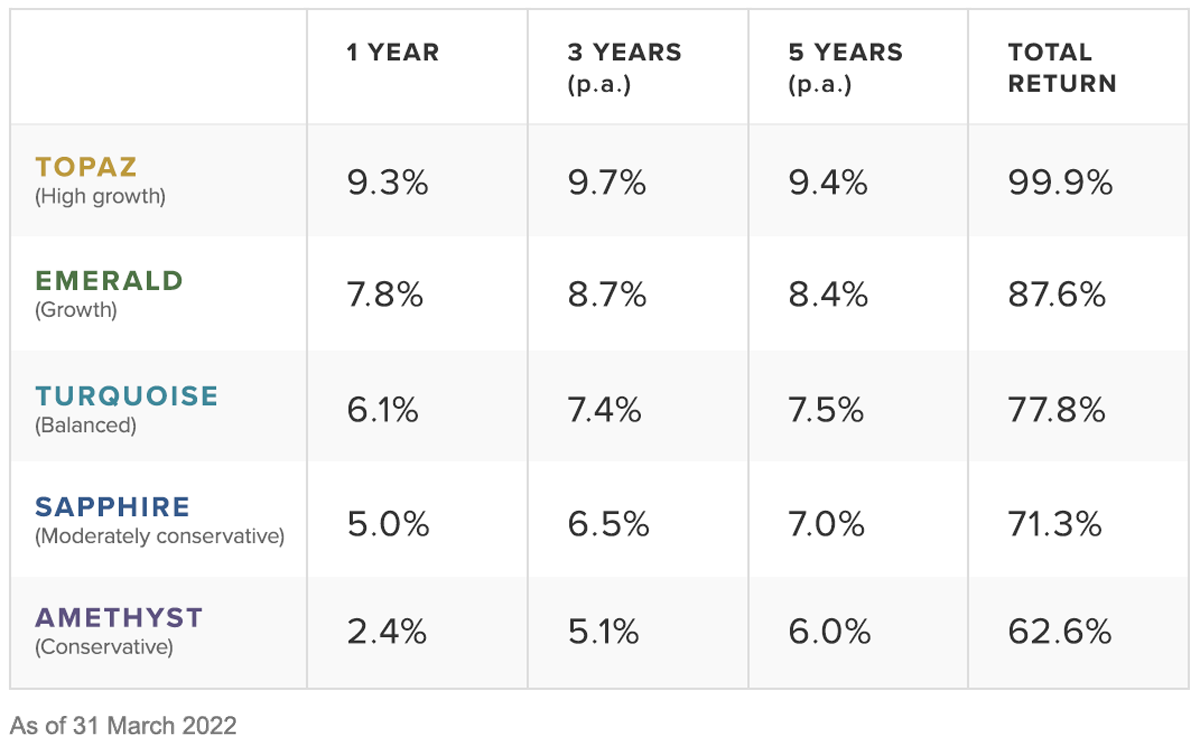

The Stockspot Model Portfolios returned between 2.4% to 9.3% after fees in the last 12 months, while the Stockspot Sustainable Portfolios returned 3.2% to 9.2% in the same period.

All of these positive returns came in 2021. The portfolios have fallen slightly since the start of 2022 in line with markets.

In the five years to 31 March 2022, the Stockspot Model Portfolios have outperformed at least 99% of similar diversified funds, delivering returns of 6.0% p.a. to 9.4% p.a. after fees.

Source: Stockspot, Morningstar website comparison group of investment funds across growth, balanced and moderate multi-sector categories to 31 March 2022. Stockspot Amethyst, Turquoise and Topaz portfolios used for comparison.

In this performance update, we discuss:

- How asset allocation and rebalancing have contributed to returns

- The importance of a long term mindset and holding some defensive assets

- Why active fund managers continue to underperform index ETFs

How asset allocation and rebalancing have contributed to returns

The market theme of the last quarter has been the conflict in Europe, rising inflation, and rising interest rate expectations. These have combined to cause significant volatility in some sharemarkets, including the tech-heavy Nasdaq which experienced a fall of 21% during the quarter.

The Stockspot Portfolios have benefited from having a significant allocation to gold. We made asset allocation changes in February 2021 which included increasing our gold allocation and reducing government bonds. Rising inflation and interest rate expectations have led to one of the worst quarters in history for government bonds.

Data as of 31 March 2022 using LBMA London Gold Price AUD, Bloomberg AusBond Composite 0+ Year Index AUD, MSCI All Country World Index AUD

While bonds have fallen, Australian resources shares have risen on the back of higher commodity prices and inflation. Australian bank shares have benefited from higher interest rate expectations.

Stockspot’s allocation to gold and Australian shares has helped to offset weakness in global sharemarkets, particularly emerging markets.

During the recent market volatility, we have been rebalancing portfolios for many clients, locking in some profits from gold and investing the proceeds into shares. This is similar to the rebalancing we did in March 2020 after the COVID-19 market drop.

Rebalancing always feels counterintuitive since it involves selling investments that have performed well and buying investments that have fallen. However, it’s important for keeping portfolios in line with their target weights.

Many clients have already benefited from the automated rebalancing that took place in March. Since we rebalanced, shares have rebounded between 4% and 8%.

Despite bonds having one of their worst quarters in decades due to rising interest rate expectations, they are still an important part of our portfolios. In this recent article we explain why bonds are still worth owning and often rise even when interest rates are on the way up.

The importance of a long-term mindset and holding some defensive assets

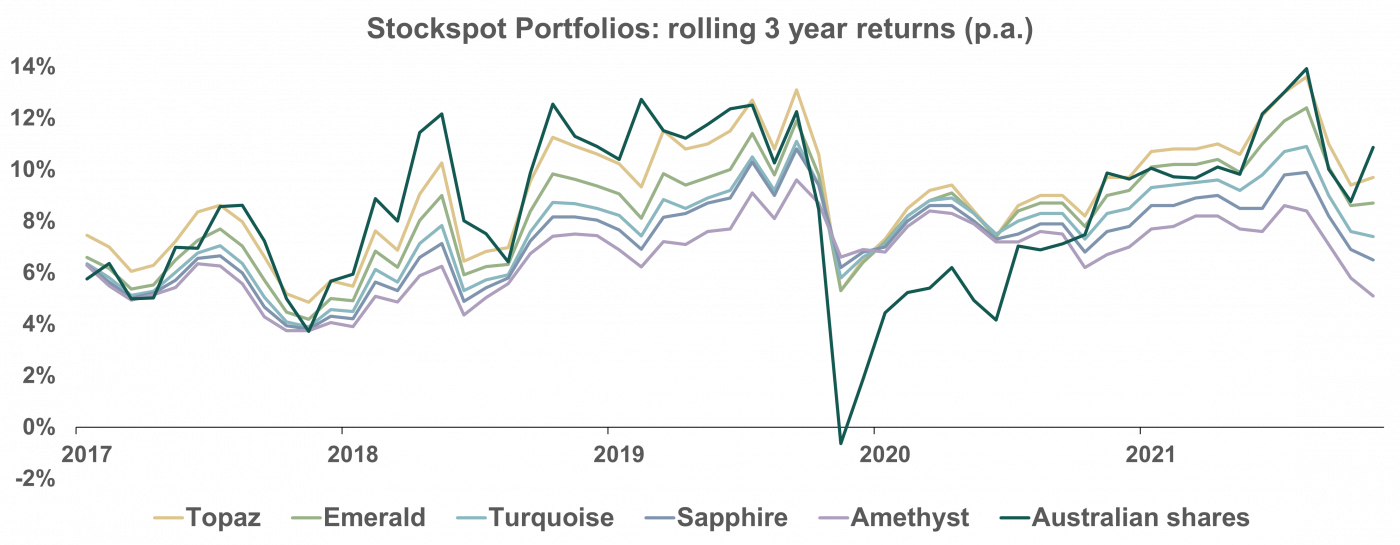

Over the short-term, markets are completely unpredictable. However, the longer your time horizon, the higher the probability of positive returns. This is why we encourage all clients to aim to invest for three years or longer to maximise the chance of success.

| Australian sharemarket time frame | Probability of positive return | Probability of negative return |

| Daily | 52% | 48% |

| Monthly | 61% | 39% |

| Quarterly | 67% | 33% |

| Half Yearly | 70% | 30% |

| Yearly | 76% | 24% |

| 3 Years | 88% | 12% |

| 5 Years | 90% | 10% |

| 10 Years | 100% | 0% |

Over rolling three year periods, the Australian sharemarket has risen 88% of the time. Having an allocation to bonds and gold would have helped to boost your performance on those rare occasions when markets suffered falls.

This is why we still recommend an allocation to gold and bonds for long-term investors.

Our allocation to defensive assets has helped to reduce the impact of large falls in the market (like March 2020) and maintain positive three year rolling returns across the market cycle. Avoiding large losses helps you stay confidently invested and achieve your goals.

Why active fund managers continue to underperform index ETFs

Across periods of market volatility like early 2022 you might expect active fund managers to perform well. This hasn’t been the case. Active funds continue to perform poorly compared to index ETFs across all assets including Australian and global shares. We’ve previously explained why index ETFs do better than active funds in down markets as well as why we avoid all active funds including big name brands like Magellan, Platinum and Wilson Asset Management.

Many big brand name active funds are seeing significant fund outflows due to underperforming the broad index. We believe this is a secular trend that will continue over many decades since active management is a zero-sum game. Here’s how two of Australia’s largest global funds have performed compared to the Global 100 ETF we recommend to clients.

| 1 year | 3 years (p.a.) | 5 years (p.a.) | |

| Stockspot’s choice: Global 100 ETF (IOO) 0.4% fee | 21.4% | 17.4% | 16.2% |

| Platinum International Fund 1.35% fee | -6.7% | 4.1% | 6.3% |

| Magellan Global Fund 1.35% fee | 1.1% | 6.7% | 10.6% |

$10,000 invested into the Global 100 ETF five years ago would be worth $21,213 today compared to $13,549 in the Platinum International Fund. Platinum would need to outperform by 9.5% each year, for the next five years, after all management fees and performance fees, in order to just catch-up to the global index ETF.

Our message to clients is simple. Stick with low-cost index ETFs and stay well diversified across assets, sectors and countries to have the best chance of long-term investing success.