The reason behind falling bond prices

Government bond prices have been falling because the market believes that future inflation will eat into the interest paid on the bonds.

Inflation expectations can come from two sources:

– excess cash sloshing around the economy to be spent on goods and services and

– a squeeze in the ability of providers of goods and services to meet the demand.

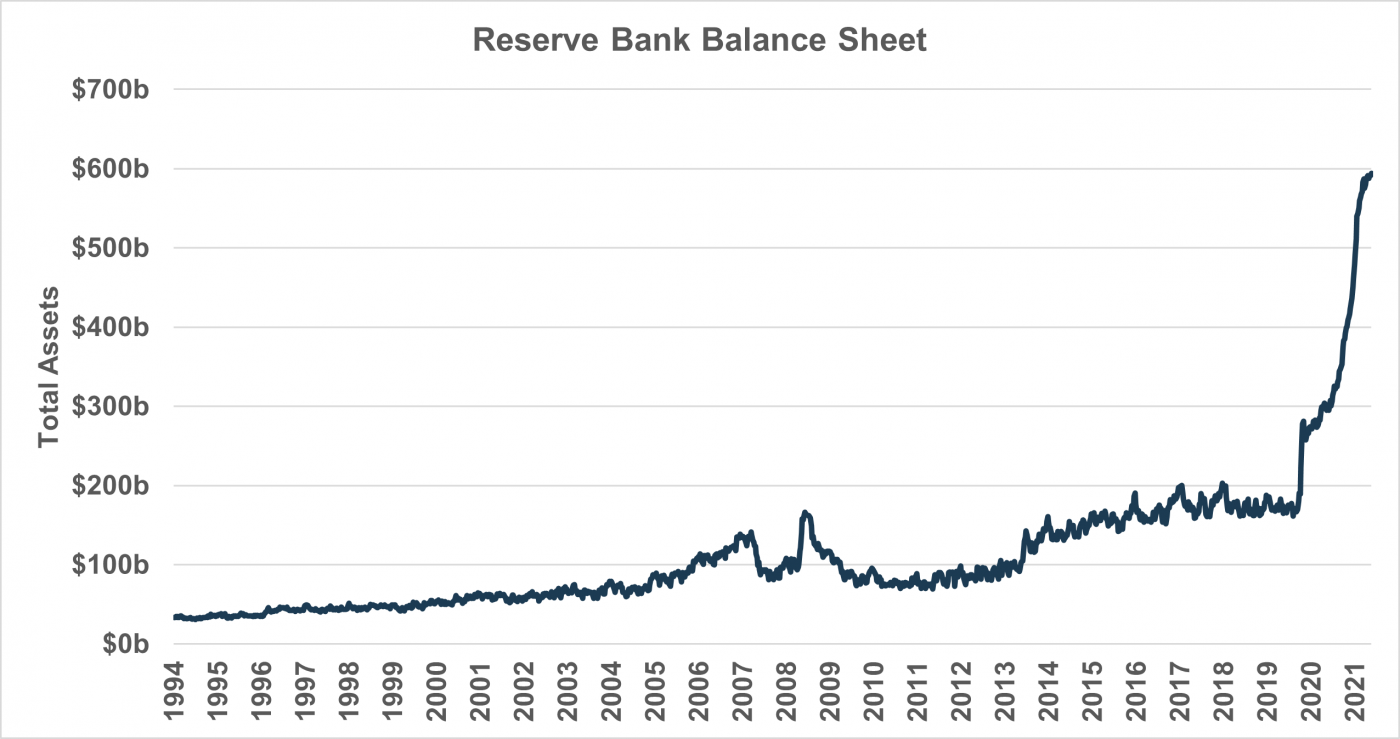

Since the start of COVID-19 the federal and state governments have borrowed huge sums to provide cash assistance to prop up businesses. Governments borrow by issuing bonds with a long term maturity. Over the same period the Reserve Bank of Australia (RBA) has been buying loads of government bonds on the open market. Buying bonds keeps the price of bonds high and thereby keeps interest rates low.

This chart shows the size of the RBAs bond purchases.

Bonds and inflation

The cash from the governments and the Reserve Bank has ended up in consumers’ pockets. As the risks of the pandemic recede and the economy opens up, consumers are very keen to spend and invest this cheap money.

However there have been bottlenecks in the supply of goods and services. Lots of goods, especially imported goods, have been difficult to get because overseas manufacturers are unable to produce as much due to their own COVID-19 constraints. Furthermore the ability to ship the goods has also been severely constrained by COVID-19 resulting in transport costs increasing enormously.

In Australia it is becoming increasingly difficult to find employees to provide the services that people want to spend their money on. This problem has been exacerbated by the fact that thousands of foreign workers on temporary visas have left Australia.

We are now seeing clear signs of the market recognising that the amount of cheap money sloshing around and the limited supply of goods and services to spend the money on is letting the inflation genie out of the bottle.

The Reserve Bank has now recognised this risk by announcing this week that it has abandoned its commitment to continue to buy bonds.

What about shares?

The Australian share market is up 29.6% over the 12 months to 31 October 2021 as businesses respond to higher customer demand.

Financial shares have performed particularly well since the potential for higher future interest rates increases profit margins for banks and insurers. For example, Commonwealth Bank shares recently reached an all-time high of $109 after touching a low of $53 in March 2020. That’s a rise of 106% before dividends.

What is Stockspot doing about it?

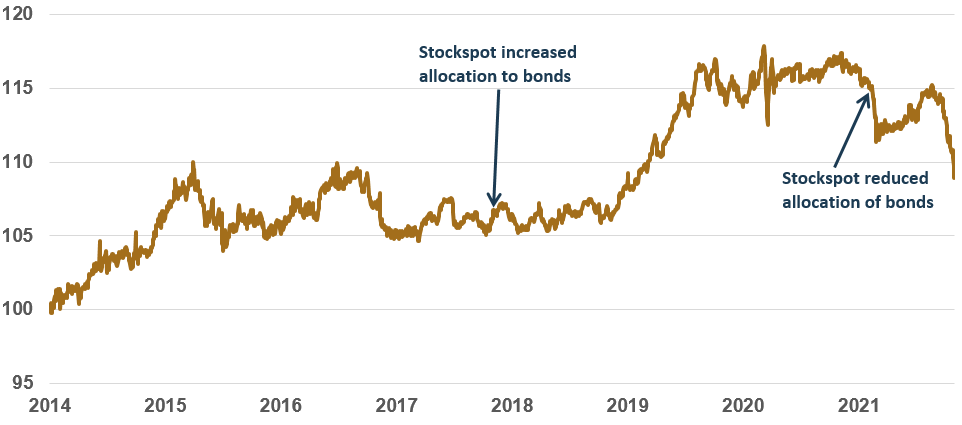

Stockspot recognised early the risks of inflation to government bonds and in February 2021 reduced the allocation of bonds in favour of emerging markets and gold.

Gold is normally a good hedge against inflation and other risks. Pre COVID-19 it was trading at AU$2,200 and increased to AU$2,800 in August 2020, reflecting the uncertainty of the pandemic. It is now trading around AU$2,400 as the uncertainty diminishes.

Gold is an insurance policy to protect against the situation when inflation expectations cause interest rates to run out of control.

Should I reduce bonds in my portfolio?

No.

Reducing your bonds now would be like not renewing your car insurance just because you haven’t made a claim over the last year. The reason you hold insurance is to protect yourself against future uncertainty – bonds and gold act as portfolio insurance in a very similar way.

Should I change investment strategy now?

No.

When markets rise or fall, it can be tempting to change your investment strategy to chase the best performing investments or avoid underperforming ones.

Changing your strategy in response to market movements is a form of market timing and is more likely to throw you off-track from reaching your goals.

If your personal circumstances haven’t changed, then you should stick with your existing investment strategy that’s been matched to your risk capacity, timeframe and your goals.

Automated rebalancing like we did for clients in March 2020 and November 2020 also helps to ensure you continue to take the right amount of risk along the way.

Should I still own bonds if I’m investing for long term goals?

Even for very long term investors we believe having an allocation to bonds and gold is important, which we explain in this video.

How have the Stockspot portfolios performed?

Our Model Portfolios have returned 3.1% to 14.4% over the 12 months to the end of October, while our Sustainable Portfolios have returned 4.4% to 14.4% over the same period.

Over 1 year there is a pronounced difference between the returns of our higher growth strategies compared to our conservative strategies. This is due to the growth strategies having a higher allocation to shares which have done well, compared to the conservative strategies which hold more bonds and gold which have underperformed.

However over longer periods of time, the conservative strategies continue to perform well, posting returns of 7-8% p.a. over 5 years.

Look at your portfolio as a whole

It’s impossible to consistently predict which asset classes will perform well or poorly in any given year. That’s why the Stockspot Portfolios are diversified across a broad range of different assets. This allows for smoother returns over the long run.

Because of this diversification, the Stockspot portfolios have maintained positive returns each year since we began in 2014.

Our portfolios have also outperformed 99% of similar diversified portfolios over five years due to having the right mix of assets and selection of funds.

Like a bouquet of flowers, your portfolio contains a bunch of different assets that will bloom at different times. This just means that your portfolio is well diversified and able to weather different environments.