We are hard-wired to be idiot investors. Worse than that, we’re not getting any smarter regardless of how much we read, research and educate ourselves.

Nobel Economics Prize-winner Daniel Kahneman in his 2011 book Thinking Fast and Slow, showed that even knowing about our own psychological weaknesses doesn’t make us better investors.

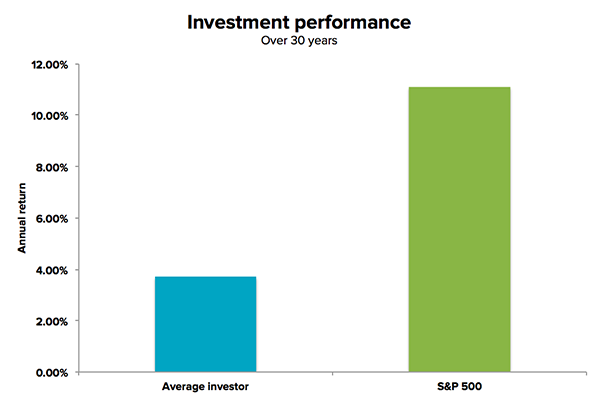

In fact, over the past 30 years the average share market investor in the US earned an average annual return of just 3.7% compared to the S&P 500’s 11.1% annual return.1

Much of this lacklustre performance can be attributed to our own behavioural biases. We are born risk-averse, which leads to us forgo profitable opportunities to avoid the possibility of losses. Kahneman discovered that we feel the pain of losses twice to 3x more than the enjoyment of gains.

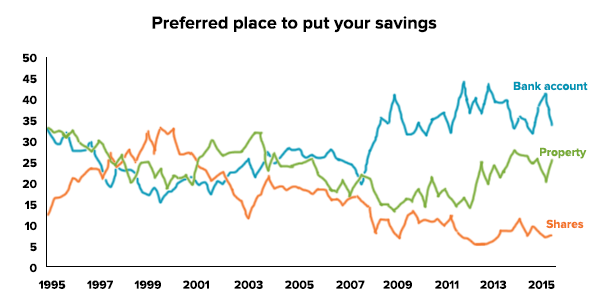

This explains why only 8% of Australians think the share market is the smartest place to invest savings compared to 26% who favour property and 33% cash. Shares are now less popular than they have been for decades despite being the best performing investment asset over the long term.

Source: Westpac survey

This fear of losses is exacerbated by availability-bias because we put too much weight on the recent past. With the global financial crisis fresh in the memory of many people, the share market still seems a risky place to invest despite a much longer history of solid returns.

We also exhibit overconfidence in our own skills which causes us to over-trade rather than take a set-and-forget strategy that reduces brokerage costs and stress.

When we do make money in markets, we attribute profits to our ‘skill’ and losses to ‘bad luck’. This makes us believe we have more control over short-term investment results than we actually do.

And we have an overwhelming tendency to follow others into popular trends. This herd mentality can lead to market bubbles that cause immense damage to individuals and society when they collapse.

More information doesn’t help

Economists like Kahneman have shown that investor education adds little value and people aren’t getting smarter about managing their money.

Even with decades of behavioural finance theory behind us, the majority of investors still succumb to the same profit-destroying temptations that have existed since the first share market opened for business in 1531.

Access to instant news online via the internet hasn’t helped either – if anything, research has shown that the internet has made us less intelligent investors because it has magnified our overconfidence and the illusion of control.

So if individual investors aren’t using the lessons of behavioural economics to profit, who is?

You needn’t look further than financial news programs to see behavioural finance at its beautiful best. Financial pundits are experts at using our behavioural basises to sell a product or story.

Take the stockbroker who uses his recent track record to promote to his investment newsletter – tapping into the famous hot-hand fallacy and some very selective framing. The financial product that promises to protect against another financial crisis – honing in on our acute risk aversion and availability bias. Or the financial news anchor who promotes the idea that volatility and down days in the market are bad news for investors.

Test your investment biases

If you think you’re immune to the spin, here’s a test to see if you can beat your biases…

Which 5-year market would you prefer to invest in periodically each year if you didn’t intend to withdraw your money until 5 years from now?

If you voted A you’re in the majority – while B usually receives the least votes. However you might be surprised to learn that chart B actually delivers the best returns, and A the worst.

The reason B performs best is because bumpy markets actually work in your favour since they provide investors with opportunities to buy into weakness.

So if you intend to invest steadily and don’t plan on touching the majority of your portfolio for many years you can ignore short term market moves and simply stick to the plan.

History shows that investors do best when they invest in a well diversified portfolio, ride out volatility, rebalance to reduce risk, and top up their balance regularly.

Market commentators and the investment industry have done a wonderful job at tapping into behavioural economics to reinforce our worst habits. The result is that many investors are tempted into over-trading, switching strategies too often, following the herd into overcrowded investments and subscribing to expensive and unnecessary services to get investment advice.

Next time you’re tempted to turn on the financial news channel for investment views, why not switch on the History, Sport or Discovery channel instead.

You’ll miss this week’s stock pundit predictions, but at least you won’t be under the illusion that you’re getting an investment edge from listening to them.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.

1 DALBAR research looking at 30 years of performance data from 1984 to 2013