What is cryptocurrency?

Cryptocurrencies are digital currencies that are encrypted (secured) using encryption methods, also known as cryptography.

Bitcoin was the first cryptocurrency, powered by a public ‘ledger’ that records and checks all transactions chronologically. This is known as the blockchain. The success of Bitcoin has led to the creation of a large number of other cryptocurrencies which are similar but serve different user cases. There are now thousands of cryptocurrencies available such as Etherium, Ripple and Litecoin (also known as ‘altcoins’).

What are the different types of cryptocurrencies?

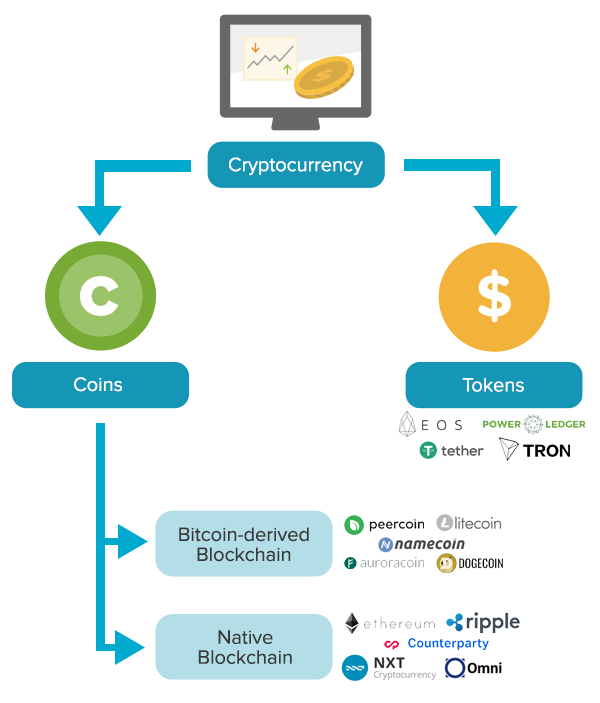

Cryptocurrencies fall into two broad categories: coins/altcoins and tokens.

What are altcoins?

Altcoins are an alternative to the original Bitcoin. Many altcoins are built using Bitcoin’s publically available structure with changes to its underlying code. This creates a new ‘coin’ but with slightly different characteristics. Examples of these Bitcoin-derived coins include Litecoin and Bitcoin Gold.

Then there are other altcoins that weren’t born from Bitcoin’s structure but instead come from their own blockchain. Examples of these coins include Ethereum and Ripple.

The similarity of all coins is that they each have their own blockchain to record transactions.

What are tokens?

Tokens sit on top of an existing blockchain and owning a token gives someone credit to access a good or service in the future.

Creating tokens is much easier than creating a new coin since you use a standard template that has already been created (like Bitcoin or Ethereum). Tokens are created through an Initial Coin Offering (ICO), which is a form of crowdfunding that works by selling tokens to fund a project.

An example of this is an Australian based blockchain business called Power Ledger which allows buyers and sellers to trade solar energy between one another via the blockchain.

To facilitate trading solar energy, they’ve created a token on the ledger of Ethereum, an existing cryptocurrency. These tokens don’t give you any ownership in Power Ledger business but instead the tokens grant you part ownership of their blockchain network which may (or may not) be valuable one day.

Power Ledger raised AU$34 million through it’s token sale in 2017 and was valued at $500m in early 2018. This value has since diminished to $50m in 2020.

What is the future of cryptocurrency?

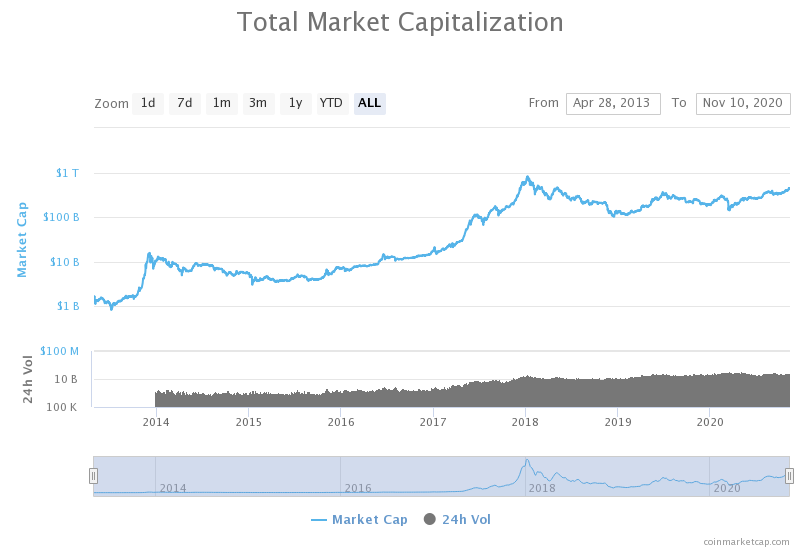

Bitcoin and the cryptocurrency market has already experienced several ‘hype cycles’ where prices rocketed, before falling 80-90% as the technology and adoption caught up with inflated expectations. One happened in 2011 and then another 2013, and again in 2017.

After reaching a total market value of US$830 billion in December 2017, the total cryptocurrency market lost 85% of its value and fell to US$130 billion by the end of 2018. It currently stands at just over US$400 billion, and is up 100% in 2020.

The logarithmic chart below illustrates gradual adoption of cryptocurrency over time, and shows two of these hype cycles (in 2013 and 2017) that were then followed by periods of price consolidation.

There are many factors that can be attributed to the success of Bitcoin. Low or negative interest rates, falling trust in governments, as well reduced confidence in banks and central banks since the Global Financial Crisis have all had an impact on investor interest. Similar to traditional money, Bitcoin requires those who adopt it to believe in its inherent value. For over 10+ years, there’s been a growing number of advocates who trust Bitcoin, as well as other cryptocurrencies. As the number of Bitcoin advocates grow, it’s likely this will have an impact on the value of different cryptocurrencies.

Why has the price of cryptocurrency fluctuated so much?

Adoption of new technology

Bitcoin and other cryptocurrencies have followed a similar path of growth and adoption to other technologies in the past. This has been characterised by bursts of exponential growth (bubbles) followed by periods of consolidation.

These Bitcoin bubbles are comparable to the story of Amazon.

Back in December 1999, Amazon traded at US$110 per share with excited punters predicting that it would dominate online shopping.

But in 2000-2001, Amazon’s share price fell from US$110 to US$5. This was a whopping 96% fall, and it wasn’t until 2009 that the price went back to US$110. Investors with nerves of steel (or who invested cash they didn’t need) were the most likely to hold on for nearly ten years until the stock recovered. And the ones who made decent returns had to wait 19 years for the price to reach US$3,300 in 2020.

It’s important to remember these scenarios, because, similar to Amazon in the early days, retail Bitcoin investors have been most active during the bubble periods in 2013 and 2017. Unfortunately, many of these investors who bought during these hype periods weren’t able to hold their Bitcoin through periods of consolidation in 2014 and 2018 where the price fell at least 85% before starting to rise again.

Watch this interview on the Channel 9’s popular Sunrise show in 2018, where we discuss the Bitcoin bubble, Power Ledger, and Amazon

After the above interview, Bitcoin dropped from US$20,000 to US$4,000. After this fall, it’s been on an upward trajectory. In November 2020, the Bitcoin price went back to US$15,000.

It’s likely the price of Bitcoin, as well as other more established cryptocurrencies like Ethereum, will be higher in five to ten years time as cryptocurrency becomes more widely accepted.

However, investing in Bitcoin or other cryptocurrencies is the same as investing in any other undiversified risky asset like individual shares, equity crowdfunding, or art. You should follow a sensible investment process – rather than hoping you’ll get lucky with the next bubble.

To find out exactly how to manage your risk read our article on the best way to invest in Bitcoin or another cryptocurrency.