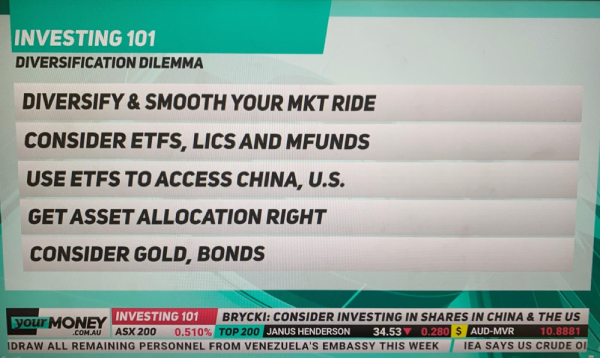

Different asset classes perform differently at different times and the impact they face as a result of certain market conditions can vary accordingly. Having a diversified investment portfolio can help mitigate losses investors face during period of stock market (and economic) uncertainty. At Stockspot we’re firm believers in the importance of considered diversification and here are my top 5 reasons why diversification is important.

Diversification gives you a smoother ride

Diversification is about spreading your money across different investments to enjoy a smoother ride. It serves as a cushion to protect your basket when a few eggs crack.

Portfolio diversification is important for anyone who doesn’t want to experience stomach churning ups and downs in their portfolio, which is what happens when you only own a few shares.

The theory on how to use diversification was pioneered by Harry Markwitz in his paper “Portfolio Selection” published in 1952.

He showed that by owning shares in different industries and countries as well as other asset classes like bonds, you could get a smoother portfolio return without sacrificing return. Markowitz later won the 1990 Nobel Prize in Economics for his work.

You can diversify across Australian shares using ETFs, LICs or by using mFunds

Contrary to what many believe, owning a portfolio of 10 or 20 Australian shares isn’t very diversified because these companies are typically in a few sectors that are exposed to the Australian economy and move in the same direction as each other.

Since 2014 banks and telcos in Australia have fallen -30 to -50% so owning Westpac, Commbank and Telstra hasn’t provided much of a cushion at all!

You can spread your money across more Australian shares by investing in a broad market ETF, like we do at Stockspot.

ETFs give you a broader mix and lower risk. We invest our clients in the ASX 300 ETF (VAS) which spreads their money across the 300 largest listed Australian companies.

Spreading your money into global shares gives you better return opportunities

The next level of diversification is to invest into shares in other regions like the US, Europe and China.

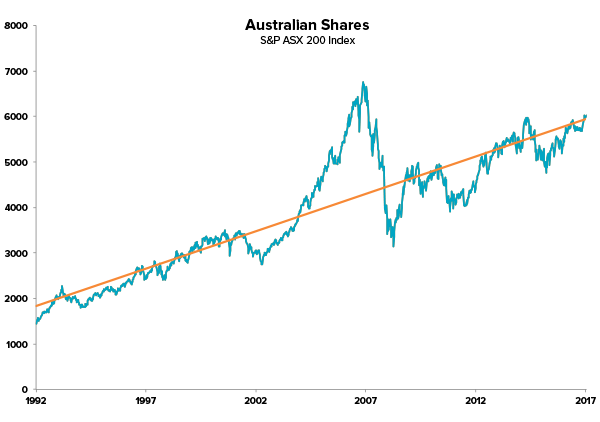

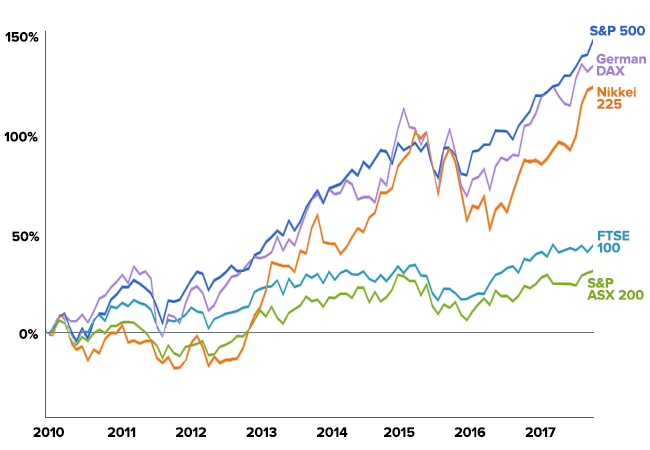

Other regions can do better than Australian shares at different points of the market cycle. US shares have risen 311% over the last 10 years whereas Australian shares are only up 93%.

These days ETFs make it easy to diversify into international shares too. Our favourites are the Global 100 ETF (investing in worlds largest 100 companies) and emerging markets ETF (IEM) which invests in developing high growth economies.

Here’s how we select global share ETFs for clients.

Owning some bonds and gold will help you weather all types of markets

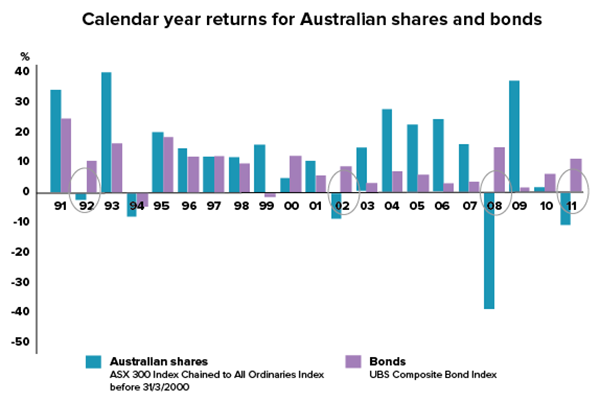

A third piece of the diversification puzzle is the benefit of owning defensive assets. When Australian and global shares suffer setbacks it usually happens at the same time.

That’s when you want to own some defensive assets that move in the opposite direction to give your portfolio some cushion. We like Australian bonds and gold for their defensive qualities.

In 2018 when Australian shares fell by -2% for the year, Australian bonds rose by 4% and gold by 8%. In fact the last 7 times Australian shares fell in a calendar year, Australian bonds rose on every occasion!

This is the beauty of diversification. Timing the share market is difficult but by owning some defensive assets you’ll be more confidently able to weather all types of markets and stay invested.

Even though share markets fell in 2018, all of the Stockspot strategies had positive returns for the year thanks to their allocation to bonds and gold.

Why look for the needle in the haystack when you can buy the haystack!

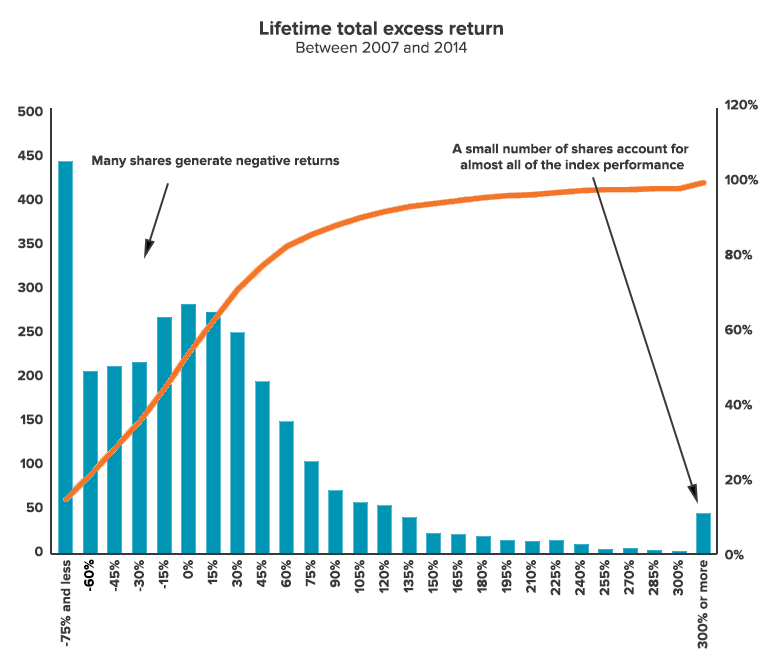

Broad diversification guarantees that you’re invested in the best performing companies which drive most of the market’s return.

A study of share market returns between 1983 and 2006 showed that 39% of shares actually fell in value (even before inflation!). Less than 4% of shares accounted for all of the wealth creation in the share market.

This mathematical reality is one of the reasons 80% of professionals do worse than the market.

That 4% handful of winning shares is always changing– over the past 5 years it’s been Apple, Google, Facebook and Amazon. In the 90s in the US it was Dell, Lucent, Pfizer and Walmart.

Owning the entire market via an index fund or ETF is the smartest way of earning consistent returns and not missing out on these shares.

Recap:

Find out how Stockspot makes it easy to grow your wealth and invest in your future.