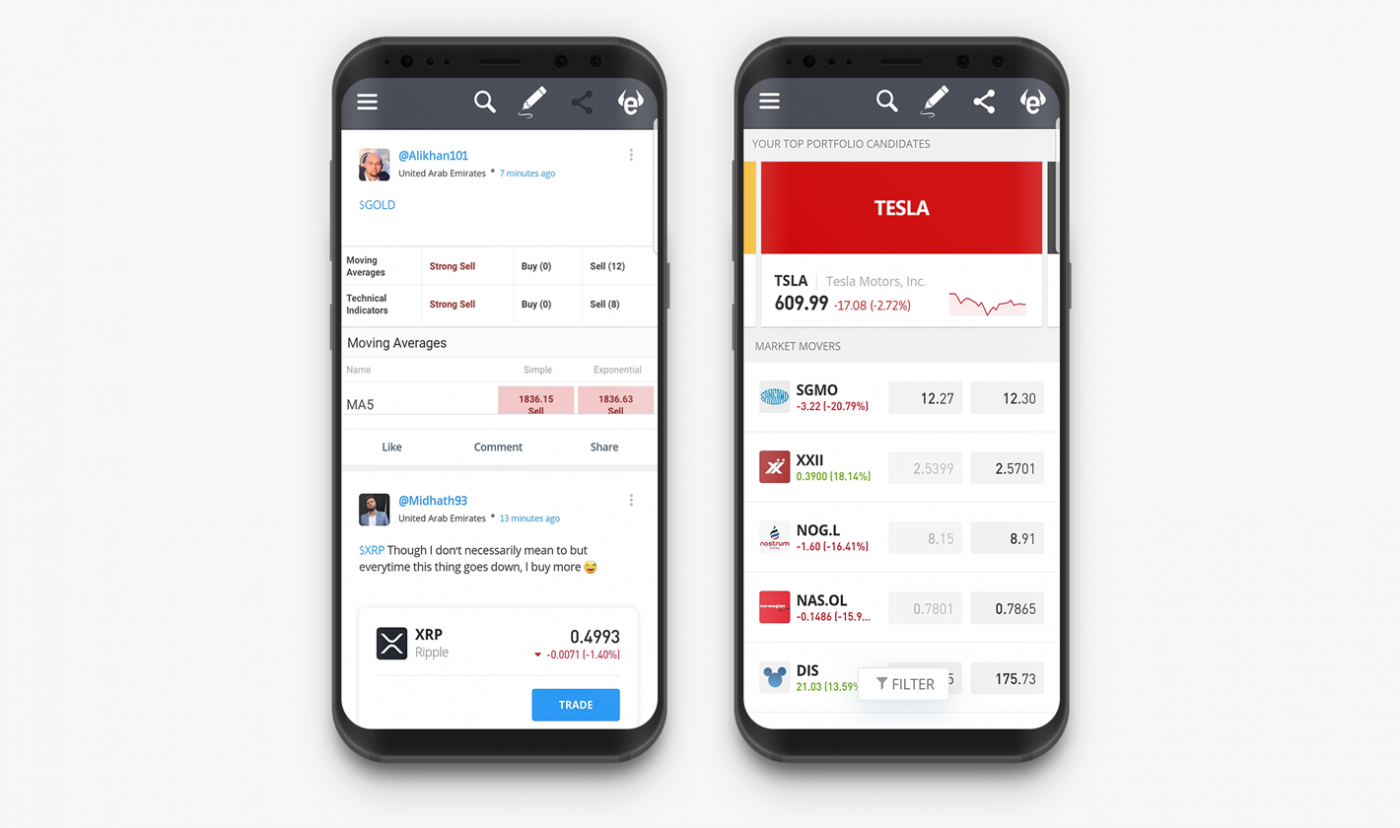

The stand-out features of eToro are the multiple assets you can trade (shares, foreign currencies, cryptocurrencies, and commodities like gold and oil), and their CopyTrader and CopyPortfolio functions. The ‘copy’ functions allow users of the platform to imitate the strategies of more experienced investors.

‘Copied’ investors can join eToro’s Popular Investor program, which rewards investors for allowing their portfolio and trades to be copied.

eToro also has a News Feed, similar to feeds on other social networks like Facebook or Twitter. The eToro newsfeed allows anyone on the platform to post opinions, updates, and suggestions so that users can learn from each other.

eToro offers CFD trading. CFDs, or contracts for difference, are complex financial instruments and come with a high risk of losing money rapidly due to leverage. According to the eToro website, 71% of retail investor accounts lose money when trading CFDs with eToro.

The Australian regulator, ASIC will also be enforcing lower leverage and tougher regulation on CFD providers from 29 March 2021.

Is eToro free?

Initially opening up an account on eToro is free, although you will need to have a minimum opening balance of USD$200, and the minimum trade size of USD$50 for share trading.

eToro doesn’t charge any commissions or fees on trading US shares, but they make their money through:

- Currency conversion: eToro only operates in US$ and will charge currency conversion fees if you deposit AUD. This is 0.5% for bank transfers, and 1% for other methods including PayPal or credit card. As currency rates fluctuate so will your returns.

- Withdrawal fees of USD$5

- Buy/sell spread

- CFD funding fees

- Inactivity fee of $10 per month if you haven’t logged in for 12 months or more

- Cryptocurrency trading fees

Check the eToro website for the most up to date information on their fees.

Is eToro trustworthy?

eToro is regulated by the Australia Securities and Investment Commission (ASIC) and holds an Australian Financial Services License (AFSL).

This means that the platform is regulated, but the asset classes on eToro can be risky in the hands of an inexperienced investor. Investors can buy and sell cryptocurrencies, forex and CFDs (contracts for difference), which are all high-risk investments.

Do I directly own my eToro investments?

The eToro trading platform is not an exchange or a market. This means that you can only buy and sell stocks within the eToro trading platform. It’s not possible to move open positions out of your eToro account to another broker or to another person.

When buying a stock or an ETF on eToro, you gain ownership, and the underlying asset is held in your name.

However, eToro doesn’t have CHESS sponsorship (being CHESS sponsored means the ASX is keeping a list of who owns what shares). This means that if eToro should ever collapse, your assets held are not held legally and beneficially in your name.

Additionally, if you buy a CFD you don’t have the same rights as owning assets like shares directly on a HIN at the exchange.

Find out why direct ownership of your investments is important.

How does eToro work?

For an Australian customer to open an active trading account with eToro, you will be asked to make a minimum initial deposit of USD$50 (at time of writing).

You’ll need to fill out a profile which will be public unless you mark it ‘private,’ and once you’ve deposited funds, you can start trading, either by picking shares or other assets yourself, or by copying the portfolio of a more experienced investor.

If you’re interested in share trading, you can currently buy (and hold) US listed stocks through eToro. These stocks that are traded on the NASDAQ and NYSE markets. However, you can’t buy individual Australian stocks listed on the ASX through eToro.

You can also buy fractional shares on eToro. This means being able to purchase as little of 0.1% of a share from high-priced companies, such as Amazon or Facebook.

How do I withdraw my money?

Your initial withdrawal from eToro will require you to have a verified account (which means you’ll need government issued ID, as well as proof of your address). Once you have a verified account, you can withdraw your money at any time, but processing time may take a few business days.

Is eToro good for beginners?

eToro has positioned themselves as a social platform, and as such, those who are keen on trading regularly can learn from other investors. The platform offers various trading tools and courses, and every trader who signs up to eToro is given the opportunity to practice their strategies with a dummy account including $100,000 of virtual money.

The platform charges inactivity fees, so by inference does not encourage passive investment. Since active investment needs a lot of research and attention to the market movements, it might not be the easiest way to invest for a beginner.

Additionally, while you can purchase shares, the other assets available on the platform are the domain of more experienced investors (CFDs, forex, and cryptocurrencies).

eToro and Robinhood compared

Robinhood offers free trading in the U.S. but makes most of its money from selling order flow and receiving compensation for directing orders to different parties for executing a trade.

Robinhood also earns money from margin lending which means an investor can borrow money from Robinhood to buy stocks. Robinhood isn’t currently available in Australia.

eToro and Stake compared

eToro and Stake both offer zero commission brokerage for Australians. This means you can invest in US shares like Apple, Tesla, and Amazon.

However, Stake lists more U.S shares than eToro does, and has a greater range of ETFs.

On Stake you can buy a fractional share with as little as $10, whereas eToro charges the minimum trade of $50. Stake also doesn’t charge any brokerage fees but earns 0.70% every time you move your money from Australian dollars into U.S. dollars to invest. Stake operates through it’s U.S. market clearinghouse partner, DriveWealth.

Read our Stake review and Stake comparison to Stockspot.

eToro and SelfWealth compared

eToro allows buying and selling of shares, but not Australian shares. You can trade in foreign currencies, cryptocurrencies, and commodities like <gold and oil. While there is no brokerage for purchasing shares, there are currency conversion fees and fees for purchasing assets other than shares.

SelfWealth offers trading of Australian shares with brokerage starting at $9.50. SelfWealth have also recently introduced US share trading at $9.50. Your investments are held directly in your name on your own individual HIN.

Find out more about SelfWealth and compare to Stockspot.

eToro and Stockspot compared

The main difference between Stockspot and eToro is that Stockspot provides investment advice and an ongoing service. On eToro, advice is provided by other investors who may or may not be experienced, but when you join Stockspot, your personal situation is reviewed, and then you receive a recommendation for the best-suited investment strategy based on your goals and investment time horizon.

With Stockspot, once you settle on your investment strategy, you get a properly diversified portfolio (including Australian shares, global shares, emerging markets, bonds and gold). Stockspot reviews the investment on an ongoing basis and will rebalance your portfolio when necessary.

When you invest with eToro, you’ll only get shares and there won’t be any defensive assets in your portfolio, unless you buy them separately. Having proper diversification over different platforms can get tricky and expensive.

With eToro you need to pick all of the investments yourself and review them yourself. If you want to invest in Australian shares, you’ll have to use another platform, which could get tricky to manage over the long term.

If your aim is to regularly buy and sell investments to try and make short term profits, this might be your preferred strategy. But, if you’re a long-term investor, your portfolio should be regularly reviewed and rebalanced in line with market movements.

For some people, managing their own investments can be a rewarding hobby. But studies have shown that correct investment selection, the right portfolio allocation and automatic rebalancing can add over 2% p.a. in pre-tax performance each year. Stockspot manages all of this for you so you can benefit from expertise and automation and you don’t need to worry about anything.