Welcome to our new series of reviews and discussions of all the trading platforms and share trading apps in Australia. In this article, we discuss Stake, what is it is and how it may or may not work for you. It’s important to understand exactly what each platform or app does, so you can choose the best investment strategy for you.

See: Our review and discussion Superhero

See: Our review and discussion of SelfWealth

See: Our discussion and review of the eToro trading app

See: Our discussion and review of Sharesies

What is Stake?

Stake is an online stockbroker that offers trading in ASX and U.S. stocks and ETFs for Australian investors. You can buy whole or fractional shares in U.S. listed companies for $0 brokerage. Aussie shares and ETFs are charged $3 brokerage.

When you trade on Stake, you can only trade in US dollars.

Stake allows users to trade on the ASX with CHESS sponsorship and you will have your own Holder Identification Number (HIN). Because Stake offers a CHESS-sponsored model, shares are held on your own HIN and only whole shares are supported. You cannot purchase fractional ASX shares.

The initial purchase of shares in any listed ASX company or ETF must be at least $500. This is the ASX ‘minimum marketable parcel’ rule. However after that initial $500 purchase, there is no minimum on subsequent purchases of shares in the same company.

What is Stake Black?

Stake has an upgraded version of their platform, called Stake Black, priced at US$9/month or US$90/year.

Stake Black offers analyst ratings, pro-level data, and price targets.

How does Stake provide zero U.S. brokerage?

Stake makes its money mainly from a foreign exchange fee of 0.7% when a customer chooses to move their money between an AUD and a USD account.

Stake makes money every time you transfer money from Australian Dollars (AUD) to U.S. Dollars (USD). You pay US$0.70 on every A$100 transferred (min FX fee US$2).

If you transfer AU$100 into US dollars and then back into Australian dollars you will pay US$4 (approx. AU$5.71, or 5.7% of the transferred amount).

If you transfer AU$1,000 into US dollars and then back into Australian dollars you will pay US$14 (approx. AU$20, or 2% of the transferred amount).

They also earn interest on cash in US brokerage accounts, and from anyone who’ll pay for Stake Black in the future.

Is Stake safe?

Stake uses DriveWealth, a B2B U.S. broker-dealer who, via ICBC US acts as the custodian of the US shares you purchase via your Stake account.

The custody holding model used by DriveWealth comes with a different set of benefits of risks compared to the direct ownership model in Australia where your investments can be held on your name at the registry via your own individual Holder Identification Number (HIN).

Find out why direct ownership of your investments is important.

Can you day trade on Stake?

When you use Stake, you’re subject to the Pattern Day Trading rule which means you can’t make more than three day-trades (buys and sells of the same share in the same day) in a “rolling” five-day period (five trading days in a row).

This rule doesn’t apply if you have $25,000 or more of equity in your account.

If you’re marked as a Pattern Day Trader, you may be restricted from making another day trade for 90 days under US regulatory (FINRA) rules. You can read about Pattern Day Traders on Stake’s website, and you can read our tips for aspiring day traders.

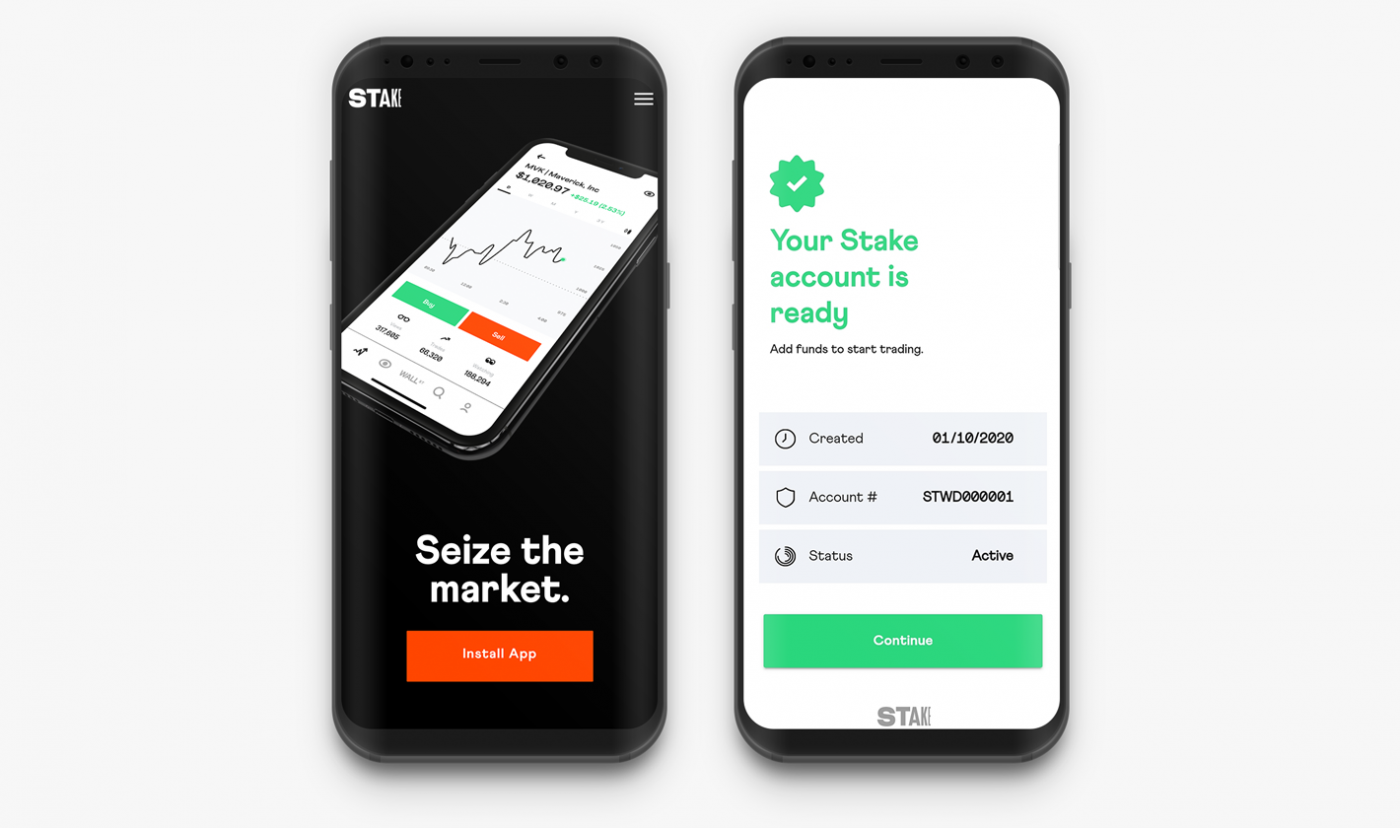

How does Stake work?

You can create an account with Stake on their website in a few minutes and are able to fund your account on the same day. You’ll need to verify your ID in the process so make sure you have a form of ID available. Once your account has been set up and funded you will be able to buy and sell ASX and U.S. shares.

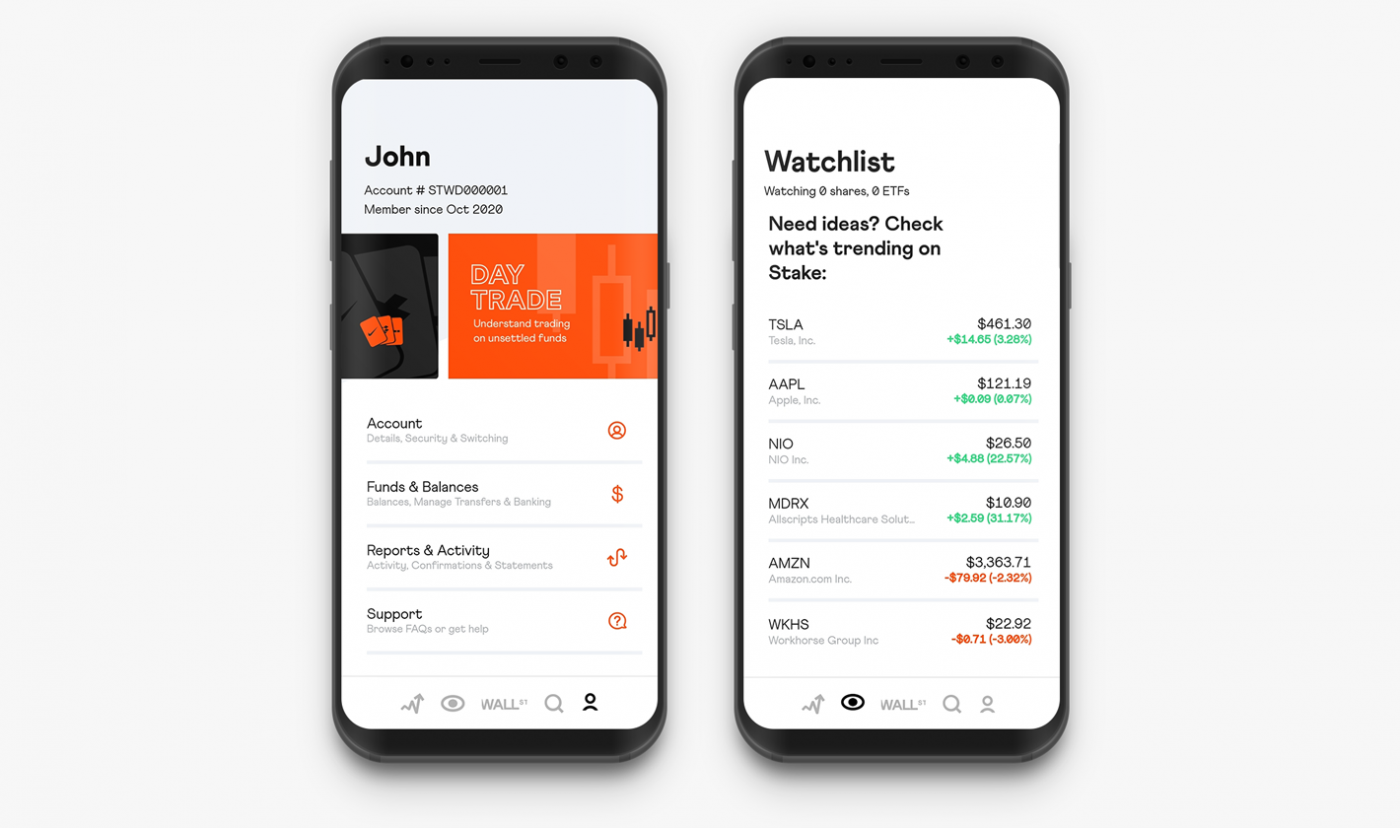

You can search for U.S. and ASX stocks and ETFs via the Stake app’s search function, and you can add stocks to your watchlist via the love heart button.

In addition to individual searches, the app sets out investment categories such as cannabis, gold and emerging markets.

Once you’ve figured out what you want to invest in, the Add Funds page is where you’ll make AUD deposits which are automatically converted to US dollars.

Can you buy GameStop on Stake?

Stake currently can’t offer buys on GameStop ($GME), AMC Entertainment ($AMC) and Nokia ($NOK) due to increased capital requirements set by the DTC (Depository Trust Company). See here for up to date information on buying GameStop from Stake.

Find out more about short squeezing and the current situation with GameStop.

Stake and Robinhood compared

When Stake launched, it was touted as the Robinhood alternative in Australia.

But the way the two operate is quite different. Unlike Robinhood in the U.S. Stake makes money from currency conversion every time you move money from Australian dollars to U.S. Dollars.

Robinhood offers free trading in the U.S. but makes most of its money from selling order flow and receiving compensation for directing orders to different parties for executing a trade. Robinhood also earns money from margin lending which means an investor can borrow money from Robinhood to buy stocks.

Stake and Superhero compared

Stake offers trading of U.S. listed shares and ETFs with zero brokerage fees but earns 0.70% every time you move your money from Australian dollars into U.S. dollars to invest.

Stake offers $3 brokerage on Australian shares with CHESS sponsorship. You own your shares under your HIN.

Superhero offers trading of Australian shares with brokerage starting at $5. Your investments are held on an omnibus account with others. They’ve also recently started offering brokerage-free US shares and ETFs, but you’ll be charged a foreign exchange fee of US$0.50 for every AUD$100 transferred.

Read more about Superhero here.

Can you trade cryptocurrency on Stake?

No. You can’t trade cryptocurrency on Stake yet. They are looking to launch cryptocurrency trading towards the end of 2022.

Stake and SelfWealth compared

Stake offers trading of US stocks with $0 brokerage. You will be charged $3 brokerage on Australian shares and ETFs. You own your Australian shares under your HIN.

SelfWealth offers trading of Australian shares brokerage costs of AUD$9.50. They also offer trading of US Shares with brokerage costs of USD$9.50. Your investments are held directly in your name on your own individual HIN.

Find out more about SelfWealth and compare to Stockspot.

Stake and Stockspot compared

The main difference between Stockspot and Superhero is that Stockspot provides investment advice and an automated investing service. With Stockspot, your personal situation is reviewed, and then you receive a recommendation for the best-suited investment strategy based on your goals and how long you plan to be invested.

Once you settle on your investment strategy, you get a properly diversified portfolio (including Australian shares, global shares, emerging markets, bonds and gold). Stockspot reviews the investment on an ongoing basis and will rebalance your portfolio when necessary.

With Stake you need to pick all of the investments yourself and review them yourself. If your aim is to regularly buy and sell investments to try and make short term profits, this might be your preferred strategy.

For some people, managing their own investments can be a rewarding hobby. But studies have shown that correct investment selection, the right portfolio allocation and automatic rebalancing can add over 2% p.a. in performance each year. Stockspot manages all of this for you so you can benefit from expertise and automation and you don’t need to worry about anything.

You can see how the Stockspot portfolios have performed here.