Make the most of your Stockspot account with the Stockspot dashboard .

You can track your investments, view your account balance, add new accounts, and find detailed information about your portfolio.

Here’s a quick guide to using your Stockspot dashboard.

Contents:

- Account overview

- Your investments

- Goal Tracker

- Performance

- Transactions

- Documents

- Transfer money

- Invite

- Your profile

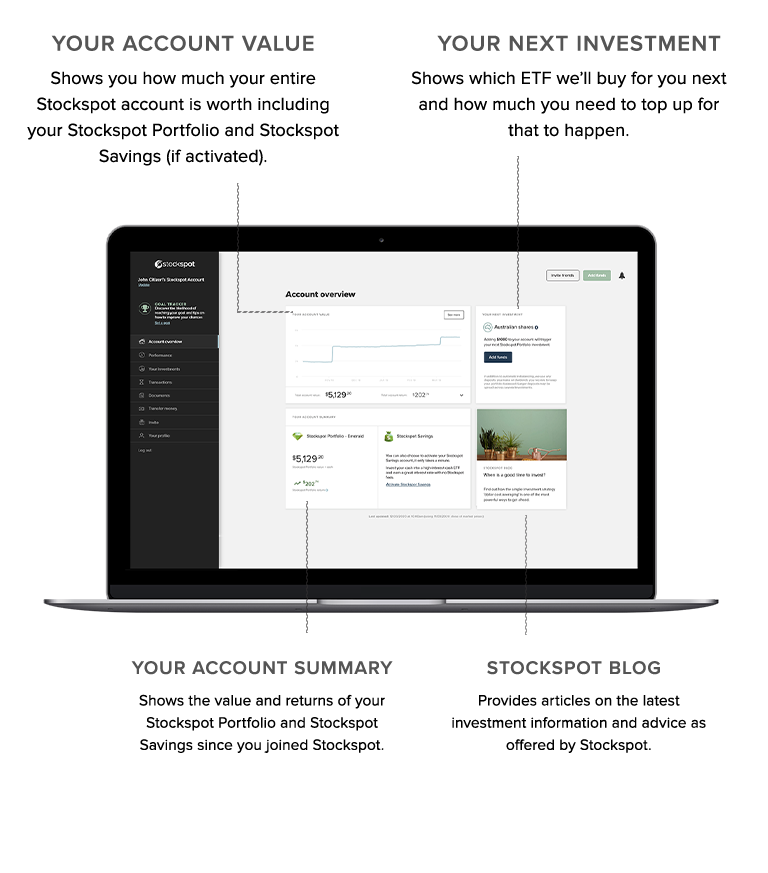

Account overview

This section provides a summary of your Stockspot account.

- YOUR ACCOUNT VALUE shows you how much your entire Stockspot account is worth including your Stockspot Portfolio and Stockspot Savings (if activated).

- YOUR ACCOUNT SUMMARY shows the value and returns of your Stockspot Portfolio and Stockspot Savings since you joined Stockspot.

- YOUR NEXT INVESTMENT shows which ETF we’ll buy for you next and how much you need to top up for that to happen.

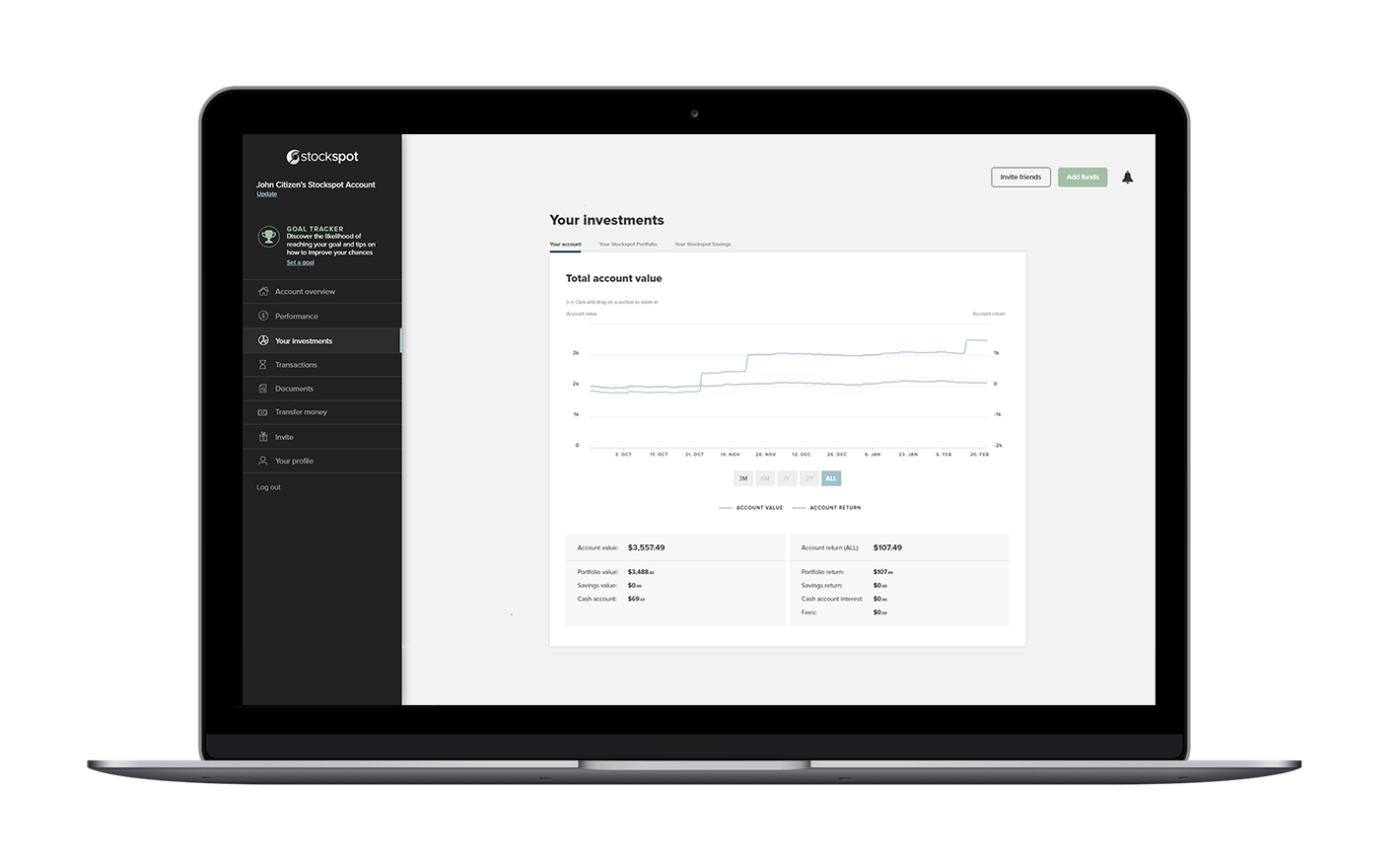

Your investments

In this section you’ll find information about your Stockspot account which includes your Stockspot Portfolio and your Stockspot Savings.

Your Stockspot Account

This is where you can view the total value and total returns from your Stockspot Portfolio and Stockspot Savings combined.

- The blue line shows the total value of your entire portfolio.

- The green line shows your portfolio’s total return (ie. what you’ve made from your investments). This line will rise and fall over time. Market fluctuations are a normal part of investing and will occur.

- You can also zoom in to see a specific period of time. You can reset the view using the Reset zoom button.

Your upcoming distributions can also be found here. Some of your investments may pay dividends and distributions quarterly, monthly or half-yearly.

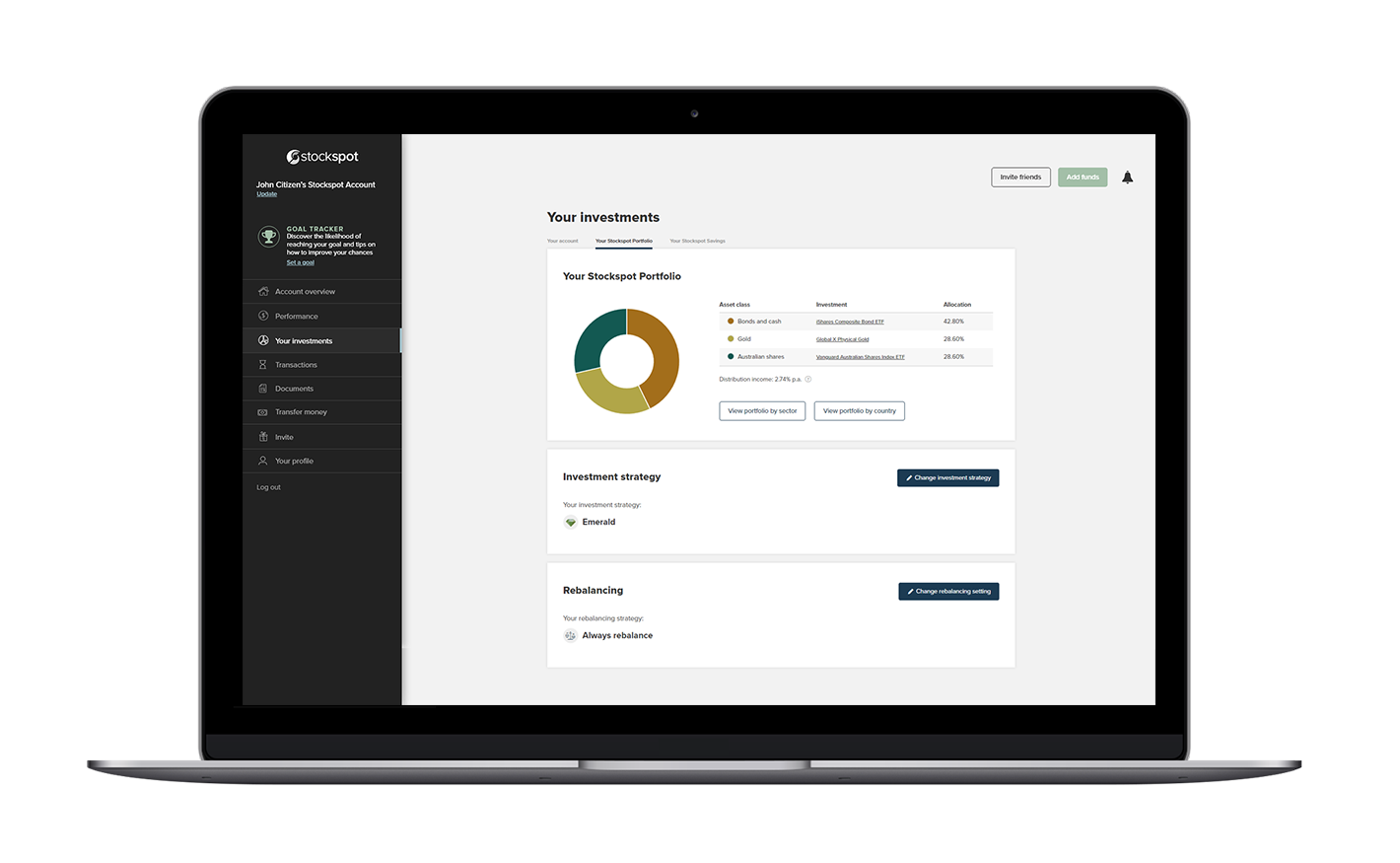

Your Stockspot Portfolio

This is where you can view your Stockspot portfolio’s current asset allocation (including a breakdown by country and sector).

You can also:

- View and change your investment strategy, including switching to a Sustainable portfolio. All changes are reviewed by our team to ensure they match your investment profile and goals. You can learn more about how we recommend an investment strategy in this article: What is your risk profile and how does it help your investment strategy?

- Add Stockspot Themes. Themes will unlock in your dashboard once your portfolio reaches $50,000 or more. You can customise your portfolio by adding themes from our list of growth and defensive options.

- View and change your rebalancing strategy to suit your personal situation and cash flow needs. You can set your rebalancing strategy to always rebalance, buy only, or pause.

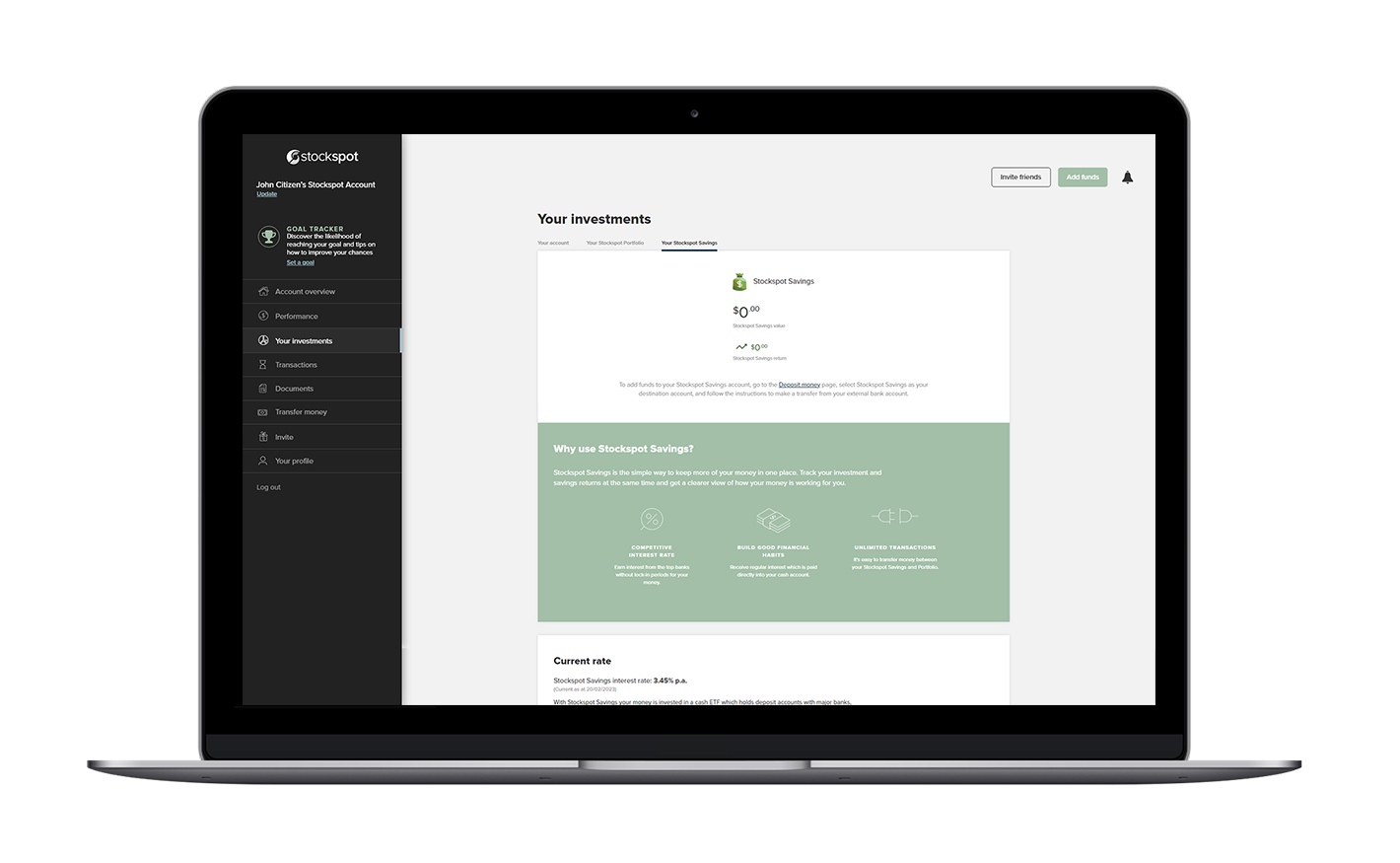

Your Stockspot Savings

If you have activated your Stockspot Savings this is where you see how much you have invested and the amount of interest you have earned on your savings. Here you can also view the interest rate you will earn on your savings as well as the banks your money is held with.

If you haven’t activated Stockspot Savings yet, it’s easy to set up. You can learn more about how to get started in this article:Stockspot Savings.

Funds are invested into a High Interest Cash ETF that’s suitable for short-term investing goals.

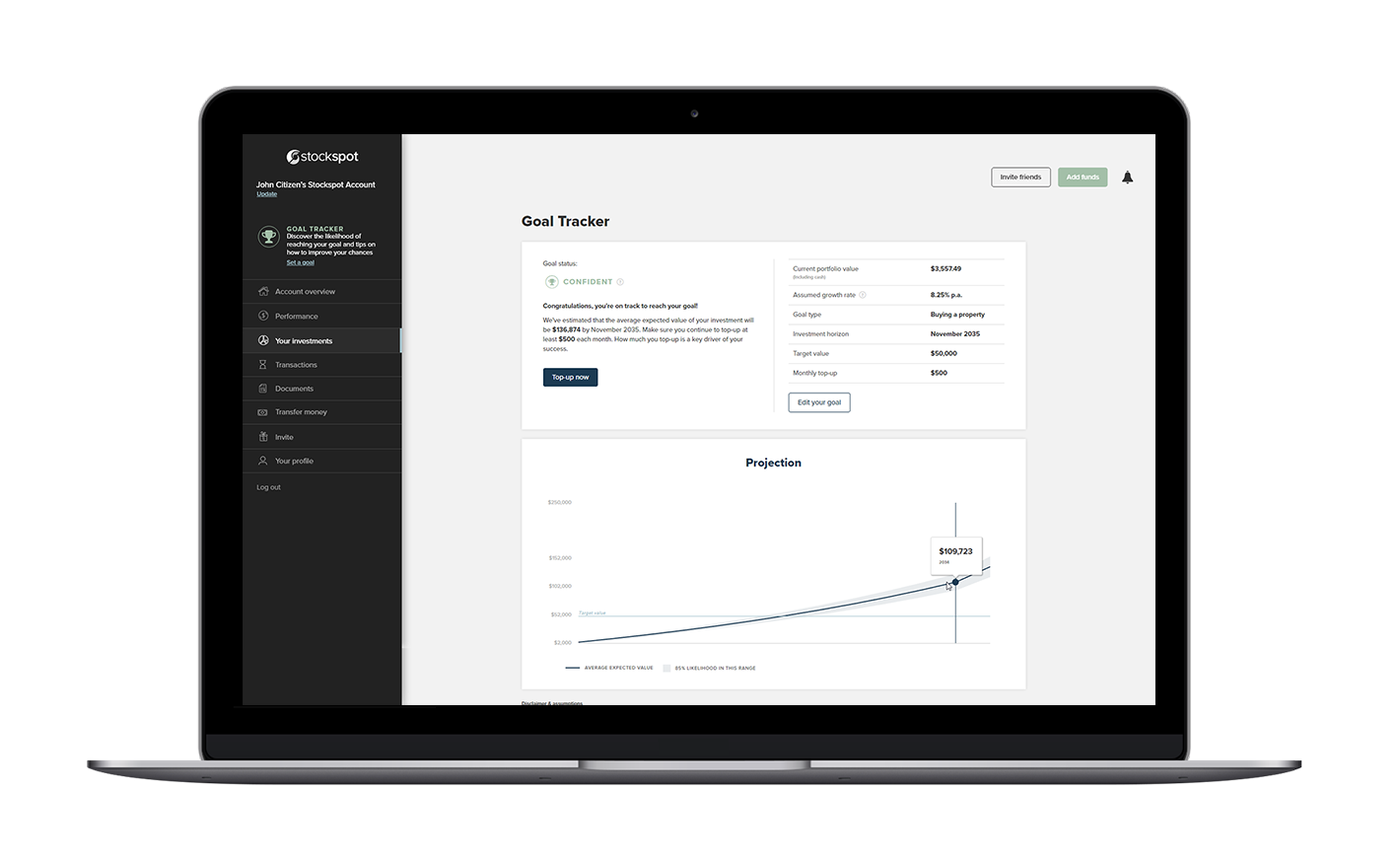

Goal Tracker

The Goal Tracker is a great way to set an investment goal and check on your progress along the way. See at a glance whether you’re on track to meet your goal, and get handy tips for how to get there faster.

Simply click ‘Set a goal’ and follow the steps to get started. Your goal is always editable so you can make changes any time.

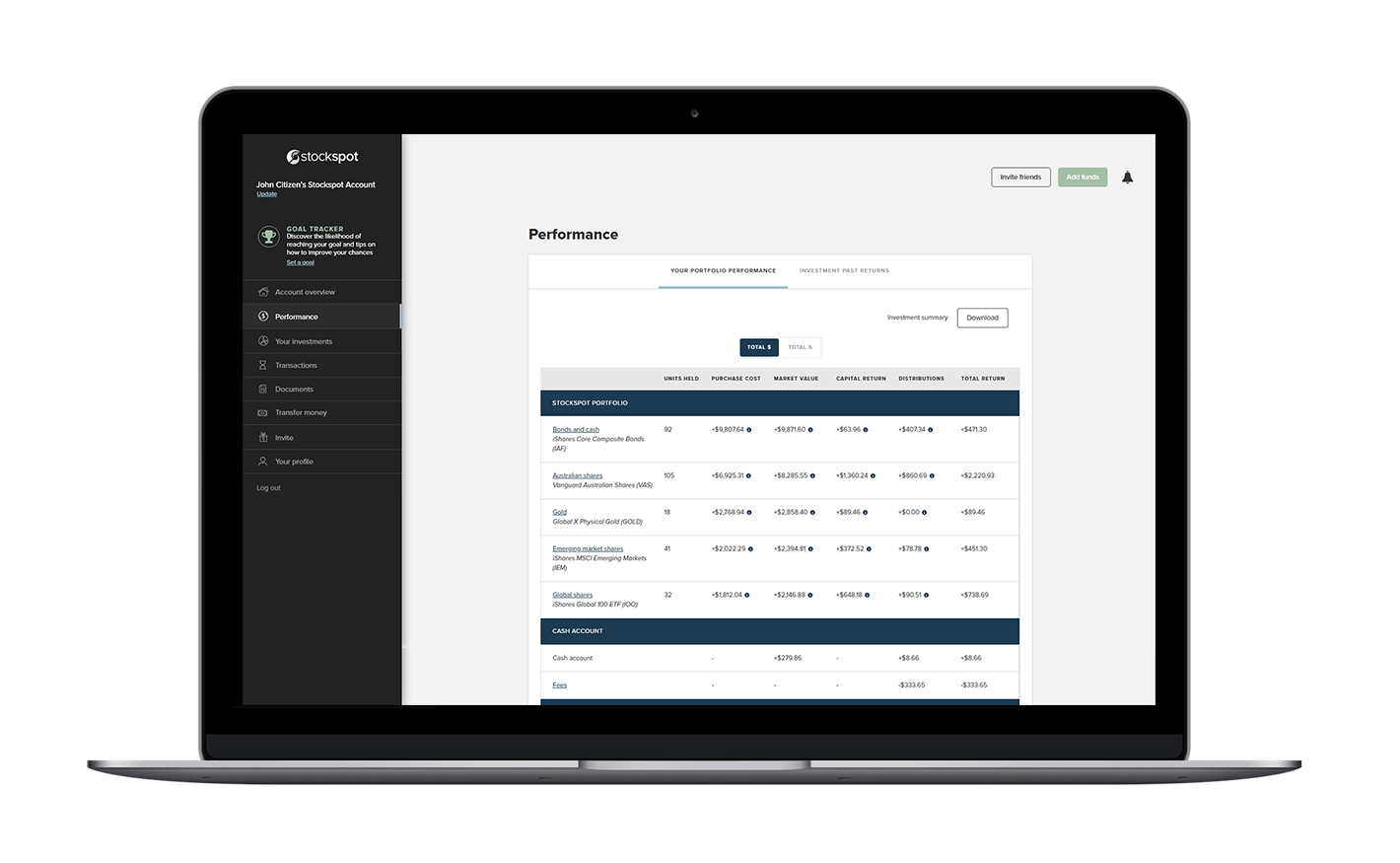

Performance

This page shows the performance of each investment in your Stockspot portfolio, how much is invested in them, and what their return is.

View your returns in dollars (TOTAL $) or percentages (TOTAL %) by using the toggle button at the top of the page. You can learn more about how we calculate returns in this article: How does Stockspot calculate returns.

- UNITS HELD: the number of units you own in each ETF. For example this portfolio owns 123 units in the Vanguard Australian Shares ETF.

- PURCHASE COST: this is the original purchase cost of your investments. Hover over the ‘i’ symbol for the calculation.

- MARKET VALUE: how much your investment is worth today. Hover over the ‘i’ symbol for the calculation.

- CAPITAL RETURN: how much you’ve made from your investments. Hover over the ‘i’ symbol to see a breakdown into realised and unrealised capital gains.

- DISTRIBUTIONS: dividends and other cash distributions from your investments. Hover over the ‘i’ symbol to see pending and already received distributions.

- TOTAL RETURN: the net sum of your Stockspot portfolio taking into account your capital return and any income received.

Distributions (the DISTRIBUTIONS column) appear after they’ve been paid and reconciled by our Stockspot engine. This is because we do the tax reconciliation for you in preparation for the investor tax statements we provide at the end of each financial year.

You can drill down on any of the investments to see each buy or sell transactions, when they were done and how much you paid.

You can download your investment summary report (either in PDF or CSV format).

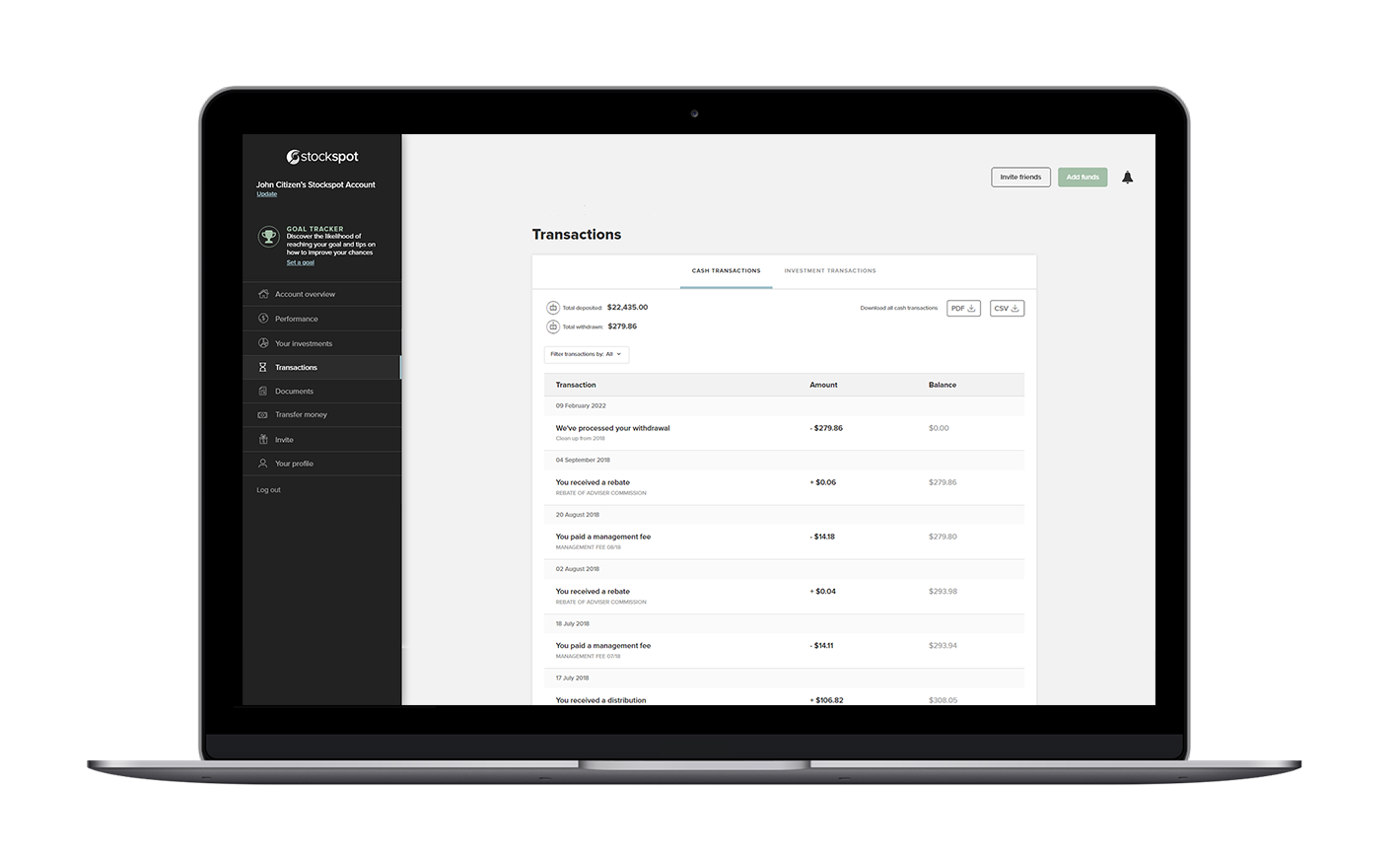

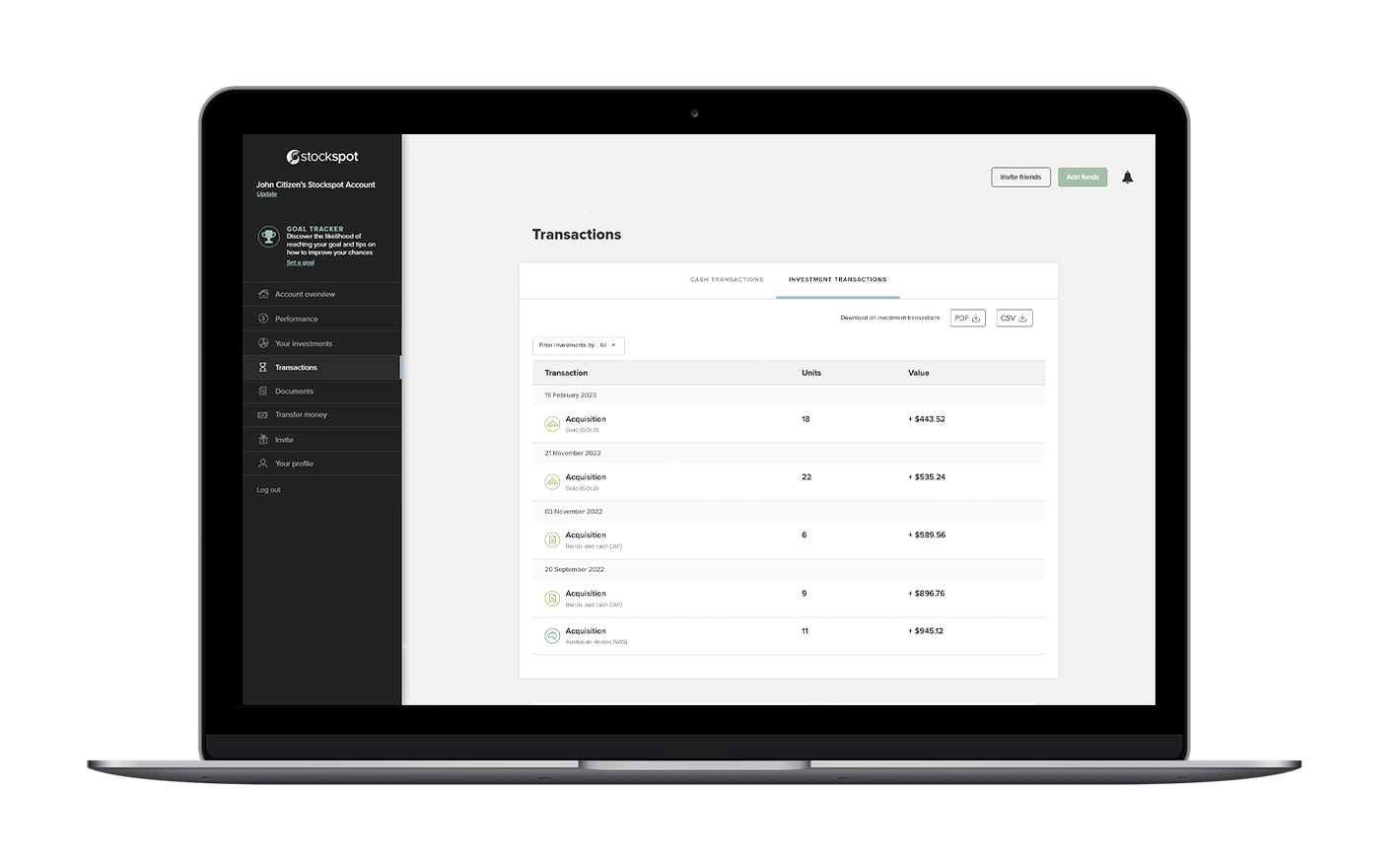

Transactions

In this section you can view a detailed list of the cash and investments transactions for your account.

Cash Transactions

View the cash transactions in your Stockspot cash account. You can filter by transaction type (All, Distributions, Interest, Fees, Deposits, Withdrawals). You can download a PDF or CSV file of your cash transactions.

Investment Transactions

View the investment transactions in your Stockspot Portfolio. You can filter by investment type (All, Emerging market shares, High interest cash, Gold, Australian shares, Bonds and cash, Global shares). Each transaction is represented by an icon, description of that transaction, the quantity involved, and the value of that transaction.

You can download a PDF or CSV file of your investment transactions.

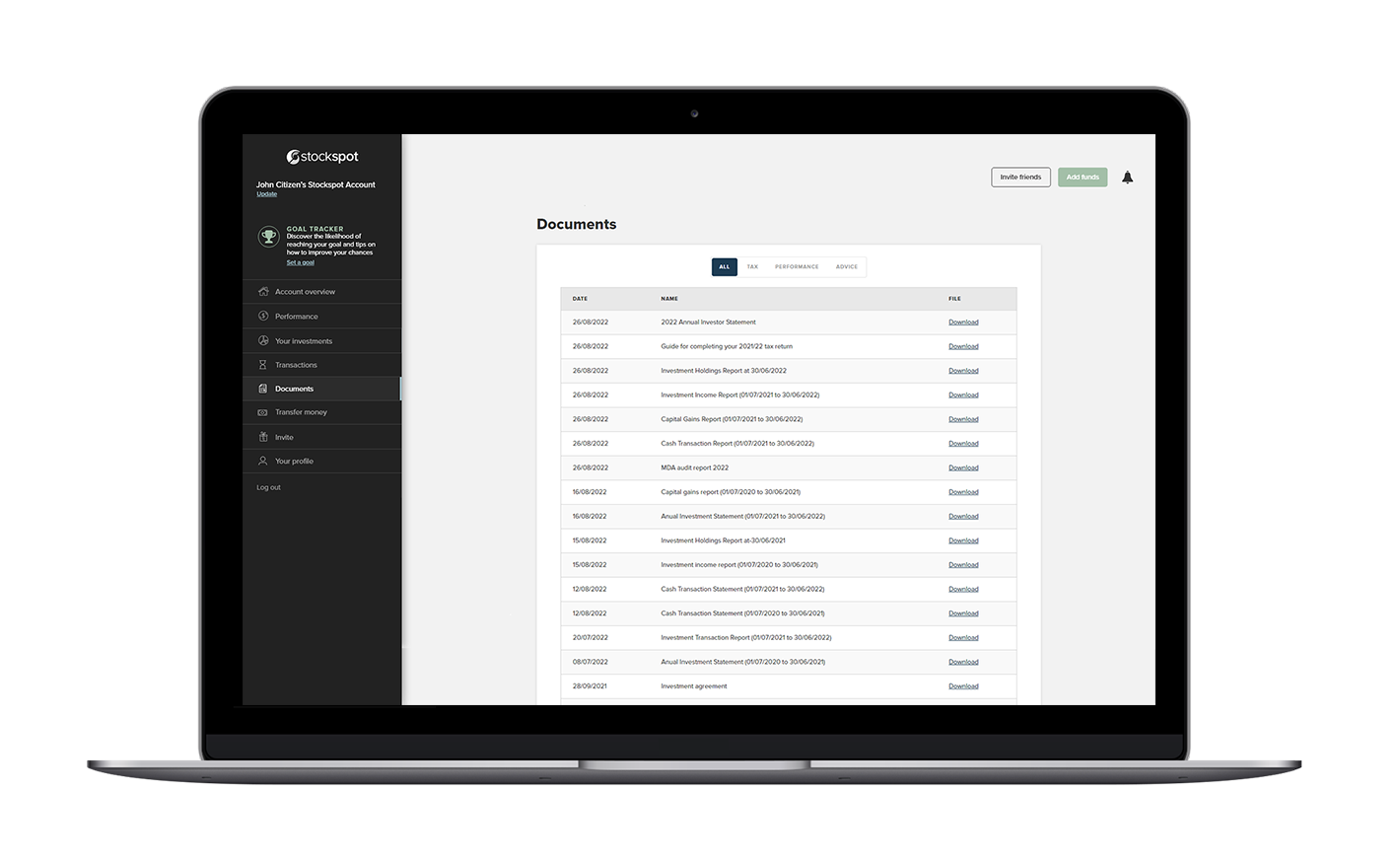

Documents

In this section you’ll find your documents, agreements, and paperwork related to your Stockspot Portfolio and Stockspot Savings.

These documents relate to:

- TAX: Your investor statements and reports to help make doing your taxes simple.

- PERFORMANCE: Your performance statement that shows how your portfolio is tracking.

- ADVICE: Your investment agreement and any updated agreements you’ve signed since you joined.

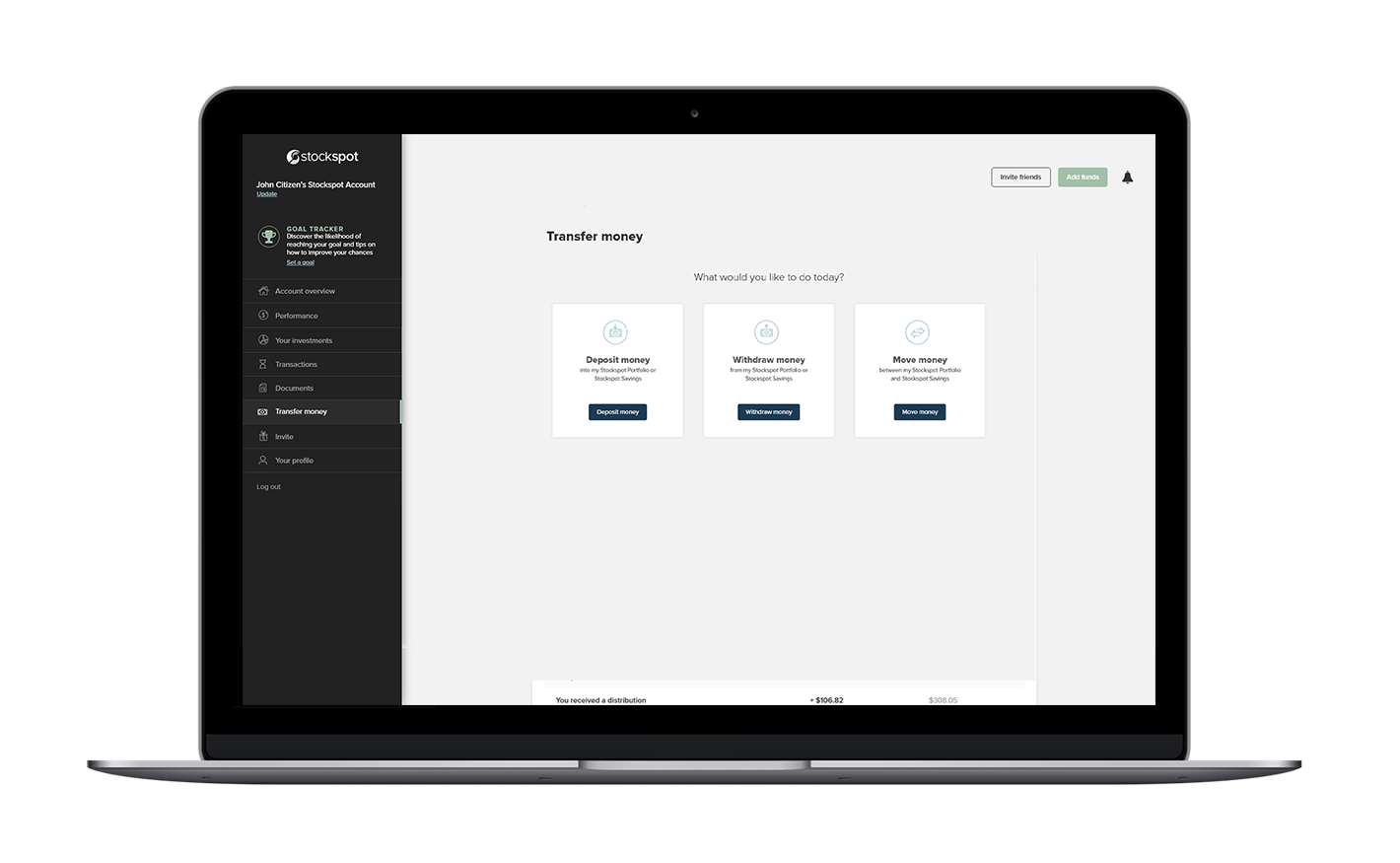

Transfer money

This section allows you to transfer money into your Stockspot accounts via bank transfer or BPAY (where available). Please note, this function is only available on the desktop version of the Stockspot dashboard and is not available on the Stockspot app.

Deposit money

Select to view your bank transfer and BPAY details.

Many Stockspot clients set up a regular transfer from their bank account so we can help them dollar cost average. You can learn more about the benefits of dollar cost averaging in our article: When is a good time to invest.

Withdraw money

You can lodge a full or partial withdrawal request for your Stockspot Portfolio or Stockspot Savings at any time.

It may take up to five business days for the funds to arrive in your linked bank account. Stockspot does not charge any fees for withdrawals.

Move money

If you have activated your Stockspot Savings, you can transfer money between your Stockspot Portfolio and Stockspot Savings.

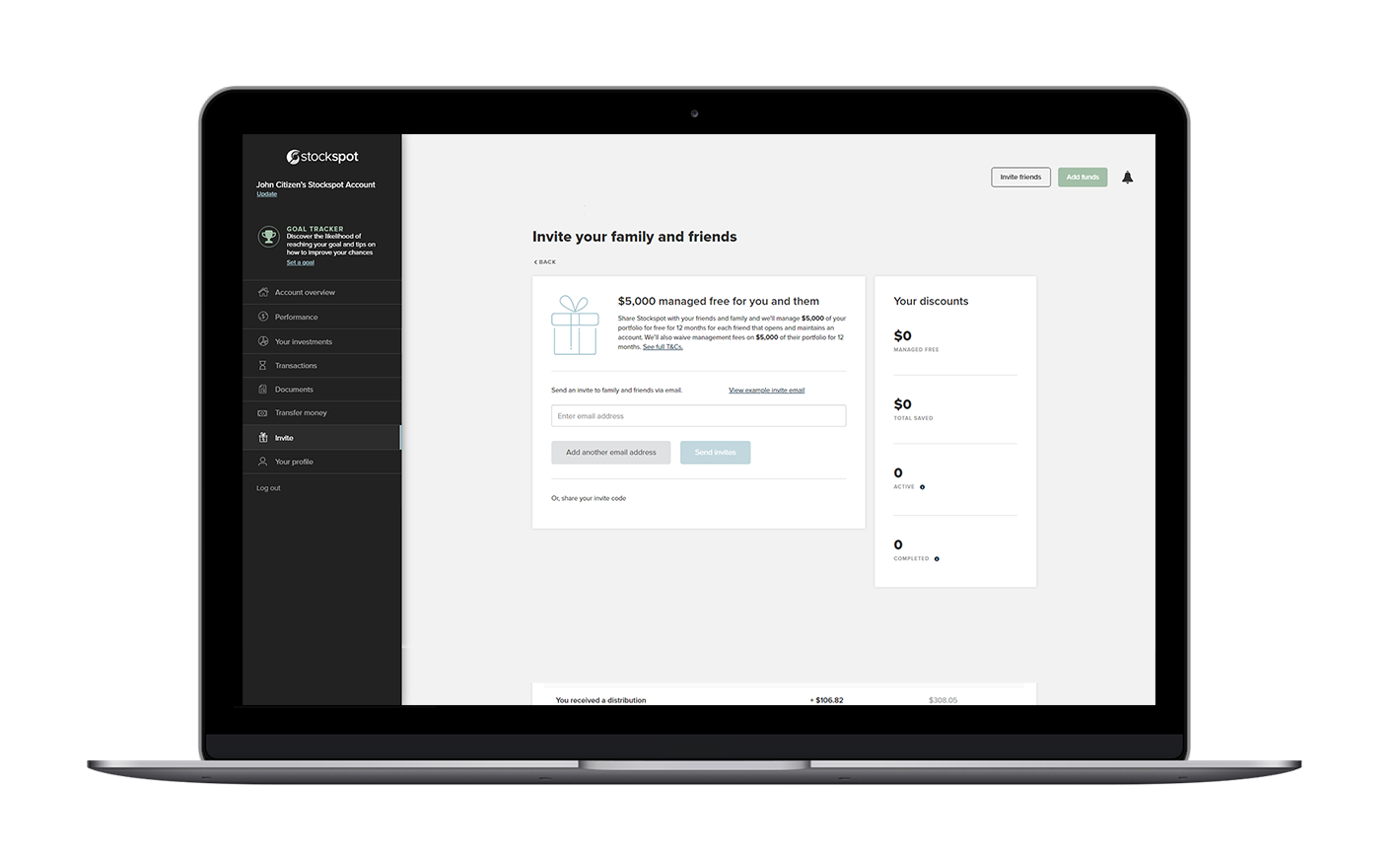

Invite

This section allows you to invite your family and friends to join Stockspot. For every person that you invite who invests with us, we will waive the fees you pay on the first $5,000 of your portfolio for 12 months. And we’ll do the same for your invitees’ portfolio for 12 months as well!

The more you share, the more you (and your family and friends) save together – and the faster your portfolio grows. This gives your family and friends the chance to try Stockspot and see how it can help them achieve their financial goals.

Simply add their email address and click Send invites. Invite as many people as you like.

Your discounts: provides a summary of how much you are saving in fees thanks to your successful referrals. Here are some tips on how you can help your family and friends start investing today.

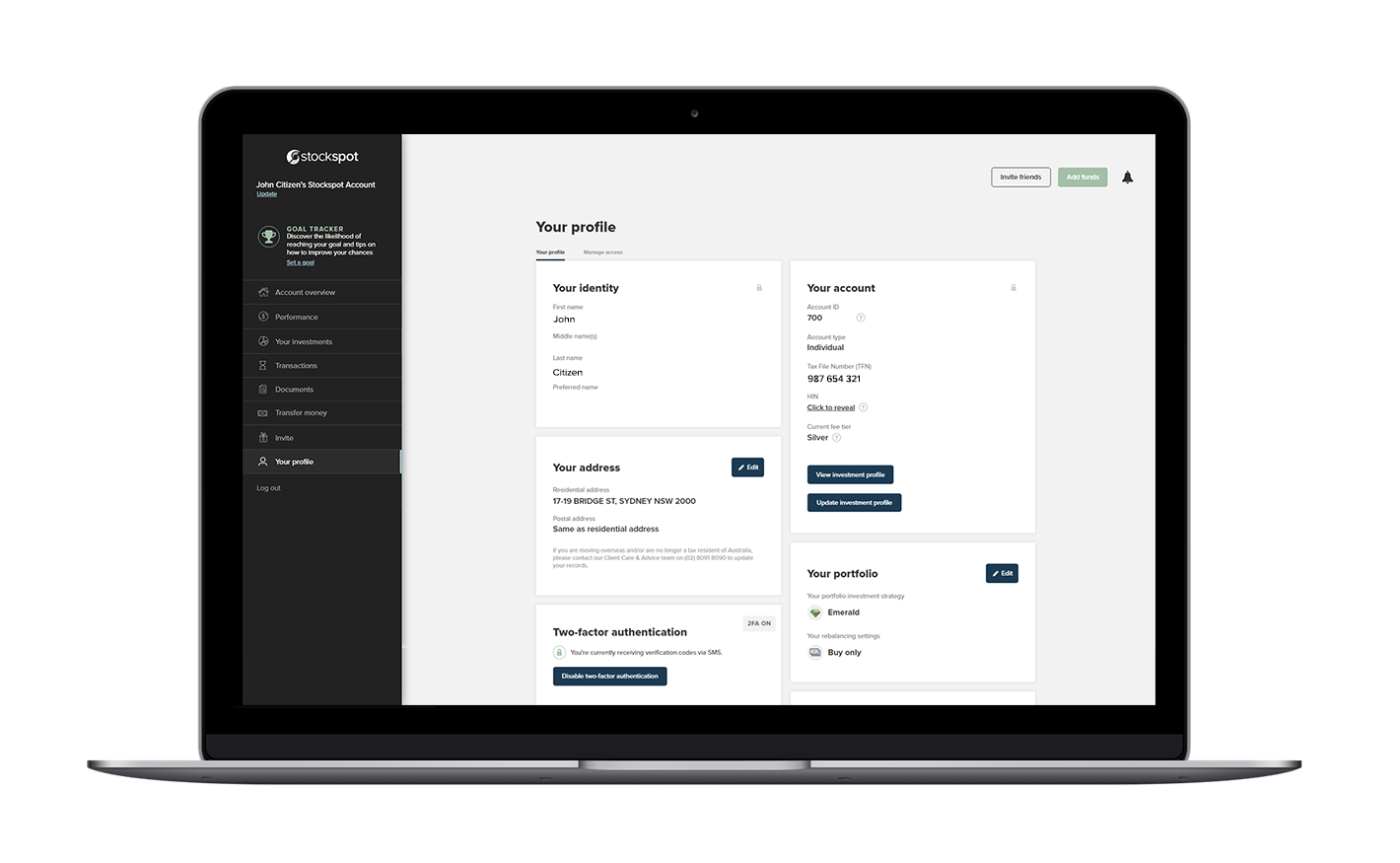

Your profile

This section allows you to view and update your account settings and personal details.

Your profile

From here you can also view or update your current investment profile if your circumstances change. Your investment profile is based on your current financial situation, how long you want to invest for and your capacity for risk.

We’ll ask you to log in and review your profile each year as part of our annual review process.

You can also set up two-factor authentication for an extra level of security on your account.

Manage access

You can give your accountant or financial adviser access to a view-only version of your portfolio for tax and strategic advice. They will not be able to make changes on your account. We’ll then email them with instructions on how to view your Stockspot Portfolio and Stockspot Savings.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.

This article was originally published in November 2018 and was updated in September 2019 and February 2023.