Every Stockspot account has a cash account linked to it. The cash account is where you deposit funds for investment into your Stockspot Portfolio or Stockspot Savings, and where your ETF distributions are paid each quarter. Any funds added to the cash account will be invested whenever the minimum investment balance is reached.

How does a Stockspot Cash Account Work?

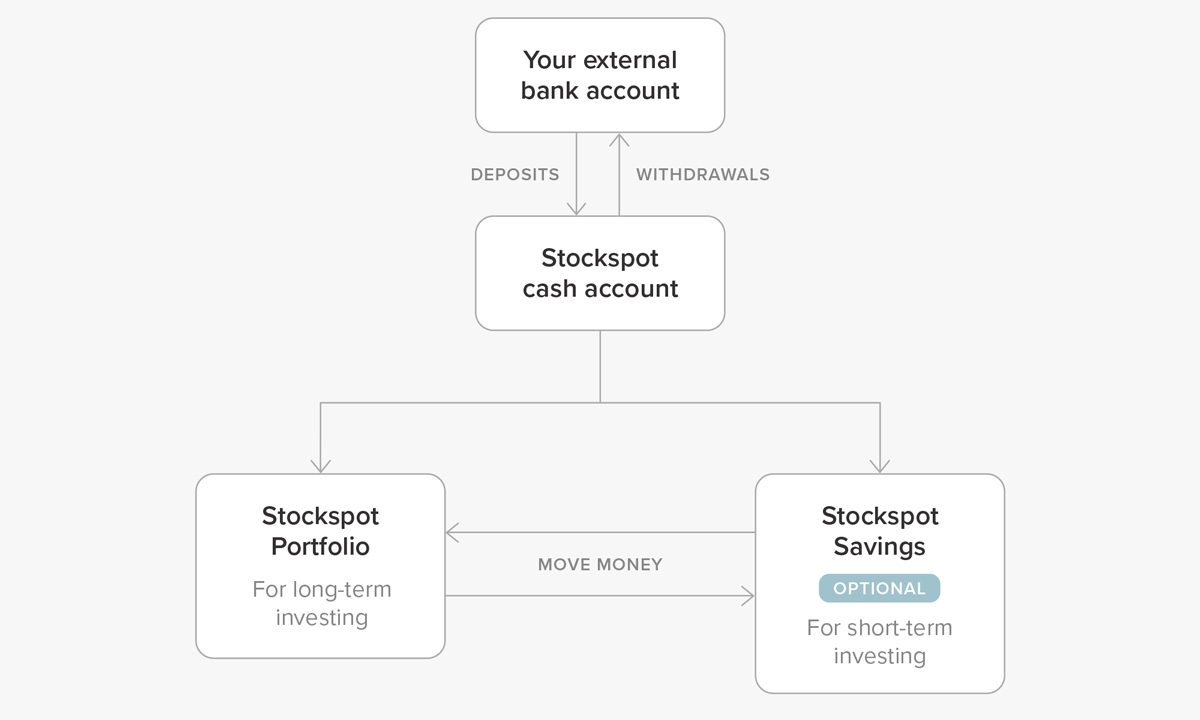

Your Stockspot Account is made up of three components:

- Stockspot Cash Account: this is the cash account where you deposit funds into

- Stockspot Portfolio: this is where we hold your investments

- Stockspot Savings: this is an option to access a higher interest cash ETF

You can deposit money into your Stockspot Cash Account at any time via a bank transfer from your regular bank account. Our system will automatically invest the funds, provided there is sufficient funds in your account to trigger a purchase of new investments.

The minimum to start investing is $2,000. Then for top-ups, you have full flexibility to top-up with any amount, anytime.

Your funds will be invested each time your cash balance is:

- $500 (for portfolios less than $50,000)

- $2,000 (for portfolios over $50,000)

There will always be a small cash buffer in your Stockspot Cash Account for the automation of monthly fees.

How is a Cash Account different to Stockspot Savings?

Your cash account is where you deposit funds for investment into your Stockspot Savings or your Stockspot Portfolio.

As a Stockspot client you have the option to activate a Stockspot Savings account. Stockspot Savings is an alternative to a high interest savings account. It’s not a bank account, rather a high interest earning Cash ETF as a better way to save for shorter-term goals (three years or less). Stockspot invests in the BetaShares Australian High Interest Cash ETF (ASX: AAA).

You can choose to deposit funds into your Stockspot Savings account by changing your deposit destination in the ‘Transfer Money > Deposit Money’ section of your dashboard. You can also move money from your Stockspot Savings into your Stockspot Portfolio, and vice versa in the ‘Transfer Money > Move Money’ section of your dashboard.

What are the benefits of using a Stockspot Cash Account?

The Stockspot Cash Account is a simple and easy way to streamline your deposits. Our system will automatically invest the funds whenever there are sufficient funds in your account to trigger a purchase of new investments. You can easily keep track of your Stockspot Cash Account balance in the Account Overview screen in your dashboard and the Stockspot app.

You can set up a regular investment plan to transfer money into your Stockspot cash with no restrictions on the amount or frequency of top-ups. Simply set-up a regular transfer from your own bank account to your Stockspot Cash Account. Stockspot does not charge any fees for deposits.

Can Stockspot or anyone else debit funds from my Stockspot Cash Account?

Stockspot, as the MDA Provider, has withdrawal authority on your cash account to transfer funds into your linked bank account when you decide to sell your investments. It also enables any fees, if applicable, to be deducted from the cash account each month.

Where can I find my Stockspot Cash Account details?

You will have originally received them by email. The details are also located in the ‘Transfer Money > Deposit Money’ section of your Stockspot dashboard and the ‘Deposit’ money section of your mobile app.