Welcome to our new series of reviews and discussions of all the trading platforms and share trading apps in Australia. Here we discuss SelfWealth. Remember, it’s important to understand exactly what every investing or trading platform or app does, so you can choose the best strategy.

See: Our review and discussion of Superhero

See: Our review and discussion of Stake

See: Our discussion and review of the eToro trading app

See: Our review and discussion of Sharesies

See: our discussion and review of the Pearler investing platform

What is SelfWealth?

SelfWealth is a trading platform for Australian shares at a flat fee of AUD $9.50, and US shares at USD $9.50 per trade. If you trade US shares from SelfWealth, an FX fee of 60bps will be charged. All shares are CHESS sponsored on your own individual HIN so you are the full legal and beneficial owner of the shares.

SelfWealth is a platform for self-directed investors so there is no personal advice on how to invest.

What is SelfWealth Premium?

SelfWealth Premium can be described as a social network that enables you to track the portfolios of other SelfWealth members so you can see what trades they are making. This can help you make investment decisions for yourself.

When you create a SelfWealth share trading account, you’ll be able to try out all of the features offered with SelfWealth Premium for the first 90 days without being charged. If you then decide that you’d like to keep using the features provided to SelfWealth Premium accounts, you can continue for $20 per month.

How does SelfWealth provide low brokerage?

SelfWealth offers flat fee brokerage costs of just $9.50 per trade regardless of the size. This is significantly less than online brokers like CommSec and NABtrade.

SelfWealth has been able to keep their costs low by outsourcing functions such as execution and clearing to a third-party wholesale stock broker.

Is SelfWealth safe?

Customers of SelfWealth are issued with a unique holder identification number, or HIN. This means you have direct beneficial and legal ownership of shares that you buy through SelfWealth. This is the same model used at Stockspot where all client investments are held safely on their own HIN.

Find out why direct ownership of your investments is important.

How much time does it take?

It’s really up to you. You could purchase your shares on SelfWealth and then let them ride out the ups and downs of the market, but there’s recently been a surge in day-traders and swing traders trying to beat the market.

This is all down to personal preference and individual understanding and knowledge of the market. If your aim is to regularly buy and sell investments to try and make short-term profits, this might be your preferred strategy. But, if you’re a long-term investor, it’s important that your is reviewed and rebalanced so you’re cushioned against market falls.

Additionally, research by ASIC and others overseas have found that approximately 80% of day traders lose money and 75% quit within 2 years. Managing your own portfolio is difficult and with platforms like SelfWealth is that you don’t receive any portfolio advice, risk management or rebalancing.

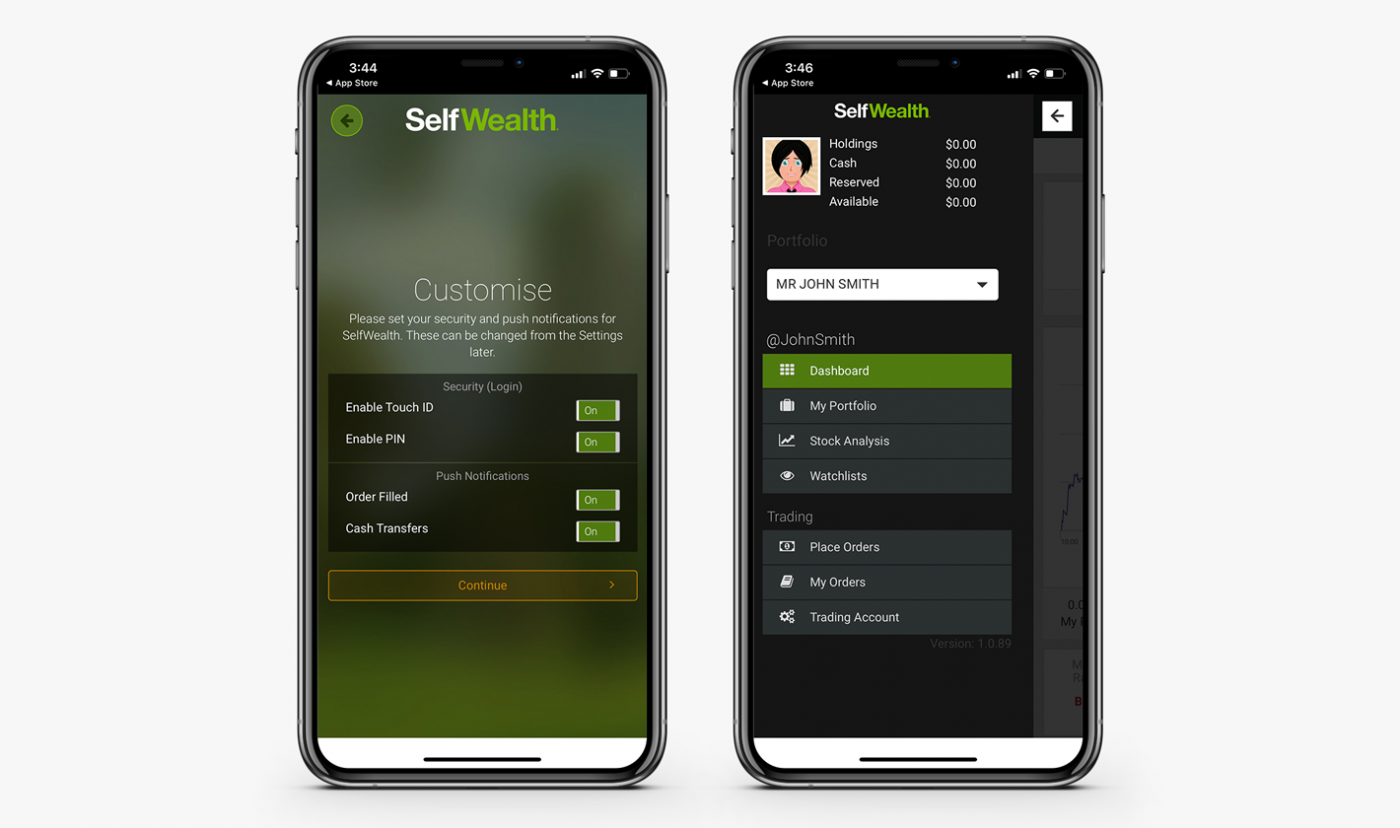

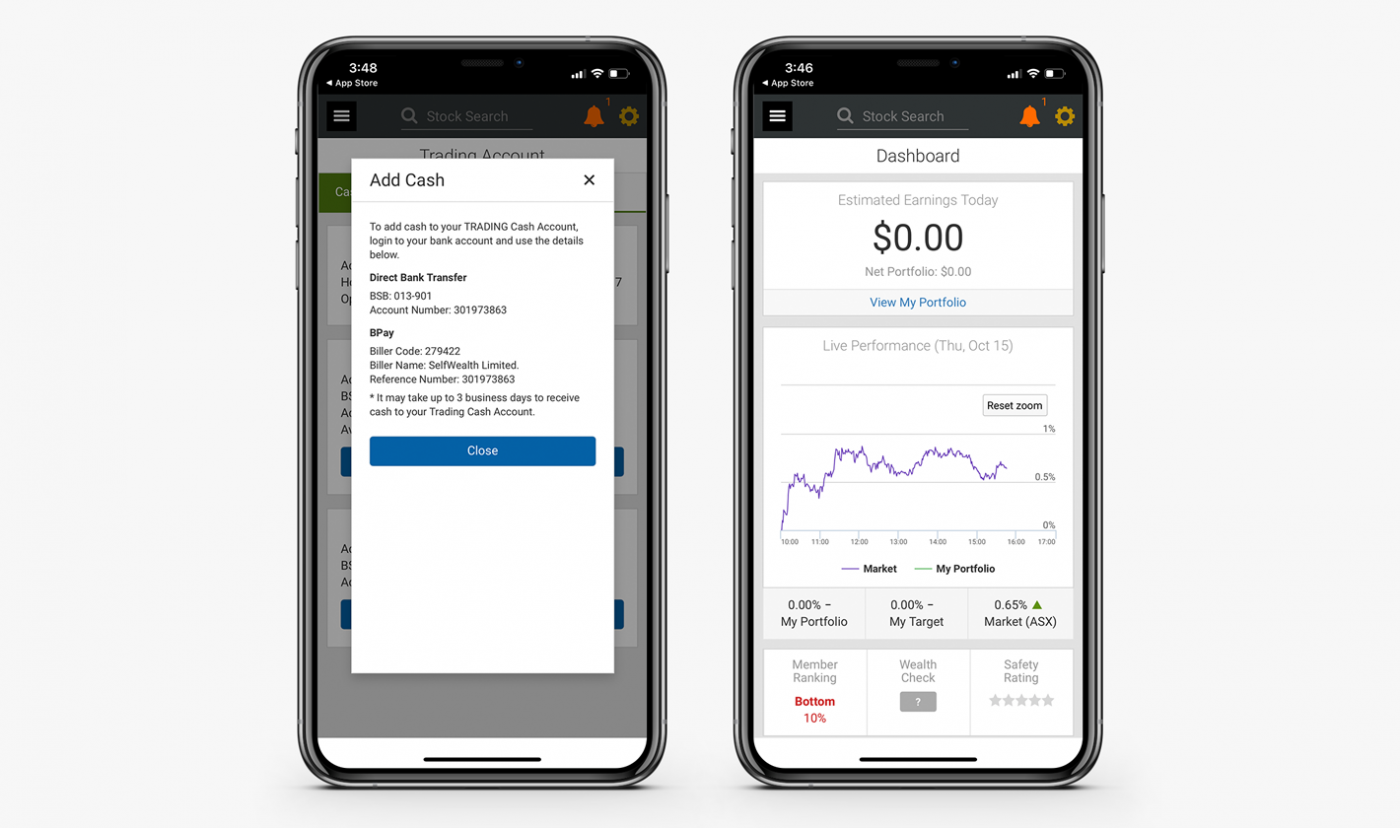

How does SelfWealth work?

You can create an account with SelfWealth on their website in a few minutes and can fund your account within a few days. The first minimum deposit for the ASX is $500.

The reason funding your account doesn’t happen automatically is because of all the checks and balances that need to happen in the background. (You’ll need to verify your ID in the process so make sure you have a form of ID available).

Once your account has been set up and funded you will be able to buy and sell Australian shares and US shares.

Any trade you make could take around two days to settle. You’ll get confirmation from the share registry that the shares are listed in your name.

SelfWealth allows you to create different types of accounts: individual, kid joint, company, or a trust account. Unlike Stockspot, Selfwealth charges fees on kids accounts.

SelfWealth and Robinhood compared

Unlike Robinhood in the U.S, SelfWealth makes money from brokerage every time you trade. SelfWealth also earns revenue from its own ETF and they also earn interest from the cash you leave in their account.

Robinhood offers free trading in the U.S. but makes money from selling order flow. Payment for order flow is the compensation a brokerage firm receives for directing orders to different parties for executing a trade.

Additionally, Robinhood allows users to invest on margin, which means an investor can borrow money from Robinhood to buy stocks. While this could lead to greater gains, it could also lead to huge losses.

SelfWealth and Superhero compared

One of the key differences between SelfWealth and Superhero is the brokerage. Superhero offers trading of Australian shares with brokerage starting at $5, whereas SelfWealth offers trading of Australian shares with brokerage starting at $9.50.

Selfwealth minimum investment on Aussie shares for the first time is A$500 while Superhero minimum investment is A$100.

Superhero also offers brokerage-free US shares and ETFs, but you’ll be charged a foreign exchange fee of US$0.50 for every AUD$100 transferred.

The other difference between SelfWealth and Superhero is that with Superhero, your investments are held on an omnibus account with others. With SelfWealth, your investments are held directly in your name on your own individual HIN.

Read more about Superhero here.

SelfWealth and Stake compared

SelfWealth offers trading of Australian shares (and recently US shares) with brokerage starting at $9.50. Your investments are held directly in your name on your own individual HIN.

Stake gives Australian investors exposure to thousands of US stocks and exchange traded funds (ETFs), but you can’t trade Australians shares. Stake does not charge any brokerage but Stake earns money every time you transfer money from Australian dollars (AUD) to U.S. Dollars (USD). You pay US$0.70 on every A$100 transferred (min FX fee US$2).

When you use Stake you can purchase fractional shares, whereas you can’t do this with SelfWealth.

Additionally, with Stake, your investments are held on an omnibus account with others. Stake uses DriveWealth, a B2B U.S. broker-dealer who, via ICBC US, acts as the custodian of the US shares you purchase via your Stake account.

The custody holding model used by Stake/DriveWealth comes with a different set of benefits of risks compared to the direct ownership model utilised by SelfWealth.

SelfWealth and Stockspot compared

The main difference between Stockspot and SelfWealth is that Stockspot provides investment advice and an ongoing service. With Stockspot, your personal situation is reviewed, and then you receive a recommendation for the best-suited investment strategy based on your goals and investment time horizon.

Once you settle on your investment strategy, you get a properly diversified portfolio (including Australian shares, global shares, emerging markets, bonds and gold). Stockspot reviews the investment on an ongoing basis and will rebalance your portfolio when necessary.

When you invest with SelfWealth, you’ll only get shares and there won’t be any defensive assets in your portfolio, unless you buy them separately. Having proper diversification over different platforms can get tricky and expensive.

Additionally, you’ll need to pick all of the investments yourself and review them yourself. If your aim is to regularly buy and sell investments to try and make short term profits, this might be your preferred strategy. But, if you’re a long-term investor, your portfolio should be regularly reviewed and rebalanced in line with market movements.

For some people, managing their own investments can be a rewarding hobby. But studies have shown that correct investment selection, the right portfolio allocation and automatic rebalancing can add over 2% p.a. in pre-tax performance each year. Stockspot manages all of this for you so you can benefit from our expertise and automated technology.