With record low interest rates in Australia, we wanted to offer our clients the opportunity to access a secure and stable option with a better rate than most bank accounts.

Stockspot Savings is available to clients who hold a Stockspot Portfolio, and was launched in 2018.

In this article, we’ll answer some common questions:

- What is Stockspot Savings?

- How is Stockspot Savings different to my Stockspot cash account?

- What is a high interest cash ETF?

- Which cash ETF does Stockspot use?

- What are the benefits of Stockspot Savings?

- Fees for Stockspot Savings

- What is the interest rate?

- How does interest get paid?

- Why does the capital value of Stockspot Savings move around?

- Why does my Stockspot Savings balance show a negative number?

- Are there any transaction restrictions?

- How do I start investing into Stockspot Savings?

What is Stockspot Savings?

Stockspot Savings is an alternative to a high interest savings account, designed for cash savings you don’t want to invest in your Stockspot Portfolio.

Rather than deposit money with a bank or buy a term deposit, Stockspot Savings will place your money into a high interest cash Exchange Traded Fund (ETF). You get access to the best interest rates from the big banks without having to lock away your savings for months or years.

High interest cash can be a suitable place to park funds that may be needed in the shorter term (3 years or less). Stockspot Savings provides a high level of security, as well as providing regular interest income. Unlike bonds, the capital value of cash will not fall in a rising interest rate environment.

How is Stockspot Savings different to my Stockspot Cash account?

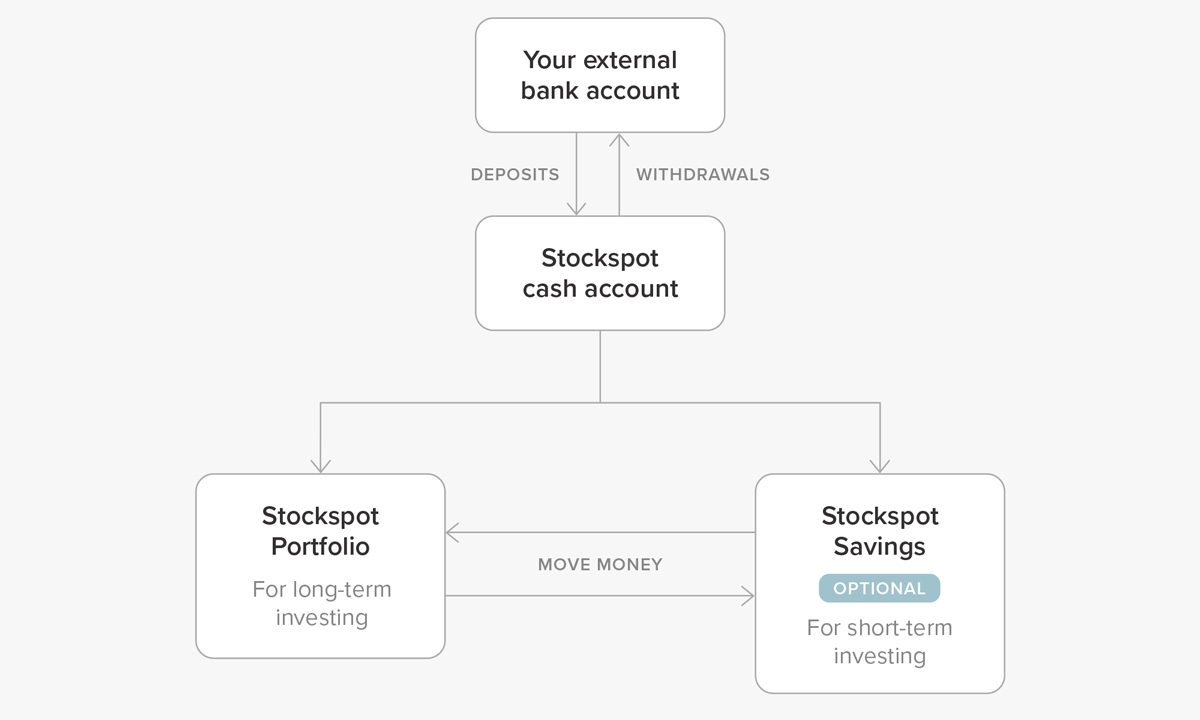

Stockspot Savings is a cash ETF. When you invest in Stockspot Savings you purchase units in the cash ETF. It’s $2,000 to get started and has top-up minimums of $500.

Your Stockspot Cash Account is your ‘cash hub’ for your portfolio. It’s the account you deposit funds into for investment into either your Stockspot Portfolio or Stockspot Savings. It’s also the account your distributions are paid into.

The image below shows the relationship between your Stockspot Cash Account, Stockspot Savings and your Stockspot Portfolio.

What is a high interest cash ETF?

High interest cash ETFs have been available on the ASX since 2012, and are an alternative to high interest bank accounts. When you put your money in a cash ETF, your money will be deposited into major banks regulated in Australia by APRA.

As opposed to directly depositing money into a bank account, you are purchasing units in a cash ETF.

The cash ETF allows you to access a higher interest than some savings accounts because the ETF providers negotiate a higher interest with the banks than individuals are able to do themselves. The interest rate can change and often does when the RBA announces interest rate changes.

Which cash ETF does Stockspot use?

Stockspot invests into the BetaShares Australian High Interest Cash ETF (ASX: AAA). This is an exchange traded fund (ETF) that deposits investor funds into a portfolio of at-call bank deposits, notice deposit accounts and 30-90 day term deposits with major banks.

The BetaShares Australian High Interest Cash ETF pays income monthly to clients (around the middle of the month). The interest rate can change and often does when the RBA announces interest rate changes.

What are the benefits of Stockspot Savings?

Stockspot Savings allows you to earn a high interest rate without needing to open a bank account or lock your money away for extended periods.

Other benefits include:

- No minimum deposits or minimum card transactions unlike a high interest savings account

- No lock in periods

- No termination/withdrawal fees

- Low administration set-up and costs

- Secure and safe as deposits are with banks regulated by APRA

- No introductory rates

- No hidden fees or charges, small print or onerous terms and conditions

- You can access your money whenever you want

- Seamlessly integrates with your Stockspot Portfolio so you can easily transfer money to your Stockspot Portfolio as part of a dollar cost averaging investment strategy.

Stockspot Savings fees

The high interest cash ETF fee charged by BetaShares is 0.18% per year. This fee is an indirect cost to you as it comes out of the ETF unit price (i.e. interest rate is net of fees). The interest rate you see on your account already has the ETF management fee deducted from it.

Stockspot does not charge any fees for money invested in Stockspot Savings.

What is the interest rate?

The current rate will be published in the Savings Settings section of your dashboard. Just like when you deposit money with your bank, interest rates with cash ETFs can change.

Small changes can happen month-to-month and large changes typically happens when the Reserve Bank of Australia (RBA) announces an interest rate change.

We are constantly reviewing the cash ETF options available for the best possible interest rate for you.

How does interest get paid?

The high interest cash ETF pays interest in the middle of each month to whoever owns units at the start of the month. The interest is paid directly into your Stockspot Cash Account and is visible in your dashboard the next business day.

Why does the capital value of Stockspot Savings move around?

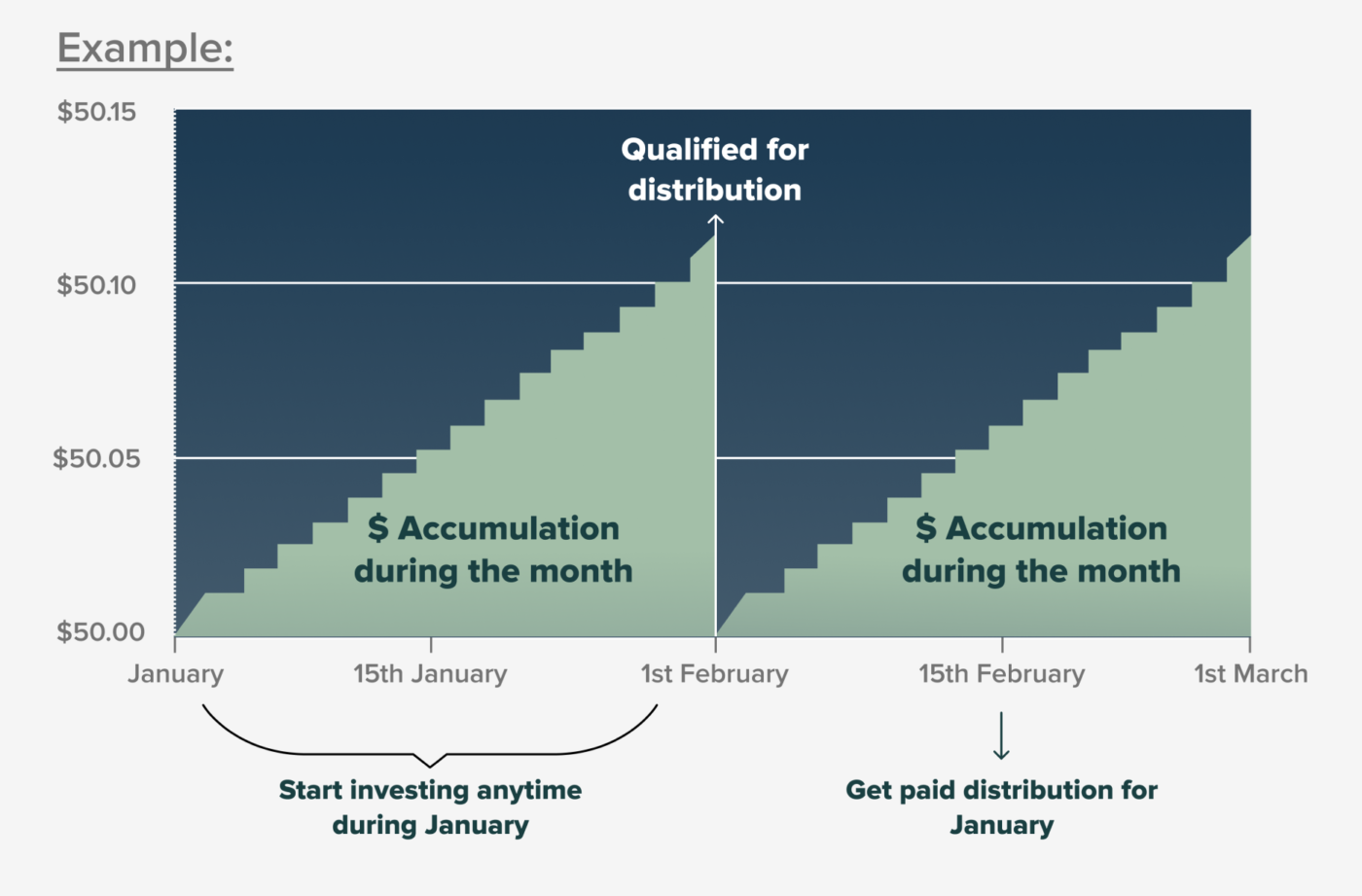

The high interest cash ETF has an ex-distribution date, which is the first working day of every month. On this day, the unit price will fall by an amount similar to the ‘ex distribution’ (interest). This is normal and similar to any other ETF. It reflects that people who owned the ETF yesterday were entitled to last month’s interest whereas people who buy it today will need to wait until next month’s interest.

As the interest accrues through the month, this builds into the ETF’s value and is represented by an increase in the ETF price throughout the month. This can be seen in the graph by the steady climb in the unit price.

Then once it reaches the ex-dividend date (i.e. the peak point in the graph), the price will fall back down to reflect that you need to wait a month to receive the next interest amount. That is, over the course of the month its price increases until it pays its distribution and its price drops a corresponding amount. This happens to stop people from buying in mid way through a month and expecting to receive a full month’s interest.

Why does my Stockspot Savings balance show a negative number?

The high interest cash ETF will sometimes appear to show a negative capital return during the month. This happens between when the ETF owes you interest (i.e. goes ‘ex’ distribution) and when it pays your interest in the middle of the month. Rest assured that the dip in high interest cash ETF unit price will be offset with the interest payment once it arrives in your account on the Payment Date (middle of the month).

For example, you might have deposited funds into your Stockspot Savings on the 25th of the month and we bought units in the high interest cash ETF at $50.10. A few days later, the ETF goes ‘ex distribution’ of 5 cents per share and the price of the Stockspot Savings ETF drops to $50.06.

The dip in high interest cash ETF unit price of 4c will be offset with the interest payment of 5c once it arrives in your account on the Payment Date (middle of the month). The difference between the 5c you receive and the 4c that the ETF fell by will mean that for this first month you only received a partial interest payment to reflect that you were only invested for part of the month.

Are there any transaction restrictions?

No. You can make as many deposits and withdrawals as you like. It usually takes 2-3 business days to withdraw from Stockspot Savings to your linked external bank account.

We generally recommend that Stockspot Savings is suitable for money that you expect to need in 3 months to 3 years time. Money you need in less than 3 months is better suited to a regular bank transaction account where you have immediate access to your money.

How do I start investing into Stockspot Savings?

You can start investing into Stockspot Savings by following these steps:

1. Activate Stockspot Savings in your dashboard

2. We’ll email you when Stockspot Savings is active

3. In your dashboard go to Transfer Money then to Deposit and select Stockspot Savings as your default deposit destination. You should receive a confirmation email.

If you select Stockspot Savings: Any deposits you make from your external bank account will be invested in your Stockspot Savings.

If you select Stockspot Portfolio: Any deposits you make from your external bank account will be invested in your Stockspot Portfolio.

You can also request to transfer money between Stockspot Savings and Stockspot Portfolio in Transfer Money – Move Money in your dashboard.

We hope this article helped you. If you have any other questions, visit our FAQs section for even more information on Stockspot Savings.