You’re watching the tele as you get ready for work. The 7.20AM finance news comes on and you dash to brush your teeth.

You know for the next 5 minutes the finance expert is going to stand in front of a ridiculous number of computer monitors and ‘blah blah blah’ their way through the ‘market update’ and use finance jargon you don’t understand. It’s enough to make you weep into your first coffee of the day.

It often seems like the finance industry is created on a house of jargon designed to keep people baffled to the point that they just give up and collectively say ‘take my money’.

Here’s a list of some financial jargon terms you’ll probably come across at some point and what they mean in plain English.

Active investing

Also known as active management. An investment strategy that relies on picking stocks or timing the market to beat others. See active vs index investing.

Anchoring

One of the ways your brain tricks you when investing (and other times in life). It is our tendency to grab hold of irrelevant information in the face of uncertainty to make decisions. Read more on how anchoring impacts your investing.

Asset allocation

Sounds pretty technical but chances are you’ve done it already. If you’ve left all your money in the bank then guess what, you’ve already done some asset allocation. Buying a house? That’s asset allocation! Any time you’re making a decision on where to put your money that’s asset allocation.

When we make recommendations to clients we suggest an asset allocation strategy that involves spreading money across various different investment choices like shares and bonds which move in opposite directions to each other. This is an asset allocation strategy that involves diversification.

Asset class

These are broad categories of different things you can invest in such as shares, bonds, cash, property or commodities.

Asset consultant

A business that is paid a lot of money by fund managers to tell them how to do their own job. Their primary purpose is to take the heat when things don’t turn out right. For a list of asset consultants with consistent track records see hedge fund managers.

Basis point

If someone wants to talk about interest rates or mortgages while also showing that they watch the business news channel they’ll probably use this term. It’s another way of describing 1/100th of 1%.

So if interest rates have risen 25 basis points it means they’ve risen by a quarter of 1 per cent or 0.25%. In exchange rates, a basis point is also known as a pip. If the Australian dollar has risen 25 pips then it’s up a quarter of 1 cent.

Bear market

A market where share prices are falling. Often used by TV pundits to point out that markets have already gone down and scare people into selling near the bottom.

Bull market

A market where share prices are rising. Another overused term usually used to make inexperienced investors feel FOMO (fear of missing out) and buy after prices have already risen consistently for a long period of time.

Buy-sell spread / Bid-ask spread

This is the difference between the entry price and exit price of an investment. To buy the investment you need to ‘cross the spread’ and buy from the lowest seller. On the other hand to sell the investment you need to ‘cross the spread’ and sell to the highest buyer.

Compounding or compound interest

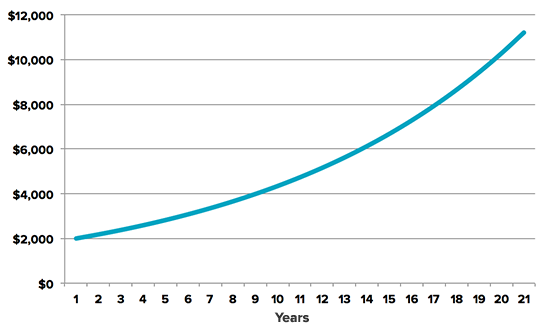

The urban myth goes that Albert Einstein called compound interest “the greatest mathematical discovery of all time”. The wonder of compounding is that it can turn relatively small amounts of money into huge sums because earning interest on your interest leads to steep shaped curve in the upwards direction. This is why we encourage clients to dollar cost average.

The opposite of compounding returns is compounding fees. We found in the Fat Cat Funds Report that the compounding impact of high fees on super could cost people over a quarter of a million dollars over their life.

Assumes an initial amount of $2,000 at 9% return per year

Counterparty risk

Also known as custody risk. This is the risk that you will lose money not because the value of your investments fall but because the business holding onto your investments goes bust. There have been many examples of this in Australia including Opes Prime and Storm Financial.

The best way to avoid counterparty risk is to make sure your investments are owned by you on your own individual Holder Identification Number (HIN). This is how all Stockspot investments are held. If your investments are combined with others under a ‘comingled’ investment structure then you have counterparty risk.

Diversification

Spreading your risk across may investments to reduce the impact of any single investment on your overall returns. Read more on the importance of diversification.

Dollar-cost averaging

Also known as ‘averaging in’. Buying shares regularly over time to reduce the impact of short term ups and downs in the market and improve the chance for a positive return over different time horizons.

Efficient frontier

Different groups of investments have different elements of risk and return. The efficient frontier is the best or ‘optimal’ meeting point of any group of investments. The efficient frontier concept is a major part of modern portfolio theory, and demonstrates the importance of diversification. Read how to build an awesome investment portfolio.

Exchange Traded Funds (ETFs)

An investment product that is traded on a stock exchange that let you invest in a broad range of investments without needing to buy and manage each investment individually. ETFs track entire ‘market indices’ like Australian shares and global shares. Diversifying across many investments helps to reduce your risk compared to buying individual shares. ETFs also have the same benefits of shares such as dividends and the ability to sell whenever you want.

There are hundreds of different ETFs available for Australian investors to chose from. We compare all of the options in our annual ETF report. You can also read What is an ETF.

Fat Cat Fund

A fund that has consistently disappointed its investors while paying the financial industry handsome fees. Ok, we made this term up but every year we find plenty of funds that match this description. See the Stockspot Fat Cat Funds Report.

Fintech

A broad category of digital financial products that aim to solve consumer problems using technology. It is usually applied to businesses that are disrupting sectors such as payments, money transfers, loans, fundraising and investment management. See bank rip offs that wont exist in 2020.

Franking credits

A tax benefit of owning shares that produce income in Australia. Where companies have already paid corporate tax they can give to you as a shareholder a ‘franking credit’ which reduces how much tax you need to pay on their dividends. Franking credits are particularly attractive for people on low tax brackets or in the draw down stages of superannuation. Franking credits can be provided to holders of individual shares as well as owners of Exchange Traded Funds (ETFs).

Fund issuer

This is the creator of an investment product. Superannuation funds and managed funds being two of the most common in Australia. The issuer is the business that builds the product and ‘issues’ it to the public which usually requires a document called a ‘product disclosure statement’ or PDS for short.

Guaranteed return

A good sign you should run for the hills unless you’re looking at a bank account. Apart from interest on a bank savings account, nothing is guaranteed. There is a high chance any product brandishing this term is a complicated financial product that is taking risk somewhere you’re not aware of. Either that or the ‘guaranteed’ part of the return is actually eating into the capital you invested.

Guaranteed return products are usually blatant false advertising once you dig into what’s happening in the background. Similar returns can almost always be achieved using a much lower cost combination of cash, bonds and shares.

Hedging

Any strategy that looks to reduce the impact of a negative event by making an investment in the opposite direction. For example, life insurance is a form of hedging to reduce the impact of an event (unexpected death) on your family.

Index investing

Also known as passive investing. An investment strategy that follows the market in total instead of picking individual stocks. See active vs index investing.

Inflation

This is the gradual increase in prices over time and the reason why even your savings account isn’t safe over the long run.

Leverage

Also known as gearing. This means borrowing to invest. When prices are rising (shares, houses or anything else), gearing helps to magnify your profits. When prices are falling leverage has the opposite effect, quickly wiping out the value of your investment.

Mean reversion

The equivalent to Newton’s law of gravity for investing. When something goes up faster than everything else it’s almost certain to have a period of ‘coming back to the pack.’ This happens for individual shares and whole asset classes. Unfortunately people tend to get most excited after an investment has risen and before it’s about to fall. See why you shouldn’t rush into tech stocks today.

P/E ratio

A common way of measuring whether a share is expensive or cheap by dividing it’s share price by it’s earnings per share. A low P/E (price-to-earnings) ratio suggests that a company’s earnings will be able to pay for it’s share price quickly and therefore it is ‘cheap’. On the other hand high P/E ratios are typically associated with companies growing quickly or that are expensive. Despite being popular there is no proven way to use P/E ratio to make money.

Paradox of skill

The reason why it’s so difficult for professionals to make money by picking stocks since there are so many experts competing against each other. Read more on why stock pickers underperform.

Ratings agency

A business which is paid by fund managers to tell them how good they are so they can remind their clients. Read more on what fund ratings won’t tell you.

Rebalancing

A investment strategy that helps to reduce your risk over the long term. It involves selling investments in a portfolio that have grown faster than others and buying more of the investments that have fallen behind. Read how rebalancing works.

Risk

This just means something is unpredictable. When you invest in a share you need to accept the chance that it’s value may fall tomorrow. When you take on unpredictability you should be rewarded by a higher return. On the other hand if you leave your money in the bank it is highly predictable what that will be worth tomorrow but you’ll earn a lower return.

Risk aversion

Our tendency as humans to avoid risk wherever possible even where this sometimes leads to a worse result. Read more on how to retrain your investment brain.

Risk profile

Your capacity to handle market ups and downs when investing. Lots of financial advisers will ask you 30-50 question to determine this however we think that’s a waste of time because those questions are usually the same few repeated in several different ways. We ask clients 8-12 questions to determine their risk profile, investment horizon and need for regular income along the way.

Robo-advice

Also known as automated investing or digital advice. A new way of investing that emerged in the US around 2010 that uses technology to help more people invest without a human advisor. Robo-advice uses technology to automate many of the jobs a traditional human financial adviser would do including investing, rebalancing and tax reporting. This can be offered at a much lower cost and made available to people with small amounts to invest. Read more on how robo-advice works.

Smart beta

Also known as strategic beta, alternative beta, fundamental beta, advanced beta, enhanced beta and probably a few other names – aims to combine elements of passive index investing and active fund management to deliver the best of both worlds. Smart beta products almost always look fantastic looking backwards over a select period of time and fund issuers aggressively market them based on the particular time period that makes them look best. Over longer periods of time smart beta strategies tend to revert to the average just like any other active strategies. See more on whether you should buy into smart beta.

Socially responsible investing

Also known as ethical investing. A style of investing that considers both financial return and social good to bring about social change. Read more on socially responsible investing.

Theme / Thematic investing

Thematic investing refers to investing based on a broad picture view on what countries, sectors or areas of the market may do better than others. We give clients the option to pick up to 3 themes for their portfolios.

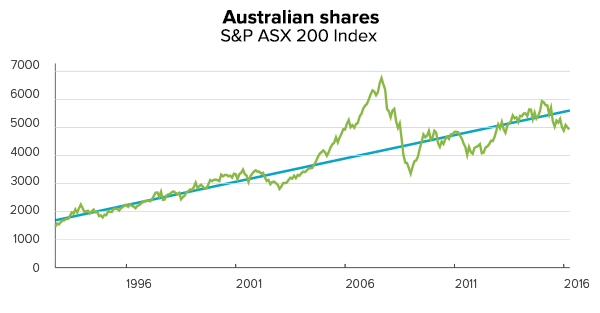

Volatility

The short term ‘ups’ and ‘downs’ in the market around a long-term upward trendline. Volatility is what you need to endure as an investor to earn a return.

Yield

Your annual return expressed as a percentage of the capital you invested. For example, annual dividends of $40 on a $1,000 portfolio would represent a 4% dividend yield.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.