In this article, we discuss Pearler, how it works and how it compares to Stockspot’s automated investing service.

It’s important to understand exactly what each platform or app does, so you can choose the best investment strategy for you.

- What is Pearler?

- How does Pearler work?

- How does Pearler’s pricing work?

- Pearler and Stockspot fees compared

- Is Pearler safe?

- Pearler and Stockspot compared

- Pearler super and Stockspot super

- Pearler and Robinhood compared

- Pearler and Superhero compared

- Pearler and Stake compared

- Pearler and SelfWealth compared

What is Pearler?

Pearler is an investing platform that lets you buy Australian shares, Australian ETFs, Australian LICs and US shares . Pearler also offers a micro investing option.

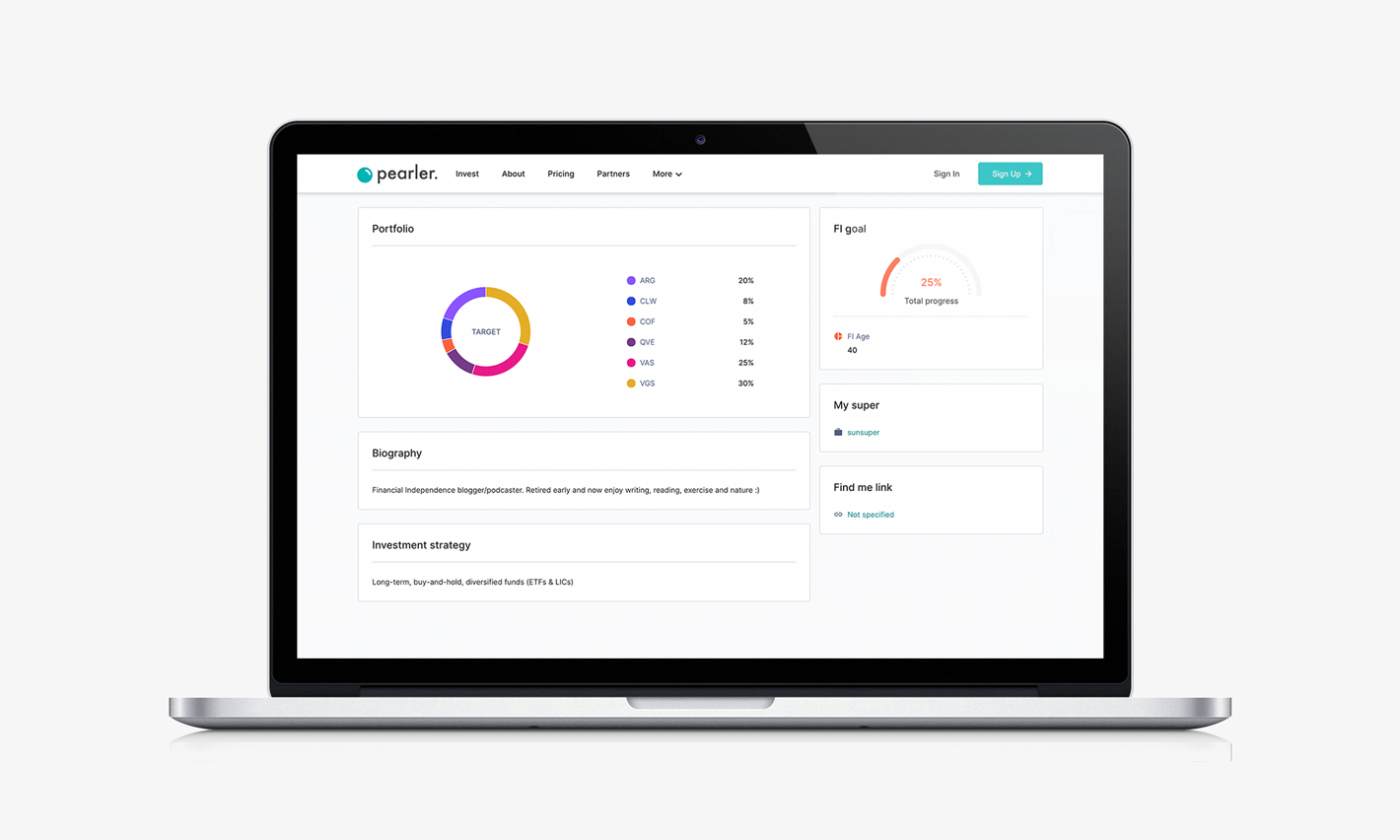

Pearler encourages long-term investing rather than short term trading and has features such as auto-deposit and auto-invest. Despite the focus on long-term investing, you’re still able to sell your investments on the platform. Pearler also includes community elements in their platform, allowing investors to compare and share their portfolios with other investors and ‘finfluencers.’

How does Pearler work?

Pearler has an app and website where users can sign up and invest. Once you’ve signed up to the platform, you’ll need to set up your target portfolio by adding the investments you want in your portfolio. Once you’ve selected your investments, you manually adjust the percentage of each one to achieve the investment mix you want.

To select the right investments, you’ll need to search individual ASX codes, or can use the “Popular ETFs” section,deciding which ETF is best for you and your goals. You can also search the portfolios of other members on the platform. It should be noted that copying another person’s portfolio comes with its own set of risks and may not suit your personal goals or objectives

You may need to do research or get advice to make sure your portfolio is set up correctly, and you’ll also need to determine how much to allocate to different investments to get the optimal weighting for your time horizon and risk capacity. Pearler doesn’t provide any personal advice on which ETFs to select, portfolio weighting or how to manage your portfolio.

How does Pearler’s pricing work?

Pearler has a transaction based model, which means the more you trade, the more fees you pay. When buying or selling shares in a single transaction, a brokerage fee of $6.50 is charged. For US shares, Pearler charges a brokerage fee of $6.50 for buying and selling plus 0.5% AUD flat fee per FX conversion between AUD and USD.

Pearler has a prepay and save 15% pricing model, whereby members can prepay $55 and get an additional $10 pearler credit, reducing the fee to $5.50 per buy.

Pearler also offers pearler micro and pearler headstart for investing for kids (micro option), both of which charge $2 per month. There is also the option for Kids to invest on the ASX (non micro-investing option) which incurs the same fee as adult investors of $6.50 brokerage per buy and sell.

Pearler and Stockspot fees compared

When looking at Pearler vs Stockspot fees, the key difference lies in how each platform charges and the level of service included.

Pearler uses a transaction-based pricing model, where every buy or sell of ASX shares costs $6.50 per trade.

Investors who wish to invest smaller amounts can access Pearler Micro investing (or Pearler Kids Headstart Micro investing) which costs $2 per month to invest in managed funds that track ETFs.

By comparison, Stockspot’s fees are generally lower for families investing for kids or investors with balances under $20,000. Stockspot allows kids to invest for free up to $10,000 (or until age 18), which helps returns compound without being eroded by fees with this fee-free limit rising as you increase your primary account balance.

For investors, Stockspot charges just $1 per month management fee for portfolios under $20,000; making it half the cost of Pearler Micro. On top of this, Stockspot is not just a brokerage or a pooled fund, it provides a fully managed investment portfolio, including automated diversification, rebalancing, and professional strategy, all held in your own name.

Stockspots full fees and pricing tiers can be found here.

In short, while Pearler suits DIY investors who want to directly trade shares, Stockspot comes out cheaper for kids (with balances under $10,000) and small portfolios (under $20,000) thanks to its respective fee free allowance and $1/month fee. This makes Stockspot a low-cost investing option, while also including a full-service portfolio management solution. For investors with balances $20,000 to $199,999 Stockspot charge 0.66% p.a., while balances $200,000 to $1,999,999 would be charged 0.528% and clients with a balance over $2,000,000 would incur an annual management fee of 0.396%.

What are Pearler’s auto-deposit and auto-invest features?

Pearler’s auto-deposit feature allows direct debit from your bank account into your Pearler CTA (Client Trust Account).

The auto-invest feature allows you to choose whether you want to make regular deposits which will be invested as soon as they come into your account, or you can choose to make regular deposits that get invested when the pooled deposits in your Pearler CTA account hit a certain value.

Is auto investing the same as automatic rebalancing?

No. Stockspot’s automatic rebalancing ensures your portfolio remains balanced and consistent with your investment goals and time horizon. Pearler’s auto investing feature simply invests according to a set of rules and doesn’t consider your investment goals, portfolio weighting, risk appetite, and time horizon.

Is Pearler safe?

Pearler is an Australian trading platform regulated by ASIC. However, it’s important to consider that when it comes to the ownership of your shares, Pearler offers a combination of approaches. While they provide direct ownership, the Holder Identification Number (HIN) for investing in Australian shares, they also utilise custodial arrangements for US shares and their micro investing option (non-CHESS-sponsored model). Custodians such as Sandhurst Trustees Limited and Phillip Capital Limited hold license for these services, leading to a combined approach and potentially reducing your individual ownership.

Stockspot believes a direct ownership model is better for investors, Stockspot clients own their investments under their individual HIN. While it can cost a little more, investors aren’t exposed to counter-party risk of the custodian. If something ever happened to Stockspot or one of the external suppliers we work with, it wouldn’t impact your investments because those investments are owned by you and you can simply take them with you. Find out why direct ownership of your investments is important. Find out why direct ownership of your investments is important.

Pearler and Stockspot compared

Stockspot is an online investment adviser, Pearler is a trading platform. Like Pearler, Stockspot is a strong advocate of long-term investing, but every individual has different goals and timeframes, and that’s why we create personalised strategies and portfolios.

Pearler users can construct a portfolio of shares, ETFs, and LICs, but they don’t provide personalised advice and you need to pick all your investments yourself.

When you invest with Pearler, you’ll need to buy defensive assets yourself, and you’ll also have to determine the correct percentages of these portfolio so you’re always hitting your target growth rate.

With Stockspot, once you settle on your investment strategy, you get a properly diversified portfolio of ETFs (including Australian shares, global shares, emerging markets and defensive assets like bonds and gold). Stockspot reviews the investment on an ongoing basis and will rebalance your portfolio when necessary. If you want to personalise your recommended portfolio, you can do this once your portfolio hits a certain amount, via Stockspot Themes. You don’t need to keep on top of your investments because we do it for you – but clients can talk to an adviser about their investments whenever they like.

Additionally, Stockspot has a 9 year track record of returns. You can see how the Stockspot portfolios have performed here.

Pearler Super and Stockspot Super

In 2025 Stockspot launched the Stockspot Super product, an ETF only superannuation solution, to help Australians build and grow their retirement savings. In 2025 Pearler launched Pearler Super, designed for younger Aussies.

Pearler and Robinhood compared

Pearler promotes itself as a long-term investing platform, Pearler makes money from brokerage fees. Robinhood is a trading app that’s only available in the U.S. They market ‘free trades’ but make most of their money from selling order flow and receiving compensation for directing orders to different parties for executing a trade. Robinhood also earns money from margin lending which means an investor can borrow money from Robinhood to buy stocks.

Pearler and Superhero compared

Pearler offers Australian shares, US shares, ETFs and LICs, and offers $6.50 brokerage.

Superhero offers trading of Australian shares with brokerage starting at $2 or 0.01% on balances over $20,000. Superhero also offers US shares, and charges a brokerage of US$2 or 0.01% over $20,000.

Unlike Pearler, Superhero doesn’t have a direct ownership model, and instead, your investments are held on an omnibus account with others.

Read more about Superhero.

Pearler and Stake compared

Pearler offers Australian shares, US. shares, ETFs and LICs, and offers $6.50 brokerage.

Stake gives Australian investors exposure to both Australian shares and US shares. Stake charges AUD$3 brokerage for all trades up to $30,000 or 0.01% for trades above $30,000. For US shares, Stake charges USD$3 brokerage for all trades up to $30,000 or 0.01% for trades above $30,000.

When you use Stake you can purchase fractional shares, whereas you can’t do this with Pearler.

Both Pearler and Stake’s Australian shares are directly in your name on your own individual HIN.

Read more about Stake here.

Pearler and Selfwealth compared

Pearler and Selfwealth are both Australian platforms that allow you to trade shares.

SelfWealth offers trading of Australian shares and US shares, with a flat fee brokerage of $9.50. With Selfwealth your investments are held directly in your name on your own individual HIN.

One of the differences between the Pearler and SelfWealth is Pearler’s auto-invest option.