If you’re interested in the share market, by now you’ve probably heard about a company called Gamestop ($GSE). The company is listed on the NYSE (but not the ASX) and has recently had a phenomenal run, from US$19 on 4 January 2021 to a high of $483 on 28 January 2021.

Here’s how it happened and what you can learn from it as a trader or everyday investor.

What is Gamestop?

Gamestop, listed on the New York Stock Exchange as $GME, is a chain of video game shops in the US, often found in suburban shopping centres. They’re the parent company of the Australian video game retailer EB Games.

Why did the share price of Gamestop rise so fast?

Essentially, a group of traders on a Reddit discussion board called r/WallStreetBets decided to target this company because it was a known ‘short position’ or ‘shorted stock’ of a well-known hedge fund called Melvin Capital.

What is a short position and short selling?

A short position is when you borrow a share that you don’t own (from someone) and then sell it on the share market expecting the price to go down (short selling).

A short seller needs to eventually buy back the share and return it to the person it was borrowed from. The reason people short stocks is to buy the share back at a lower price than it was sold for so they can make a profit.

The danger of shorting stocks is that if the share price rises instead of falls, it becomes a bigger short position and a seller may be forced to scramble to buy it back to unwind their position.

This then leads to a short squeeze.

What’s a short squeeze?

This is when short sellers realise that they need to buy back shares so they can return them to the lender. If the demand suddenly goes up for the shares, and there’s not enough supply, then the share price will rise. This is known as a short squeeze.

Gamestop and short squeezing

The traders on the Reddit forum, r/WallStreetBets, decided to try and orchestrate a ‘short squeeze’ by buying Gamestop shares on the Robinhood trading app to send the share price higher and force Melvin Capital to buy back their short.

By late 2020, the price had started to go up, from $4, to $8, to $12, and then to $19 by the end of December 2020. Once Redditors cottoned on to this, more and more people started buying in.

Eventually this sent the Gamestop share price rocketing from $19 to nearly $500. Because the short position became so large, Melvin Capital suddenly needed a US$2.75 billion bailout from two other well known hedge funds. Unfortunately, this wasn’t enough and a couple of days later, after the price kept increasing, Melvin Capital was forced to ‘buy back’ their short, locking in billions in losses.

Interestingly, Gamestop isn’t the only company Redditors are targeting, with other languishing stocks like Blackberry, AMC and Nokia also experiencing gains because of exactly the same practice.

What we can learn from Gamestop?

If you’re a trader – beware of high short interest

When I worked in the investment team at UBS, we would sometimes short shares because we had a negative view of that company and expected the share price to fall. Before we did this, one of the metrics we’d always check was the ‘short interest’. This is a daily number published by the ASX that shows the percentage of the total shares that have been sold short.

Often, poor performing companies have high levels of short interest because many funds believe the share price will fall and are making this bet at the same time. A good example is traditional retailers like Myer and David Jones. They both had had high short interest for years due to declining margins and online competition.

When short interest gets too high

If short interest gets too high however, this becomes a risk because it becomes a ‘crowded short’. This makes the stock prone to a squeeze , because, similar to the Gamestop situation, funds need to buy back a lot of shares at the same time.

As a general rule, if the short interest in a company is over 20% of the total shares, it would be considered a ‘crowded short’ and should be avoided because the risk of a short squeeze is too high.

In the case of Gamestop, the short interest was over 100%. Many hedge funds like Melvin Capital were expecting Gamestop to go bankrupt and they’d never have to cover and return their shares. But such high short interest had an explosive impact when they needed to buy back the shares at the same time because there weren’t enough shares to buy back.

If you’re an everyday investor…should you buy Gamestop shares?

A few smart people and a few lucky people have done very well betting on Gamestop shares rising and made a lot of money.

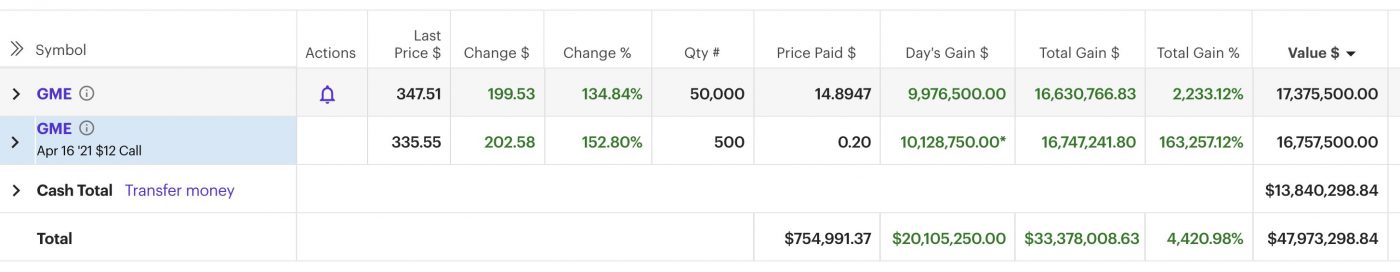

What’s happened with Gamestop shouldn’t be confused with investing. It’s speculation. And when it comes to speculation, you’ll always hear about the winners, like the trader on Reddit who made US$48 million on Gamestop (true story!).

Speculation isn’t easy

Unfortunately, for every Redditor who’s made a cash bonanza, there are thousands more who’ve lost money speculating. Once a situation like Gamestop is in the news and everyone knows about it, the potential reward to get involved is far outweighed by the risk.

You might get lucky and get out in time, but chances are slim. By their very nature, outsized trading profits can only flow to a very small number of people.

Rather than find the needle and chase the next hot stock, my advice is to buy the haystack by owning a low cost portfolio of diversified ETFs and holding for many years to enjoy compound growth.

Sure, it’s not as exciting as the prospect of getting rich quick with a stock that goes to the moon, but it’s a proven strategy and much more likely to provide decent returns.